-- Published: Thursday, 9 November 2017 | Print | Disqus

By Frank Holmes

Recently I identified five agents of change that I believe investors should know about right now. I’d like to add one more to the list: Mohammad bin Salman. The crown prince of Saudi Arabia, 32, was little known outside the region before this past weekend when he jailed members of the royal family, presumably in an attempt to consolidate power ahead of taking the throne. Resembling a plotline from an episode of “Game of Thrones,” the mass detentions signal a seismic change in Saudi leadership—which, in turn, is putting upward pressure on global oil prices.

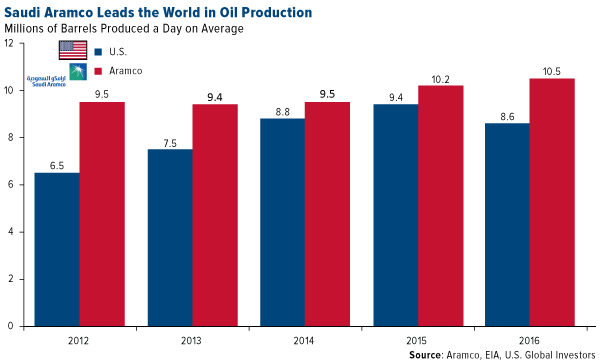

Saudi Arabia is the world’s second-largest oil producer and single biggest oil exporter, so any development that might alert investors that the kingdom’s production levels or oil policy could be disrupted has historically had a profound effect on prices. When the country’s former king, Abdullah bin Abdulaziz Al Saud, passed away in January 2015, oil jumped more than 8.6 percent for the week.

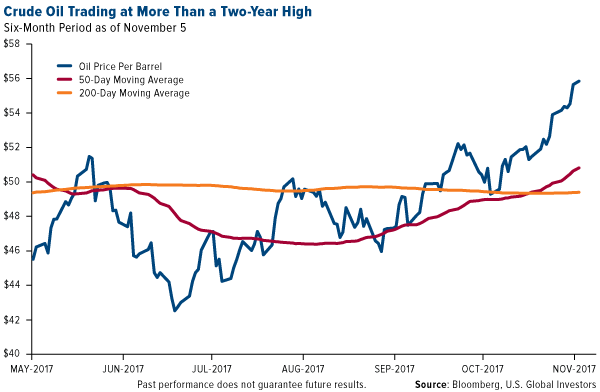

And so was the case on Monday, after news broke of the shakeup. West Texas Intermediate (WTI), the American benchmark for crude, closed above $57 a barrel for the first time since June 2015, adding nearly 35 percent from its summer 2017 low. A weaker U.S. dollar, down about 3.2 percent from the same time last year, is also providing support, as is slower U.S. supply growth following Hurricanes Harvey and Irma.

click to enlarge

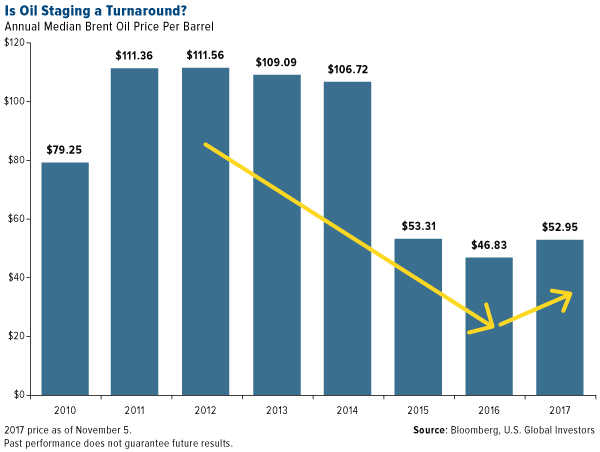

Mike McGlone, commodity strategist at Bloomberg Intelligence, points out that 2017 marks the first year since 2013 that the median price of WTI crude is higher than the previous year’s. (This is assuming WTI will trade range bound or higher between now and the end of 2017.)

The last time we saw Brent do this was from 2011 to 2012. On Monday, the European benchmark closed above $64 a barrel, more than a two-year high. As of November 5, Brent crude had made positive weekly gains in 10 out of the past 11 weeks.

click to enlarge

Taken together, this has the bulls excited. Hedge funds are currently building record or near-record net long positions in oil, indicating they’re betting prices will continue to climb. According to Reuters, bullish positions in Brent stood at a record 587 million barrels as of Friday, with a record 530 million of those net long.

“Most investors appear to believe prices are moving into a new and higher trading range and want to ride the rally until the new price ceiling is discovered,” says Reuters.

Saudi “Game of Thrones” Could Be More than Mere Palace Intrigue

But let’s return to Saudi Arabia and Mohammad bin Salman, known to many as “MBS.” The official explanation for the detainments—which involve at least 11 princes, including well-known billionaire investor Prince Alwaleed bin Talal, four ministers and “dozens” of ex-ministers—is that they are part of an ongoing crackdown on corruption. According to the BBC, this is only “phase one,” meaning we can probably expect to see more to this process.

MBS’s fight brings to mind Chinese President Xi Jinping’s anti-corruption efforts, which have been ongoing since Xi assumed power five years ago and have led to the detainment or punishment of an astonishing 1.4 million party members, according to multiple sources.

The implications of Saudi Arabia’s own sweeping crackdown, unprecedented in the kingdom’s 85-year history, understandably have many investors spooked. Dennis Gartman, editor of the widely-read Gartman Letter, told CNBC this week that he thought MBS’s actions were “terribly detrimental to crude oil prices” in the long run.

MBS has a supporter in President Donald Trump, though, who tweeted on Monday that he has “great confidence in King Salman and the Crown Prince of Saudi Arabia, they know exactly what they are doing… Some of those they are harshly treating have been ‘milking’ their country for years!”

But there’s more to the story than mere palace intrigue. The richest country in the Middle East is undergoing radical changes as outlined in its “Vision 2030” plan, unveiled in April 2016. Among its goals, headlined by the young MBS, is a push to reform the government’s role in everyday life. Today it’s estimated that around 80 percent of Saudi household income depends on government subsidies, supported by vast oil revenues. The hope is to shrink this dependency, especially now that the price of Brent has fallen significantly since its all-time high of $140 a barrel in 2008. Many state-run industries could be privatized in the coming years, including its behemoth oil industry.

Saudi Arabia is a youthful country—about 70 percent of its citizens are under the age of 30—and so the kingdom is also seeking to modernize its society and relax several restrictions that are believed to have held back economic growth. This past September, the country finally permitted women to drive, and there are targets in place to grow the number of women in the workplace.

Aramco: The IPO of the Century?

But possibly the most significant and ambitious goal in Vision 2030 is to wean the kingdom’s economy off of oil exports, which accounted for roughly 87 percent of total budget revenues as of December 2016. Toward this end, Saudi Arabia plans to privatize a part of the country’s crown jewel, Saudi Aramco, the largest energy company in the world by far. In its 2016 annual review, the state-run company said it produced an average 10.5 million barrels of crude a day. By comparison, the entire U.S. produced 8.6 million barrels a day on average in the same year.

click to enlarge

According to Forbes, Aramco generates more than $1 billion a day in revenues, which is a little difficult to fathom.

In an exclusive interview with Reuters, MBS said that Aramco was on track for a 2018 initial public offering (IPO) and that it could be valued at more than $2 trillion. This would make it the largest IPO in history. By floating only 5 percent of the company, MBS expects to raise as much as $100 billion, which would go into a public investment fund (PIF) to help finance other segments of the economy.

“The government should not be in control of the private sector,” Price Mohammad said. “You create opportunity, you create business, you create development, you hand it to the investor and start creating something new.”

Not to wade into conspiracy theories, but the crown prince’s anti-corruption campaign and impending Aramco IPO could be related. Saudi Arabia wants oil support at $60 a barrel before the giant energy company goes public, and a royal shakeup of this magnitude could be one way of achieving that.

The Challenges of Getting Listed

As exciting as an Aramco IPO is, I wouldn’t put my full faith in it coming to fruition. For one, the Saudi Stock Exchange in Riyadh is simply too small and undeveloped to handle the massive trading volume the biggest IPO in history would require.

Getting listed in New York has its own challenges. Although President Trump is strongly urging Saudi Arabia to float shares on the New York Stock Exchange (NYSE), the kingdom is concerned that doing so would open itself up to litigation. In 2016, a bill was passed allowing victims of 9/11 or their families to sue the Saudi Arabian government.

On Monday, the Financial Times reported that the London Stock Exchange (LSE) has made a “very strong case” for Aramco to get listed in the U.K. In April, Prime Minister Theresa May visited the kingdom, accompanied by the LSE chief executive, presumably to pitch the idea of a London IPO to Saudi officials. In addition, the LSE has sweetened the deal by announcing it would loosen certain rules and restrictions on Aramco that apply to other companies.

However this plays out, we’ll certainly continue to monitor it, as well as the oil market. Because of the drama in Saudi Arabia and further extended production cuts planned by the Organization of Petroleum Exporting Countries (OPEC), Morgan Stanley just raised its forecast for the price of oil, estimating WTI to average $58 a barrel in the second quarter of 2018. It could be time for investors to consider oil equities again.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

| Digg This Article

-- Published: Thursday, 9 November 2017 | E-Mail | Print | Source: GoldSeek.com