-- Published: Wednesday, 4 April 2018 | Print | Disqus

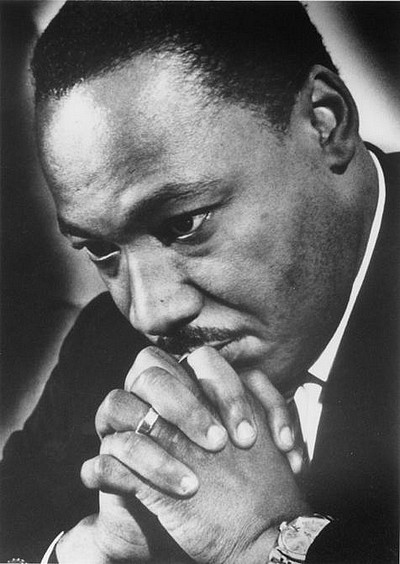

– Civil rights leader Martin Luther King Jr. assassinated 50 years ago today

– An anti-war campaigner, protesting against the damage inflicted by military operations

– King was almost prophetic in his vision that wars would drive a bigger wedge between rich and poor

– Foresaw the damage that would come to US in terms of costs to society and the economy

– Fifty years on Western nations can learn from King’s words when it comes to considering costs of war

– War is financed by debt bringing significant financial burdens on investors, savers and future generations

Source: caboindex

Today is the fiftieth anniversary of the assassination of civil rights leader Martin Luther King. He not only fought for the rights of minorities but he spoke out against inequality and the damage done by war.

In the fifty years passed we have perhaps not had a year full of such political, emotional and economical upset as we have in the last twelve months or so.

In this time we have had a convergence of major political shifts, civil rights campaigns, saber-rattling between nuclear powers and the rise of populism. This is something that has arguably not been seen at this level for many years previous.

This convergence has lead to a world that seems fraught on many levels and on the precipice of change. What kind of change is up for debate by many sides. Sadly attempts at change can be followed by violence and war, from all parties. Whether it’s civil rights movements such as Black Lives Matter, gun control demonstrations or more global efforts such as Trump’s attempts to affect the Middle East in some way, North Korea’s desire to gain respect around the globe or Russia’s keenness to demonstrate its strength against the West – each may end in violence and military action.

Martin Luther King was known for many things – an equal rights campaigner, a economic campaigner and a peace campaigner. All qualities that are appreciated today as much as they were fifty years ago. He fought to highlight the dramatic costs to society and the economy when it came to war – whether civil or otherwise.

Campaigner for peace and non-violent demonstration for change

King’s words resonate as strongly today as they did fifty years ago, less than a week before his death:

I want to say one other challenge that we face is simply that we must find an alternative to war and bloodshed. Anyone who feels, and there are still a lot of people who feel that way, that war can solve the social problems facing mankind is sleeping through a great revolution. President Kennedy said on one occasion, “Mankind must put an end to war or war will put an end to mankind.” The world must hear this. I pray to God that America will hear this before it is too late, because today we’re fighting a war. Martin Luther King, Jr., Remaining Awake Through a Great Revolution, 31 March 1968

King was openly critical of the US government and their military policies, referring to them as “the greatest purveyor of violence in the world today.” He was prophetic in his declarations as to the damage military operations could do to the US at it pursued military activities both at home and abroad.

Exactly one year before his death, on April 4th 1967, King gave a speech in protest of the war in Vietnam. Of the US he said: “a nation that continues year after year to spend more money on military defense than on programs of social uplift is approaching spiritual death.”

He warned of the widening gap between rich and poor at home whilst spending on military operations abroad increased disproportionately. This is more glaringly obvious today than it was fifty years ago. Western countries are entangled in military exercises around the world, with no means with which to pay for them. Countries on both sides of the field are driven further into debt, with far lasting consequences for their citizens.

The true cost of war

The 2017 Global Peace Index found that violence cost 12.6% of global GDP. This means that the economic impact of violence on the global economy in 2016 was $14.3 trillion in purchasing power parity (PPP) terms, the equivalent of $5.40 per person, per day.

This gives no indication to the direct financial cost of war. By way of example a report from Brown University’s Watson Institute for International and Public Affairs finds that finds that an average American taxpayer has spent $23,386 on post-9/11 wars. The report estimates that by the end of this year the overall U.S. spending on wars in Iraq, Syria and Afghanistan could reach $5.6 trillion.

This is just direct spend. Study author Neta Crawford explained that ‘future interest payments on borrowing for the wars will likely add more than $7.9 trillion to the [US] national debt…Thus, even if military spending plateaus, interest costs will far surpass total war costs unless Congress devises another plan to pay for the wars, for instance by selling war bonds or increasing taxes’

In the modern Western world wars are financed by borrowing. Borrowing is a debt on future generations and a cost to society from day one. It is the opportunity cost of money going towards domestic projects such as healthcare, education, social mobility and infrastructure.

The Watson Institute Cost of War project reminds us of the following:

- The human and economic costs of these wars will continue for decades with some costs, such as the financial costs of US veterans’ care, not peaking until mid-century.

- US government funding of reconstruction efforts in Iraq and Afghanistan has totaled over $170 billion. Most of those funds have gone towards arming security forces in both countries. Much of the money allocated to humanitarian relief and rebuilding civil society has been lost to fraud, waste, and abuse.

- War spending created fewer jobs than similar spending investment in clean energy, public education, and health care.

- Federal investment in military assets during the wars made for a lost opportunity to significantly boost capital improvements in core infrastructure such as roads and public transit.

- War spending financed entirely by debt has contributed to higher interest rates charged to borrowers such as new homeowners.

The final point regarding interest rates is key for investors to pay attention. Whilst higher interest rates may seem like an excellent reason to hold interest-bearing assets, in truth the wider impact they can have on an heavily indebted economy can be devastating.

Who will end up paying for the abandonment of King’s dream?

An indebted economy means an indebted people which inevitably leads to major financial upset. It wouldn’t come as a surprise to find ourselves in yet another situation where investors exposed to the financial system are being called upon (read: told) to support the economy and banking system. Hard-earned assets would not be safe should the government perceive a better use for them.

There are many side-effects of wartime, one of the most long-lasting is the financial impact on individuals’ savings. Nowadays ‘war’ does not just means guns and tanks, it can be trade wars or currency wars. Sadly, they’re not exclusive of one another.

Trade wars frequently turn to currency wars. These decimate the capital of companies and the wealth of people and nations. It can also result in stocks and shares losing value sharply and crashing. Governments in any kind of war can be ‘forced’ to devalue people’s savings and in the next crisis, bail-ins will likely see savers’ accounts plundered … all for the public good.

This is where gold bullion comes into its own. Throughout history it has acted as a safe haven during times of protectionism and economic war. This was seen most recently in the 1970s.

The world was already a very uncertain financial and economic place with a lot of clouds on the horizon. Trump’s reckless actions have made this outlook even more uncertain. This bodes well for the gold price in the coming months and years.

Safe haven gold bullion will come into its own as these real risks become manifest.

News and Commentary

Gold steady as China-U.S. trade tensions escalate (Reuters.com)

Stocks in Asia Trade Mixed; Treasuries Steady (Bloomberg.com)

BlackRock’s $1.3 Billion Gold Fund Feels Pain of Miners (Bloomberg.com)

Sberbank to increase gold sales to India and China in 2018 (Reuters.com)

The Gold Price Driver (GoldSeek.com)

And The Fastest Growing Bank Asset in 2017 Was… Subprime (ZeroHedge.com)

Why April Showers the Pound With Good Fortune (Bloomberg.com)

Trade Tensions Are Already Hitting Industrial-Metal Prices (Bloomberg.com)

MARKET MELTDOWN CONTINUES: Gold And Silver Prices Begin To Disconnect (GoldSeek.com)

Gold Prices (LBMA AM)

03 Apr: USD 1,336.60, GBP 949.65 & EUR 1,085.99 per ounce

29 Mar: USD 1,323.90, GBP 941.69 & EUR 1,075.80 per ounce

28 Mar: USD 1,341.05, GBP 946.24 & EUR 1,082.23 per ounce

27 Mar: USD 1,350.65, GBP 954.64 & EUR 1,087.41 per ounce

26 Mar: USD 1,348.40, GBP 949.27 & EUR 1,086.95 per ounce

23 Mar: USD 1,342.35, GBP 952.80 & EUR 1,088.65 per ounce

22 Mar: USD 1,328.85, GBP 939.36 & EUR 1,078.10 per ounce

Silver Prices (LBMA)

03 Apr: USD 16.52, GBP 11.78 & EUR 13.44 per ounce

29 Mar: USD 16.28, GBP 11.58 & EUR 13.21 per ounce

28 Mar: USD 16.46, GBP 11.63 & EUR 13.28 per ounce

27 Mar: USD 16.64, GBP 11.79 & EUR 13.41 per ounce

26 Mar: USD 16.61, GBP 11.67 & EUR 13.39 per ounce

23 Mar: USD 16.53, GBP 11.70 & EUR 13.39 per ounce

22 Mar: USD 16.52, GBP 11.64 & EUR 13.41 per ounce

https://news.goldcore.com/

| Digg This Article

-- Published: Wednesday, 4 April 2018 | E-Mail | Print | Source: GoldSeek.com