-- Published: Monday, 12 February 2018 | Print | Disqus

Source: Michael J. Ballanger for Streetwise Reports 02/09/2018

The physical metals will continue to outperform mining shares until there is some stabilization in the global arena, posits precious metals expert Michael Ballanger.

-->In the "I hate to say I-told-you-so" category, it looks like the Punxsutawney Phil came out of his den last week, took one look at the state of the global stock markets, and decided to go back to bed for six years. One short week after I posted "Never Underestimate the Replacement Power of Equities Within a (HYPER) Inflationary Spiral," complete with a chart with five smiling faces of those that would be responsible for "Dow 25,800," we have lost a very quick 2,000 Dow points and 105 for the S&P 500. The VIX (CBOE Volatility Index) has moved from around 9 to nearly 50 and the UVXY [Proshares Trust Ultra VIX Short-Term Futures ETF] ("the divorcee-maker" since 2009) went from $8.52 topping over $30 on Monday.

CNBC guest commentators are now displaying manic-depressive-type patterns of speech as they waffle back-and-forth stammering and stuttering about how they predicted this bloodbath and how and why investors "have to take a longer-term perspective." In light of these rapidly altered conditions, I am proud to display a NEW chart complete with the concerned faces of the POTUS and the poster-child for U.S. stocks, CNBC's "Mad Money" maestro, Jim Cramer. You will notice that the smiles in January 17 missive are now frowns as the ramifications of the $5 trillion wealth implosion are slowly being assessed.

Now that we have all had the chance to breathe and avoid the inevitable "Spanish Inquisition" from our spouses who happened to catch the early-week headlines and are several milliseconds away from demanding a forensic audit on our personal trading accounts, I had to laugh at the mess created as Janet Yellen left the Fed last weekend in reference to the forced board changes at Wells Fargo and I loved how Jon Najarian described how "she tossed a live grenade into the room as she left."

The dramatic swings this week have been a classic exercise NOT in the psychology of quivering, screaming carbon units but rather the reaction of the boys at 33 Liberty St. (NY Fed) to the abject terror of the Steve Liesmans of the world. The more the sweat beaded on the brows of the CNBC anchors, the closer I was getting to pulling the trigger on the UVXY position. It was finally consummated when I got about fifty emails/tweets/IMs asking me if I was ADDING to the UVXYs with the best being "DUDE, wake up! UVXY trading $32 in the after-hours markets!" That is what happens when people become mesmerized with short-term trends and I quickly replied "You want to be a SELLER of volatility, not a buyer up 300% in nineteen days!" Then, I watched in absolute delight as they took the Dow apart on Thursday afternoon and then took Asia down last night.

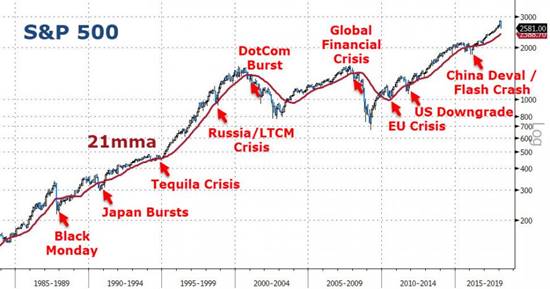

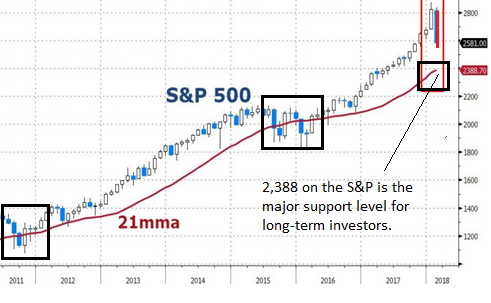

A gentleman by the name of Richard Breslow offers these two charts as a couple of reasons why it is WAY TOO EARLY to be "buying the dip." The 21-month moving average has carried a gravitational pull for stock prices going all the way back to the 1970s and since it got so exaggerated since 2016, it stands to reason that a full-blown return to that line is in the cards. The one small problem for the dip-buyers is that line is another 7.4% below Thursday night's closing levels and if stocks are taken there, all gains since Q1/2017 are vaporized and the granddaddy of modern bear markets will have arrived. Mind you, Donald Trump's "need-to-be-loved" behavioral bias might result in a full-blown PPT assault now that the 200-DMA for the S&P is under assault.

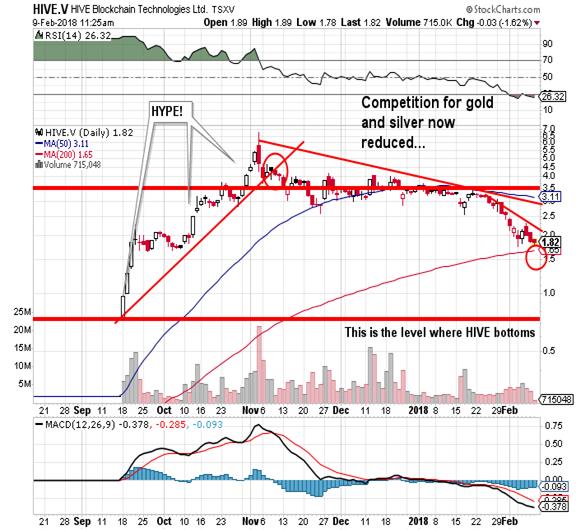

As for gold and gold miners, many of us have had to listen to legions of Millennials and Gen-Xers castigating their older colleagues for failing to comprehend the "true meaning" of cryptocurrencies and the growth potential behind cannabis stocks. For that reason, the two lead dogs in the Canadian space, WEED and HIVE, are now sporting losses from their respective tops of 41.75% and 73% respectively. Now the younger crowd are starting to feel the same pain that we have felt since the politicians and their central bank attack dogs put a rope around the necks of gold and silver back in 2013. The point is that this bloodbath is eventually going to force investors back to the safety of the traditional safe havens that we KNOW are gold and silver and away from the "flavor of the month" novelties like weed and blockchain.

Last point for the week is that while gold prices are holding together nicely above the $1,310-1,315 level, silver continues to underperform and the HUI (NYSE Arca Gold BUGS Index) is now back below the early December lows. As I wrote about last week, the problem with gold miners in a market crash is that as far as the margin clerks are concerned, gold miners are the same source of liquidity as shares in Apple or Netflix or Amazon and they get sold along with everything else. So, until we get some type of stabilization in the global arena, the physical metals will outperform the shares.

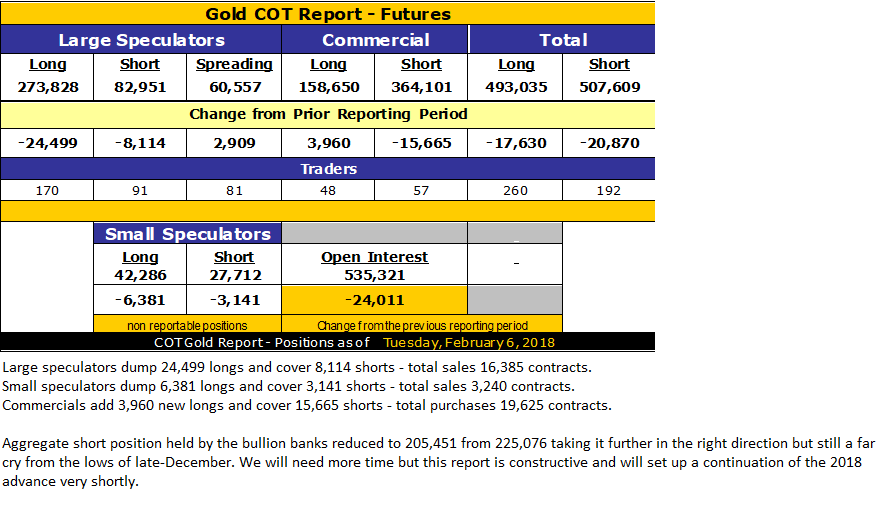

COT Report:

No surprises here. . .large specs get purged with market-related redemptions triggering capitulation; bullion banks sit there with zero margin problems and cover.

I noticed that the two creatures with whom I share this humble abode on lovely Lake Skugog have returned to the confines and are actually poking their heads around corners to see if I am pacing the room, potential projectiles in hand while enjoying animated conversations with lampshades and mirrors. That is usually the signal for them that mayhem is nigh and remaining within any sort of landing zone for paperweights and wine bottles is hazardous at best. As it would be, I am calmly seated at my workstation eagerly anticipating the arrival of calm, which might explain their somewhat tentative behavior, which, after all these years, might be understandable given the sawed-off shotgun I have been romancing for the past five hours.

I'll show them "volatility". . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

All charts and images courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

| Digg This Article

-- Published: Monday, 12 February 2018 | E-Mail | Print | Source: GoldSeek.com