-- Published: Wednesday, 30 May 2018 | Print | Disqus

By: David Haggith

It’s simple math — an equal and opposite reaction. After a long spell of QE took mortgage interest down to the lowest it has ever been, a long spell of QT (quantitative tightening) is going to take it back up again. That’s why I forecasted another housing collapse with confidence last year:

Rising mortgage rates will certainly cause housing sales to fall. Prices will follow for those houses that have to sell because, as mortgage interest rises, people won’t qualify for as large a mortgage as they do now. It’s all part of the developing Epocalypse in which multiple industries collapse into the final depths of the Great Recession as the fake recovery fades out of existence like a mirage.

The big difference between 2010 and now, and between 2008 and now, is that home prices have skyrocketed since then in many markets – by over 50% in some markets…. In other markets, increases have been in the 25% to 40% range. This worked because mortgage rates zigzagged lower over those years, thus keeping mortgage payments on these higher priced homes within reach for enough people. But that ride is ending. (Zero Hedge)

I gave this part of my 2018 economic predictions more time to play out than I did for Carmageddon or the Retail Apocalypse or a 2018 stock market crash because mortgage rates are not as volatile as things like credit-card rates, nor do housing prices quickly reverse. People can hold out for a year or more or choose not to sell at all before they are inclined to drop the price of their most treasured asset.

Nevertheless, mortgage interest is rising at the fastest rate seen in nearly half a century in what has been the most prolonged increase in 46 years. Rates are already at 4.66% on a 30-year mortgage and briefly touched a seven-year high, even though the Fed’s unwind is only at half speed and has only been happening (at an even lower speed) for a little over half a year.

Mortgage rates spiked in a big way today, bringing some lenders to the highest levels in nearly 7 years (you’d need to go back to July 2011 to see worse)…. Today did cover quite a bit more distance than other recent “bad days.” (Zero Hedge)

As interest rises, sales and prices will go into decline; but right now we still have a lot of rebuilding to do from the hurricanes and wildfires; rates are just beginning their rise; and we are entering the peak building and buying season. That means I expect a summer housing boom this year — a last hurrah — as buyers try to pour into the market before rates rise any more … as soon as school is out … and as rebuilding from last year’s hurricanes and fire storms gets under full swing.

That’s in keeping with what I said last year when I had predicted a housing decline for that summer. Housing did start to show notable problems, but the hurricanes and wildfires changed all of that to where I revised my date (prior to any known change in reported housing statistics) to say the housing decline that had begun would be delayed until the fall of 2018 due to the flurry of buying and rebuilding that the storms would necessitate.

I predicted a quick rebound to housing last fall when any of the storm afflicted who could move quickly would suck up available inventory or move to other regions and find new jobs. Then I said there would be a delayed boost for rest who chose, instead, to build new homes or rebuild damaged ones. That boost would be delayed until spring and summer of this year because clean up and planning and, in many cases, infrastructure repairs have to happen before new construction can begin, and we were moving into winter which inhibits construction.

After this coming fall, however, it’s downhill all the way for housing. The only caveat I see for that prediction is the same one that saved housing when it started going down last year: the national weather service says we are on track for another year of major storms (both hurricanes and fire storms all over again … if they know what they are talking about.) If such difficult-to-predict events materialize, they will again force a lot of people to buy new homes or rebuild old ones. That, however, is not a rinse-and-repeat cycle that can restore the economy.

While the housing market would get another temporary boost from the flurry of rebuilding, it is a boost that ultimately makes the economy weaker. The broken-window theory for rebuilding and economy doesn’t work. Things really work like this: If storms hit in the same areas that were hit a year or two before, then already bedraggled people are less resilient toward starting the rebuild all over again. As a result, those areas go into permanent decline because people simply give up and move out.

In other words, the temporary boost that we saw due to storms last year came at a cost to resiliency this year — not just the resiliency of people but the resiliency of banks toward making loans in those regions and of insurance companies to keep insuring in those regions. We’re a very resilient nation, so we can endure a lot of blows; but that doesn’t mean they make us stronger or that we are invincible. Even if storms hit in different areas, resiliency of insurance companies to keep absorbing heavy losses has declined some due to last year and would decline more this year. Insurance rates would have to rise for companies to remain solvent. Obviously, these events also reduce future resiliency by increasing many people’s debt to a level of strain they can barely take.

Storms can create a stimulus boost, but they do not turn around a secular decline. They do not change the fact that rising interest rates overall are inevitably destructive to the housing market.

How is a housing collapse evident this year in spite of storm recovery?

I can still offer support for my claim that housing is in the process of collapsing, even though we are getting a boost from reconstruction and from people quickly absorbing what inventory was available in the aftermath of the storm. The decline can be felt in the softening of statistics that developed earlier this year as the Federal Reserve’s Great Unwind from QE picked up steam.

Look at some of the headlines and stories in housing as the year developed:

Housing collapse facts from January:

New Home Sales Tumble 9.3 Percent Amid Nasty Winter Weather It was the biggest drop since August 2016. November sales were also revised lower — to 689,000 from an originally reported 733,000, but were still the strongest since October 2007. Nevertheless, the drop was steeper than economists had forecast. Weather was blamed. Oddly, the decline was led by a 10 percent drop in the Midwest and a 9.8 percent drop in the South — the very areas where storm stimulus should have been the strongest.

Mortgage Applications, Refinancing Drop as Interest Rates Rise Rising borrowing costs were blamed for the decline in refis (down 2.9%) as well as in mortgage applications for new purchases (down 2.6%). Average interest rates on 30-year mortgages rose to their highest level since March 2017.

Housing collapse from February:

Weekly Mortgage Applications Plunge 6 Percent as Rates Spike Applications for loans to buy a home decreased another 6 percent in just one week. Average interest rates on 30-year mortgages rose to their highest level since January 2014, and the 15-year hit its highest level since April 2011.

Sales of Existing Homes Fall 3.2 Percent, Most in 3˝ Years A persistent shortage of houses pushed up prices and kept first-time buyers out of the market. This was the second straight monthly decline and reflected decreases in all four real-estate regions of the country. Economists for reasons unbeknownst to intelligent people had actually expected existing home sales to improve, instead they took their biggest year-on-year drop since August 2014. Again, lack of supply was blamed for the decline. (Has it occurred to any economists that people may not be putting their homes on the market because they know their next mortgage will require significantly higher interest? That would be one more way that rising interest will clobber the housing market. ) Due to lack of supply, housing prices rose even in the face of declining sales.

New Home Sales Drop 7.8 Percent to 5-Month Low in January New home sales also plummeted for a second consecutive month, particularly in the south where weather is less of a factor and where last year’s storms should have boosted sales. This raised “concerns the housing market is losing momentum.” Economists started to catch on: “Given the softening in the housing data over the past few months as well as the recent increase in mortgage rates as well as tax changes that reduce the attractiveness of mortgage financing, we think it is very likely that real residential investment will decline in the first quarter.” Leave it to modern economists to not see a housing collapse coming until it actually hits.

New Home Sales (Predictably) Fall Out Of The Boom, Too “What has happened is little more than the anticipated (for anyone not obviously biased by the boom narrative) drawdown in transactions following the aftermath of the storm aftermath…. Hurricanes Harvey and Irma produced undeniably large disruptions…. Prior to them in August and September, the real estate market was unusually weak. Leading up to August, there was a noticeable deceleration and even contraction.” (Just as predicted here for last year.)

Housing collapse facts from March:

Housing Starts Plunge 7 Percent Construction starts of multi-family housing declined 26% (MonM), while permits for future multi-family home construction decreased 5.7 percent. Permits for single-family homes decreased by 0.6%. A survey showed builders were becoming less upbeat about sales and buyer traffic over the next six months.

Existing Home Sales Jump 3 Percent Despite Leaner Inventory Sales of existing homes, however, rebounded, particularly in the south and west where hurricanes and firestorms did their damage. Sales soared 6.6 percent in the South, where the bulk of sales activity occurred, and vaulted 11.4 percent in the West.

Low Supply of Homes Continue to Hinder Housing Market “So, is the housing market improving, weakening or stagnant. The answer seems to be yes. Purchases of previously owned houses rose in February, but the level remains somewhat disappointing. Over the year, sales were up minimally and were pretty much at the same pace we averaged during 2017. In other words, it is going largely nowhere. The big problem is the low level of homes on the market.”

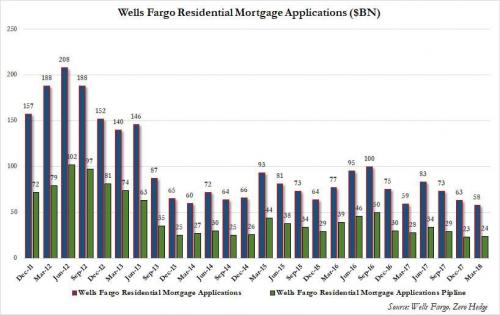

Wells Just Reported The Worst Mortgage Number Since The Financial Crisis Mortgage lending — the bread and butter of banking — declined again. Wells Fargo, America’s largest mortgage lender, reported its second quarter of serious declines in its mortgage business. Here is a map of their mortgage activity since the last housing collapse:

Housing collapse 2.0 as reflected in Well Fargo data.

You can see the post-recession pick-up and then the decline to the present. Of course, with interest rates rising due to Fed tightening, a drop in mortgage applications at the epitome of mortgage bankers was completely predictable. (So, why didn’t everyone predict it?) When prices go up, sales drop — basic economics that most of the world’s economists have lost sight of entirely.

See a pattern here:

Pending home sales provide clear evidence of a developing housing collapse

Green bars have slowly become non-existent, and red bars now rule.

Housing collapse facts from April:

Mortgage Applications Jump 4.9 Percent Amid Spring Buying Season Refi apps finally rose, too, and the average time (nationwide) it takes a median-priced home to sell dropped to a low of 81 days — a level not seen since just before the last housing collapse.

Housing collapse is imminent, but DO hold your breath

In short, things are building exactly on the revised schedule I laid out for my predictions last summer right after the storms temporarily changed everything. (My predictions, being not based on a crystal ball or divine inspiration, are based on how economic trends are coming together; but I don’t attempt to predict extreme weather. I did, however, predict immediately how the weather — extreme as it was — would impact the economic realities I had been forecasting.)

Housing sales and construction generally picked up this spring, as I expected, and I expect sales and construction to soar this summer because buyers will likely flood the market, knowing that they’ll never see mortgage interest rates this low again … unless there is another housing market collapse and a drop back into the Great Recession. People who don’t read here, however, might not know that another housing collapse is building, so they may likely feel desperate to take their last chance at a respectable mortgage rate and desperate to pile into rising prices just like they were at the turn to the last housing collapse. (Whereas, I am inclined to do the opposite — sell now, and hold for prices to come down and then buy a home mortgage free; but that’s just me.)

Buying a home “has become an exercise in speed and agility,” Zillow Senior Economist Aaron Terrazas writes in the report. “This is shaping up to be another competitive home-shopping season for buyers, who may have to linger on the market until they find the right home but then sprint across the finish line once they do.” (NewsMax)

There are many signs of general decline in the housing market, but a false salvation came in the fall and again in the spring and summer due to rebuilding from hurricanes and firestorms, relocating due to storms, and now a last-minute rush to get in on the sunset of low mortgage rates.

That all will expire this fall when building slows due to weather, and sales of existing homes slow because people don’t tend to move after school starts. The Trump tax reform is also designed to deliver a major blow to the housing industry by reducing write-offs for mortgage interest as well as for state property taxes.

By then, low mortgage interest rates will be disappearing in the rearview mirror, and other economic problems in stocks, retail store closures, and auto sales, along with delinquent auto loans, will have begun to mount some serious pressure on the overall economy, making it harder for many to maintain the loans they already have. Those with adjustable-rate (I call them time-bomb) mortgages will be destroyed because falling house prices mean they will be underwater when forced to sell because they cannot afford their ever-expanding payments. The primary driving force, however, is the Federal Reserve’s Great Unwind.

Then, of course, their is the Canadian boom and bust, and London is languishing. That is to say, the turn has already begun in both of those markets. So, this time is different. It’ll start out globally, rather than just end that way.

Meanwhile, the media is glibly reporting everything the banksters say, which is that banks are in a much more stable position this time. So, let’s analyze that:

Repeating all the foolishness that took place just before the last housing collapse

Here’s another repeat from the Great Recession: When housing needed a boost last time around in an attempt to sustain its ridiculous peak, Fannie Mae and Freddie Mac started dropping downpayment requirements to make for a little more ease of entry. That wasn’t enough, so they and the Federal Reserve also trimmed back income restrictions and softened other loan terms in order to try to avoid a housing collapse.

And here we are again today:

Freddie Mac Launches “3% Down” Mortgage With No Income Restrictions This time there are no geographic restrictions and NO income restrictions.

Can anyone say, “Hallelujah!” Just when you thought they would never roll out those zany loose credit standards that assured that the last housing collapse would also take out the banks, they do an even bigger job of it. That means it is almost certain banks will fail again this time due (again) to sloppy credit standards.

I mean why do you need income in order to service a loan? Right?

Yet, it gets better, these slack terms are aimed at first-time buyers, so that they can find a way to enter this market that they have been priced out of … just like first-timers were last time. Yeah, the loosest terms go specifically to those who have no track record of having ever made payments on a mortgage. But don’t worry, the banks will be safe because the loans are still secured by the value of the home as collateral in a market of rising prices. You do remember that from last time, right? Real estate prices never go down, right?

As an added safety margin, one of the buyers under this new program must participate in a “homeownership education” class! (That’s gotta warm your cockles.) I hope the class includes a course on “Why Income Matters” so that the penniless will be inspired to get a job in order to service their mortgage.

No wonder Fannie Mae reported that consumer confidence in housing has leaped back up to the highest level it has seen since … well … just before the last crash.

We learned nothing … or did we?

(The italicized part is said with a sinister tone.) It’s become a constant refrain on this site: “We learned nothing.” By “we,” I mean the nation as a whole and particularly its banks and its politicians and all of those who report on them in the mainstream media, but certainly not readers who spend time on sites like this that give alternative views that are called “fake news” by the people who create fake news.

Oh, but wait: maybe the banksters did learn something. Quite a lot, in fact. They learned they can make vaults full of money off of dumb-ass loans, and then we’ll bail them all out so they don’t fall on us when those loans collapse. They learned that, during a housing collapse, their banks will rapidly become twice as big as they were when they were merely too big to fail. They learned the megamergers they lust after in their late-night dreams are assured because the Federal Reserve won’t merely allow them to merge; it’ll force them to merge … at fire-sale prices!

The banksters even learned that their bonuses will still be paid (by the government), and their salaries will increase because of their glad-handing ability to obtain government funding — the prerequisite for which is that you crash your bank head-on into an economic collapse that anyone can see coming. They learned they will even be given carte blanche to create practically infinite streams of new money and give it all to themselves alone so they can play in the stock market under the pretense that it will somehow trickle down to the mauling masses

And they learned that no one will ever go to jail, even if they engage in little acts of corruption to take advantage of the overhyped market, such as by rigging interest rates or by convincing their clients to buy the things that they, themselves, are selling as fast as they can. Those, in fact, are the banksters that will be looked up to most for advice by the politicians and the media market gurus on how to save the world. They are the Blankenstein monsters that rule the world.

So, I guess we did learn something after all!

http://thegreatrecession.info

| Digg This Article

-- Published: Wednesday, 30 May 2018 | E-Mail | Print | Source: GoldSeek.com