-- Published: Wednesday, 2 May 2018 | Print | Disqus

By James Anderson

One dealer bankrupted in 2016 with two of its directors indicted in April 2018 on fraud charges. The other dealer still gets over from its 1980’s branding yielding high volumes of google searches, and thus possibly churning and burning new novice customers every day. Allegations of fraud total $362.5 million USD in lost customer and vendor funds combined.

#1 Silver Gold Scam Indictment: Northwest Territorial Mint

For those who were paying attention or had perhaps even done business with them, the following Northwest Territorial Mint (NWTM) news may not be all too shocking.

Image Source

Following the 2016 Northwest Territorial Mint bankruptcy, in April 2018 the Washington state Division of Financial Institutions filed an indictment of company head Bernard Ross Hansen (57), as well of his company’s vault manager and alleged girlfriend, Diane Renee Erdmann (45).

This story has various lessons for all bullion buyers and owners which we conclude with, regardless whether or not these two individuals are convicted and proven guilty in a court of law.

Alleged details and accusations of 20 federal felonies are rather gory in scope and size:

- NWTM operated a Ponzi-like scheme.

- Constantly lied about shipping times for customer bullion order deliveries.

- Improperly used customer capital to expand the NWTM business to other states.

- 50 people who stored their bullion with NWTM found all of part of their bullion worth $4.9 million USD supposedly missing.

- 20 customers involved in a bullion leasing program were allegedly defrauded of more than $5 million USD.

- One Canadian silver bullion producer possibly lost more than $1 million USD in silver bullion.

- Over 3,000 customers paid for orders, or made bullion sales or exchanges, that were either never fulfilled or never refunded to date. The total loss to these customers totals more than $25 million USD alone.

- As of now, over 3,000 creditor claims has amassed a mostly unsecured creditor filing of nearly $72.5 million USD against bankrupt NWTM.

Sadly, if history is any precedent, unsecured creditors will be lucky to get dimes and even pennies on their dollars owed (you can even see some of the alleged professional hourly rates being charged ranging from $900 to $90 USD per hour).

Most of the functioning capital remaining (facilities, dies, machinery) will likely be auctioned off at fire sale prices, much of the proceeds used in paying professionals to oversee the matter.

This AUTHOR’s + OTHER’s Experiences with NWTM

One of my first tasks at SD Bullion was to create this free 21st Century Gold Rush guide. Within it I offer various free tools and common sense approaches you can use in order to avoid doing business with companies that may end similarly to this latest NWTM bankruptcy.

Like any industry, the physical bullion dealer market has good, bad, and incompetent actors.

It is often the incompetent and nefarious actors who end in bankruptcy, lawsuits, and even prison terms. Indeed many outfits who pose as safe havens end up being the exact opposite.

Throughout my first few years of buying bullion, I made many common beginner mistakes (purchasing shares of ETFs, speaking to and even buying from poor business practicing dealers, etc.).

Of course it is always best in life to try and learn first about how to avoid making potential mistakes before errantly making them yourself. Yet in late 2007, the internet was less robust in terms of organic bullion dealer consumer review websites (most were simply paid rig jobs). All that really existed at the time were various curmudgeon precious metal forums and the BBB which remains suspect as I have further detailed here.

I personally made many phones calls and inquiries around the bullion industry in 2007, and at the time most silver and gold dealers were using the 1980s / 1990s bear market boiler room model of trying to flip would-be bullion buyers into non-rare overpriced granddaddy gold and silver coins (semi-numismatics, anything is confiscatable by the way).

The high profit margin portion of the silver and gold industry has since shifted in part to low-mintage exclusive private rounds and government minted coins. The higher premium coins and rounds whose true value regardless of what any marketer or salesmen might allude, is only really what a dealer or perhaps an individual on eBay might pay (minus all the fees of course). But that’s another topic for another day.

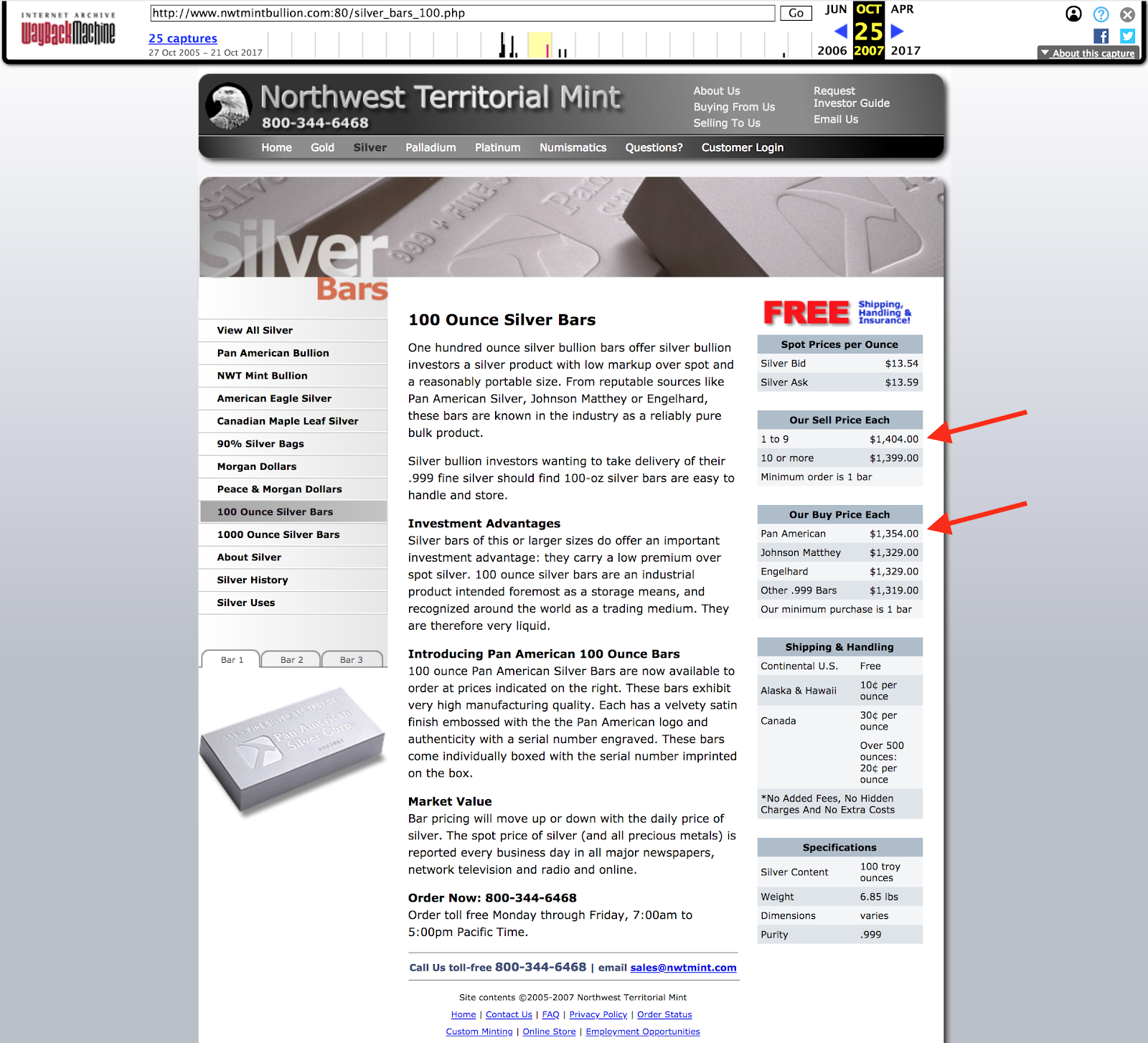

In late 2007 (use the wayback machine to verify), NWTM looked like a pretty reputable company that had rather transparent buy and sell prices published live on their website (believe it or not, this common sense approach was actually cutting edge for the day).

I myself decided to put a test 100 Silver Bar bullion order with NWTM in early 2008 and here were the results after many months and a few badgering customer service phone calls I had to make later.

Yes indeed, you read that correctly. It took an embarrassing five months for delivery.

Of course this amount of time blew well past the guideline ‘legal’ 28 day for commodity delivery timeframes selectively enforced by the CFTC and other state prosecutors.

Lesson was learned, my business was never done with NWTM again. Over the years, it was obvious based on customer feedback online and through rumor not much had changed. This is a small industry, after all.

Looking back on it now, at least the 100 oz Silver Bar that I bought from them was actually, eventually delivered to me in full. Although I probably am owed some interest on the $1,671 USD short-term capital I unsecurly loaned them.

By 2011 and 2012, more reliable internet gold dealer review websites began hosting long sordid digital records of customer accountings which mostly documented complaints of Northwest Territorial Mint’s poor business practices.

Other silver and gold dealers who have had terrible track records for years still operate and find new customers everyday. But as you can see in this instance with NWTM, if can sometimes take years, even decades or more before all allegations, bankruptcy, potential facts become fully known, and any or some frauds possibly prosecuted.

#2 CFTC Alleged Silver Gold Scam Indictment: MONEX

The CFTC (again) alleges this older generation brand-name gold dealer has committed fraud with its leverage account customers with some $290 million USD of losses in off-exchange leverage accounts in a less than 6 year time frame.

Source

Funny but not really, I thought the LA Times wrote a similar article eight years ago, in 2010.

Time will only tell if these allegations are proven truthful or if they ever get fully prosecuted in a court of law. I personally spoke to a representative of this company in 2007, and that salesman attempted to turn my silver bullishness into a leverage play.

Leverage?

No thanks back then, not now. Try never ever.

Good luck in your apparently never ending lawsuits.

Precious metal silver prices can be volatile, trading their price action short-term is real risky.

Leverage often ends in losses (e.g. $1 billion bailed-out Hunt Brothers, 1980 an example).

There are further instances of companies gone and even still some in operation who have yet to come to grips with the internet’s ability for customers, bloggers, and vloggers to communicate misgivings in mass.

Eventually organized bad business practitioners likely find failure in one form or another.

Often times, it can take decades for runs on the bullion supposedly stored, backorder the dealer to bankruptcy, or for alleged fraud prosecutors to finally win.

Of course bad business practitioners could always stop and start another sleazy company, but in the end, professionals in the physical precious metal industry who flourish long term only do so by making winning deals for all parties involved.

10 LESSONs to LEARN HERE and NOT REPEAT

- Never buy from silver or gold dealers with large time delays in delivering to you, the exact bullion that you order. Even in the worst bullion shortage the industry has had (during late 2008), waiting more than 28 days for delivery should remain unacceptable.

- If you somehow ever get caught in an extended situation where a dealer is not delivering within a reasonable timeframe, politely demand your capital back in writing with explicit prosecutable details. If recent company customer complaint volumes are large enough, it may even merit you quickly taking a ‘Market Loss’ on your delayed order if only to simply ensure you don’t end up in some neverending lawsuit and bankruptcy proceeding.

- If it’s a small bullion order, possibly paying a slight premium with a credit card helps ensure that if the dealer doesn’t deliver, your credit card ‘chargeback’ will at least get your funds returned. Credit card companies favor customers over merchants (they make more money from the former (avg 20% APR), not the latter (avg 2.5 - 3% merchant account fees).

- Always check the latest organic customer review websites before you place any and every bullion order. Do this each and every time to help ensure that the potential bullion dealer you may do business with is indeed delivering on their word at reasonable prices. If not, move on. There are plenty of reputable bullion dealers consistently delivering on their word at fair price points. Your capital is too precious to risk, overpay with, or lose.

- Stick with the most popular low premium bullion brands and hallmarks for your stack. One’s that have the largest and deepest recognition and two way markets. If someone ever offers you gold or silver price exposure on leverage, laugh out loud as you leave that to outsized price gamblers and price moving commercial banks on CME Group’s COMEX / NYMEX.

- Never have a bullion dealer be your trusted non-bank storage middle man. This simply opens the doors too widely for potential fraud and fractional reserve ponzi-like lending to take place. NWTM is not the first alleged bullion storage business to bankrupt and use customer funds. Another recent example of why never to allow someone who buys and sells bullion to have any dominion over your non-bank stored bullion is here.

- Anyone paying attention to financial frauds over the last few decades knows that even the Big 4 Accounting firms often miss or fail to report frauds occurring for years at a time and for various reasons. In my experience, most accountants have little to no clue how this industry operates. When contracted they often get overwhelmed when auditing bullion storage facilities and operations. To do the job correctly requires deep dive forensic accounting, product knowledge, robust full access to customer records with random third party verifications, and many days if not weeks to fully count and verify purported holdings. In the real world folks, that costs a lot of time and money. Accounting firm audits can also be consistently manipulated through customer record riggings. In essence, the truth can be obfuscated for long durations. Simply take as direct of control of your bullion holdings as you reasonably can.

- If you choose to have large lots of bullion at home, keep this information and knowledge limited to only your most trusted loved ones. Silver and gold bullion home raids are a real threat to anyone with loose lips.

- For any home bullion storage in size, consider an industry-first new option offering a ‘Home Bullion Insurance’ policy in case of theft ever happening. Policy prices are very reasonable and are often less than 1/2 the annual amount you would pay if you had a direct account with a secure logistics provider safeguarding them with full insurance (as low as 20 basis points or less annually to insure home stored precious metals, i.e. gold and silver bullion items).

- If you have near $50k USD or more of physical bullion you want stored professionally outside you domicile, only do so directly with reputable long proven track record secure logistics firms. Disintermediate and cut any and all middlemen bullion dealers or their subsidiary companies out of your safe bullion storage. Doing this can (A) help reduce the prices you will pay, and (B) it adds further optionality when you go to sell. Basic common sense plus historical precedent illustrates this also helps you (C) vastly reduce the risks associated with most private and publicly traded companies who offer bullion storage.

Unfortunately our reach is not large enough to forewarn all new and existing bullion market participants. There will be more alleged frauds and bankruptcies to come.

As well many international bullion buyers do not have such developed bullion industry service sector as we do in the United States of America. Their options for direct delivery to home are often limited, yet they should still follow the aforementioned suggestions when considered professional secure logistics non-bank storage (disintermediate, no middlemen, go direct).

In reporting this latest bullion dealer bankruptcy and ongoing potential fraud indictments, our hope is you will take heed some of the varied lessons ingrained and now new to the market.

Find further tools plus tactics to buy and sell bullion intelligently in our 21st Century Gold Rush.

| Digg This Article

-- Published: Wednesday, 2 May 2018 | E-Mail | Print | Source: GoldSeek.com