-- Published: Tuesday, 31 October 2017 | Print | Disqus

By Jordan Roy-Byrne CMT, MFTA

Over the past two years, Gold has been inversely correlated to bond yields. In a low inflation environment, falling bond yields drive real interest rates lower which benefits Gold. Conversely, rising yields are generally negative for Gold. When long-term yields exploded higher in the second half of 2016, Gold declined hard. Now with long-term yields threatening a potential major move higher, Gold and gold stocks have sold off and there is a risk of further losses. However, at somepoint rising yields can push Gold higher.

To answer the question of when we must understand what drives Gold.

Gold performs best amid falling or negative real interest rates. That occurs when inflation is rising faster than interest rates or when interest rates are falling faster than inflation.

In terms of the yield curve, a steepening curve is bullish for Gold. Two analysts I enjoy reading (Gary Tanashian and Steve Saville) write about this frequently. Steve Saville recently wrote that a steepening yield curve reflects either increasing inflation expectations or risk aversion linked to declining confidence in the economy or financial system. The curve can steepen due to rising inflation or plummeting interest rates and in particular short-term rates. The chart below, which plots Gold and the yield curve (bottom) highlights recent periods of a steepening yield curve. Both periods were driven by a sharp decrease in short-term yields.

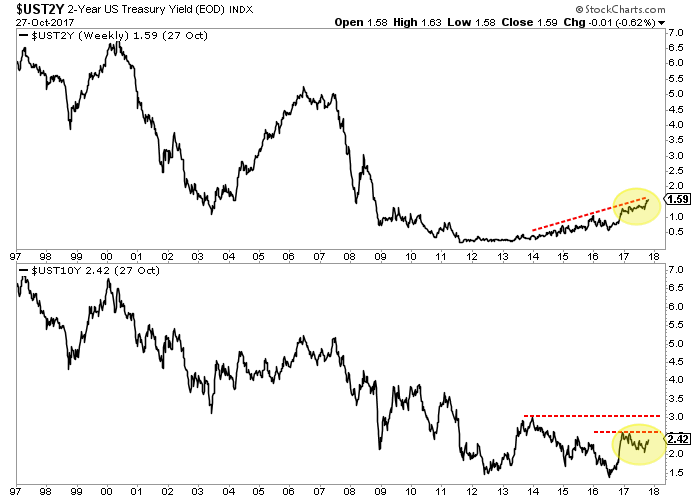

The yield curve (above) has stabilized at present as both short (2-year) and long-term bond yields (10-year) are rising again. To answer the original question, rising yields will be bullish for Gold only when long-term yields are rising faster or in other words, when inflation is rising faster than short-term yields. For example, if the 2-year yield (often a proxy for the Fed funds rate) peaks at 2.00%-2.25% but the 10-year yield surges well above 3.00%, that would be bullish for Gold.

Gold and gold stocks have failed to surpass their 2016 peaks and continue to go nowhere because the fundamentals are not yet bullish. Real interest rates are currently trending higher and the yield curve is flattening, not steepening. That could change if inflation expectations increase which would cause long-term yields (10-year) and inflation to rise faster than short-term rates or the Fed funds rate. The prognosis for Gold and gold stocks remains bearish into year end as we wait for lower prices and a low risk buying opportunity. The good news is those who buy weakness in the months ahead could position themselves for strong profits in 2018. Find the best companies and wait for the sector to get oversold and test strong support. To follow our guidance and learn our favorite juniors for 2018, consider learning more about our premium service.

Jordan Roy-Byrne CMT, MFTA

Jordan@TheDailyGold.com

| Digg This Article

-- Published: Tuesday, 31 October 2017 | E-Mail | Print | Source: GoldSeek.com