-- Published: Friday, 5 January 2018 | Print | Disqus

By Steve St. Angelo

Enjoy the good times while you can because when the economy BLOWS UP this next time, there is no plan B. Sure, we could see massive monetary printing by Central Banks to continue the madness a bit longer after the market crashes, but this won’t be a long-term solution. Rather, the U.S. and global economies will contract to a level we have never experienced before. We are most certainly in unchartered territory.

Before I get into my analysis and the reasons we are heading towards the Seneca Cliff, I wanted to share the following information. I haven’t posted much material over the past week because I decided to spend a bit of quality time with family. Furthermore, a good friend of mine past away which put me in a state of reflection. This close friend was also very knowledgeable about our current economic predicament and was a big believer in owning gold and silver. So, it was a quite a shame to lose someone close by who I could chat with about these issues.

Before I get into my analysis and the reasons we are heading towards the Seneca Cliff, I wanted to share the following information. I haven’t posted much material over the past week because I decided to spend a bit of quality time with family. Furthermore, a good friend of mine past away which put me in a state of reflection. This close friend was also very knowledgeable about our current economic predicament and was a big believer in owning gold and silver. So, it was a quite a shame to lose someone close by who I could chat with about these issues.

While some of my family members know about my work, I don’t really discuss it with them. If they ever have a question, I will try to answer it, but I found out years ago that it was a waste of time to try and impose my knowledge upon them. Which is the very reason I started my SRSrocco Report website… LOL. So, now I have a venue to get my analysis out to the public. I don’t care about reaching everyone, but rather to provide important information to those who are OPEN to it.

As I have stated before, I receive communications from individuals all across the world and from all different occupations. The common theme I receive from these individuals, who stumbled upon my website, is that they say, “IT’S MUCH WORSE THAN YOU REALIZE.” Unfortunately, I cannot share publically the information that they have provided, but I can tell you that the GRAND FACADE will come crashing down to the shock and surprise by the masses.

However, I can tell you one individual has contacted me with data suggesting that one of the largest shale oil companies in the United States has been fudging its numbers for the past several years. I have had nearly a half a dozen phone conversations with this individual and the evidence points to serious fraudulent activity. And let me tell you this individual is no conspiracy nut, he was a Senior-Level person in the company. When this information becomes public, it could be the next ENRON. If so, that will destroy the investor trust in the U.S. Shale Energy Industry. Virtually overnight, we could see a collapse of capital investment in an industry that hasn’t really made any profits since it started producing shale oil and gas nearly a decade ago.

Unfortunately, I continue to read articles and receive emails from individuals who believe that the vast U.S. shale energy resources will make the U.S. energy independent. I am completely surprised by the lack of wisdom of supposedly highly intelligent individuals who should know better. Furthermore, it seems to be that the debate is not about discussing facts and reason, but rather between the TRUTH & LIES.

Thus, there is a big disconnect between individuals with CHARACTER, INTEGRITY, and TRUTH versus those who don’t care about increasing the debt to produce shale energy. According to these individuals, they don’t care if someone gets stuck with the debt if it allowed them to make money or for Americans to enjoy low-priced gasoline. This is exactly what is wrong with the world today. The world has become so big; we don’t care about screwing someone else in order to make a buck. If it isn’t our money, then the hell with them.

So, to debate someone with that sort of mentality, it’s a total waste of time. You cannot debate an individual based on facts and truth if they come from a position of fraudulent activity and lies. Just like oil and water, they don’t mix. I can tell you; I see this all over the internet… even in the alternative media community. Of course, these individuals will reply that they are correct. However, their position is flawed because their ideology is also flawed.

Here is a piece of advice. Don’t waste time debating individuals who don’t base their ideas on truth and sound data. The only reason I do it via my articles is to prove why their analysis is flawed because people are still making up their minds. I don’t do it to change the mind of the analysts, (example, CPM Group’s Jeff Christian), but to provide information that helps individuals understand the reality of dire energy predicament we are facing because it all comes down to the energy.

That being said, I haven’t received a reply from Jeff Christian in regards to my article, CPM Group’s Jeff Christian Responds “NEGATIVELY” To The SRSrocco Report On Silver Investment Demand. After my first article, Jeff left some choice words in a comment, which motivated me to reply. Of course, Jeff didn’t reply to the second article because I gather he realizes that the FACTS & DATA prove their gold and silver price analysis has been flawed for 40 years. So, it’s better for Jeff Christian and the CPM Group to keep quiet as they want to continue selling their Gold and Silver Yearbooks to the industry.

The Fundamentals Point To The GREAT DELEVERAGING Of The Economy… Dead Ahead

While the mainstream media and financial networks suggest that THIS TIME IS DIFFERENT for the markets…. it isn’t. The fundamentals of the markets are so out-of-whack, I am amazed people can’t see it. This is also true for the Bitcoin and cryptocurrency market. While a small group of crypto-investors have made a killing, it’s mostly digital wealth. While I don’t have a problem with someone making profits investing in cryptocurrencies, I do have a problem when they believe this technology is the wave of the future. For some strange reason, they must believe in the ENERGY TOOTH FAIRY.

While some of these cryptocurrency analysts (or supposed analysts) believe that we are heading into a new high-tech world where we no longer have to work, just live phat on our Billions in Bitcoin profits, the Falling EROI – Energy Returned On Investment never sleeps. That’s correct; it continues to erode our modern way of living each passing day. Unfortunately, adding more technology does not solve our energy predicament, it just makes it worse.

Also, individuals who believe in FREE ENERGY technology or supposed advanced ALIEN ENERGY technology hand-me-downs, to save the day… you are grasping at straws. Now, I am not trying to change anyone’s mind who believes in free energy or alien technology, but all I ask is that you stay alive for another 5-10 years to see the mistake of your ways. Yes, that may sound a bit confident or arrogant, but empires have come and gone in the past. The current one is no different.

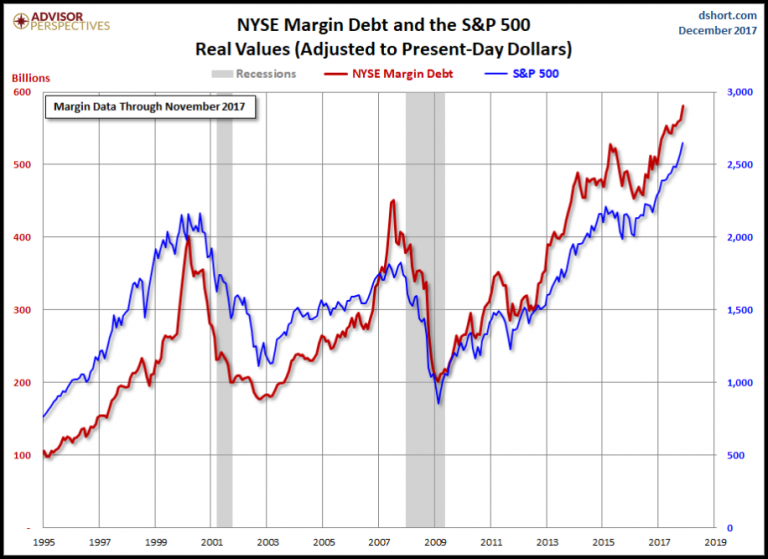

Let’s first look at the NYSE margin debt. According to the chart by the Advisor Perspectives, the New York Stock Exchange margin debt is at new record high:

As we can see, the NYSE margin debt (by traders) is nearly $600 billion versus $400 billion in 1999 and $450 billion in 2007. Which means the NYSE margin debt is 33% higher than the level it was right before the 2008 U.S. Housing and Banking collapse. If we look at the 1999 and 2007 NYSE margin debt graph lines (RED), we can spot a huge spike right before they both peaked. If this is the way it will happen in the current trend, then we will likely see a huge spike and stock market MELT-UP before it peaks and collapses.

You know…. the last chance for the really stupid traders to get SUCKED in.

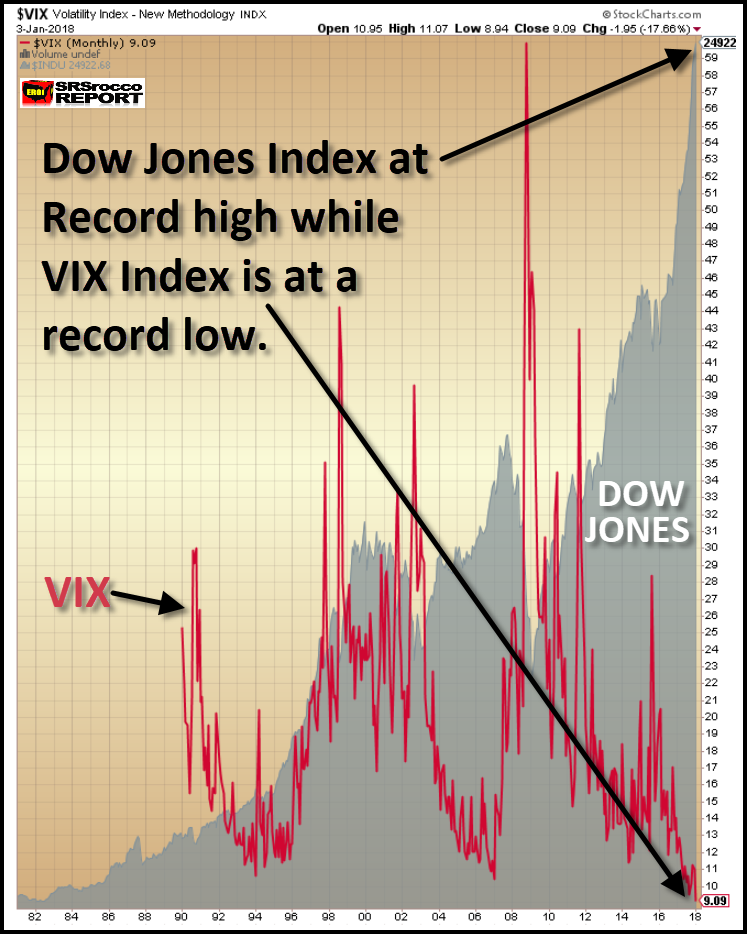

So, as the NYSE margin debt reaches new record territory, so has the VIX Index and the stock market. Yesterday, the VIX Index (measures volatility in the markets) closed at a new record low of “9”, while the Dow Jones Index ended the day at a record high of 24,922 points:

Today, the Dow Jones Index has reached another record at 25,100. Just like the cryptocurrency market, the only direction is HIGHER. Who knows how low the VIX Index will go and how high the Dow Jones will reach, but my gut tells me that this will be the year that the fun finally ends.

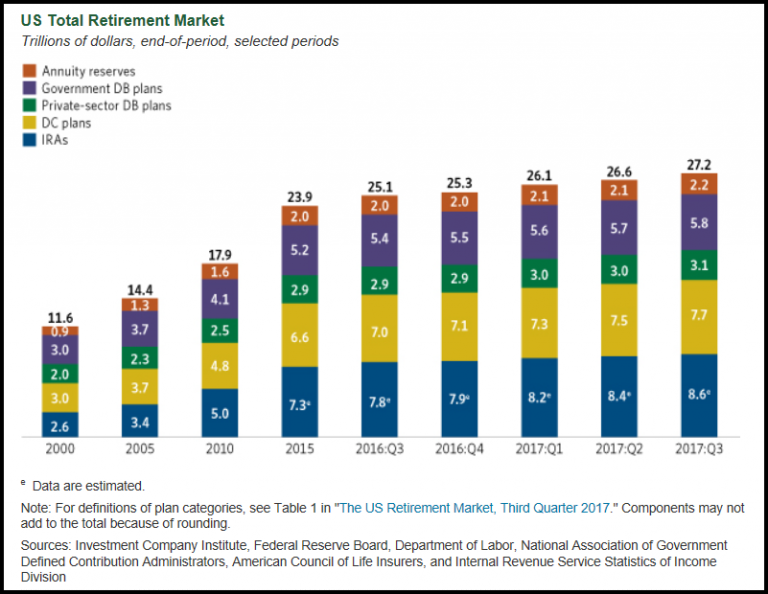

Of course, if we have new record highs in the stock markets, we should see the same with the U.S. Retirement Market:

According to the ICI – Investment Company Institute, the U.S. Retirement Market hit a new record at $27.2 trillion in the third quarter of 2017. I would imagine the U.S. Retirement Market will surpass the $28 trillion mark in 2018. When Americans feel rich via their investments, it makes them also feel good about buying more crap they don’t really need or can afford.

You see, frugality has been totally erased from Americans’ mindset. By being frugal, I am talking about being extremely wise and cautious about spending ones fiat currency. Being frugal is one of the most important aspects of a successful household. However, if frugality were reintroduced to Americans, then the entire economy would collapse overnight. Why? Because, the U.S. economic model is based on buying as much as we can on debt and credit. If we moved back to being frugal or buying only with cash, then 95-98% of the U.S. economy would disintegrate.

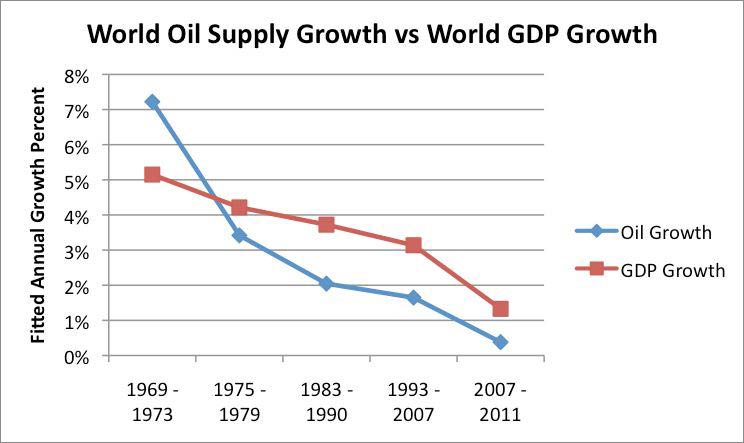

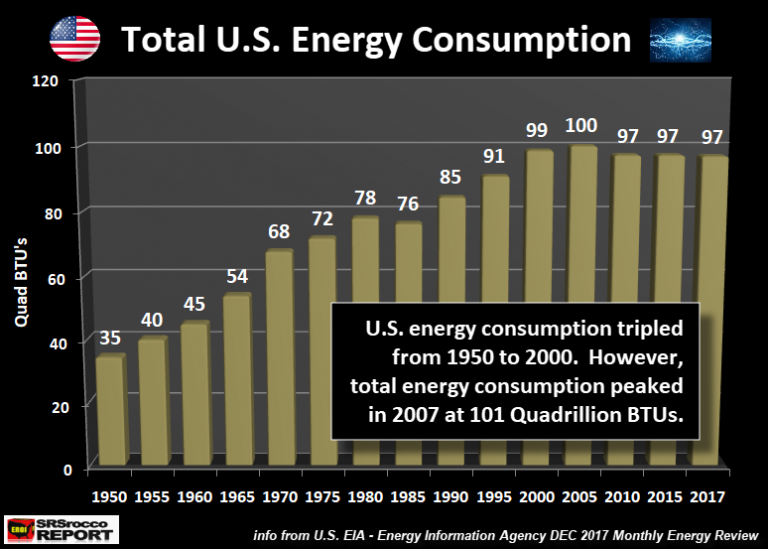

What is quite interesting about the U.S. stock and retirement market is that their values have skyrocketed while our energy consumption has remained flat since 2000. This wasn’t the case from the 1950-2000 period. As U.S. energy consumption increased, so did the value of the stock market. This was also true for world GDP:

Global GDP growth increased in percentage in line with world oil production growth. However, it was different for the United States. While total U.S. energy consumption remained flat since 2000, the value of stock and retirement markets skyrocketed higher:

This chart shows total U.S. energy consumption in Quadrillion BTUs. As we can see, total U.S. energy consumption tripled from 35 Quad BTUs in 1950 to 99 Quad BTUs in 2000. However, total energy consumption has been virtually flat ever since 2000 while the value of the U.S. Retirement Market has increased from $11.6 trillion to $27.2 trillion and the Dow Jones Index has surged from 11,000 to 25,000 points currently. Both markets are up approximately 130% since 2000 while energy consumption is flat.

That is most certainly a neat trick by the Fed and Wall Street Banks. Of course, there will be individuals who say the value of STOCKS, BONDS, and REAL ESTATE can rise on flat energy consumption. They can say that because they are completely FOS… FULL OF SHITE. Pardon my French.

When we look at the world in digital values instead of energy data, we can come up with virtually anything. The value of stocks, bonds, and real estate have been wildly inflated due to Central Bank money printing and the tremendous increase in debt. If an individual stayed awake during their economic classes in high school or college, NET WORTH comes from subtracting DEBTS from ASSETS. However, today… we don’t worry about the debts. We only look at the assets. This is like eating all the junk food during the holidays and not worrying about the way it comes out the other end.

Americans have deluded themselves into believing that crap that is put on our dinner plate is good for us. So, why should we blame them if they forget about debts and only look at assets? It makes perfect sense when LIES and FRAUDULENT activity are the predominant ideology in society.

When The Markets Crack, So Will The Price Of Oil… and with it, The Economy

If you have been reading my analysis on energy, you would understand that oil is the KEY FACTOR to the health of our economy. It doesn’t matter if we were to come up with some new energy technology like cold fusion or thorium energy reactors, they don’t solve our LIQUID ENERGY PREDICAMENT. The world doesn’t run on electricity; it runs on liquid oil. If you remember anything, that is one not to forget.

Regardless, I have looked over cold fusion and thorium reactors (along with many other “silver-bullet” energy-saving technologies), and they just don’t work. Yes, I would imagine some individuals will send me information to the contrary, but the fact remains… our retail markets are based on the just-in-time inventory system. That system needs liquid fuels to function, not electricity. So, when liquid energy runs into trouble, the world economy runs into trouble.

While I have presented a lot of articles and analysis on the Great U.S. Shale Energy Ponzi Scheme, I am not going to focus on that today. Rather, let’s look at the oil price and its dynamics going forward. As I have mentioned, I believe the price of oil will trend lower even though we may experience price spikes. My realization of the continued falling oil price came from the Thermodynamic work of Bedford Hill (TheHillsGroup.org) and Louis Arnoux. While some do not agree with the findings of The Hill’s Group or Louis Arnoux, the only error I can see in their work is the timing of the Thermodynamic Oil Collapse. And that is really not an error as they stated their calculations are based on the “Average Barrel of oil.” Thus, there is room for improvement of their model as well as a degree of accuracy… but not much.

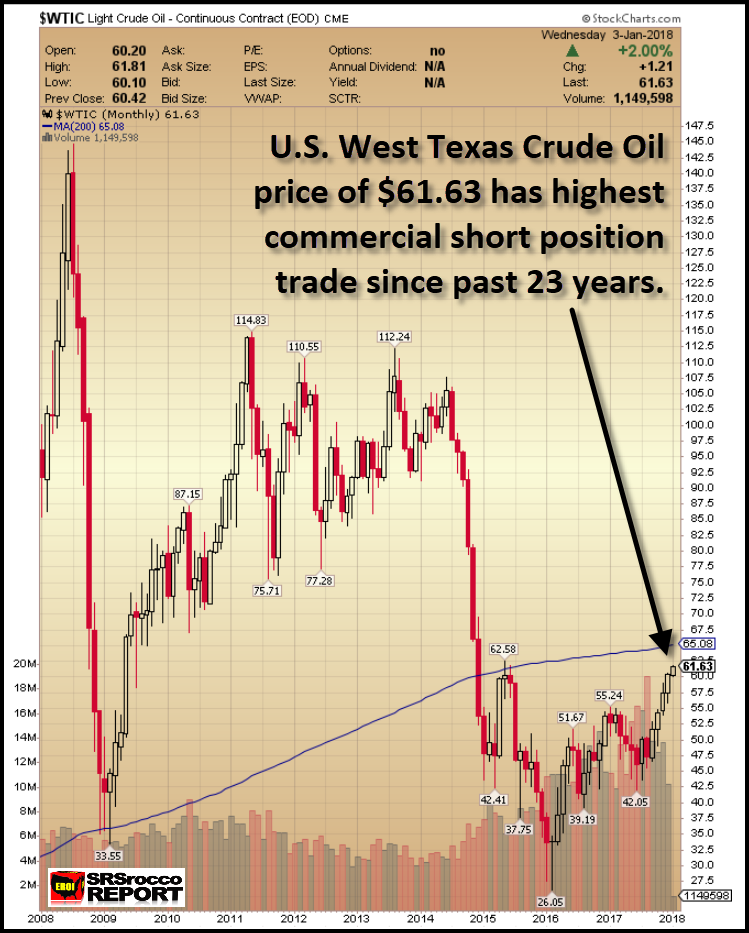

If we look at the current oil price chart, it seems as if it is heading back towards $65 (200-month moving average-BLUE LINE) and then up to $100:

However, the COT Report (Commitment of Traders) shows a much different setup. The amount of commercial short positions in the oil market is the highest going back 23 years. Furthermore, the current 644,000 commercial short positions are even higher right before the price fell from $105 in 2014:

You will notice when the price of oil was at $105 in 2014, the commercial shorts (hedgers positions) were approximately 500,000 contracts. Today at $62, the current commercial short positions are 644,000 (the chart above is two weeks old). Furthermore, when the price of oil fell from $105 down to a low of $26 at the beginning of 2016, the commercial short positions fell to a low of 180,000 contacts. So, it looks like the oil price is being set up for one hell of a fall.

Now, the interesting part of the equation is this… will the oil price fall when the markets crack, or before? Regardless, if we look at all the indicators (VIX Index record low, Stock Market Record High, NYSE margin debt record high or commercial short positions on oil at a record high), we can plainly see that the LEVERAGE is getting out of hand.

These indicators and others give me the impression that the economy and markets are going to BLOW UP in 2018.

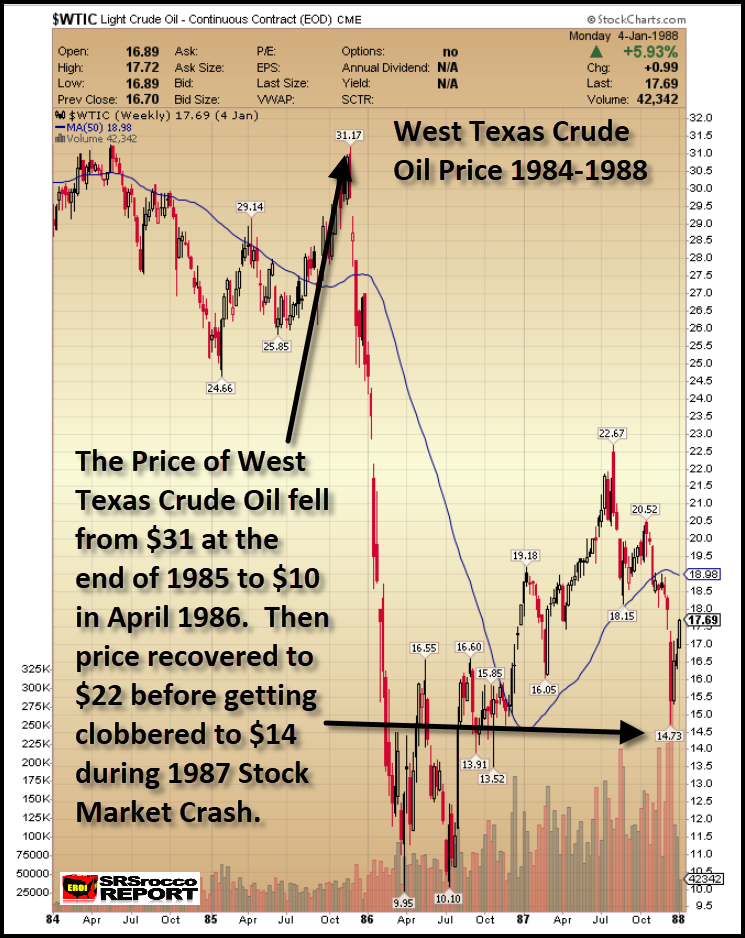

Moreover, this setup already took place in the market back in 1987. While I have written about this in a previous article, I wanted to show it using the oil price from 1984-1988. Very few people knew that the oil price dropped like a rock from $31 in 1985 to a low of $10 in 1986:

The decline in the price of oil from $31 to $10 was quite similar to what happened in 2014 when the price fell from $105 to a low of $26 in 2016. Also, the oil price recovery in both periods was quite similar as well. From July 1986 to August 1987 and from January 2016 to January 2018, the oil price (and economy) recovered. The oil price more than doubled from its low in 1986 ($10-$22) and 2016 ($26 to $62).

However, a few months before the infamous BLACK MONDAY Stock Market Crash on Oct 19, 1987, the oil price peaked and declined by nearly 20% ($22 down to $18). So, are we going to see a similar pattern this time around? Will the warning shot be the peak and decline of the oil price as it’s currently being set up by the record amount of commercial short positions? These are all very good questions in which I have no answer, but clearly, history does repeat itself.

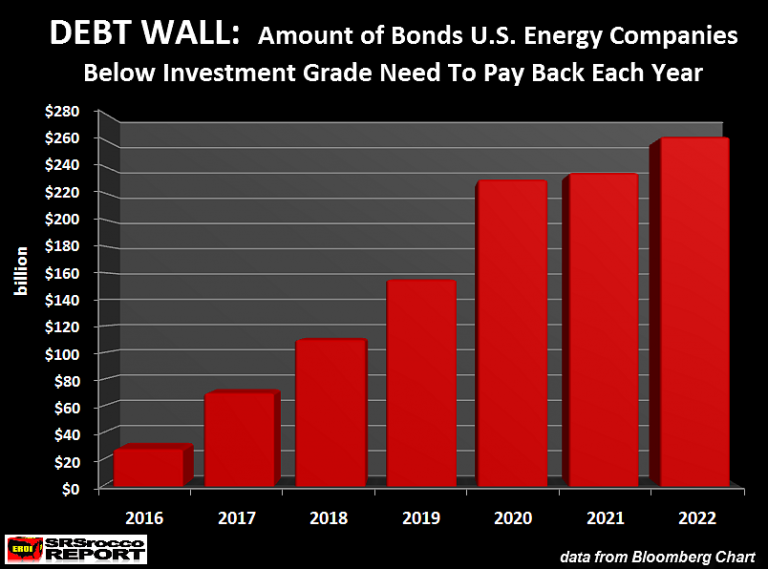

Either way, the indicators are pointing to one hell of a deleveraging of the markets. Investors need to understand when the oil price heads south once again; it will likely be the death-knell for the already weak U.S. Shale Oil Industry. We must remember, when the markets were collapsing in 2008, the U.S. oil industry was still in relatively good shape. Today, most of the shale companies have debt up to their eyeballs. Once again, here is the chart of the coming ENERGY DEBT WALL:

The tactic used by the Shale Energy Industry was to take investor money and push back the PAYBACK as far as possible. The intent was to BAMBOOZLE as many SUCKERS as possible before anyone realized just how unprofitable it was to produce shale oil and gas. A perfect example of this is the poster child of what’s wrong with the shale oil industry… Continental Resources.

Before Continental Resources embarked on the Great U.S. Shale Ponzi Scheme, the company only had $165 million in debt (2007) and was paying an annual interest payment (on their debt) of $13 million. Fast forward to today, Continental now has over $6.6 billion in long-term debt and will likely pay over $300 million in their interest expense this year.

This is precisely why Continental Resources announced the issuance of $1 billion in new Bonds so they could pay off existing ones that were coming due. And get this. The SUCKERS who purchased the $1 billion of new bonds, will not be paid back until 2028… LOL.

The POOR SLOBS that purchased those Continental bonds need to read about the Fiasco that happened to BHP Billiton when they blew over $50 billion in their investment in the wonderful U.S. Shale Ponzi Scheme.

I would like to remind investors that the definition of a PONZI SCHEME is to use new investor money to pay off existing ones. This is exactly what is taking place in the U.S. Shale Energy Industry. Because Continental has pushed back the payback period for ten years, they have received additional funds to continue the facade a bit longer. It is quite likely that Continental Resources will no longer be around in ten years to pay back that debt.

But why should that matter? Why should the CEO care about the debt if he made $millions and was able to sell most of his stock before the public realized what a worthless PIECE OF GARBAGE shale oil and gas have been?? Again, this is the fabric of our society. As long as some other SMUCK get’s stuck with the bill…… who gives a RATS AZZ??

To tell you the truth, when the markets finally crack, and the real carnage rips through the U.S. economy, we only have ourselves to blame. There are no pointing fingers when we are all involved. Especially the Bitcoin and cryptocurrency fanatics. I hate to say it, but those who believe they are going to get rich on CRYPTOS so they don’t have to work anymore…… let me provide you with my famous saying.

GOD HATH A SENSE OF HUMOR…..

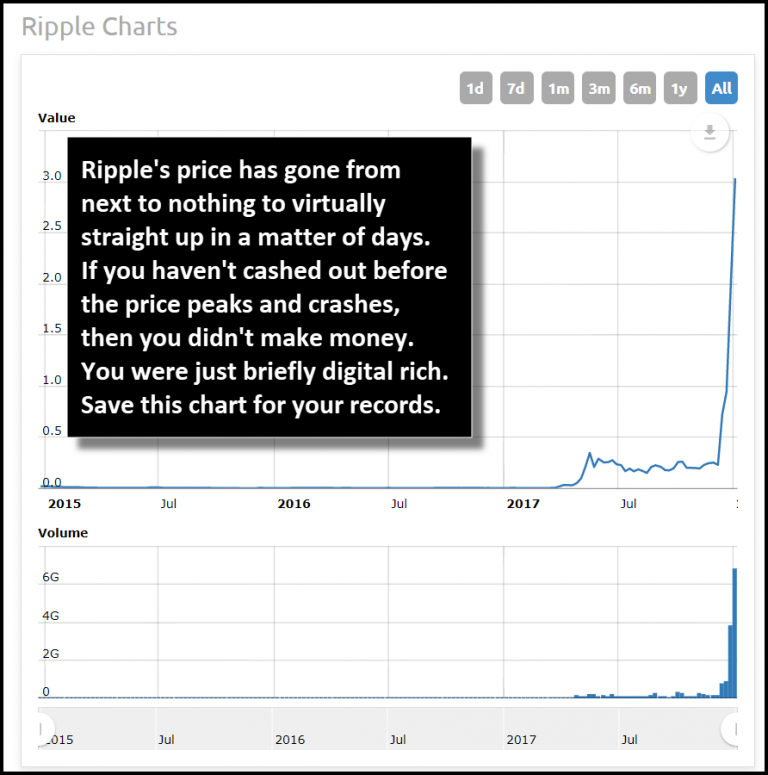

Currently, the cryptocurrency that is now stealing the show is Ripple. Anyone who bought Ripple a year ago for $0.005 a piece is salivating on the profits they have in their account. I would imagine the BOOZE and MONEY SPENDING are really flowing. However, if you look at Ripple’s chart and you don’t see a problem…. you might want to check yourself in and get an MRI brain scan:

There’s a lot more that I can say about Ripple and the other cryptocurrencies, but either you get it, or you don’t. Those that don’t get it now… will likely get it shortly. Unfortunately, the cryptos won’t be the new technology that will change our world for the better. Rather, they will be another Tulip Mania that we can add to the growing list.

In conclusion, the U.S. and world economies are heading towards one heck of a crash. What happens when this occurs, it’s anyone’s guess. Likely, the Central Banks will step in with their magic and print money like crazy. However, this is not a long-term solution. If you haven’t bought some physical gold and silver insurance yet and are waiting to time the markets, GOOD LUCK WITH THAT.

Lastly, I wanted to personally thank all those who have supported and continue to support the SRSrocco Report site. Your generous support allows me the opportunity to continue putting out the analysis and articles. As I have mentioned, I will be soon putting out new Youtube Videos that I believe will help explain some of these concepts better.

Check back for new articles and updates at the SRSrocco Report.

| Digg This Article

-- Published: Friday, 5 January 2018 | E-Mail | Print | Source: GoldSeek.com