-- Published: Tuesday, 8 May 2018 | Print | Disqus

By Frank Holmes

Call it the news of the year, perhaps even of the decade. For the first time since the Korean Peninsula was divided in 1948, leaders of the two warring nations met in what had the look and feel of a jovial reconciliation between two estranged family members. Kim Jong-un of North Korea and President Moon Kae-in of South Korea made a number of important, though tentative, breakthroughs, including an agreement to denuclearize the peninsula and a pledge to revisit several infrastructure projects that would help bring some economic unity to the two Koreas.

Which the North desperately needs, as anyone reading this knows.

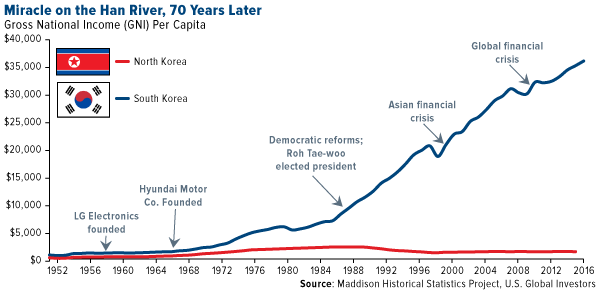

Below is economic development, as measured in gross national income (GNI) per capita, for the two nations since division. The chart looks not unlike the one I shared comparing Cuba and Singapore since their founding in 1959.

click to enlarge

Thanks to rapid growth spurred early on by business-friendly policies, South Korea is today the fourth largest economy in Asia—following China, Japan and India—and the 11th largest in the world. Most of its citizens enjoy a comfortable, middle-income lifestyle and can afford to own many of the popular consumer goods and vehicles manufactured by Samsung, LG, Hyundai and other Korean household name brands.

North Korea, on the other hand, has not advanced in any material way and today has an economy roughly 30 times smaller than its southern neighbor. Its inhabitants routinely suffer great hardship, from famines to a lack of adequate health care.

For now, many analysts are skeptical that this new development will have a huge impact on the surrounding Asian region—in the near term, at least—since North Korea’s economy is small and lacks the infrastructure necessary for rapid expansion. It’s unlikely we’ll see the sort of boom Vietnam experienced after opening its economy up to foreign direct investment (FDI) in the late 1980s. It’s just as unlikely we’ll see unification anytime soon, as that would require the presiding Kim to end the dynasty that began with his grandfather Il-sung.

Nevertheless, all good things must begin somehow, and this is as good a beginning as I can imagine.

South Korea Expected to Lead in Dividend Growth

Investors also seem to be taking in the news with a side of skepticism. The Korea Composite Stock Price Index (KOSPI) advanced a little under 3 percent in the three trading sessions following the summit, but since then it’s pared all of those gains.

South Korea is very attractive right now, with stocks trading at cheap valuation multiples relative to those in neighboring countries. Gross domestic product (GDP) growth remains robust, rising 2.8 percent in the first quarter.

The Korean market has a reputation for having a low payout ratio, despite many of its multinationals being flush with cash, but that looks set to change. Pressured by the government to do more to attract and keep foreign investors, the countries’ top 10 firms paid out a record 7 trillion won, or $6.46 billion, to offshore investors last year. Samsung Group ranked first, its payouts rising a massive 45.6 from the previous year to total 3.91 trillion won.

According to CLSA estimates, based on FactSet data, Korea tops the list for dividend growth this year and next. The investment bank is looking for a 20 percent compound annual growth rate (CAGR), which would be a huge improvement over other markets around the globe.

click to enlarge

Will Korea Become the First Cashless Society?

Recently I asked the question: “How long till bitcoin replaces cold hard cash?” The answer is: Sooner than you might think, though I’m using “bitcoin” here as a proxy for all digital currencies.

Cointelegraph reports that the Bank of Korea (BOK) announced that it’s looking into using blockchain technology and cryptocurrencies for all transactions. Such a move, according to the bank, would improve customer convenience and eliminate the cost of producing physical bills and coins.

The BOK has already set up an organization to research digital currencies and the possible ramifications of transitioning to a completely cashless society—something the Korean government has had its eye on since at least 2016.

Adoption is happening much faster than expected. Last month, the country’s leading crypto exchange, Bithumb, and Korea Pay Services, a mobile payment service provider, said they would work together to make crypto transactions available at thousands of stores and outlets.

According to the Korea Times, virtual currency payments will be made available at as many as 6,000 store locations across the country in the first half of 2018. By the end of the year, 2,000 more locations will come online.

Chinese Equities Have Outperformed Since 2001

Morningstar reports that, from March 2001 to March 2018, China stocks had the strongest annualized growth among global markets. Over the 17-year period, the MSCI China Index delivered an amazing 12.2 percent in annualized total returns, compared to the MSCI Emerging Markets Index with 10.7 percent and the MSCI World Index with 6 percent.

click to enlarge

What I find incredible is that, when the MSCI Emerging Markets Index was created in January 1988, China wasn’t even included. Today, the Asian giant has the heaviest weighting, representing nearly 30 percent of the index.

But the emerging markets index is changing yet again. Until now, the MSCI included only Chinese stocks that are traded on foreign exchanges—Hong Kong or New York, for instance. Starting June 1, domestic, Shanghai-listed Chinese stocks, known as A-shares, will be added for the first time ever. This will give foreign investors greater, and unprecedented, exposure to the world’s second-largest equities market.

The timing couldn’t have been better, as a huge number of Chinese unicorns—private firms with valuations exceeding $1 billion—are expected to raise capital this year through initial public offerings (IPOs), in Shanghai and elsewhere.

According to the Wall Street Journal, around a dozen Chinese companies, with a collective valuation of $500 billion, have been working with banks and investors to roll out an estimated $50 billion in new shares. Of those, the largest by far is smartphone-maker Xiaomi, which is expected to raise at least $10 billion in Hong Kong, the most ever for the exchange.

Manufacturing in China expanded again in April, posting either a 51.4 or 51.1, depending on which source you trust more—the Chinese government or financial media outlet Caixin.

click to enlarge

The Month of May Has Been a Great Time to Buy Gold

On a final note, May is here, and that means we could see yet another excellent gold buying opportunity. In the chart below, you can see the yellow metal’s average monthly returns for the 30-year period and 10-year period. Although there are noticeable differences, in both cases, May was a great entry point ahead of the late summer rally in anticipation of Diwali and the Indian wedding season, when gifts of gold jewelry are considered auspicious.

click to enlarge

During this May in particular, the price of gold has been feeling the pressure of a stronger U.S. dollar, currently at a 2018 high, and rising Treasury yields.

But as I said in a recent Frank Talk, there are a number of reasons why you might want to consider adding gold stocks to your portfolio, including faster inflation and shrinking supply.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The KOSPI Index is comprised of 200 of the largest and most liquid issues traded on the Korean Stock Exchange. The index market capitalization is weighted, meaning that firms with the largest market value have the greatest influence on the KOSPI's returns. The MSCI China Index captures large and mid-cap representation across China H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 153 constituents, the index covers about 85% of this China equity universe. The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries. With 1,649 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI Emerging Markets Index captures large and mid-cap representation across 24Emerging Markets (EM) countries. With 846 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The compound annual growth rate (CAGR) is the mean annual growth rate of an investment over a specified period of time longer than one year.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

The Caixin China Manufacturing PMI (Purchasing Managers' Index) is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 private manufacturing sector companies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2018.

| Digg This Article

-- Published: Tuesday, 8 May 2018 | E-Mail | Print | Source: GoldSeek.com