-- Published: Sunday, 29 October 2017 | Print | Disqus

By David Haggith

Is the Federal Reserveís Great Unwind already coming unwound? I thought it would be good to check up on Federal Reserve balance sheet reduction since the Fed is supposed to be up and running on the move out of quantitative easing this month. It should be fascinating to see what progress the Fed is making as it happily applauds its own successful recovery.

The Federal Reserve balance sheet reduction that didnít happen

Is balance sheet reduction the Fedís Gordian knot?

After all, the Federal Reserveís End of Quantitative Easing Didnít Happen last time they said it would. It turned out the Fed actually planned to continue QE at a gradual level by reinvesting matured assets. Nevertheless, the mere announcement in 2013 that it would terminate QE in 2014 created the infamous ďTaper Tantrum.Ē The Fed hadnít said anything back then that I was able to find about reinvesting the funds in its balance sheet until after they supposedly stopped QE in the fall of 2014. It turned out the stop was not a quite a full stop.

Unwinding its balance sheet is likely to prove to be the Fedís Gordian knot.

Federal Reserve balance sheet reduction that didnít happen Ö again Ö so far

So, here we are, and so far there is no reduction. It is now three years since the Fed ďended quantitative easing,Ē and its balance sheet is still holding around the $4.5 trillion mark where QE was supposed to end. Now thatís gradual! Itís taken three years just for the Fed to say it is going to start reducing the balance; so, letís see how that balance sheet reduction is going for them now that it has supposedly started:

The Federal Reserve claimed it was going to start balance-sheet reduction in October at a rate of $10 billion per month and then start increasing that reduction in January by $10 billion per month until eventually it is unwinding at a rate of $50 billion a month, which will be the rate at which it plans to continue unwinding.

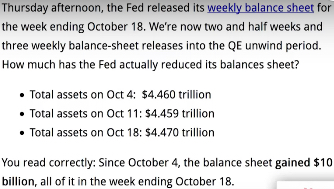

Here is how the Fed was doing in the first three weeks of its planned unwind:

Oops. Instead of reducing its balance sheet (unwinding quantitative easing) by $10 billion this month, The Federal Reserve actually increased it by $10 billion! Yikes! Did they find they needed to start QE back up as soon as they unwound $o.001 trillion?

After reading the above summary, I dug a little deeper to find the Fedís latest October 26th release. It shows the balance back down to $4.460 trillion. Still oops. Thatís right back to exactly where they started the month, and that is the final balance sheet release for October!

Now, it could just be that the Feds are moving accounts around and plan a $10 billion reduction on the last day of the month now that they know pretty well where the month stands. That would actually be the smart way to go about it. If thatís the case, that wonít show up until their next balance sheet release on November 2nd.

It could also be that the Feds have discovered they just canít quite get started Ö again. Just like they havenít been able to get started over the past three years! After all, there have been hurricanes that the federal government needs to fund. (Thereís always something. Next time it may be new wars or catastrophic snow storms or an unprecedented bad holiday shopping seasonÖ. who knows? Itís a big country with endless big problems to fund.)

The final proof of the Fedís ability to start unwinding will be in next weekís release when the last few days of October are all in. But if you wonder why the economy and the markets havenít experienced any jog from the unwind so far, itís because there hasnít been any unwind so far; and the reduction that is planned (if it even happens) is a minuscule dose ó a mere trial run ó in order to test the waters.

Clearly, the Fed is moving with extreme caution Ö if at all. That tells you with certainty that even the Fed knows its balance sheet reduction is perilous. After all, the entire national economy has been ďrebuiltĒ upon that balance sheet inflation.

Stay tuned. If the Federal Reserveís balance sheet is not down by next Thursdayís balance sheet release, something has gone wrong with the plan. The time to watch is now.

http://thegreatrecession.info/blog/fed-balance-sheet-reduction/

| Digg This Article

-- Published: Sunday, 29 October 2017 | E-Mail | Print | Source: GoldSeek.com