-- Published: Monday, 4 December 2017 | Print | Disqus

Source: Michael Ballanger for Streetwise Reports 12/01/2017

Precious metals expert Michael Ballanger discusses Bitcoin, currency devaluation, and gold and silver.

-->In the year 301 AD, the Roman unit of barter was the denarius, which had originally been 95% pure silver when introduced by Augustus at the end of the first century BC but by the time of Diocletian's rule, it had moved to 50,000 denarii to a pound of gold. Ten year later, it took 120,000 denarii to buy a pound of gold and by 337, that figure was 20,000,000. What had occurred in a mere 400 years was that a slow and agonizing erosion in the purchasing power of the Roman currency accelerated to full fiat disintegration and that complete and total disregard for the denarius was attributed as one of the underlying causes of the Fall of the Roman Empire. Nothing was more evident in the underlying rot permeating Roman society, economics and national security than the refusal by the Barbarian armies to accept anything but gold as payment for their leaving the Roman legions alone. Rejection of the currency of the Roman Empire was complete and irreversible.

One of the omens of impending inflationary spirals is the tendency of those individuals controlling large swaths of wealth to reject any form of "savings" in the form of bank deposits or interest-bearing certificates. They choose instead to jettison cash or cash-equivalent instruments because of a loss of faith in the ability of local currencies to retain purchasing power. We have seen this over the ages from Weimar Germany to Zimbabwe and now Venezuela, and where gold and land were generally the tried-and-true assets of choice for those wishing to protect their wealth from the insanity and irresponsibility of governments, today in 2017 with the advent of technology and its attendant curses and wonders, the wunderkind of today have actually created their own receptacle for frightened wealth and that is the true meaning of Bitcoin and its incredible "success."

When the chief technology engineers sat down ten years ago after watching the global bankers vaporize the financial system and then turn right around and "save" it through a massive and globally coordinated counterfeiting racket, they determined that anywhere government has control over money (as in the banking system), there could be no certainty of anything responsible or prudent whereas there was absolute certainty that corruption would exist at a systemic level. Therein lies the reason for the invention of blockchain technologies and the best-performing "asset" of 2017, Bitcoin, which is ahead an astonishing 1,000% year-to-date spurring the creation of hundreds and hundreds of "wannabes" being trotted out as heir apparents.

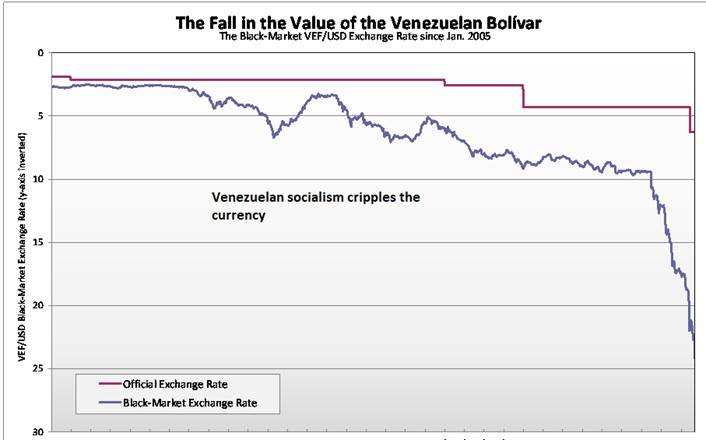

Traditionally, investors moved to the old saws, gold and silver, as safe havens for decomposing currencies and as recently as this year, we have witnessed the efficacy of wealth preservation as Venezuelan citizens that moved their savings to U.S. dollars from the bolivar avoided the most hideous of outcomes as the bolivar collapsed. This is precisely what occurs when confidence sinks to zero and hoarding of staples escalates.

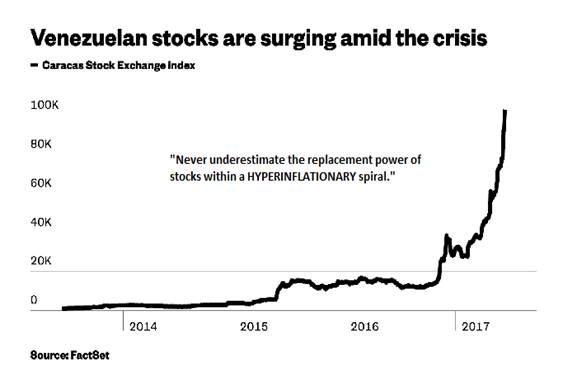

If they further diversified by converting bolivar to gold, the outcome was predictably preferable to holding cash in mattresses or term deposits in a Caracas banking institution. However, it was the early escalation in stock prices that became the harbinger of collapse in the bolivar's purchasing power. "Never underestimate the replacement power of stocks within an inflationary spiral" the saying goes and no more relevant than when "inflation" metamorphoses into "hyperinflation" as seen recently in Venezuela.

Now, in the Western world and specifically the U.S, it is apparent that very large holders of American dollar wealth have decided that they want to have control of the currencies to which they transfer wealth, keeping it away from the interference and meddling of politicians and the global banking cartel. Whereas gold and silver, by way of physical possession were once the stores of value within which wealth sought sanctuary, government intervention and manipulation by way of the derivative exchanges sent the members of this elite class of billionaires scurrying for the ultimate alternative to the precious metals and herein lies the genesis of Bitcoin.

In my opinion, BTC represents the final chapter of the repudiation of fiat currencies by those of the Super-Wealth fraternity. They own all of the prime real estate around the world; they own all of the publicly traded behemoths listed on global stock exchanges; and they own every politician and every court of law in existence. Ergo, there was only one glaring vulnerability to which the elite class were exposed—currency risk. Now, with Bitcoin, they have removed accessibility of this product to the Rothschild-ian Mantra of "controlling a nation by controlling its currency," which was and is the modus operandi of the banker class. The maniacal move of BTC in 2017 represents total disdain, not for Zimbabwe dollars or Venezuelan bolivars, but for U.S. dollars, euros, and yen.

Now you may have noticed that I have purposely refrained from offering predictions on the outlook for BTC and the myriad of blockchain "wannabe's" that are being marketed like pretzels at a ball game. My inbox this week is stuffed with dozens and dozens of these deals and the more difficult to assess and analyze, the more the demand swells. It seems that scarcity outweighs logic in handicapping this type of mania to the extent that when I see junior exploration companies announcing plans to restructure into blockchain business ventures by way of a twenty-something engineering graduate two years out of school, it is eerily reminiscent of the DotCom mania of the late 90s which, by the way, marked the bottom of the gold markets and the top in the tech bubble.

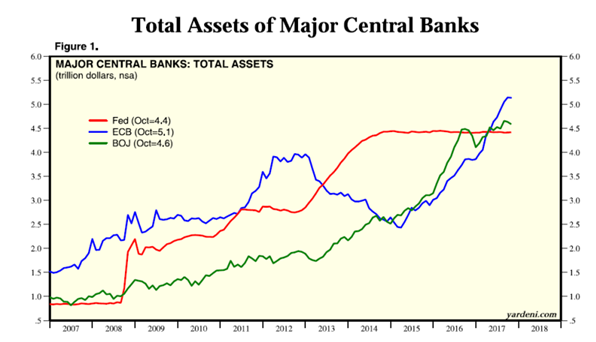

With central bank balance sheets engaged in an unrelenting escalation of credit creation, one needs look no further than the chart shown below in order to rationalize the increases being seen not just in the U.S. but around the world. All major stock markets are dancing with all-time highs as the impact of serial money-printing impacts prices. The Achilles Heel of the banker class—real estate, the ultimate collateral upon which banks are grounded—has rebounded with a vengeance in the U.S. and Europe with housing bubbles now in Canada, Australia and Sweden. That collateral so terminally impaired in 2008 is now the Mother's Milk of the Banker Class with prices in many locations eclipsing the highs of 2005–2007. After all, that was the sole intent of Paulsen-Bernanke bailout at the bottom of the markets in 2009. A scant ten years later from a time when bankers were being hunted down in places like Iceland and Ireland, the American bankers have soared unimpeded to even greater riches than they enjoyed blowing up the sub-prime bubble.

I offer this commentary neither as a bull or a bear on BTC or this new industry called "blockchain" but rather as a 40-year observer and interpreter of market events. I am adamant in my conviction the just as central bank largesse is responsible for the asset bubbles popping up around the world, it is also the impetus for Bitcoin. More importantly, just as the turning of the leaves and the southern flight of flocks of geese are harbingers of fall and winter in the northern hemisphere, the emergence of alternative currencies replacing gold and silver as monetary sanctuaries is an underscored harbinger of the acceleration of the decomposition of the modern fiat currency regime. For traditionalists such as I (meaning "old and stubborn"), I shall opt for the certainty of possession as it pertains to physical gold and silver and the preservation of wealth. I leave this infatuation with digital havens to the younger and more daring but young or old, the message contained in the Bitcoin phenomenon is far more important than directional accuracy or investment merit. It is an omen of change in a manner far more important than the arrival of the internet or putting a man on the moon.

Think "Venezuela". . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of Michael Ballanger.

| Digg This Article

-- Published: Monday, 4 December 2017 | E-Mail | Print | Source: GoldSeek.com