-- Published: Tuesday, 3 October 2017 | Print | Disqus

By Jordan Roy-Byrne CMT, MFTA

The precious metals sector started September with a bang. Gold, which had already eclipsed $1300/oz, pushed to $1360/oz while Silver broke its downtrend line (from its late 2012 and 2016 peaks). Unfortunately, precious metals would soon reverse course and more. Gold ended September down nearly 3% and below $1300/oz. Silver lost 5% and its breakout. The gold mining indices (GDX, GDXJ, HUI) lost 7% to 8%. The monthly charts argue the major breakout from multi-year bottoming patterns will have to wait until 2018 at the soonest.

Gold’s bearish September reversal occurred at multi-year resistance. On a chart showing daily or weekly closing prices, Gold’s highest close in September occurred at the resistance line connecting its early 2014 and 2016 highs. In addition, Gold opened near $1330 (critical monthly and quarterly resistance), traded above it but then closed well below it. While it is difficult to see, Silver opened very close to key resistance at $17.80, traded up to $18.29 (near major monthly resistance) but closed the month well below $17.00. Silver failed in a resistance area that has been very important (note the arrows) for the past 10 years. Gold failed at a level that has been important since 2014.

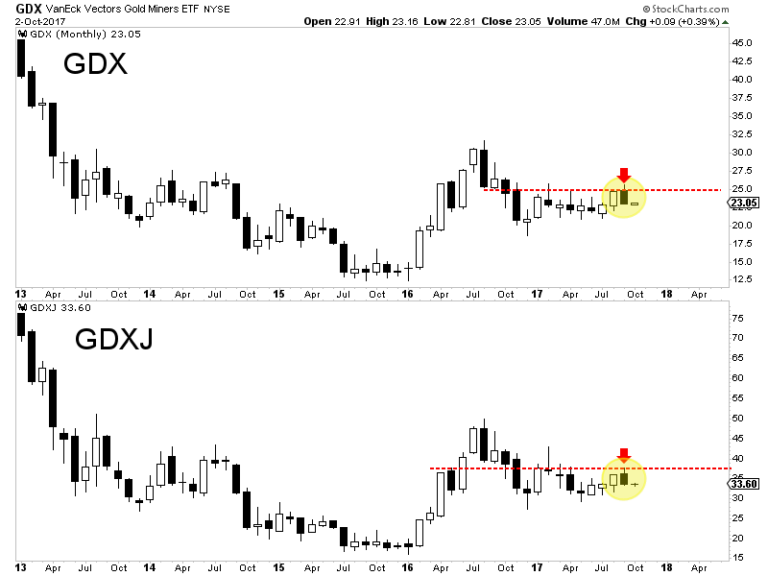

The miners like the metals also failed at important resistance levels. GDX opened September around resistance at $25, traded above it briefly but closed the month down at $23. GDXJ tested resistance at $37 but closed the month down at $33. The monthly candle charts below show the importance of GDX $25 and GDXJ $37. A monthly close above those levels could trigger a major leg higher. However, the monthly charts argue that scenario is not close at hand.

The monthly charts for Gold, Silver and the gold mining stocks show a failure at important resistance and that implies over the months ahead the precious metals sector will remain in its complex, multi-year bottoming pattern. The negative technical outlook is not a surprise as the Federal Reserve is likely to tighten policy and the extremely oversold US Dollar begins a rebound. Simply put, precious metals are not yet ready for primetime. They could be waiting for a sustained rise in inflation or a serious equity market correction. Our goal is to buy value with a catalyst or buy very oversold conditions within the junior space. This action has served us well since last December and should continue to work well over the weeks and months to come. To find out the best buys right not and our favorite juniors for 2018, consider learning more about our premium service.

Jordan Roy-Byrne CMT, MFTA

Jordan@TheDailyGold.com

| Digg This Article

-- Published: Tuesday, 3 October 2017 | E-Mail | Print | Source: GoldSeek.com