-- Published: Monday, 1 January 2018 | Print | Disqus

By John Mauldin

Objects in Motion

Fed Pops Its Own Bubble

The Trump Effect

What Could Go Wrong?

What to Do

Black-Eyed Peas, Hong Kong, Sarasota, and Boston

In addition to popping champagne corks and black-eyed peas (at least in the South) on New Yearís Day, year-end brings something else for economists and portfolio managers: annual forecasts. People want to know what the coming year will bring. I would like to know, too. But since Iím on the other side of your monitor, I must give you my own forecast. Caveat emptor applies.

I donít really think of myself as a forecaster. I talk about the future all the time, of course, and I tell you what I think is coming Ė but whether it will arrive next month, next year, or five years from now is a different question. Timing is hard.

So, when I write annual forecast letters like this one, I put some extra pressure on myself. In addition to identifying the macro forces in play, I try to anticipate when we will see their impact. Thatís never been easy, and it seems to get tougher every year. But inquiring minds want to know, so here we go.

First, a brief message. If you missed my email on Thursday, I want to be sure you know that the Alpha Society is now accepting new members. The Alpha Society is one of my happiest achievements, and Iím excited to see it growing. When I started writing Thoughts from the Frontline almost two decades ago, little did I know that it would quickly garner a ďtribeĒ of curious and thoughtful readers. Getting to know you has been an amazing honor.

The Alpha Society is really an extension of that relationship Ė itís for those of you who simply want more. More intellectual stimulation, more communication with people who thoroughly enjoy debate and discussion, more opportunities to talk to me and the Mauldin Economics editors. The driving goal behind the Alpha Society is to enrich your world and the world at large.

Is that a lofty ambition? Yes. Is it achievable? Absolutely. If you have time today, please take a look at your invitation. Itís also worth mentioning that your membership fee may be tax deductible, so if you want to apply it to 2017ís return, now is your chance.

Objects in Motion

As you probably recall, Iíve long criticized the economics profession for its ambition to be a ďhard scienceĒ like physics or chemistry. I think the global economy is far too complex and far too dependent on irrational human behavior for that ambition to be realized. However, there are some occasional similarities.

Think back to high school science. Remember Newtonís Laws? The first one is about inertia and motion:

An object at rest stays at rest, and an object in motion stays in motion, with the same speed and direction, unless some other force intervenes.

In similar fashion, an economy that is moving in a particular direction will probably continue in that direction until something makes it change Ė either the forces that put it in motion lose strength, or other forces counteract them.

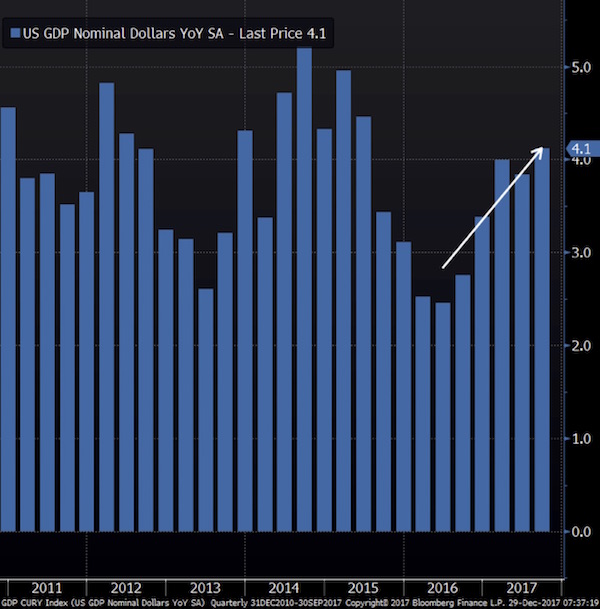

My friend Sam Rines gives us a wonderful illustration of that basic principle. The following is a graph of nominal GDP growth for the last six years. Normally, when we talk about GDP numbers, we talk in terms of real GDP, or GDP with inflation backed out. Even though there are various measures of inflation, real GDP growth measures the actual buying power of your dollars.

There is a great way to illustrate the difference between real and nominal GDP growth. If you bought the S&P 500 Index in 1966, it was 16 years, until 1982, before your nominal dollars recovered. But, taking account of inflation, it was 26 years later, or 1992, before you saw any increase in your buying power. Not exactly what your financial planner was forecasting for you in your retirement plan. Using the average market returns for the last 80 or 100 years to forecast your returns for the next 20 years, or until your retirement, is both foolish and dangerous. Forecasting what your portfolio will look like in a reasonable length of time, say 10 or 20 years, all depends on your starting point. If you happen to be part of the demographic that allowed you to start in 1982, you look brilliant. If you began in 1966 instead? Not so much.

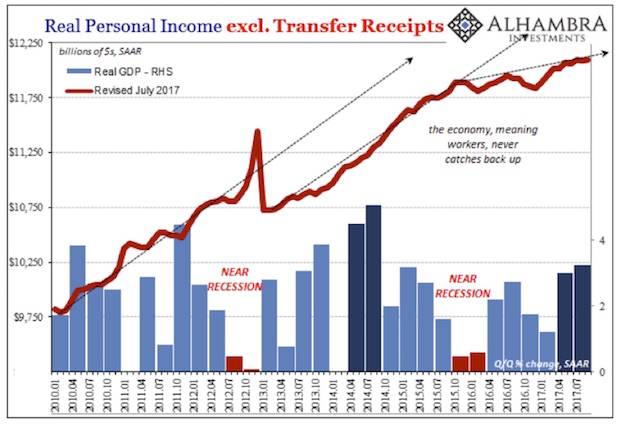

But real personal income, while it has grown modestly over the last seven years, has begun once again to flatten. This chart courtesy of Jeff Snyder at Alhambra.

But I will lean on our law that objects in motion tend to stay in motion for my 2018 forecast. I think the US economy will maintain its current slow but steady growth, because no greater forces are likely to stop it. But of course I have to add an asterisk, which we will get to in a bit. I donít mean to suggest that no other forces exist; they certainly do. But as weíll see, they will either balance each other so that there is no net change, or they will come at us from outside in unpredictable fashion.

I am not, however, predicting smooth sailing for the stock market. The economy and the stock market are different animals. The equity markets face serious challenges and will endure a reckoning at some point, but I donít think it will happen in 2018. In fact, 2018 could be our last calm year for some time, so we need to use it constructively.

Fed Pops Its Own Bubble

Before we get into 2018, letís quickly review how we got here. In response to the 2008 financial crisis and the recession it sparked, the Federal Reserve and other central banks deployed zero or near-zero interest rates, quantitative easing, and assorted other interventions. These may have averted an even worse disaster, but their impacts were far from ideal. Nonetheless, the economy slowly lifted off as consumers rebuilt their balance sheets and asset values rose.

The asset values climbed in large part because the Fed practically forced everyone with money to invest it in risk assets: stocks, real estate, corporate bonds, etc. The resulting wealth effect theoretically enabled more spending, at least by those in the top income quintile. The recovery has been slow and ugly, and too many people still donít feel the progress.

The Fedís trickle-down monetary policy hasnít really worked. (I note with some irony that the same economists who espoused what can only be called trickle-down monetary policy scoffed at Reaganís trickle-down fiscal tax-cut policy. There is essentially no difference between the two, except the source of the funds.) Those who gripe about income inequality actually have points to make. Even if you filter out the top one half of 1% (the tech billionaires, Warren Buffett, et al.), there is still a large imbalance in how much the top and bottom earners have benefited from the Fedís lopsided monetary policy.

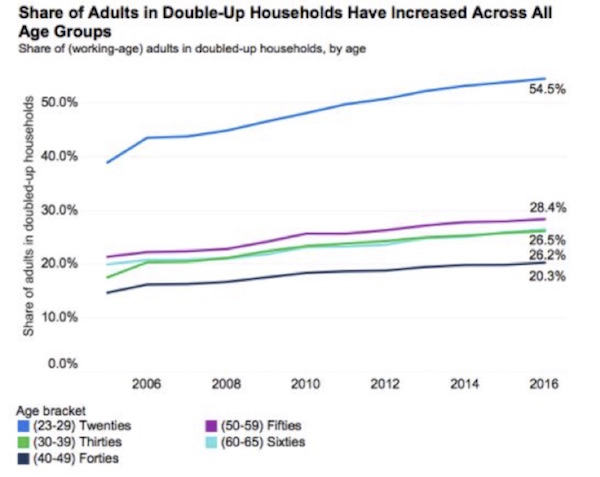

The chart below, based on data from Zillow, shows that the share of unmarried adults in double-up households has increased in all age brackets, and especially among Millennials. Having a few Millennials in my own family, and even some young Gen Xers, the need to double up is readily apparent to me. Rents are just too high for the average person. Also notice that nearly one in three people between ages 50 and 59 is living with someone else in order to save on rent and other expenses..

Furthermore, nearly 5 million Americans are in default on student loans. Is it any wonder people are doubling up on their housing?

The economy and markets are growing, but the benefits of that growth are not evenly distributed. Supposedly a rising tide raises all boats, but itís not working that way today.

Now the Fed is slowly reversing its stimulus measures, both by raising short-term rates and by letting its bond portfolio shrink as it matures. Both measures have a tightening effect on an economy that isnít growing remotely as well as it has in past recoveries. So why is the Fed doing it? Because the FOMC members fear inflation will take hold if they do nothing. I think they are probably wrong there, but my opinion isnít factored into their models.

In other words, my #1 risk factor for the US economy in 2018 is Federal Reserve overreach. I think there is a significant chance that their anticipated inflation will not appear and the Fed will tighten too much too soon. Frankly, the same risk applies to Europe as the ECB significantly reduces its quantitative easing.

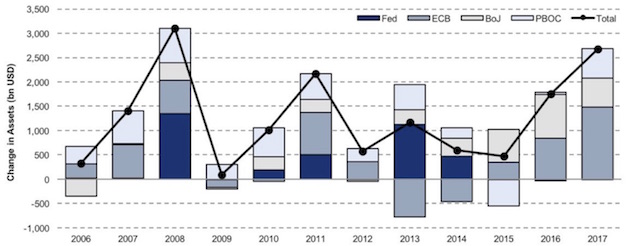

Look at the graph below (hat tip my friend Tony Sagami), which shows the amount of quantitative easing that was pumped into the economy in the last few years. With 2Ĺ trillion dollars of monetary stimulus from the worldís central banks, we still need tax cuts and boosted infrastructure spending to expand the US and global economy? Seriously?

Further, their quantitative tightening, which is what it really is, is going to reduce M2 money growth from its current 4% to less than 2%, as Lacy Hunt pointed out to me a few days ago. That slowdown is likely to affect the velocity of money, exerting further deflationary pressure on the economy.

It is monetary policy madness to raise rates and undertake quantitative tightening at the same time. Do I think the economy can actually stand three rate hikes next year? Without risking a recession? I think itís likely that it can. But nobody has anything in any of their models, based on anything like real experience, that predicts what will occur if there is effective quantitative tightening at the same time. This is a real-time experiment.

In 2018 there will be almost $1 trillion less global QE than in 2017. What does that mean? We donít know Ė and by we I mean you and I and all of our central bankers. I donít much care what their models say, because their models have been continually, disastrously wrong. They create those models in order to give themselves excuses to do what they want to do, and then they conduct massive monetary experiments on economies to sees what happens. Sometimes everything works out. Sometimes it doesnít.

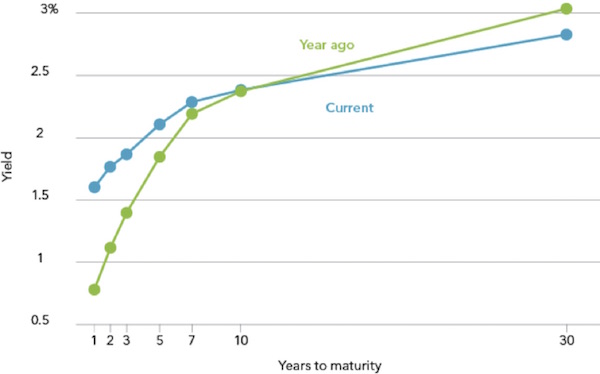

Here is the US Treasuries yield curve as of December 5, from a graph on Seeking Alpha by Richard Turnill. The curve is slightly flatter today than it was then.

As Iím sure you know, an inverted yield curve happens when short-term rates are higher than long-term rates. I have used the yield curve to accurately predict the last two recessions. But letís add a note here: A flattening yield curve does not mean there is a recession in our future. The yield curve has to be inverted for a period of time; and since World War II, when we have had an inverted yield curve for a protracted period, we have typically waded into a recession a year later. So even when we get an inverted yield curve, it doesnít necessarily mean that we should immediately head for the storm shelter. In the last two cases of inversion, stocks continued rising (by over 20% in 2006!) before the general market rolled over and a recession ensued.

I recall an offstage debate David Rosenberg, David Zervos, and I had in Florida two or three years ago. They were arguing that the economy would not weaken until we had an inverted yield curve. And my question was, quite simply, ďHow can we have an inverted yield curve, since the Fed is going to hold rates down almost forever because of the risk of their rising and thereby making the economy worse?Ē And they assured me that the Fed would eventually get around to raising rates, probably by too much, and that we would then get an inverted yield curve and could start thinking about storm shelters. It looks like they were right.

The Fed can control the short end of the yield curve but has limited influence over the long end. Right now the federal funds rate is 1.5%. One-month US dollar LIBOR is 1.57%, and 12-month LIBOR is 2.1%. Do I think todayís economy can stand a 2.25% fed funds rate? Yes, I do.

The Trump Effect

Fortunately, I think another force will counteract the Fedís actions, at least for 2018, and thatís what I will call (for lack of a better term) the ďTrump effect.Ē Like him or not (and I know from the email I get that many of my readers donít), the new administration is making some good things happen. I think the combined impact of deregulation, tax cuts, and (possibly) infrastructure spending will push back against the Fedís monetary tightening and keep the economy on roughly the same course as in 2017.

If the Republican tax bill isnít what you wanted, join the club Ė I was a charter member. Iíve met with my accountant, and the new law probably wonít help or hurt me very much, but it wasnít intended to. It was about reducing corporate taxes to help US companies compete with the rest of the world. The headline stories tend to look at the publicly traded giants, but I think the real impact will be on small and mid-sized businesses Ė particularly exporters and everyone who competes with imports. The lower tax rates will help them expand and even cut prices.

Having said that, the tax cuts wonít perform magic. I donít expect uninterrupted 3% growth for the next decade, as some of the billís cheerleaders predict. We will have another recession long before then, and it will probably be a deep one.

I have been talking about the new law with senior financial executives of large, privately held companies, my own accountant, and a number of friends. This is going to be like 1986, when everybody figured out how to game the system. You changed from being a C corp. to a sub-S corp. When you look at Thomas Pikettyís fudged and manipulated US income numbers in his laborious and ill-conceived book Capital in the 21st Century (which came out to massive academic acclaim Ė which says something about economic academia), you see this massive spike in US income in 1986. Did US citizens suddenly get rich? No, companies simply changed from being regular corporations to being pass-through corporations, which massively increased their reported income without actually increasing their real income. I did the same thing. You were an idiot not to. Today we all use LLCs, and it is rare to see a sub-S corporation created today. But I still have that 1986 sub-S corporation as an operating entity. Same difference as an LLC, just different tax reporting.

Now, you are going to see a lot of larger private pass-through corporations become regular C corporations again, because thatís how they can game the new tax system. In addition, blue-state politicians are already discussing ways to alter their tax systems so that their residents can get around the new SALT deduction limits. The tax revenue that Congress thinks itís going to get is not all going to show up, so the deficit is actually going to be worse than projected. (Letís come back in three years and see if this prediction was right.)

Goldman Sachs estimates the tax changes will boost GDP by an annualized 30 basis points in 2018Ė2019, then fade away. That seems as reasonable guess as any. The changes will help keep the mild expansion alive and push back against Fed tightening, and I think Trump-driven regulatory easing should help as well. Ask any CEO in practically any industry how much regulatory compliance costs Ė then stand well back. Now, if my friend GOP Rep. Jeb Hensarling can push through his reform of DoddĖFrank and ease regulations on small banks, we could see an even bigger boost. Regulatory costs are a major expense item, and companies would much rather spend that money on other things like worker training and maybe even pay raises.

These same factors will also let public companies distribute more capital to shareholders via stock buybacks and dividends. That should support stock prices at least at current levels and possibly push them higher still. It may not be another 2017-style record year, with numerous sectors gaining 20% or more, but it should be a decent year.

Notice that I said ďshould be.Ē Events could also conspire to derail that happy scenario. Letís look at what could do it. Winter is coming, but not just yet.

What Could Go Wrong?

My more-of-the-same forecast presumes that monetary tightening and fiscal easing will roughly offset each otherís impacts. Of those two, Iím more confident on the fiscal side. I think any error will likely emanate from the Fed Ė namely, that it will tighten too far and/or too fast.

Predicting the Fedís behavior is especially hard at this point, even with their dot plots, because the cast of characters will change significantly. We can also expect some transitional hiccups as Janet Yellen bows out and Jerome Powell sets his own sail.

What could happen that would make the Fed slow its present course of tightening? A sharp drop in inflation expectations should do it, but Iím not sure how that might happen. Energy prices are moving up, food and housing arenít getting any cheaper, and out-of-pocket healthcare costs are hitting families hard. The low unemployment rate hasnít yet created much wage pressure, though many economists think itís coming. I have my doubts. I think weíll see at least the three rate hikes in 2018, as the FOMCís last set of dot plots indicated, and maybe more.

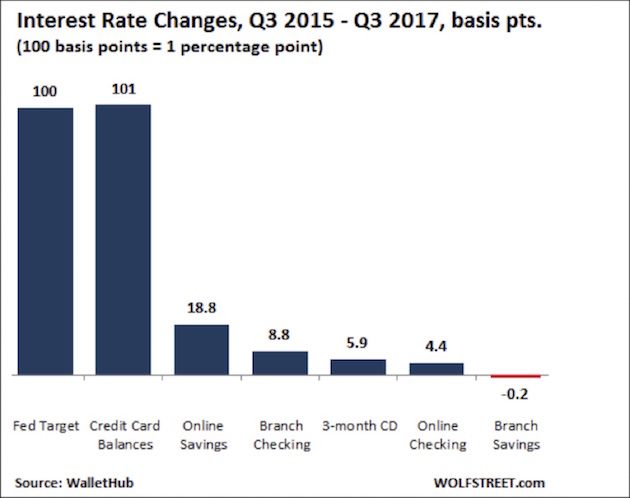

My friend Michael Lebowitz flagged some interesting rate data last week. Fed hikes to date have raised borrowing rates, just as you would expect, particularly for floating-rate loans and adjustable mortgages. That means additional cash outlays for debtors, i.e. most Americans, and less to spend on other goods and services.

Source: RealInvestmentAdvice.com

Normally this added expense would be at least partially offset by higher rates earned by savers, but bank-deposit and money-market yields havenít risen nearly as much as loan rates have. Current Fed policy is punishing debtors without helping savers. Thatís wonderful for bank profits, but the Fedís tightening may have more deflationary impact than it expects. It raises the odds of a policy error.

Fed error is my top domestic policy risk factor for 2018, but itís far from the only risk. Other central banks matter, too. If the European Central Bank and/or the Bank of Japan decide to follow the Fedís lead and begin to exit from their own stimulus programs, global liquidity could fall faster than presently expected. The impact would depend on exactly how the policy shifts occur, but markets might shift quickly.

Other risks are out there, too. The debt crisis in China; US military action against North Korea; the Middle East conflict, which affects oil and gas production; dueling trade wars Ė you know the list. Add to it the newest bubble asset, Bitcoin, whose possible collapse would strip a lot of money from people who canít afford to lose it. A lot could go wrong Ė but probably wonít; or if it does, the changes should remain manageable.

What to Do

Weíll begin to see the market impact of the tax changes when 2018 trading opens this week. The typical Santa rally ends on the second trading day of the year. The Stock Traderís Almanac tells us that if we end up on a high on January 3, an extraordinarily high percentage of the time weíll be up for the year as well. That said, I continue to emphasize that if you have large open gains in some of your holdings and youíre a bit concerned about them, you might want to cash in and buy back at lower valuations. One way or another, I suspect weíll see a significant correction at some point in 2018. It has been so long since weíve had a correction that we are due one.

Corrections can happen anytime, not just in the midst of economic weakness. Frankly, I think it would be healthy for the Dow to back down by 10% or so. That kind of correction would skim off some of the froth and give new entrants a lesson in humility. I would treat any such weakness as a buying opportunity, especially for stable, dividend-paying companies. You might be able to lock in some good yields.

A correction or even a bear market (a 20% drop in the market indexes) that isnít accompanied by a recession becomes a V-shaped recovery in the market prices. Think 1987 or 1998. Bear markets during recessions are ugly in that their recovery periods are long.

The even bigger opportunity might be in high-yield bonds. Theyíve not yet begun to retreat. If we get into a real fear-based market that thinks recession is coming, I think weíll see 15% yields in the junk bond segment. Theyíll get even better if recession actually appears. You see opportunities like this in the high-yield market only every 15 to 20 years. When they emerge, you have to put aside your fears and buy for the longer term. The technical charts show nothing but down when that pattern does happen. But a 15% yield and almost 50% capital gain can make that trade a meaningful addition to your portfolio.

If youíre holding stocks, investment real estate (as opposed to income real estate), or even more nebulous assets like Bitcoin, I would seriously consider taking some profits in early 2018, with an eye toward getting back in at lower prices when we get a decent-sized correction. That may not happen in 2018, but I suspect itís not too far away.

All that said, consumer optimism is at an all-time high. For whatever reason, all the consumer polls are telling us that itís ďHappy Days Are Here Again.Ē Note that the song was written in 1929 and debuted in 1930 Ė just in time for the Great Depression. Consumer sentiment today is a real-time indicator, and as they say, itís subject to change. But right now, the public is in a good mood, for a variety of reasons.

Bluntly, we are due for a correction in the markets, but weíve been due for some time. And itís not just the stock markets: Do you realize that the euro has not dropped more than 1% against the dollar for the entire year? Volatility is seemingly a thing of the past. Until, of course, it isnít.

Iím going to close this first of my forecast issues at this point, to keep the letter from getting too long. Next week weíll review the forecasts of other writers and friends, as I write to you from Hong Kong. The week after I will likely look at more specific markets, such as like energy, and offer additional comments on the tax reforms. But for now, let me wish you the very warmest and happiest of New Years.

Black-Eyed Peas, Hong Kong, Sarasota, and Boston

Shane and I will host close to 100 friends and neighbors on New Yearís Day for black-eyed peas, ham, and cornbread. And lots of mimosas. I think Shane is getting ready to cook about 8 gallons of black-eyed peas. Seriously. And while there will be a small quantity of them for the vegetarians among us, the bulk of them will have bacon, ham hocks, and smoked ham, plus a ton of seasonings; and one of those pots will have a healthy helping of jalapenos.

The next day we will fly with Lacy Hunt and his wife JK to Hong Kong, which, I have found out, is the longest flight in the American Airlines system: 17 hours and 15 minutes. It sounds like an opportunity to get some rest and catch up on some work.

When I get back, I am going to have to spend the day in Sarasota, looking at a new biotech company that my friend Patrick Cox thinks is extraordinarily promising. Honest to God, as skeptical as I am about government and central banks, I am extraordinarily optimistic about the human experiment. I think our world is going to be so much better in 20 years that the outcome exceeds our imagination.

I will have to get to Boston in mid-January to meet with new business partners and do a deep dive into the future of my business. Again, Iím extraordinarily optimistic about what I will be able to provide to you as investors and readers in terms of information, online services, and investment opportunities. More on that front in the future.

For now, letís close out 2017. I am sincerely grateful to have been able to write this letter for 20+ years Ė and to have had so many of you join me for the ride. When I talk about my one million closest friends, itís not just idle chit-chat, at least in my mind. When I sit down to write, I try to think of a person I want to talk to and share my latest thoughts with. Not a large audience, not the world, but you.

You give me the most valuable commodity in the world, your precious attention; and I try to deserve it by writing the best letter and giving you the most important information that I can. I thank you from the bottom of my heart. As one person who is overwhelmed by the information in his inbox, just as you are, I truly appreciate the value of your input.

My best wishes for 2018 Ė may it be your best year ever. I am ever optimistic this time of year, but I truly believe that 2018 will be my best year. I know that the ďbest plans of mice and men gang aft agley,Ē as the Scottish poet Robert Burns wryly observed; but as I have often pointed out, cautious optimism is the best strategy. Betting against humanity and our long-term success has always been a losing proposition. Betting against governments? Thatís a different story. But nobody in 2038 will want to go back to the ďgood old daysĒ of 2018. And as I will be writing in some of my future letters, your chances of making it to 2038 are a lot better than you think.

So letís raise our champagne glasses high in a toast to the New Year and a great future. I look forward to exploring that future with you.

Your ever-optimistic and eating black-eyed peas for good luck analyst,

John Mauldin

subscribers@MauldinEconomics.com

Copyright 2017 John Mauldin. All Rights Reserved.

| Digg This Article

-- Published: Monday, 1 January 2018 | E-Mail | Print | Source: GoldSeek.com