-- Published: Sunday, 4 March 2018 | Print | Disqus

By David Haggith

How inflated with debt have we become? How long can we float on our own bloat? Reasonably trim in 1970, the sum of all debt publicly financed by the US government was $275 billion. Last week, the government sought to raise $258 billion in just one week! The weekly financing to keep the government afloat is now about equal to all the debt it amassed over the course of its first 188 years.

We are Fed up on debt

What went wrong? Well, the very next year, President Richard Milhous Nixon took us the rest of the way off the gold standard, allowing the nation’s central bank to create money at will, cutting the tether that had long restrained the Federal Reserve from going insane with using its powers to enrich its member banks. Since the central bank’s customary way of creating new money in the economy is through the issuance of debt by its member banks, we have seen a huge expansion of debt. Whenever the economy is lagging, the Federal Reserve suppresses the market rate of interest to entice people who don’t want additional debt to take more on so they can juice the economy with more spending.

Some people might try to argue that the much lower debt in 1970 is just a matter of inflation. They’d be partway right and all the way missing the point. In today’s dollars, the debt back then would have been $1.2 trillion — still only one twentieth what it is today. But the point they’d be missing is that the inflation they are using to make 1970’s $275 billion debt sound a lot bigger is nearly all due to Nixon removing the central bank’s tether to gold. So, it is a circular path out of the equation.

While the value of the dollar got ground to dust under Richard Milstone Nixon, total debt (now at $67 trillion of public and private debt), even adjusted for inflation, has risen from 150% of GDP to 350%! Over that same time, the Fed’s balance sheet (money in the economy) has grown at about five times the rate of inflation. (General prices have not inflated nearly as much as the supply of money inflated because most of the money circulated in stocks and bonds, creating inflation in those markets. Money only inflated prices where money flows.) Back in 1970, the Fed’s balance sheet stood at $55 billion compared to today’s $4+ trillion.

You don’t have to take my word for these figures. Take it from the Fed. Here’s total public and private debt in the US over GDP:

Think maybe we’ve gotten ahead of ourselves in debt? This increasing rate-of-rise in debt was made possible only by lowering rates of interest and loosening terms of credit. Now the Fed wants to tighten up on that, but there is no way to crush back down on the blue line without compressing the desirable orange line even lower.

Due to the Law of Diminishing Returns, the Fed’s path (and government’s) of increasing GDP by creating money out of debt is now requiring greater amounts of debt to maintain essentially the same rate of growth in total production. You cannot remove the lift created from ever-cheaper credit and not see the orange line fall off when it is that cheap credit that helped it rise.

Of course, the government has decided to come to the rescue by replacing the Fed’s creation of money with its own freeing-up of money that was already there but was taxed away from people; but it’s going to do this through the creation of more debt, too. It thinks. But, with the Fed not buying, who is going to? People who are already over-extended? Investment banks who are no longer getting free money from the Fed intended for buying bonds? People form other countries that are also planning to back off on money creation?

Fiscal conservativism died from morbid obesity!

We have now hit a new norm of $1 trillion annual government deficits in the US (and that only includes on-budget items, which usually don’t include war expenditures, Social Security, etc.). The Republicans, who pretended to be deficit hawks throughout the Obama era just to keep Obama from getting credit for anything, were slavering to stuff us all fatter on much higher debt as soon as they received full control of the kitchen.

While we had seen occasional trillion-dollar deficits during the so-called recovery period, they had not yet become the norm. Republicans made those high deficits the norm almost overnight: Starting from their 2017 apocalyptic deficit of $666 billion, Republicans approved a continuing resolution that added $200 billion (which is 20% of the new normal trillion-dollar deficit in just one new step). They took that leap without a hint that they will ever back that out of the budget in future years. From there, they created tax cuts that will add, at minimum, another $200 billion during each of the next ten years. Ta da, $1 trillion annual deficits for years to come! On top of that, our Republican congress and president are now grinding out a plan for additional fiscal stimulus spending and disaster relief.

I always believed Republican rectitude would end as soon as they controlled all parts of government, and clearly that has proven true. (It’s easy to sound like you have fiscal rectitude when all you are doing is complaining about what the other team is doing because you don’t have the power to enact your own wishes anyway. It’s quite another thing to restrain yourself from making all your own wishes come true when all the power is in your hands to make them come true.)

How the monster we fed will now swallow us

We are now ramping up government debt by orders of magnitude at the same time when interest on our mountains of debt will easily rise to 4% in about two years. I come by that number partly from the present rate of interest rise but mostly from the fact that the Fed is moving out of controlling the cost of debt, and will be doing so at a faster rate in the months ahead. (That is, if it stays with the program it has promised; and if it doesn’t, we simply have QE forever.) Mostly I come to it because 4% is the low side of what interest on the debt has historically been when the Fed wasn’t sopping up all government bonds, bills, and notes.

Interest rates have clearly started moving in that direction, tickling the toes of 3% almost every week. So, anticipating one more percent within two years is a conservative estimate since the cost of debt is far from priced in, having been artificially regulated down by the Fed for nearly a decade. The movement in 10-year and 30-year yields last month was the beginning of pricing in the Fed’s flight from financing the government, not the end. (I actually think it will rise a lot faster than that. I would not be the least surprised to see the 10-year yield hit 4% this year, but I’m being conservative in my predictions for where it is headed.)

Getting back to the low side of normal for interest on the national debt will increase the cost of maintaining that debt by a minimum of 50% over two years, and whatever happens to government interest rates always impacts consumer rates to an even higher degree. So, existing credit cards with variable interest, mortgages with variable interest will easily double in cost on levels of debt that many already find hard to manage. At the same time, new credit cards and mortgages will become so expensive that consumption will slow, not grow; housing will fall, not stall.

(Peak debt also includes corporate debt, but that could be alleviated by the government corporate tax cuts if those cuts are put toward paying off corporate debt. Peak debt also includes margin debt and other forms of debt within the stock market in addition to individual consumer debt and all of that government debt. I refer to all of those as “peak debt” because they are all at record high levels where any change in interest will have enormous impacts. Because interest on all of that debt is minuscule by historic standards, it is easy to double it. Small numbers double more easily than large ones.)

A rise to the low side of normal for government bond interest will likely put interest payments alone on the national debt at a $1 trillion a year by the end of this decade (because the debt will also rise by another $3-4 trillion by then with all new debt being financed at the higher rates and all rolled-over debt being financed at those rates, and most of the US debt is short term, so will roll over soon).

The time (end of 2020), then, is not far off when the entire newly normal trillion-dollar deficit will be consumed just to pay interest on the debt. Whether inflation drives interest up or the Federal Reserve’s unwind or the Republican’s new normal of trillion-dollar annual deficits or the president’s proposed fiscal stimulus plan, the concern that is shaking markets is ALL about lethal levels of interest coming to our already monumental mountains of debt.

Of course, the overarching truth here is that we may not even get there because the economy will start to collapse well before then.

So, that is why I call our present state “peak debt.” The snowball is speeding up and building in size so quickly now that there is no political possibility of stopping it before it crushes us. In the past two months alone, we’ve seen the rate of increase in debt and the weight of interest on the debt grow simultaneously at new-normal speeds never before seen. It’s not going to stop because Congress isn’t going to reverse its drop-taxes-and-add-spending plan, and the Fed is not going to stop getting out of government bonds — not, at least, until it is too late — because both entities believe they can do what they are doing. It is religious dogma with them.

The path of floating the economy upward with ever growing debt expenditures was always unsustainable economically because you cannot increase the rate at which you are piling on debt forever. That unsustainability has been the enduring theme of this blog. When I began the blog, it was remotely possible we could change course and avoid collapse. Now, with the sudden rise in long-term interest rates, breaking free as the Fed stops suppressing then, we are entering the final days when all of that debt will consume us.

David Stockman, who has often written about peak debt, warns,

“Whatever expansionary impulses that do remain in the U.S. economy are about to get smothered by the impending collision between soaring debt issuance by the U.S. Treasury just as the Fed prepares to dump upwards to $2 trillion of existing debt securities into the bond pits…. The punters on Wall Street have been so addled by years of Fed monetization of the public debt that they now think rising yields are a ‘good thing’ and reflect rebounding economic growth. No, they don’t! … There is literally no way out of the fiscal trap now rapidly unfolding in Washington — short of a thundering financial collapse.” (NewsMax)

Stockman also noted that congress’s new cut-taxes-and-engorge-more plans mean the federal debt will swell to $35 trillion in ten years. That is a debt mountain that is 30% more than the entire economic output of the United Sates, and that figure only includes the on-budget stuff, not social security, war, disaster relief, etc.

The Committee for a Responsible Federal Budget agrees and even says 35-in-10 is the optimistic scenario.

An unseen bond cache will overstuff the bond market’s supply this year

Even those hundreds of billions of dollars that you have heard will be repatriated by corporations with overseas operations are mostly held in bonds that corporations will have to sell if the money is going to be used for the kinds of capitalization and labor wage improvements that Trump has said will supercharge the economy. It’s not sitting around in liquid cash.

Those hundreds of billions in bonds represent additional supply into the bond market that has been off the table for a long time (essentially in other countries). That glut will hit this year, even as the Fed moves toward its own plan of rolling off $600 billion in government and corporate bonds from its balance sheet each year. Much of that is in government bonds that the Fed has, until now, been refinancing whenever they mature.

Now add to that Trump’s insta-tarriff policy. Simple economic reality there is that countries doing less trade with the US buy fewer US treasuries because they don’t need to exchange as many US dollars. In addition to not needing to buy US treasuries (at the very time when the government is looking for financiers to replace the Fed) they may have retaliation incentives that cause them to intentionally move further from US treasuries than they need to just to hurt the US … if for no other reason than to try to muscle us back from our poorly-thought-out tariff ideas. (While I’m for fair trade versus free trade, now is not the time when the US can afford trade wars.)

How on earth can any analyst argue (as many seem to believe) that it is possible to dump all of that supply of bonds into the market while subtracting numerous major buyers (the Fed most of all) and not see interest rates on long-term debt rise quickly to 4%? Or maybe to infinity and beyond.

The ease with which we could hit that number this year is why I said in previous articles that this first drop in stocks is a mere foreshock of much greater bond shocks to come later this year. It is why I have firm convictions that the economy is going to break up badly this summer. This first drop in stocks was just a burp. Wait until the roaring belch of interest from our planet-sized, gluttonous belly of debt rips loose in the final quarter of the year!

Further signs that we are straining against peak debt

Consider also the anomalous situation we just went through where we saw the value of the dollar continue to fall when interest on US treasuries was rising. Bonds (bond prices, which are inverse to yields), stocks and the dollar all fell together. Normally, the value of the dollar rises against other currencies when the interest on US bonds rises because the higher interest entices foreign buyers to buy US bonds in US dollars. If dollar is falling even as bond interest is rising, that indicates people aren’t moving to buy up US bonds even at the higher yields they are offering.

From that, I draw out something that is disconcerting at the level of basic instinct: as quickly as long-term bond interest has rocketed upward (by market standards), it is not fast enough to entice people to essentially buy the dollar up in value by investing in US debt. That is born out by the fact that treasury auctions did not perform as well in February as in earlier months. So, how is the government going to find enough financiers for its wild bloatation when the Fed stops refinancing much greater quantities of bonds later this year and as corporations start competing to sell their bonds … unless interest goes up a lot faster?

Could the lack of sufficient buyers, even at higher yields, indicate that investors are realizing interest cannot rise without imploding the very debt they would be investing in? That is the true definition of peak debt — when you climb up the mountain of debt to such rarified atmosphere that no one wants to climb higher for any level of promised reward. (Or, at least, not enough people do to meet your funding needs.)

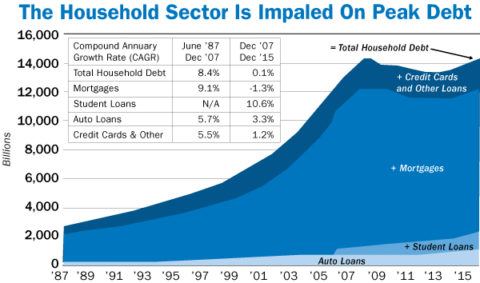

This graph from David Stockman shows that the best the Fed could do after years of trying to get us out of the Great Recession was to entice everyone back up on a slow slog to the previous debt peak by quadrupling its balance sheet, — a.k.a., money supply — at the lowest interest ever known. This huge acceleration of effort just to boost us ever so slowly back to the levels of debt we once had is a stunning example of the law of diminishing returns. Now that nearly everyone made the slow climb back to the last summit, the Fed plans to double the interest rate on the full mountain! You have to be a total idiot to think that will work!

Debt reaches its implosion point when yields can no longer rise fast enough to entice investors because every rise in interest makes investors fear the debt is even more likely to default. It is a catch-22 situation where the faster rates rise, the more investors grow concerned that the mountain of debt is becoming unstable. Thus, the rising rates create their own demand for even higher rates with fewer buyers. Kaboom!

Mountains that have taken years to form collapse suddenly.

http://thegreatrecession.info/blog/fed-up-on-peak-debt/

| Digg This Article

-- Published: Sunday, 4 March 2018 | E-Mail | Print | Source: GoldSeek.com