-- Published: Wednesday, 16 May 2018 | Print | Disqus

By Dominic Frisby, Money Week

2018 has been a noisy year so far: stocks have been up, then down, then up, but ultimately gone nowhere.

Precious metals are a little lower than where they started. Bonds are quite a bit lower. Crypto currencies are a lot lower.

Oil supply and demand chart (Money Week)

There’s been babble and squawk about all of them.

But one normally clamorous asset has quietly ground upwards.

And that asset is oil.

The stealth bull market in oil continues

Back in early 2016 I called oil my “trade of the lustrum” (a lustrum is a five-year period – it’s an almost criminally underused word). With West Texas Intermediate oil (WTIC) at $33 a barrel, and Brent crude oil at $36, we said “buy, hold and forget”.

The wager has been a good one. With the usual wobbles along the way, oil has steadily ground higher so that now, two years on, WTIC stands at $71 and Brent at $79.

On revisiting the trade along the way, we’ve noted that this is a stealth bull market, and stealth bull markets are the best kind of bull markets, because few people are talking about them.

But this is the bottom line: it’s a bull market. Bull markets are to be involved in, not stared at. You want to have some oil exposure in your portfolio. It’s that simple.

Previous oil bull markets have been accompanied by powerful narratives: the explosion of the Asian middle class – especially in China – means huge demand. A dearth of new discoveries in readily-accessible locations means the end of cheap oil. Oil production has peaked; it declines from here. We are past Peak Oil.

Instead we’ve seen technological advances which have seen the US become the world’s largest oil producer. Production is no longer such an issue, apparently. New battery technologies and electric cars have been the hot topics. And as for the Asian middle classes and their new-found wealth – they appear to have disappeared, for all you read about them.

Of course, the Asian middle classes have not disappeared. They are now richer than they were during the bull market of the 2000s. There are many more of them. And, despite what you may hear about the vehicles of the future, the vehicles of the present run on oil.

Supply may have increased, but so has demand. Demand is growing all the time and it exceeds supply, as this chart from the International Energy Agency (IEA) shows.

There will be wobbles along the way; there always are. Indeed, measures of momentum such as RSI (relative strength index) and MACD (moving average convergence/divergence) both show oil to be overbought and due a pullback.

But this is a trend, my friends, and my trade-of-the-lustrum advice remains in play: buy, hold, forget.

Oil bull markets end with a great deal of noise. This one has not got noisy yet.

I should say it’s all the more impressive in 2018 for the fact that the oil price has quietly carried on rising, even as the US dollar has strengthened.

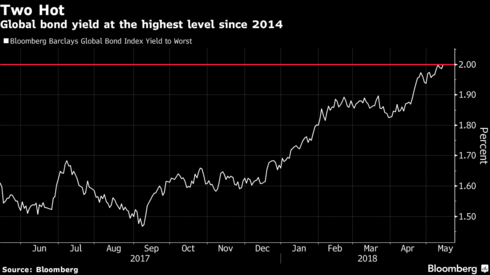

By the way, the fact that Treasury bond yields have been rising in the US at the same time as oil makes the macro theory that the financial backdrop has changed from one of deflation to one of inflation all the more credible.

More and more, the theme of inflation seems to be making itself present in our lives once again.

Full Money Morning article including the best way to play rising oil prices here

News and Commentary

Gold crawls up on safe-haven support; dollar limits gains (Reuters.com)

Asian Stocks Decline With U.S. Yield Around 3% (Bloomberg.com)

Dow aims for 8-day win streak as trade worries fade (MarketWatch.com)

U.S. Stocks Mixed as Treasuries Slip, Oil Gains: Markets Wrap (Bloomberg.com)

Eisman of ‘The Big Short’ Fame Recommends Shorting Deutsche Bank (Bloomberg.com)