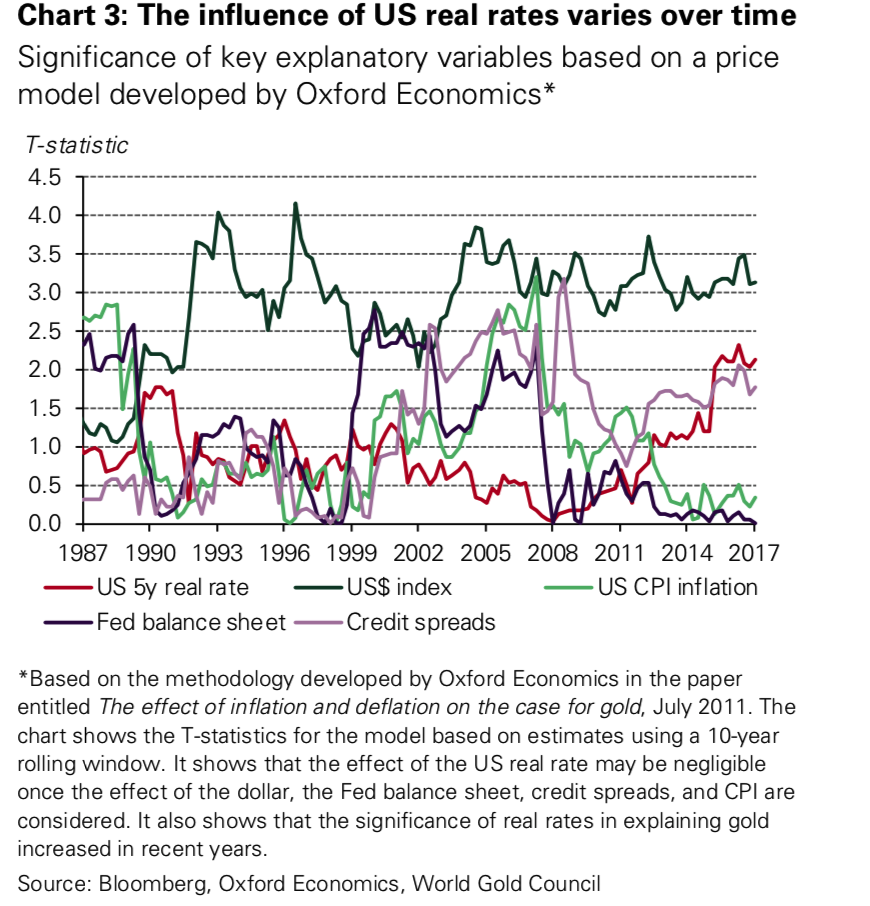

‘[This] was likely a result of the strong influence that US monetary policy was exerting across global markets. This period coincided with a shift in investor expectations of US monetary policy from being very accommodative to moving towards normalisation.’

Conversely, higher rates are not always linked to higher prices

We are always quick to assume that US interest rate changes will begin to affect the price of gold. But consider the variety of demands involved in the gold market: jewellery, or technological demands- are they all influenced by US interest rates? The chances are, no.

‘US interest rates do not necessarily influence the behaviour of global consumers of gold jewellery or of technology demand. Nor do they affect the behaviour of investors outside the US for whom local interest rates matter more than US rates’

Interestingly the WGC research finds that whilst gold does react best to negative US interest rates, they can remain below 2.5% (significantly higher than today) and average gold returns remain positive.

‘Falling rates are generally linked to higher gold prices; yet rising rates are not always linked to lower prices.’

Take the above with a pinch of salt

These findings with a pinch of salt. There are so many factors that affect the price of gold that investors should not focus on the policies and currency of one country to determine their buying and selling decisions.

The WGC finds four broad categories which affect the price of gold. It is interactions between these categories that affect the performance of the precious metal.

Wealth and economic expansion: periods of growth are very supportive of jewellery, technology, and long-term savings

Market risk and uncertainty: market downturns often boost investment demand for gold as a safe haven

Opportunity cost: the price of competing assets such as bonds (through interest rates), currencies and other assets influence investor attitudes towards gold

Momentum and positioning: capital flows and price trends can ignite or dampen gold’s performance.

When it comes to gold’s long-term trend, the lobbying group finds that:

‘drivers related to wealth and economic expansion are generally more relevant for gold’s long-term trend. And drivers linked to the other three categories play a significant role in gold’s countercyclical behaviour.’

The US dollar will overtake rates when it comes to influence on gold price

In our view, one of the reasons the dollar will overtake rates to explain the direction of the gold price, is that movements in the dollar already reflect inflation expectations of monetary policy in the US. At the same time, they also reflect expectations of interest rate differentials between the US and major economies, as well as investors’ views on trade imbalances – all factors that are currently relevant for gold.

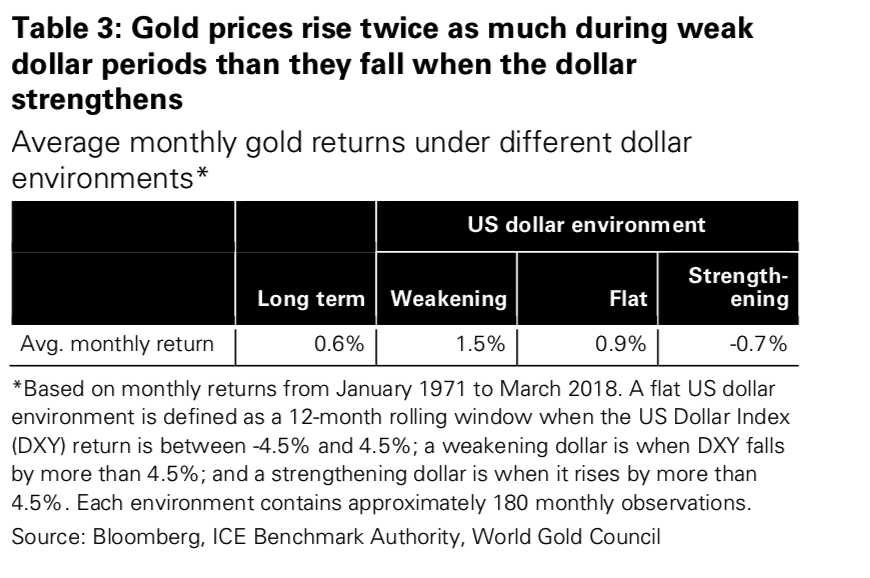

There is an ‘asymmetric correlation’ between gold prices and the US dollar. Why? Because not everyone pays for their gold in US dollars. Local currency movements impact demand more.

Thus, gold’s behaviour is best understood as a broad fiat currency hedge rather than simply a dollar hedge. This is apparent in periods when major currencies weaken, and investors buy gold to hedge that risk – for example, during the European sovereign debt crisis. In such instances, gold and the dollar have tended to move in sync, with both benefiting from safe haven inflows.

This further explains why the uncertain times ahead due to heightened geopolitical risk are likely to see further gold price gains. Even if the dollar strengthens on announcement of war in Syria (for example) we may still see the price of gold rise.

Read the original research here.

Recommended reading

Four Key Themes To Drive Gold Prices In 2018 – World Gold Council

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Gold Does Not Fear Interest Rate Hikes

News and Commentary

Gold hovers near 5-wk lows amid dollar pressure, rising yields (Reuters.com)

Asian Stocks Mixed as Tech Rises; Dollar Steady (Bloomberg.com)

Gold prices could ‘test five year highs’ later this year: Researcher (CNBC.com)

Ex-UBS Metals Trader Beats Spoofing Conspiracy Charge (Bloomberg.com)

Deutsche Bank to Reduce Investment Banking in Focus on Europe (Bloomberg.com)

Central Bankers Can’t Agree on Cryptocurrencies (Bloomberg.com)

Debt-Enabled Asset-Bubbles Are On A Crash With Demographics (ZeroHedge.com)

It’s 2-Year Yields, Not 10-Years, We Worry About Most (ZeroHedge.com)

Gold prices could ‘test five year highs’ later this year (CNBC.com)

ABN Amro: Geo-politics and sanctions support commodities (Abnamro.nl)

Gold Prices (LBMA AM)

25 Apr: USD 1,325.70, GBP 949.47 & EUR 1,085.48 per ounce

24 Apr: USD 1,327.35, GBP 951.84 & EUR 1,087.76 per ounce

23 Apr: USD 1,328.00, GBP 950.45 & EUR 1,085.64 per ounce

20 Apr: USD 1,340.15, GBP 953.52 & EUR 1,089.14 per ounce

19 Apr: USD 1,347.90, GBP 950.54 & EUR 1,090.59 per ounce

18 Apr: USD 1,346.55, GBP 949.59 & EUR 1,088.95 per ounce

Silver Prices (LBMA)

25 Apr: USD 16.57, GBP 11.87 & EUR 13.57 per ounce

24 Apr: USD 16.60, GBP 11.90 & EUR 13.59 per ounce

23 Apr: USD 16.94, GBP 12.14 & EUR 13.85 per ounce

20 Apr: USD 17.11, GBP 12.15 & EUR 13.91 per ounce

19 Apr: USD 17.20, GBP 12.09 & EUR 13.91 per ounce

18 Apr: USD 16.95, GBP 11.93 & EUR 13.70 per ounce

https://news.goldcore.com/