-- Published: Monday, 22 January 2018 | Print | Disqus

By David Haggith

My 2018 economic predictions follow through on the accurate predictions I made in 2017. In my last article, I stated that I had bet my blog the stock market would crash by January 2018. In fact, however, I’ve gone back and rechecked those predictions and my bet, and I found that I wisely hedged my bet in terms of timing due to the Trump factor. I realized back then that, for the short term (2017-2018), Trump would seriously alter the economic trajectory of the US established during the Obama years — the path by which I had been predicting an economic apocalypse would soon be upon us. Trump would not, however, improve things over the long term because our underlying economic woes would only get worse.

I made my promise when a naysayer challenged my 2017 economic predictions, which turned out much better than memory served now that I’ve gone back and actually reviewed them.

The Naysayer asked,

What if no Apocalypse happens in 2017 and even 2018? Promise to us that you will publicly apologise and admit that you scribbled tons of outrageous BS.

… and I promised in reply,

I will promise it right here and will ask you to earmark mid 2018 to come back to this page and hold me to it…. I’ll very likely do far more than apologize: I will likely apologize and stop writing this blog well before the end of 2018 if an economic apocalypse — the Epocalypse — is not clearly happening by then. (Comments to “The Inevitability of Economic Collapse” written in February 2017.)

I actually only promised to apologize if I was wrong, but I did not quite promise to quit writing my blog; and I gave a deadline of mid 2018, not the start of 2018. (Though I believed things would begin to fall part badly in 2017, I gave myself a buffer before I’d go so far as to apologize for being wrong because of I anticipated a Trump Effect.) I did say I would likely even go as far as to stop writing the blog before the end of 2018 if I was still wrong. (The “likely” is because it depends on how far wrong I am. If I am only wrong by a few months and the economy is clearly disintegrating in the late fall of this year, I’ll likely keep writing.)

While I thought to myself at the time that the economy would probably be falling apart badly by January of 2018, my article stopped short of predicting that; and it did not predict the stock market would crash at all. I only wrote that economic fundamentals would get much worse, and almost all of those that I outlined have gotten worse. I even wrote in another comment to my two prediction articles that the stock market would rise for quite awhile if the president’s promise of a grand tax plan got passed in its promised form by congress:

The Trump plan is, indeed, massive; and, if congress passes it, there is bound to be a lot of short-term lift. If congress doesn’t pass much of a plan, on the other hand, the stock market has banked on it already, so it will fall quickly. Trump’s plan in my opinion is largely short-term medicine that is long-term poison. Stocks could really shoot up if all this corporate money gets repatriated to support buybacks or payoff of debt used for earlier buybacks and if corporations wind up getting a retroactive tax break.

As fast as the market rose speculating on the hopes of that tax plan, it has risen remarkably faster now that the tax promise is a tax fact. So, those predictions have proven remarkably true. Corporate money did get repatriated retroactively so that past earnings are already coming back home at a better tax rate than corporations would have paid if they brought those earnings home in the years when they were earned. In terms of timing, what I had actually predicted in that article last February was …

Exactly when [economic collapse will happen] I’m not as certain because the election [cycle] changed things…. So for the very short term Trump’s policies may boost the economy, but mid-term and longer, Trump and his cabinetful of bankster-barons are not going to be able to stop these numerous trends from crushing us. Trump has expressed no plans to solve any of these overwhelming structural flaws that are trending against us…. So, the situation toward the latter part of this year looks worse socially [a reference to the political rage I had said was going to continue throughout 2017] and, in years to come, looks much worse financially and socially.

I gave myself more latitude in timing than I recalled giving, even saying that, because of Trump, financial catastrophe wouldn’t come until future years. In a follow-up article last February that laid out more of my predictions, I even said that it was “certain Trump’s tax plan will happen” … in spite of the fact that “we have NEVER made tax cuts without increasing the federal deficit under any president.”

I even predicted,

The stock market will rise … for awhile, at least. What we know from trickle-down economics is that it certainly does stimulate the stock market. The money that is saved on capital gains and corporate income and that is repatriated in corporate income from overseas largely goes into speculative gambling in stocks.

and …

It is unlikely that Trump’s infrastructure stimulus plan will make it off the ground in 2017.

and …

Spending will certainly increase in one area — the military.

and …

Regulatory changes will also lubricate the economy to move forward with less friction.

and that the establishment …

will do anything they can to restrain Trump’s plans to drain the swamp in Washington and as well as his plans to align with Russia and his plans to diminish nation-building efforts.

By which I meant they would likely be successful.

All of those things proved true. So, when I actually went back this month and reread the predictions I had made in those articles early last year, I found I had nothing to be ashamed of so far. I had revised my thinking about the stock market crash I saw coming soon under the Obama trajectory to state the market would actually rise dramatically in 2017 and economic collapse would not happen until the “years beyond.” (Months before that I had been thinking much differently, but a major political revolution requires a change in how one sees things.)

A complete list of my 2017 economic predictions

Here in bullet form are all the prevailing forces and events I predicted for 2017 during the first quarter of last year so you can assess accuracy for yourself:

- Trump’s tax plan — a third (and”trumped up”) round of trickle-down economics — would certainly pass in 2017. His enormous tax changes made it harder to for me predict the movement of money in 2017 because his tax plan is vastly different than all preceding years, leaving no pattern to go by. It was clear, however, that Trump’s changes would succeed in moving massive amounts of money back into the US. .

- Under his plan income gaps between the rich and all the rest would increase in the years to come (yet to be seen), leading to more class warfare years down the road.

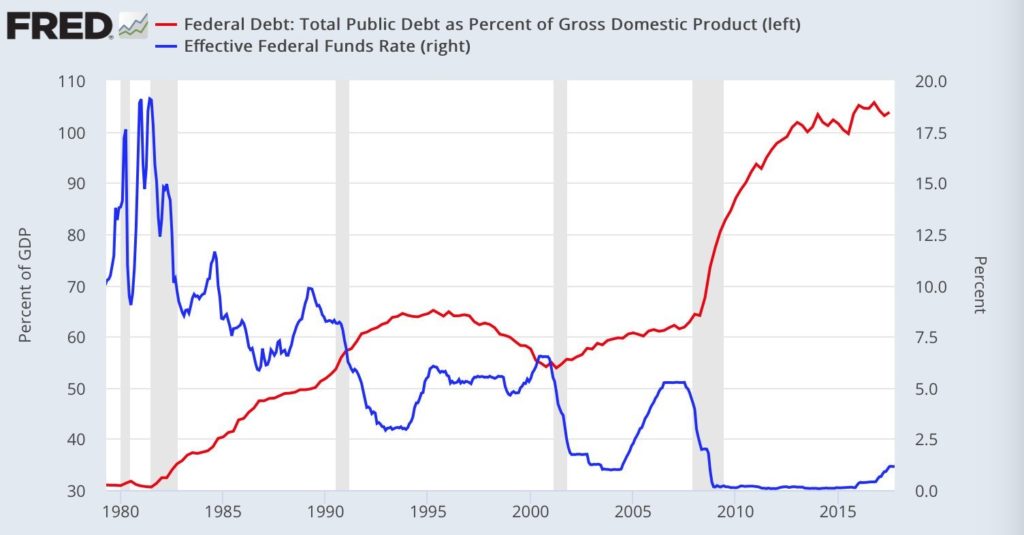

- Trump would enthusiastically continue the immoral game of spending the next generation’s money to fund our own generation’s hope for recovery and to make our lives easier; but his plan would not resolve any underlying problems our economy has and eventually will worsen those problems, such as our massive national debt (which already places a half-a-trillion-dollar debt-service strain on the economy each year even at record low interest). This will leave future generations with worse problems than we have already established for them and nothing to show for the debt we hand of to them but a collapsed nation.

- There would be some profit-taking from the Trump rally near the end of January, 2017, that would cause a likely “Trump slump” in the stock market but not an immediate crash. (A gradual slump did happen in the rally, declining for two months in March and April, after which the market picked up steam again.)

- A 2017 stock market crash later in the year seemed likely but the likelihood would be mitigated by Trump’s huge changes, which assure the market would rise for a good part of 2017 after the slump. Trumphoria would likely lose steam in 2017. (Clearly, the market did not crash, however, nor did Trumphoria wane.)

- Trump’s infrastructure stimulus plans would not happen in 2017, but military spending definitely would increase.

- US nation-building would continue throughout 2017, in spite of Trump’s promises to move away from all of our military experiments.

- Globalists (a.k.a., “the establishment”) would succeed in restraining Trump’s plan to realign with Russia, which he had said he would like to do during his campaign.

- The forces that oppose Trump (a.k.a, “the establishment”) would not retreat, assuring that 2017 would be a remarkably chaotic year in which globalists dig in and fight. 2017 would be the year in which “the unstoppable force meets the immovable object.”

- Chaos and social unrest would spread throughout the world. (When do we not have that? My point, however, was that the tensions from the election would make it worse; though that didn’t turn out as badly as I thought it would. It is, however, still developing.)

- Hillary would not be going to jail in 2017 — not even close — in spite of all of Trump’s campaign cajoling that all but promised his base he would make sure she does.

- Bailed out banksters would not be going to jail either under Trump any more than they did under Obama, so they would continue to be moral hazards as much under Trump as ever — if not more so because he was giving them all of his financial cabinet positions.

- Too-big-to-fail banks would just keep getting bigger (an underlying problem that would only get worse), and Trump’s deregulation of them (by undermining Dodd-Frank) would only exacerbate their destructive potential over time, but Trump’s deregulation would accelerate the economy as certainly as deregulation did before 2008.

- Trump would not in any way change the globalist makeup of the world’s banks nor their path. (He would not even attempt to.) Therefore, the Fed’s manipulation of the stock market (and really any market it wants to manipulate) would remain unchecked under Trump (in spite of his campaign threats against Yellen and the Fed, which would all fade into empty rhetoric, intended only to stimulate his base).

- The housing bubble would continue to get more bubblicious, but a decline would become obvious in certain areas in the summer. A collapse greater than we saw in 2007-2009 “might” start as early as 2017 in various parts of the world, including the US, but particularly in Canada and Australia and the UK as well as New Zealand and Sweden.

- The above trends, along with aging demographics and rising interest on the national debt, would continue to worsen and will remain the forces that determine our long-term trajectory, which is toward economic collapse (as Trump would do nothing to improve any of those problems and will make most of those problems worse, assuring long-term decline).

- However, for a short time, we would see a burst of economic improvement. (2017 and the first half of 2018 being that short time, after which I expect to see a reversion to the overall trend of decline caused by the forces delineated above, made worse by Trump’s plans).

- Economic collapse would probably become evident by the end of of 2017 (which it did not, but that is where I hedged my bet in terms of what I actually promised by giving myself until mid 2018 if I was going to make a public apology for being wrong).

- Globalist banksters might even collapse the economy on purpose just so they could use Trump as the scapegoat for their failed economy. (Cleary didn’t happen, but maybe that is because, as predicted above, Trump did nothing to challenge their growing ownership of this world; but left them fully in power, gave them cabinet positions, and gave them all enormous tax breaks. So, why wouldn’t they love him to death?)

Those predictions, if anyone wants to check out that I have covered them all, come from the following articles published during the first quarter of last year:

2017 Stock Market Predictions: Trump Slump in January for Stocks

If 2016 Wasn’t the Epocalypse, What the Heck Was it?

The Inevitability of Economic Collapse

The Trump Triumph Challenges Economic Predictions for 2017

2017 Economic Headwinds: Housing Bubbles Popping up and Just Plain Popping Everywhere

I’ll bet you can come back in ten years and will find the economic trends they present have prevailed an entire decade beyond their writing. In one later article (“2017 Economic Forecast: Global Headwinds Look Like Mother of All Storms“), I listed numerous additional brewing problems that could reach such a point that they would create havoc, but I never made them part of my predictions. (They were more like vultures circling in the distance.)

2017 is the foundation for my 2018 economic predictions

I’m laying all of that out because I think you’ll see that the overall list pretty accurately stated where things would head (what things would turn out to be prevailing forces), even some of it was off a bit in timing or severity. That’s why my 2018 economic predictions don’t really look any different than those for 2017.

I was a little off in thinking that I had bet my blog on a stock market crash by sometime this January because that is the crescendo I thought would develop by now, though I allowed more time in my write predictions; but the direction for nearly all of those things wasn’t off at all. I hedged my bet on the timing because I decided experience had taught me that these things develop more slowly due to countervailing forces that arise than I tend to think they will.

In another comment to one other critic regarding all of those predictions, I reiterated my earlier promise, should I prove wrong; although I recalled the timing for my guarantee incorrectly then, too:

I’ve also said that, if the economy is not clearly showing itself to be broken upon the rocks by the beginning of next year (i.e. within the first quarter of next year), I will stop writing this blog. I have put my money where my mouth is (so to speak) offering that guarantee on my words. (Because if I’m wrong at that level, I have nothing useful to say.)

As shown above, the timing recollected should have said “after the first half of next year” not “within the first quarter,” and I should have stated that I had said I would apologize mid year and probably even stop writing the blog by the end of the year (meaning if I was clearly way off). So, we are not there yet. Apparently, my memory has been holding me to a higher standard than what I had actually promised.

My struggle with timing has been because I have based all of my predictions on this blog of where things were headed on the trajectory that became clear to me under Obama; but I realized, even as I wrote out my 2017 predictions, that Trump’s first year was going to improve the trajectory we were on substantially. It would, however, only improve it for the short term (a change that I had no pattern to go by) because it actually exacerbates the major underlying economic problems.

Since most of my 2017 economic predictions generally proved accurate, they are the foundation I am following through with this year in making the following 2018 economic predictions: (I think seeing the continuity of thought, along with the wavering in timing is important so that you see none of this is out of the blue but is part of a long-term projection that has been relatively on-track so far.)

My 2018 economic predictions

So, here we are: it’s 2018, and we still have half a year to see if my biggest 2017 economic predictions come true as all of that was predicted to build toward fulfillment this year. 2017 was the year in which economic collapse that was developing under Obama would continue to develop. Yet, the thrust of my predictions was that the “Epocalypse” would not materialize in any big way until late in 2018 because Trump’s tax plan would intervene with temporary lift. We saw that predicted lift, and will continue to see it for a few months. Thus …

2018 economic prediction #1: Stock market keeps rising

Given that the Trump tax plan passed, as I said it would — and that the mere hope of his plan was driving last year’s surprise stock rally (surprise to almost everyone in terms of its size and velocity) — I expect his plan will continue to drive up stocks for a few months … maybe even until late in the year. (I’d hedge my original bet a little further, if I hadn’t already made it. I did say last month I thought there could be some profit-taking this January, too; but so far there hasn’t been, indicating to me how much lift remains in the market.)

The reality of the tax plan for the short term should prove better than the hope of the tax plan that the market expanded on last year. The new tax savings will provide a flood of money comparable in size to the Fed’s QE3. Now, instead of stock market stimulus coming from the Fed, it is coming from government coffers in the form of massive corporate tax breaks to be funded by more government debt. And just in time to replace what the Fed will be removing (at least, for awhile)!

The tax breaks will feed the stock market because most of the money recouped from the tax breaks will go into stock buy-backs, dividends and mergers and acquisitions (which will reduce jobs to the extent that the happen) … and executive bonuses and pay raises.

Why would the money go anywhere other than where all the cheap corporate bond money was going when interest rates were down and where all the QE went? It’s the same people making the decisions. Some of it, of course, is likely to go toward paying off that corporate bond debt now that bond interest is likely to rise.

To the extent that some of those tax savings are going into the general economy in the form of small labor bonuses (a thousand dollars or less), it will aid the economy, which will also be good for stocks; but bonuses are one-time show-and-tell. They are not wage increases. Very few companies have announced wage increases.

The Trump tax cuts, as much as I hate the plan for long-term reasons, almost have to stimulate the economy and are already stimulating the stock market. The idea that those savings for the top 1% and the corporate savings will trickle down to the average person in any lasting way, however, is ludicrous, given two previous major rounds of trickle-down economics that clearly didn’t trickle. Money is more like pitch than molasses, sticking in the cracks, rather than flowing down. The part of the tax break that doesn’t go to stock buybacks and dividends will go to executive bonuses or salaries, which will, in themselves, probably be used mostly for more stock purchases.

The problem in deciding whether to buy or sell stocks now (though nothing I write should the taken as investment advice as I am not a licensed investment advisor, just someone giving my opinion on the economy) is in figuring out when that temporary lift to both the economy and the stock market will fail, which leads me to …

2018 economic prediction #2: Stock market crashes

I believe the stock market will start to lose lift when the Fed’s graduated unwind of quantitative easing reaches the level where the downdraft from the Fed’s quantitative squeezing becomes greater than the uplift from Trump’s tax breaks.

The Fed says it will reduce money supply by $20 billion per month this quarter and that this squeezing of the economy will increase each quarter by another $10 billion per month until it hits $50 billion a month and continues at that level for another couple of years.

On the other side of this timing equation for the downdraft effect on the market, I don’t think anyone knows for sure how many billions per month Trump’s tax savings will actually add to the economy — not talking GDP growth, just money saved and available to spend compared to the amount of money being sucked out by the Fed.

Of course, some black-swan event like a war with North Korea or failure to raise the US debt ceiling could cause the market to drop before it dies of natural causes. The prediction above is how I believe the market’s natural collapse will time out if no surprise event knocks the wind out of it before it fails due to its own diminishing monetary lift.

I think that by mid-year the Fed’s squeeze will be substantial enough to be felt as gravity against the tax lift, making the stock market’s climb more difficult and erratic. I’d give my bet more time for an all-out crash if I hadn’t already made that bet, now that I see the size and scope of tax cuts that Trump did get passed (and because they happened later than his original target of last August, delaying their full impact).

2018 economic prediction #3: a bond market crash is the greater worry

The increase of government debt due to Trump’s tax plans will have to confront the unwind of QE (pressuring the government to find other funders for its expanding debt). That, along with his infrastructure stimulus plans if they happen, should raise the government’s interest rates in order to attract enough new funders to replace the Fed and meet the increasing expenses and declining revenue. That normal free-market response (at last) is already the reason we saw a brief movement up of longterm interest rates, causing many analysts to start writing about the possibility of the long-expected bond bear market. (The caveat to a bond bear market will be if some major part of the rest of the world crashes first and flees to US bonds for safety.)

At this point, I think the bond market is likely to crash before the stock market. While I’ve expressed in previous comments about a year back that I was not sure which would break first, the new tax plan now makes a bond-fund crash my pick because the new plan lifts the stock market at the same time that it drives up interest on bonds.

While I think some downdraft from the Fed’s unwind is likely to be felt by late spring (showing up in summer reports), the impact probably won’t be apparent to most people until fall, which is when the Fed’s unwind becomes quite sizable each month (if they stay on their promised schedule, which so far they do not appear to have been doing).

Not only is fall the time when the Fed’s unwind reaches full velocity, but it is also election time. As in any election year, the ruling party (when it has the full power of government and is desperate to keep that power) will do anything and everything it can behind the scenes to mask or delay any problems; but here are the problems they are creating for themselves:

How do you 1) lower taxes extremely, requiring more government debt, 2) increase government spending on fiscal projects, requiring more debt 3) increase government spending on disaster relief, requiring more debt, 4) increase military spending, requiring more debt, and 5) rapidly reduce the nation’s money supply, which 6) removes the Fed as the government debt buyer of last resort and 7) raises interest rates all at the same time … and not crash the economy? It’s hard for me to believe the Fed and its political consorts actually think they can do all of that. I see a train wreck coming.

Since stock support is coming from greater government debt and all infrastructure spending will come from greater government debt just as the Fed is backing away being the government’s funder of cheapest resort, bond yields should rise quickly (compared to how slowly they fell). That means bond prices fall quickly as those who want to sell old bonds with lower yields will have to drop the price they ask for the bonds they are holding in order to make their bonds salable. That means bond funds will have to sell bonds at a loss in order to cash out any people who want to move from bond funds into rising stocks … or who simply want to move out of imperiled bond funds to put their money under a mattress. Things can snowball quickly.

As a sign of things to come, ten-year bond yields at the start of the year broke the highest point they had seen since last March, and the treasury curve (the spread between short-term bond interest and long-term bond interest) steepened the most it has since Trump was elected. It wasn’t huge, but it was a tremor. I think it was a foreshock.

When you consider that government debt has never been anywhere near this high, and that leaning tower of debt is supported by rates that have hardly been lower, what happens when things normalize a little?

2018 economic prediction #4: social unrest grows worse

It’s an election year, which means opportunity to undue what happened in 2016. That will create its own unrest. Because the Trump tax cuts are the greatest gift the one-percenters ever saw, I anticipate the gap between the rich and the rest will grow increasingly stark, creating further social unrest. That spread, however, will take time to develop; but many people who see it coming will revolt now. Those wanting to change the results of the last election will have something to work with.

The full unrest will take a few more years to build, but that is where all of this headed. A major bond crash or stock crash or both hitting everyone’s retirement fund will cause social unrest more quickly if either happens and everyone looks for a place to point the finger of blame.

I predicted a bigger change toward violence in American society for 2017, and I was overly alarmist in that prediction. I think I can safely say that US society did become more divided, but it also proved more resilient than I credited it for. Having learned from that, I don’t think 2018 will be greatly unrestful, but the trend in that direction will continue.

Nevertheless, the more we widen the financial gap and the more we hand impossible debts created for our benefit to the young, the worse the unrest will become in the years ahead as the young enter a hopeless financial future and seize the reins of leadership. This 2018 economic prediction is more about the slow development and continuance of the long-term prediction that I made for 2017; but watch it build, consistent with what I’ve laid out.

How long it will be until we have social chaos every day, I don’t know.

2018 economic prediction #5: Real estate and autos start to fail again

The real-estate market and auto market started softening last spring and summer when I said they would. Then the year became the worst year in my memory for its combination of hurricanes and fires. It was certainly a record in terms of cost at $306 billion (previous record was $215 billion, adjusted comparatively for inflation). That created the need for hundreds of thousands of new homes and hundreds of thousand of new cars. Existing home sales also skyrocket because displaced people need a house NOW!

Thus, the US home sales report sounded great at the end of 2017, until you get to the end sentence and think about that:

U.S. home sales increased more than expected in November, hitting their highest level in nearly 11 years, the latest indication that housing was regaining momentum after almost stalling this year. The National Association of Realtors said on Wednesday that existing home sales surged 5.6 percent to a seasonally adjusted annual rate of 5.81 million units last month amid continued recovery in areas in the South ravaged by Hurricanes Harvey and Irma. (Reuters)

Uh huh. Just as I said would happen as soon as the hurricanes and summer fires hit but before any statistics started coming in. That was for existing home sales (the kind people need instantly when they suddenly lose their home), but the story is much different for new construction where, even more tellingly …

Construction soared by double-digits in the West and South but dropped sharply in the Midwest and fell apart in the Northeast (it was down almost 40%). (NewsMax)

Again, that is exactly what I said last fall would happen with my housing predictions when the hurricanes and fires hit. As you would expect, the report shows great growth in the West where wildfires took out homes (and where growth has generally been solid) and in the south where hurricanes took out homes, but the report presents a picture that looks like housing collapse everywhere else.

Ironically, the housing and auto industries (in terms of their overall national numbers) were saved by disaster. The disaster effect, however, should wear off early in 2018 for autos because insured cars should mostly have been replaced already, except to the extent that factories have a production backlog. That brings sales forward, making the remainder of the 2018 more difficult.

The disaster effect will probably continue through most of 2018 for houses because most houses are not mass produced, and there is site cleanup, plans, permits, etc. to work through before building even begins; and there will be a shortage of labor because of so much reconstruction all at once (which is supported by the December jobs report showing the greatest jobs growth in construction, which usually does poorly in December).

So, I’d anticipate a good labor market for construction workers for, at least, for most of the year, and that should help others, too. Given how long it takes to rebuild, housing could hold up for all of 2018, even improving in areas not ravaged as people move out of those areas that were destroyed because they cannot stand waiting longer to find a home or because their jobs were also wiped out.

Once homes are finished, they have to be furnished … including the replacement of lost personal items like clothing. So, all of this home building will be great for retail sales for, at least, half a year, maybe longer as lost tools, clothes, lawn mowers, appliances, etc, all get replaced.

However, the Fed has created a real-estate market that is utterly dependent on low mortgage rates. Quantitative easing was done to lower those mortgage rates by reducing interest on long-term debt instruments, which it believed would spill over to mortgages. Therefore, the Fed’s reversal of QE should drive those rates back up as it gets under full swing. That will create serious problems for the real-estate market later in the year. New construction loans where insurance money fell short will increase demand for loans even in a rising interest environment, helping interest rise.

At the same time, the Trump Tax Plan was bad news for housing, with lower mortgage interest deduction caps and reduced ability to deduct property tax. The pressure building on housing from the Trump Tax plan and Fed interest-rate increases and quantitative squeezing will press down on the whole industry just as the hurricane-fire stimulus effect starts to wear off. So, the end of the year could start to get really rough.

The reversal of QE will also start to put an interest-rate crush on consumers who have piled up even more credit-card debt than they did before the crash of 2007-2009.

2018 economic prediction #6: a tumultuous fall

With bond funds, mortgages, consumer credit, housing sales and autos all getting squeezed as the year grows old and with a stock market that is already long in the tooth and morbidly obese, I cannot see how we avoid a terrible final quarter, which could be even more dramatic if there is an election upset from what promises to be a mean-spirited election year.

For the time being, Republicans hold all the reins of power, so they can do a lot to try to patch the economy together, but they looked mostly like Keystone Cops last year; so I doubt they can keep it together. If Republicans do manage to hold the economy together until the election, I think things will rapidly fall apart after that, as the stimulus effect from hurricanes and wildfires wears off (barring a second round of the same this year) and the stimulus from tax cuts becomes outsized by the unwinding of QE, here and abroad.

If people tell you, “It’s going to be a great fall,” they are probably using the word to mean “collapse,” not “autumn.”

http://thegreatrecession.info/blog/

| Digg This Article

-- Published: Monday, 22 January 2018 | E-Mail | Print | Source: GoldSeek.com