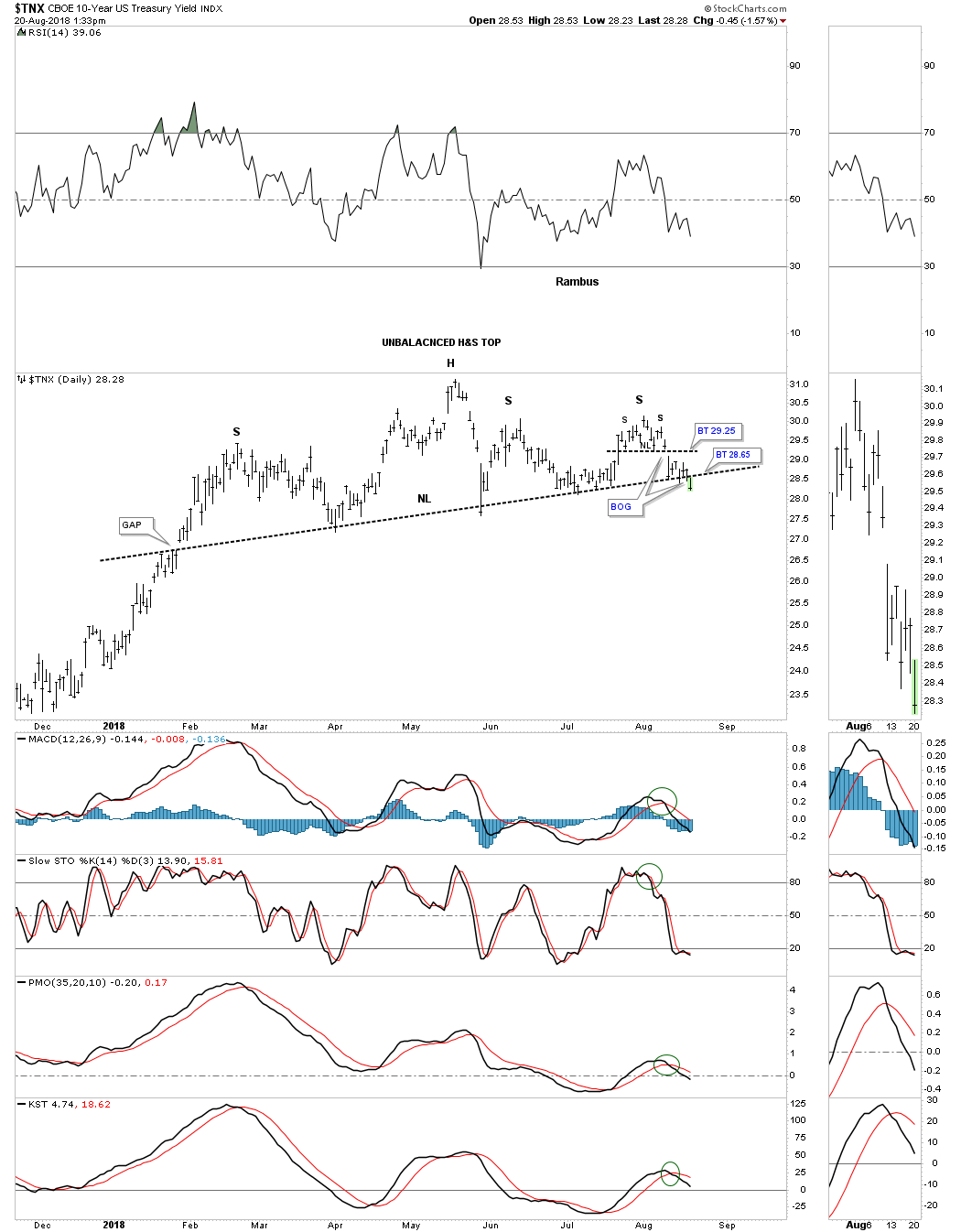

Over the last several months or so I’ve been writing about the bond market throwing us a possible curveball. Instead of continuing rising interest rate we may see falling rates. Today the $TNX, 10 year treasury yield finally broke below the neckline we’ve been following that started to developing back in January of this year. I’ve labeled the H&S top as an unbalanced H&S top as the price action formed a second right shoulder that was a small H&S top. A backtest to the neckline would now come into play around the 28.65 area.

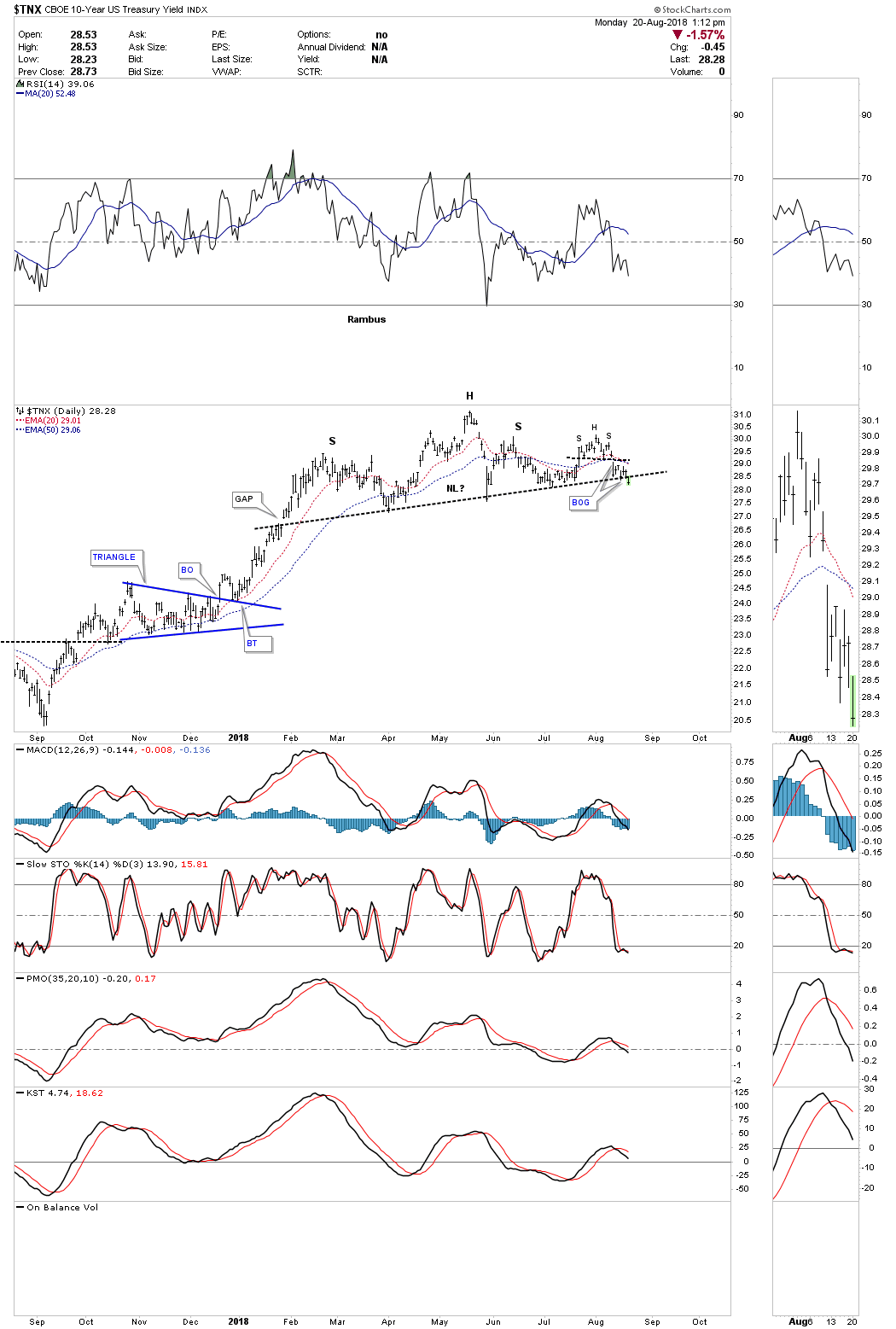

A longer term daily chart.

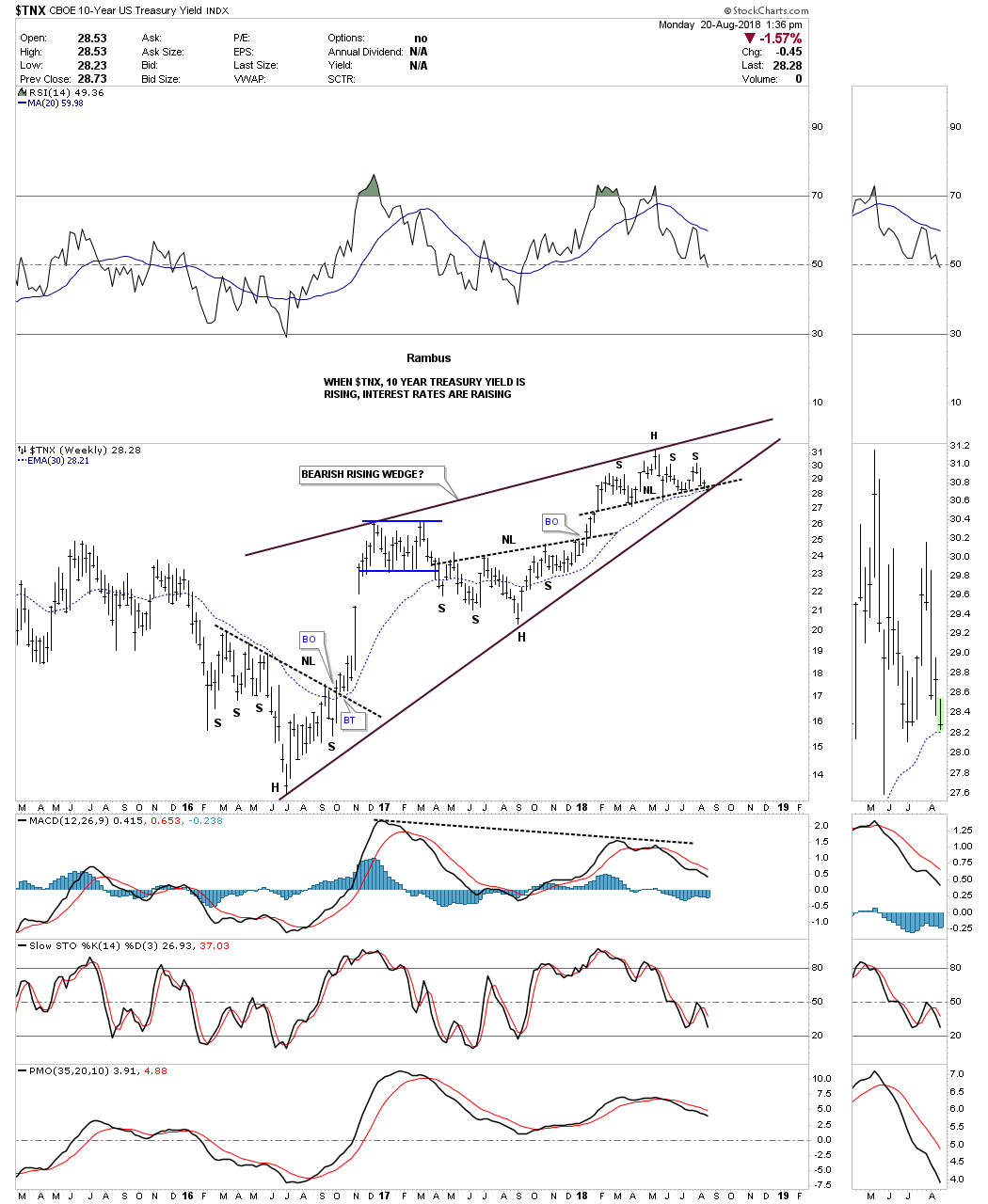

The weekly chart shows the $TNX has been rising for the last two years building out a possible bearish rising wedge with the H&S top forming at the top. That H&S top is strongly suggesting the bottom rail of the black rising wedge is going to give way to the downside. The curveball has almost reached home plate.

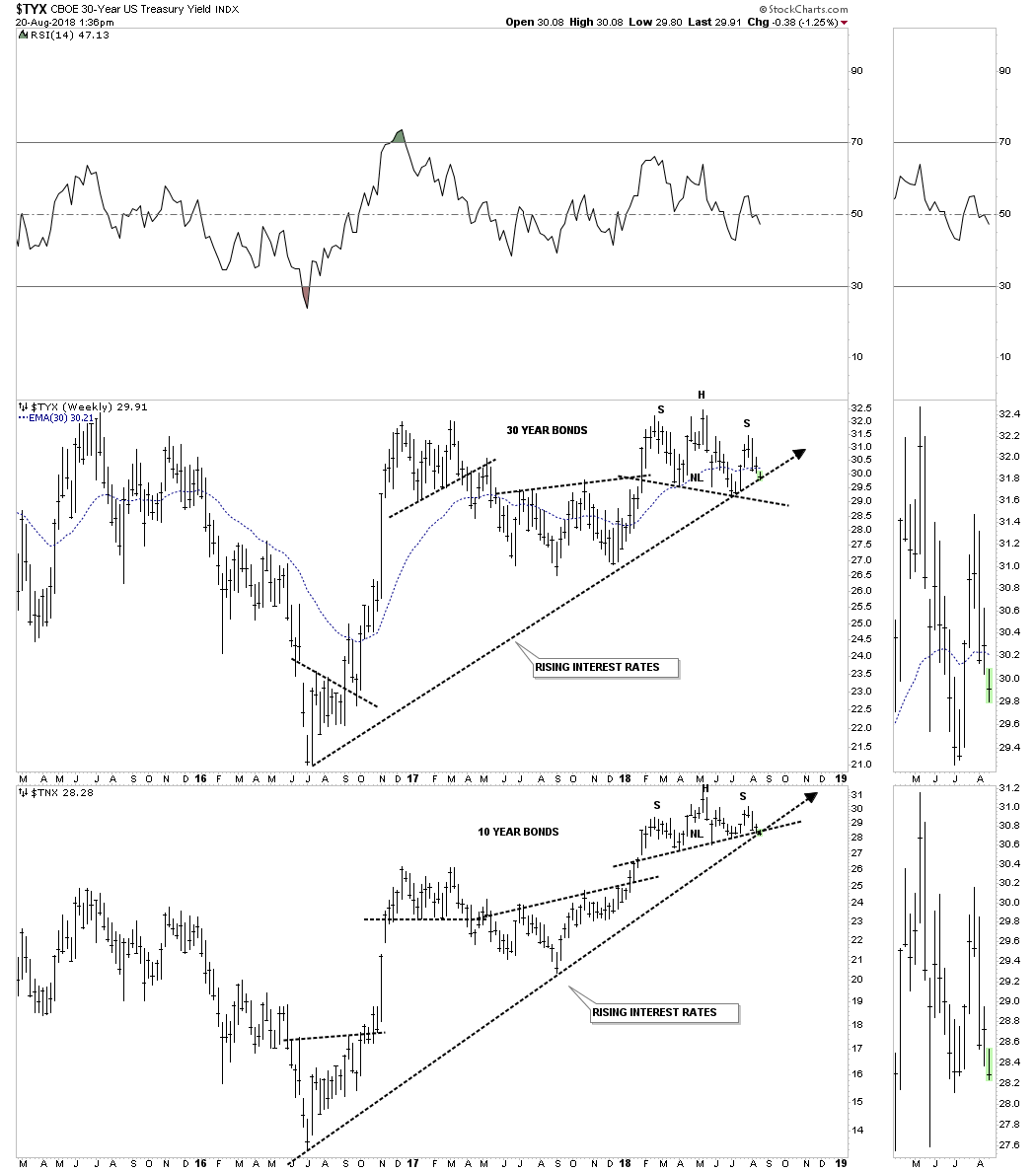

Below is a combo chart which has the $TYX, 30 year bond on top and the $TNX 10 year bond on the bottom.