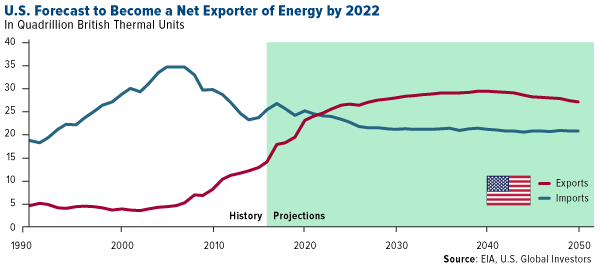

The U.S. has been a net importer of energy since 1953, but that’s set to change early next decade, according to the Energy Information Administration (EIA). In its highly anticipated Annual Energy Outlook 2018, the agency forecasts that the U.S. will become a net exporter of energy by as early as 2022, thanks in large part to the boom in shale oil and liquefied natural gas (LNG) production as well as the relaxation of export restrictions. A “golden age of American energy dominance,” as President Donald Trump described it back in June, could be upon us sooner than anticipated, putting the U.S. on a path to dethrone Saudi Arabia and Russia as the world’s top oil powerhouse.

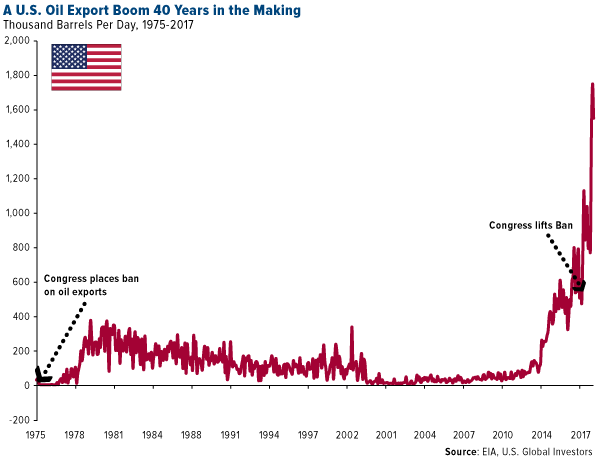

The 40-year-old ban restricting U.S. oil exports was lifted in December 2015, and between then and October 2017, exports skyrocketed nearly 300 percent.

This has galvanized shale producers into doubling their efforts to meet growing demand. Earlier in the month, I told you the U.S. produced more than 10 million barrels of oil per day in November for the first time since 1970. And in the week ended February 9, the number of active North American oil rigs rose sharply from 765 to 791, the most in nearly three years.

North America Expected to Drive Global Growth

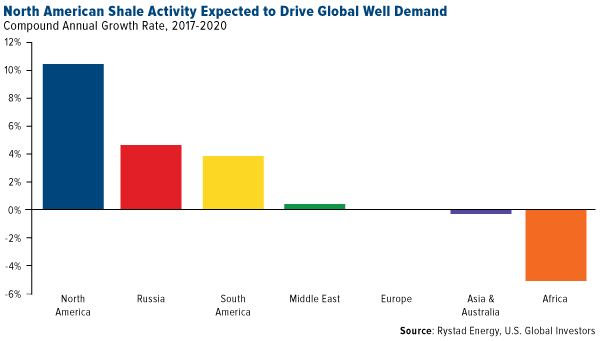

The EIA’s forecast is in line with those of independent analysts, who see the U.S., along with Canada, dominating global growth in well demand.

“North American shale activity is the primary mechanism driving growth globally,” writes energy consulting firm Rystad Energy in its January global well market outlook. The group adds that the number of wells “completed in North America increased 40 percent in 2017, and we expect 11 percent average annual growth toward 2020.”

Sign of the Times: U.S. Import Terminal Preparing for First-Ever Exports

From Texas ports, the U.S. now exports crude to as many as 30 countries, seizing valuable market share from members of the Organization of Petroleum Exporting Countries (OPEC). Since November, China has become the largest consumer of U.S. crude other than Canada, according to Reuters. (Last year, in fact, China surpassed the U.S. to become the world’s largest overall importer of oil.) And in a surprising move that shows how the rise of American shale is reshaping the global market, the United Arab Emirates, a significant oil producer in its own right, purchased 700,000 barrels of oil from the U.S. in December, Bloomberg reports.

|

Now, for the first time ever, exports are set to be conducted from America’s only deepwater supertanker offloading terminal, the Louisiana Offshore Oil Port (LOOP). According to its website, LOOP has received more than 12 billion barrels of oil from foreign and domestic sources over the past three decades, but as an imports-only facility, it’s never been used to load an export cargo—until now.

If the trial run is successful, reports Bloomberg, “it will be a step change in America’s capacity to export the burgeoning production that’s roiled global oil markets.”

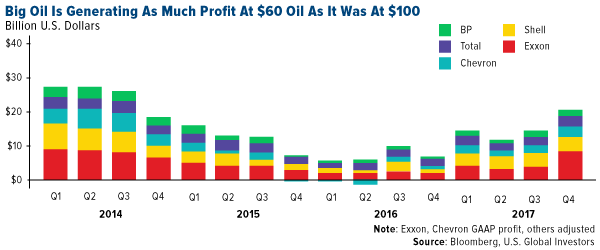

Oil Majors Reward Investors

All the extra oil supply might have some shareholders worried about lower prices and sinking profits, but for many major explorers and producers, profits have returned to the days when oil hovered above $100 a barrel. That’s the result, according to Bloomberg, “of CEOs’ focus on squeezing more from each dollar by stalling projects, renegotiating contracts and reducing the workforce.”

The opportunity for shareholders here lies in these companies maintaining or increasing their dividend payout while pledging share buybacks to offset shareholder dilution that occurred during the slump.

“The bosses of the world’s biggest oil companies are prioritizing investors over investments,” Bloomberg writes, “channeling the extra cash that comes from $60 crude into share buybacks and higher dividends.”

Curious about how you can participate in the new “golden age” of American energy? Click here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2017: Chevron Corp., Royal Dutch Shell PLC, Exxon Mobil Corp.