-- Published: Tuesday, 3 April 2018 | Print | Disqus

By Frank Holmes

If you recall, during the second presidential debate in October 2016, Hillary Clinton falsely claimed that the U.S. is “now, for the first time ever, energy independent.” Many were quick to point out the inaccuracies. For one, the U.S. has been a net energy exporter before, most recently in the 1950s. And two, America isn’t currently energy independent.

But that could change very soon. As I told you in February, the Energy Information Administration (EIA) estimates the U.S. will become a net exporter of energy by as early as 2022, and the agency recently shared fresh data that supports the narrative that America is on the cusp of taking the throne as the world’s leading energy powerhouse.

The Quest for American Energy Dominance

According to the EIA, U.S. net energy imports in 2017 fell to their lowest levels since 1982. From its high in 2007 of 34.7 quadrillion British thermal units (Btu), the difference between exports and imports has fallen steadily to 7.32 Btu, slightly above the 7.25 Btu in 1982.

click to enlarge

The decline last year was mainly due to record exports of crude oil and petroleum products, made possible since Congress lifted the U.S. oil export ban in December 2015.

And for the first time since 1957, the U.S. exported more liquefied natural gas (LNG) than it imported. Between 2016 and 2017, natural gas exports quadrupled from 0.5 billion cubic feet per day (Bcf/d) to 1.94 Bcf/d. The EIA attributes this acceleration to the expansion of export facilities in Louisiana and Maryland, with six additional ones currently under construction, according to Energy Secretary Rick Perry. As a result, the International Energy Agency (IEA) projects the U.S. will become the world’s leading LNG exporter by the mid-2020s.

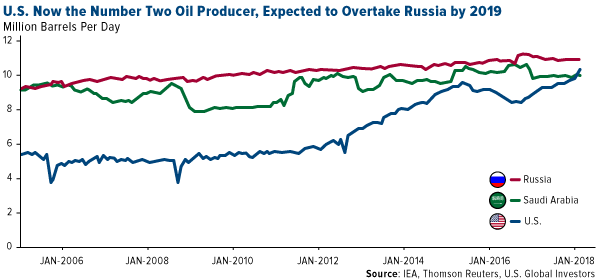

All of this follows news that the U.S. is now the world’s number two crude oil producer. Late last year, U.S. output exceeded 10 million barrels a day for the first time since 1970, thanks largely to the surge in fracking and horizontal drilling activity. This helped push the country ahead of OPEC leader Saudi Arabia, and, by 2019, it could surpass Russia to become the largest producer in the world.

click to enlarge

Oil Majors Reward Shareholders

Some resource investors might worry that all this extra supply could depress prices and hurt profits. That’s a valid concern, but it’s worth pointing out that since its recent low of $26 a barrel in February 2016, the oil price has surged nearly 150 percent—all while the number of active wells in North America has risen.

It doesn’t hurt, of course, that demand for petroleum products is just as strong as it’s ever been right now. According to the latest monthly report from the American Petroleum Institute (API), U.S. demand in February reached its highest level since 2007. This was only the third February ever, in fact, that gasoline demand exceeded 9 million barrels a day, reflecting strenthening consumer sentiment and economic growth.

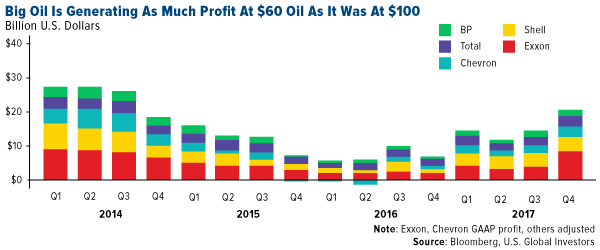

And as I shared with you last month, major explorers and producers’s profits are now in line with what they were when oil was trading for $100 a barrel and more.

click to enlarge

According to Bloomberg, the majors are now “prioritizing investors over investments, channeling the extra cash that comes from $60 crude into share buybacks and higher dividends.”

I should add that, besides offering better opportunities for investors, energy independence helps make the U.S., its allies and, indeed, the whole world more secure.

China Launches Oil Futures Contract, OPEC and Russia Enter Historic Pact

Other important developments are happening around the world right now that are already disrupting the global energy space.

The most notable is that China last Monday launched its own crude oil futures contract. Priced in yuan and traded on the Shanghai International Energy Exchange, it’s the first such Asian benchmark for oil deals.

As the world’s largest consumer of crude, China seeks to gain some pricing power in the trillions of dollars of oil that are traded every year around the world. Back in April 2016, the country introduced its own yuan-denominated fix price for gold—which it also consumes more of than any other country. The Shanghai oil futures contract is similarly designed to wrest some control over pricing from the main benchmarks in New York and London—West Texas Intermediate (WTI) and Brent—and to promote the use of the yuan, also known as the renminbi.

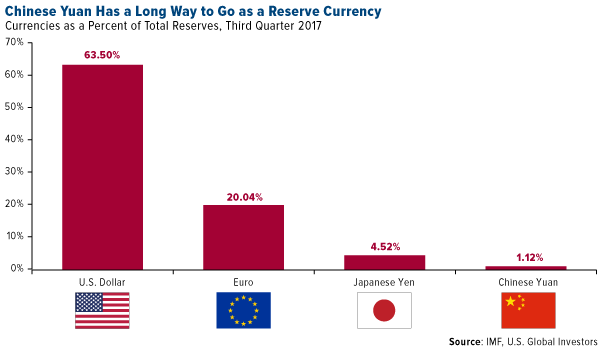

Raising the yuan’s profile and transforming it into a leading global currency has been among Chinese president Xi Jinping’s key endeavors. He scored a big win in 2015, if you recall, when the International Monetary Fund (IMF) agreed to include it in its basket of reserve currencies, placing the yuan in the same league as the U.S. dollar, British pound, Japanese yen and euro.

But as you can see below, the yuan has a long way to go in its quest to challenge other currencies. As of last year, the U.S. dollar accounted for 63.5 percent of countries’ allocated reserve currencies, compared to the yuan, which had only a 1.12 percent share. Shanghai oil futures could possibly help improve that allocation.

click to enlarge

The contract opened strong last Monday but has since fallen below WTI prices as speculators placed a series of bearish bets.

In other news, OPEC and Russia are reportedly hashing out the details on a historic alliance that would extend oil production curbs for a number of years, according to a Reuters exclusive. Saudi Arabia’s crown prince, Mohammed bin Salman, told the agency that Riyadh and Moscow were “working to shift from a year-to-year agreement to a 10- to 20-year agreement.”

Although not a member of the Organization of Petroleum Exporting Countries, Russia has often worked alongside the cartel to limit production in an effort to boost prices. A 10- to 20-year deal, however, would be unprecedented.

Oil price weakness has hurt both Russia and Saudi Arabia, as crude exports account for an oversize percentage of their total revenue. And as I’ve shared with you before, Saudi Arabia also seeks higher prices to support a possible initial public offering (IPO) this year of Saudi Aramco, the largest energy company in the world by far.

http://www.usfunds.com/

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2017: Royal Dutch Shell PLC, Chevron Corp., Exxon Mobil Corp.

| Digg This Article

-- Published: Tuesday, 3 April 2018 | E-Mail | Print | Source: GoldSeek.com