-- Published: Thursday, 19 April 2018 | Print | Disqus

Source: Michael J. Ballanger for Streetwise Reports 04/18/2018

Precious metals expert Michael Ballanger discusses the gold and silver ratio.

-->There is a famous quote about short-selling that comes from Olde English business folklore that goes something like this:

"He who sells what isn't his'n.

Must deliver or goes to prison!"

That old horse chestnut was used to frighten the Rothchildian short-sellers that used to hang out on the old New York "curb" back before governments and influence- peddling lobbyists conspired to change the rules. I used to love to find overvalued stocks or commodities and get our trading desk to call over to the loan post to see what it would cost to borrow a few thousand shares of some pumped up bowser of a stock and then attempt to catch it on an uptick in order to sell it. The entire concept was rather civilized because everyone would know that there was a highly visible bear out there trying to get short something and invariably, the principals like the CEO or CFO would find out and then the ancient game of cat-and-mouse would begin.

It would begin with the phone calls from someone at the target company introducing themselves and asking you out for coffee or a beer if you were borrowing a puny 2,000 shares with the venue morphing decidedly if the number was north of 100,000 shares. (If it was a MILLION, it was a weekend in Vegas.) I would put on my most gracious persona as the rep from the overvalued company tried in vain to change my intention of hammering his pig of a stock into the ground, but what made it a study in human behavior was that the higher the gratuity, the more maniacally I wanted to sell the stock.

Needless to say, short-selling is not the fun it used to be because everyone and their uncle are "hip" to the notion of shorting overvalued garbage thanks to terrific books and movies like "The Big Short" that really showed the world how extremely difficult it can be and how the market-makers can artificially create a squeeze on a short player by simply fiddling with the "marks" at the end of every month. I, for one, long for the old days of finding some piece of Vancouver garbage that had a $500,000 annual travel and entertainment budget and a $500 annual exploration budget and a property "next door to Friedland" (!) whose founders held all the one-cent stock that was coming out of escrow next week. Adding insult to injury and turning the ridiculous to the sublime, the CEO has just paid out an egregious amount of money and stock to the telephone room owners whose job it was to "pump up the volume." Alas, the Elon Musks of the world learned how to magnificently "manage" their stocks by way of social media and sweetheart deals with all the top 50 hedge fund managers that conspire daily to monitor the share price so that nothing "untoward" can ever happen to threaten the uptrend line, despite being the most over-priced, money-losing auto manufacturer in world history.

The same thing goes for gold and silver with massive quantities of paper gold being traded as if in a virtual reality pit of digital outcry. To say that being long the gold and silver markets since 2013 has been "interesting" is like saying that having root canal surgery without Novocain is "interesting," when we both know that the proper descriptive should be "agony" or "maddening" but one adjective to most-accurately describe these past five years of shenanigans is "costly" for many people and for all the wrong reasons. Banks cannot sanction gold or silver because there is no counterparty to the transaction. Once it leaves the bank, it is gone.

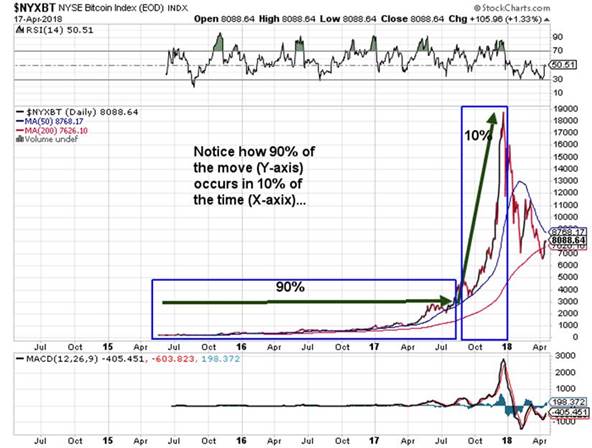

I have one idea for all of you that is, in my humble opinion, one of the greatest "short" set-ups that I have seen in over 40 years trading markets. Because I am leery of interventions and manipulations carried out constantly under the blinded eyes of regulators, I need to short something that would not be exposed to directional risk. The best example of being right about something and wrong at the same time was mid-2017 when I took one look at Bitcoin and determined that it was a bubble of the highest order. That was at $10,000 per coin. It went to $19,891 and then got bombed to under $7,000 and had we shorted it in mid-year, we still would have made money but had we shorted it on December 19, we would have made a fortune. What I knew from my short-selling experiences on the Nikkei in the late 1980s was that the most difficult part of shorting is execution (TIMING) because the biggest move on a chart comes in the last 10% of its journey along the x-axis. (Classic "bubble" chart pattern).

Getting back to my version of "The Big Short," I would not want to EVER be on the other side of a Goldman "mark" (where they could arbitrarily price your position wherever they want) and we all saw how much pain they went through until the subprime bubble was finally pricked. Instead, I like the idea of risk arbitrage, something I studied at the Wharton School in 1985 with a certain professor named Dr. Jeremy Siegel. Finding relationships between two assets that are either inordinately stretched or compressed can provide the most comfortable returns imaginable when they normalize. If there are two car companies and one is trading at 22 times earnings and the other is at 11 times earnings and they are both pretty much the same in terms of market share and growth, then being short the former and long the latter eliminates the need to be right about the direction of the automotive sector or the broad market a whole. Similarly, if live hog futures are priced too far above live cattle futures, demand for pork declines and demand for beef increases, causing the spread to narrow. Now, it doesn't matter if human meat consumption shifts in favor of fish and chicken and BOTH pork and beef decline, live hogs will crash harder than live cattle and you will have made a lot of money.

So, the Great Debate amongst the stock and USD bulls is that with the weekly chart showing RSI in the 37 range and with MACD and the Histograms turning up off a deep trough seen in February, the USD is going to rally. Since gold (and silver) are negatively correlated to the USD, is there not a hidden land mine under the metals despite an excellent COT structure and positive technical? The answer is "Maybe" so in order to take the directional risk out of the metals, what is it here in April 2018 that resembles an aberration of sorts? Surely it is the real dollar prices of silver and gold relative to equities and relative to Bitcoin and relative to Toronto real estate that remain an aberration—BUT—even greater than these disparities is the value of silver relative to gold—OR—the Gold-to-Silver-Ratio (GTSR)!

The Gold-to-Silver-Ratio

With the thousands of ETFs covering everything from soybeans to dog food to body parts, you would think that someone could create an ETF for the GTSR but the only tried-and-true method of taking the directional risk out of the precious metals at any time in history is when the GTSR is above 80:1. Last week it hit 86:1 and has quickly retraced but any level above 80 has proven to be a superb entry point. The two most liquid ETFs are the SPDR Gold Trust (GLD:US) and the iShares Silver Trust (SLV:US),and both track physical bullion. With GLD closing at $127.75 and SLV closing at $15.80, you can buy 8.08 shares in SLV with one share of GLD. To get the actual 80:1 ratio, you have to own ten (10) SLV for every one (1) GLD you are short. Assuming you are looking at a big dollar trade, you do the following:

Net Proceeds (-Cost) Margin Required

Short 1,000 GLD at $127.75 $127,750 $63,875

Buy 10,000 SLV @ $15.80 -$158,000 $79,000

Total margin required (Ask your broker about this) $142,875

You are now short the GTSR at 80.80:1

Assumption A:

USD crashes; stocks crash; commodities spike; gold and silver advance; gold is at $1,577.50 per ounce; silver is at $25.95; GTSR is at 60:1

Net Proceeds (-Cost) Profit (Loss)

Buy 1,000 GLD @ $157.75 -$157,750 ($30,000)

Sell 10,000 SLV @ $25.95 $259,950 $101,950

Profit $71,950

Funds committed: $142,875

ROI: 50.35%

Assumption B:

USD rallies hard; stocks explode to new highs; commodities crash; gold and silver decline; GLD is at $107.75; SLV is at $15.35; GTSR is at 70.

Net Proceeds (-Cost) Profit (Loss)

Buy 1,000 GLD @ $107.75 $107,750 $20,000

Sell 10,000 SLV @ $15.35 $153,500 (4,500)

Profit $15,500

Funds committed: $142,875

ROI: 1.08%

Gold and silver under Assumption B have 15.6% and 2.8% declines and the trade remains profitable. Because the relationship between gold and silver was stretched, the directional risk was removed from the initial trade set-up.

The generational range for the GTSR is as follows:

- 2007 – For the year, the gold-silver ratio averaged 51.

- 1991 – When silver hit its lows, the ratio peaked at 100.

- 1980 – At the time of the last great surge in gold and silver, the ratio stood at 17.

- End of 19th Century – The nearly universal, fixed ratio of 15 came to a close with the end of the bi-metallism era.

- Roman Empire – The ratio was set at 12.

- 323 B.C. – The ratio stood at <12.5 upon the death of Alexander the Great.

You have all read my missives on gold and silver and stocks and bonds and the VIX and my dog and my two vices until you all basically know me better than my own children so know this: shorting the GTSR is the best, low-risk trade you can ever get in today's algo-driven world. As you all know, I took my VIX profits in February and as huge as they were, they did not allow me to parlay the winning in their entirety to my beloved silver. I had to think about what would happen if I was wrong (God forbid) so I put 25% into Fortuna Silver May $5 calls and 25% into the SLV June $15 and $15.50 calls at various prices lower than here. The problem is that since those two positions represent only a portion of the profits on the UVXY trade ($9.38 to $25 in eighteen days), I still have the principal to put to work and I really did not want to give back those winnings as I have done countlessly since 2011.

So I scoured around my thumb-drive memory stick of all the "Greatest Trades of History" and found things like U.S. Secretary of State William H. Seward's purchase of Alaska from the Russians for $7.2 million and the Dutch West India Company's Peter Minuit buying Manhattan for "60 gilders" worth of "sophisticated modern (then) European tools" worth (possibly) U.S.$15,000 and, of course, the now-famous "Big Short" trades in the sub-prime derivatives in 2008 and George Soros' short of the British pound in 1992 (which George would say "broke the Bank of England" but actually simply forced it to abandon the European "Exchange Rate Mechanism").

These were all "great trades" but what earns them "legendary" status is that they were at once both laughably unpopular and comically contrarian (as was buying the UVXY in late January). Going against the crowd is not very much fun. It is psychologically taxing and emotionally draining. Nevertheless, I believe that the gold-silver "pair" is going to be a shockingly good trade and I have gone "ALL-IN" with my remaining VIX profits and whatever else I can muster after the lawyers and accountants and CRA (and ex-wives) have had their way with me.

So, do your best to look deep into the inner vault of psychological awareness and assess, as I have, what, pray tell, might be the reason that we all take hard-earned, after-tax dollars and try to be heroes. I know I have taken risk throughout my life and in my career so now is the time to invest with "the house." The current market environment is nothing more and nothing less than a "sanctioned casino" and I might add that it has "forward guidance" in respect of "future actions" that are in demonstrative favor of "the house," so while I love buying "20 cars of beans" or a "sliver of silver futures," the trade I am taking shown above will be a huge winner, on a risk-adjusted basis.

Invest with "the House" that HATES gold and cares NOTHING of silver.

If you do, you are long "the House." Not such a bad trade.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

| Digg This Article

-- Published: Thursday, 19 April 2018 | E-Mail | Print | Source: GoldSeek.com