Our proprietary cycle indicator is down.

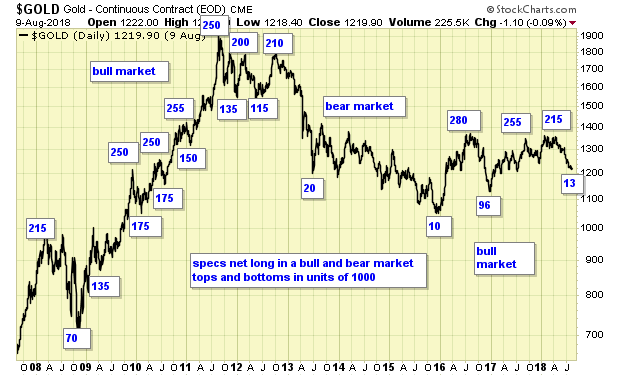

The gold sector is on a long-term buy signal. Long-term signals can last for months and years and are more suitable for investors holding for long term.

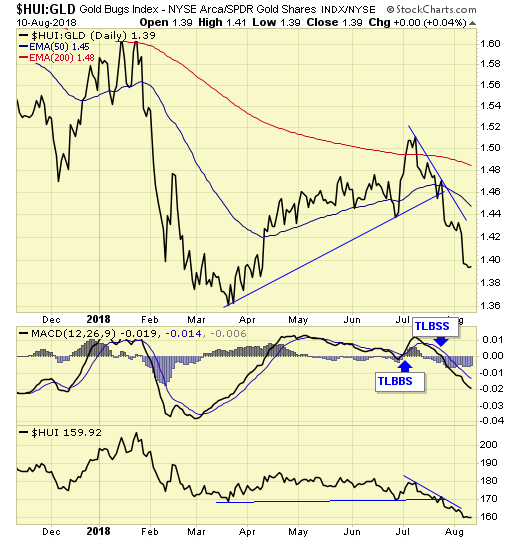

The gold sector is on a short-term sell signal. Short-term signals can last for days and weeks, and are more suitable for traders.

Our ratio between gold and gold stocks is on short-term sell signal.

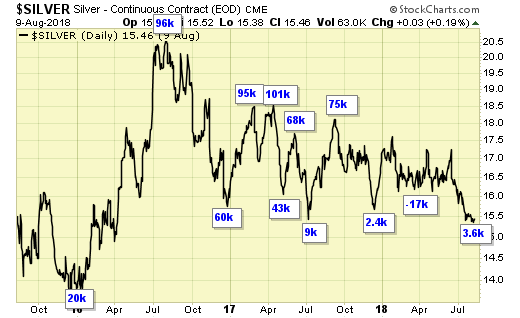

Speculation on gold is at a multiyear low.

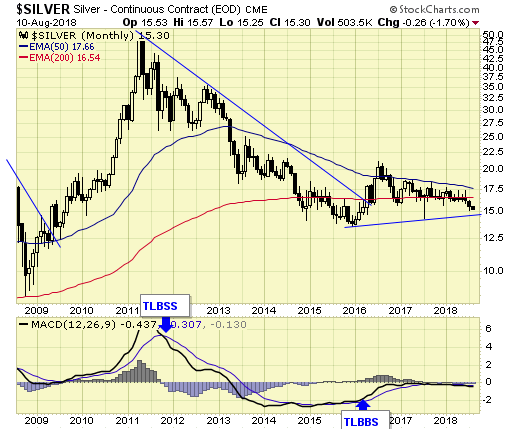

Silver is on a long-term buy signal.

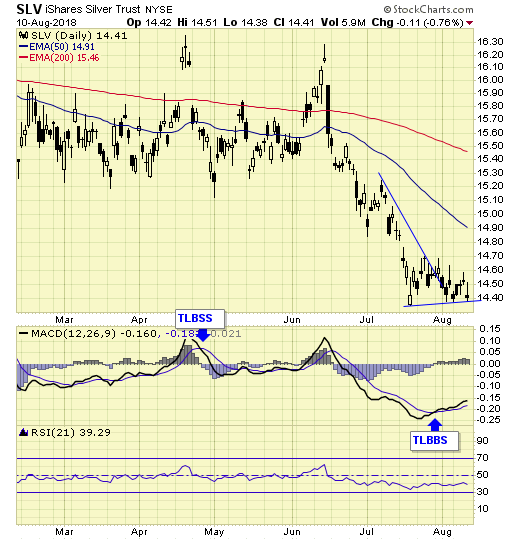

SLV is on a short-term buy signal, and short-term signals can last for days to weeks, more suitable for traders.

COT data is at levels of previous bottoms.

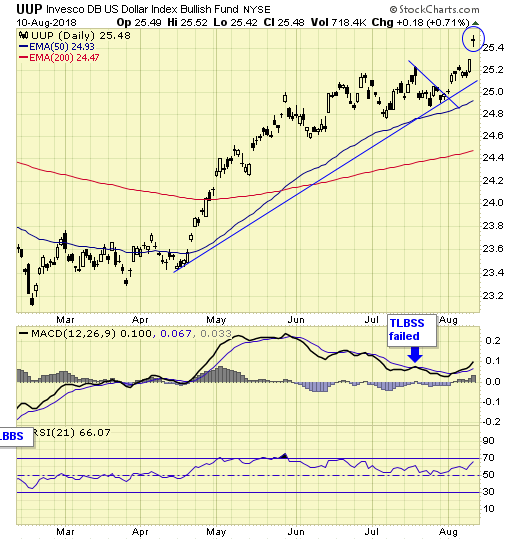

UUP, ETF for USD, gapped up on Friday. The question is, is this an exhaustion gap or breakaway gap? Over the years, my observation on such a gap after an extended rally is often an exhaustion gap.

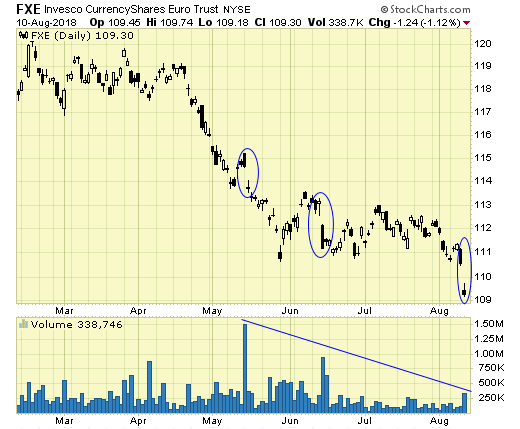

FXE, ETF for the Euro, may help shed some light. Friday’s gap had the lightest volume relative to the two previous gaps, a sign of selling exhaustion.

Summary

The precious metals sector is on a long-term buy signal. Short-term is on mixed signals. The cycle is down. From a contrarian point of view, the current extreme bearish sentiment is an excellent buying opportunity for long-term investors. We are holding gold-related ETFs for long-term gain.

Jack Chan is the editor of simply profits at www.simplyprofits.org, established in 2006. Chan bought his first mining stock, Hoko Exploration, in 1979, and has been active in the markets for the past 37 years. Technical analysis has helped him filter out the noise and focus on the when, and leave the why to the fundamental analysts. His proprietary trading models have enabled him to identify the NASDAQ top in 2000, the new gold bull market in 2001, the stock market top in 2007, and the U.S. dollar bottom in 2011.