-- Published: Wednesday, 31 January 2018 | Print | Disqus

By Frank Holmes

It’s been called a number of things: The sharing economy, or “shareconomy.” Peer-to-peer economy. Collaborative consumption. What all of these terms have in common is the idea of decentralization—and blockchain applications, including bitcoin and other cryptocurrencies, are just the latest in a trend toward this new economic paradigm.

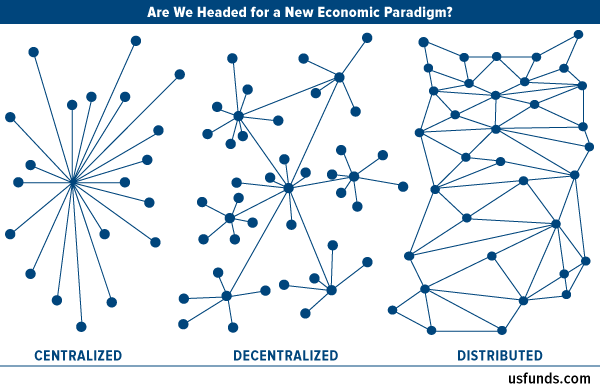

If it’s unclear what decentralization means, consider the following visual. You might have seen one like it before. On the left is a representation of a centralized, top-down system. Think of a traditional corporation, one that has only one CEO and one head office.

Now compare that to the next two visuals depicting decentralized and distributed systems. Instead of being top-down, their infrastructures are more collaborative, helping to prevent systemic failure, collusion and more.

This is the “sharing economy” business model that’s growing in prominence thanks to the internet and practiced by companies such as Facebook, Airbnb, Uber and more. Although these firms have one CEO and headquarters like a more traditional company, their assets are decentralized and widely distributed: Facebook’s content is collaborative among 2 billion users worldwide. Airbnb and Uber’s hotels and cabs are privately owned. Jack Ma’s Alibaba has no inventory of its own, relying instead on a decentralized network of retailers and manufacturers.

Blockchain, and bitcoin specifically, is the logical conclusion to this trend. Bitcoin is completely open-source and peer-to-peer. No one owns it. Unlike fiat currencies, it’s not controlled or regulated by a central authority. This is possible only through the power of blockchain, the decentralized, unmodifiable electronic ledger that records all activity across the entire system.

We’re in the very early stages of this new paradigm, but already much is expected. Mastercard believes the sharing economy will inevitably graduate beyond social media and accommodations, spreading “into new sectors, including insurance, utilities, health and social care.” And UBS estimates that by 2027, blockchain could add between $300 and $400 billion of annual economic value to the global economy.

Indeed, something interesting is happening!

Curious to learn more? Watch my interview with SmallCapPower, where I explain the reasons for my decision to invest in HIVE Blockchain Technologies!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE, directly and indirectly. This interview should not be considered a solicitation or offering of any investment product.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 12/31/2018.

| Digg This Article

-- Published: Wednesday, 31 January 2018 | E-Mail | Print | Source: GoldSeek.com