-- Published: Thursday, 21 September 2017 | Print | Disqus

By: Graham Summers

Everyone is making a big deal about the Fed's so-called "balance sheet reduction” which starts next month.

Let’s assess some facts.

First of all, the Fed plans on shrinking its balance sheet by $10-$30 billion per month. The Fed balance sheet is currently $4.5 trillion. So at this pace of unwinding it would take somewhere between 13 and 33 years for the Fed to normalize its balance sheet back to pre-2008 levels.

So the notion that this is significant is off base. It borders on irrelevant.

Second of all, the only reason the Fed is even discussing a balance sheet reduction is because stocks are soaring. The second that stocks begin to correct, multiple Fed officials will appear on TV talking about how it’s time to “slow the pace” or even “halt” its balance sheet reduction.

Let’s get real here.

The reality is that the stock market is the ONLY thing the Fed can point to as a success. The economy from 2008 to 2016 was in the weakest recovery in 80+ years. Indeed, the Fed has all but given up on the farce that it cares about the economy: yesterday, Fed Chair Janet Yellen herself admitted publicly yesterday that the Fed takes account of “asset prices” when it comes to rate hikes.

In Fed-speak, asset prices=stocks. And that’s the #1 focus for the Fed when it comes to monetary policy.

So what does this mean?

The Fed is going to engage in some symbolic shrinking of its balance sheet, but the second things get messy for stocks, the Fed will start walking back this policy.

And THAT opens the door to the REAL crisis.

A crisis of inflation.

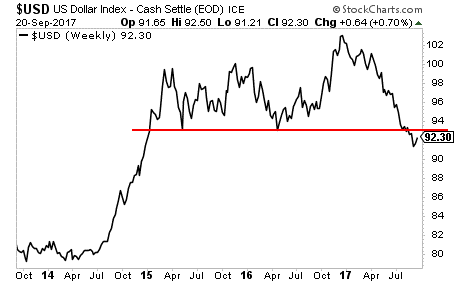

The $USD is imploding. It bounced a bit courtesy of the Fed announcement yesterday, but it's in SERIOUS trouble having taken out critical support.

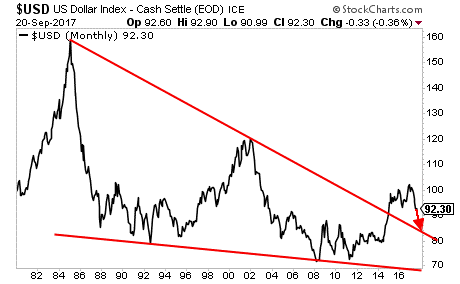

The long-term chart is even uglier.

The real CRISIS is the collapse of the $USD. And it's one the Fed doesn't want to stop. Indeed, as soon as stocks begin to correct, the Fed will start walking back all talk of a balance sheet reduction. And if we enter another crisis, the $USD will drop even farther as the Fed cranks up the printing presses with more QE.

Put simply, the big crisis will be the collapse of the $USD. And it's already underway.

If you’re not taking steps to actively profit from this, it’s time to get a move on.

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

| Digg This Article

-- Published: Thursday, 21 September 2017 | E-Mail | Print | Source: GoldSeek.com