-- Published: Tuesday, 12 June 2018 | Print | Disqus

By Frank Holmes

If you live in Texas and have any extra gold bars, coins and/or jewelry lying around that need safekeeping, you’re in luck. The Texas Bullion Depository, the first of its kind in the U.S., officially opened to the public in Austin last week, putting a cap on three years of planning and construction. The private firm managing the facility, Lone Star Tangible Assets, calls it the “world’s most advanced depository.”

This is wonderful news. Because Texas is such a trend-setting state, it might encourage other states to look into creating their own depositories. It also has the potential to attract even more investors to precious metals, which I believe are crucial components of any well diversified portfolio. As I’ve shown before, gold has little to no correlation with other assets such as equities, cash and Treasuries.

That makes the yellow metal especially favorable—now more than at any time since the financial crisis. We’re in the second longest economic expansion since World War II, and some experts see another recession as soon as 2020. A new survey by the National Association for Business Economics (NABE) finds that half a panel of 45 “professional forecasters” believe the next recession could occur between the fourth quarter of 2019 and the second quarter of 2020.

Although I don’t necessarily agree with this assessment, it’s important to recognize the risks and headwinds and prepare accordingly.

“Troubled” Deutsche Has $1.7 Trillion in Assets

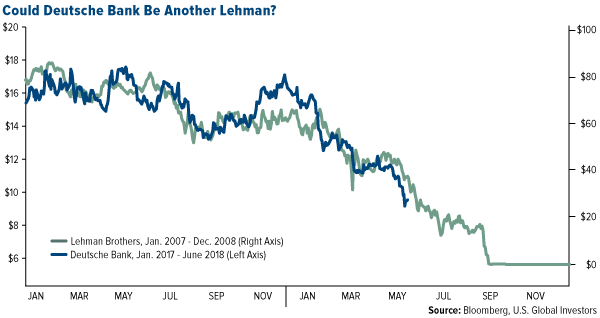

Among the most headline-worthy risks is the uncertain survival of Deutsche Bank. Shares of Germany’s biggest lender have plummeted following a first quarter report showing net income fell some 80 percent from a year ago, as well as news that the Federal Reserve downgraded the bank’s U.S. operations to “troubled.”

click to enlarge

Many analysts are already making the dubious comparison between Deutsche and Lehman Brothers, the storied American financial services firm whose bankruptcy nearly 10 years ago set off the global financial crisis. At the time of its filing, Lehman had approximately $639 billion in assets. As of the end of last year, Deutsche controlled more than double that amount — $1.7 trillion — meaning its failure could be catastrophic to global financial markets.

Ideas are currently being floated to save the distressed bank, including a German government bailout and a merger with rival Commerzbank, but nothing is guaranteed.

Record Student Debt

Something else I’m keeping my eye on is the ever-growing mountain of government and household debt. Howard Schultz, the outgoing billionaire executive chairman of Starbucks, told CNBC last week that he considered national debt to be the greatest threat to the U.S.

“I think the greatest threat domestically to the country is this $21 trillion debt hanging over the cloud of America and future generations,” Schultz said, adding to speculation that the former Starbucks chief is considering a presidential run in 2020.

I couldn’t agree more with Schultz on this point. I should add that higher interest rates are making servicing this debt even more costly than it already is. No one is off the hook.

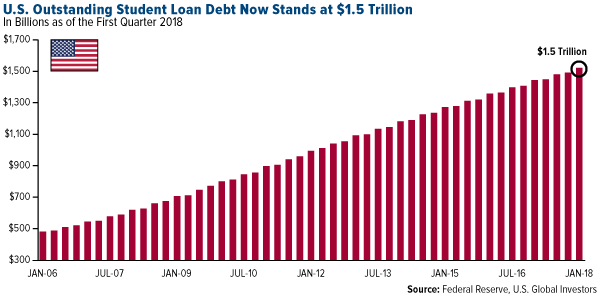

Household debt is also ballooning out of control, and today, student loan debt stands at more than $1.5 trillion. Student debt is now the largest form of debt in the U.S. after mortgages. It’s bigger than auto loan debt and credit card debt. Even more alarming is that an estimated 20 percent of borrowers right now are behind on their payments.

click to enlarge

Negative Interest Rates in America?

Between Deutsche and student debt, the implications are enormous. They also highlight my recommendation that investors have approximately 10 percent in gold, with half of that in physical bullion and the other half in high-quality gold mining stocks, mutual funds and ETFs.

As I said earlier, the investment case for gold is highly appealing right now. Should another recession happen anytime soon, the Federal Reserve at present would be hamstrung to offer monetary accommodation.

That’s according to a recent post by my colleague James Rickards, who writes that it’s historically taken between 3 percent and 5 percent in interest rate cuts to pull the U.S. out of a recession.

The problem with this is that the federal funds rate currently sits at 1.75 percent. You do the math.

Were a recession to strike tomorrow, the Fed would have very little wiggle room to ease monetary policy. It could cut rates exactly 1.75 percent, but then it would hit zero and “be out of bullets,” as Rickards says.

Of course, the Fed could dip rates into negative territory, which—in theory—should spur consumer spending. Better to spend your cash on that new boat, the thinking goes, than be punished for letting it sit in the bank. But there’s evidence negative rates haven’t worked as expected to prop up the economies that have experimented with them—notably Japan, Switzerland, Sweden and the eurozone.

And because there’s really no easier way to destroy wealth than with negative interest rates, I would expect gold investment demand to get a massive jolt.

This is precisely why German investors have quietly become the world’s biggest buyers of gold. Until recently, Germany wasn’t known as a nation of gold bugs. But following the financial crisis, the European Central Bank (ECB) slashed rates, and banks began charging customers to hold their cash. Yields on German bonds went subzero. Today, the five-year bond will cost you more than 20 basis points.

For many Germans, the only reliable store of value was gold. Investors ploughed as much as $8 billion into gold coins, bars and exchange-traded commodities in 2016, the most recent year of available data. Demand for safety deposit boxes surged.

I’m curious to see if the same will happen at the Texas Bullion Depository.

Gold ETFs Have Attracted $1 Billion a Month So Far in 2018

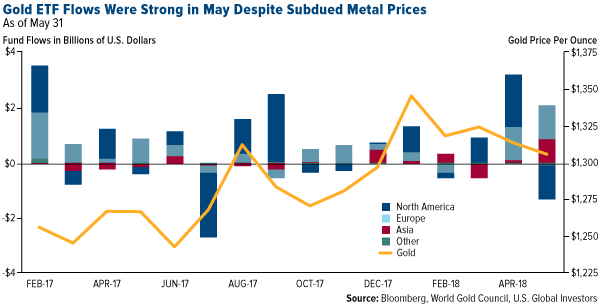

The latest report from the World Gold Council (WGC) shows that inflows into global gold ETFs in May were mostly solid. European gold funds grew by 26 metric tons, or $1.2 billion, as geopolitical uncertainty weakened the euro against the dollar. And in Asia, gold ETFs rose by 21 metric tons, or $862 million, a phenomenal 20 percent increase from the previous month. These gains were offset somewhat by net outflows from North American funds as a strong U.S. dollar pushed the price of gold below $1,300 an ounce.

So far this year, gold ETFs have attracted nearly $5 billion, or approximately $1 billion per month.

click to enlarge

This pace can be maintained for the rest of year, I believe, especially now that it looks as if the U.S. dollar has peaked. Since its 2018 high on May 29, the greenback has already lost close to 1.5 percent. This affords gold more upside potential as we head closer to Diwali and the Indian wedding season, when gifts of gold jewelry are considered auspicious.

Ready to learn more? Download my award-winning whitepaper, “Gold’s Love Trade!”

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2018.

| Digg This Article

-- Published: Tuesday, 12 June 2018 | E-Mail | Print | Source: GoldSeek.com