With the recent plunge in the S&P 500 of over 5%, has the long-anticipated (and long-overdue) market correction finally begun?

It’s hard to say for certain. But the systemic cracks we've been closely monitoring definitely got an awful lot wider this week.

After nearly a decade of endless market boosting, manipulation and regulatory neglect, all of the trading professionals I personally know are watching with held breath at this stage. The central banks have distorted the processes of price discovery and market structure for so many years now, that it’s difficult to know yet whether their grip on the markets has indeed failed.

But what we know for certain is that bubbles always burst. Inevitably. Each is built upon a fallacy; and when that finally becomes apparent to enough people, the mania ends.

And today, there are currently massive bubbles in stocks, bonds and real estate. Every one courtesy of the central banks (as we have written about in great detail here at PeakProsperity.com over the years).

And with no Plan B in place to gracefully exit the corner they have painted themselves -- and thereby the global economy -- into, the only option available to them is to double-down on the pretense that we'd all be screwed without their stewardship. They have to do this I suppose. To admit the truth would throw the world into panic and themselves out of a job.

Who knows what they think privately? But in public, they give us real gems like these:

Williams Says Fed Rate Hikes Helping Curb Financial Risk-Taking

U.S. interest-rate increases will help reduce risk-taking in financial markets, Federal Reserve Bank of New York President John Williams said.

"The primary driver of us raising interest rates is just the fact that the U.S. economy is doing so well in terms of our goals,” Williams said Wednesday in a reply to questions after a speech in Bali, where the annual meetings of the International Monetary Fund and World Bank are taking place. “But I would also add that the normalization of monetary policy in terms of interest rates does have an added benefit in terms of financial risks.”

"A very-low interest-rate environment for a long time does, at least in some dimension, probably add to financial risks, or risk-taking, reach for yield, things like that," he said.

"Normalization of the monetary policy, I think, has the added benefit of reducing somewhat, on the margin, some of the risk of imbalances in financial markets."

(Source)

And with that, our award for “Finally closing the barn door after the horse left 8 years ago,” goes to John Williams of the US Federal Reserve.

Come on, Mr. Williams. Your historic 'very-low interest-rate environment' didn't merely lead to a slight degree of higher risk at the margins here.

Instead, it has lead to an explosion of excessive risk everywhere today, including:

- Junk bonds trading near their most expensive prices ever

- Covenant lite loans out the wazoo

- The highest levels of corporate debt ever

- The most expensive stock markets ever, by several measures

- The highest margin debt on record

- Real estate bubbles across the globe

- Pensions highly exposed to the stock market

And the central banks' policy over the past decade hasn't merely been to create a “very low interest rate environment”. It has been nine long years of intense and deliberate financial repression.

The resultant risk-taking didn’t happen “in some dimension”. It happened right here on Planet Earth, in real time, and in public and private portfolios alike, across the globe.

Pensions have been monkey-hammered by this policy, forced to throw away 100 years of accumulated investment wisdom and flip from traditional allocations of 60/40 bonds-to-stocks to the opposite in a desperate chase for yield.

The mathematically-certain insolvency of much of the pension system lies on your shoulders Mr. Williams. And those of your other Fed colleagues.

Moreover, the other malignant market responses to the Fed’s distorting policies didn’t “probably add to financial risks”. It absolutely guaranteed a future crisis -- one that will dwarf any prior.

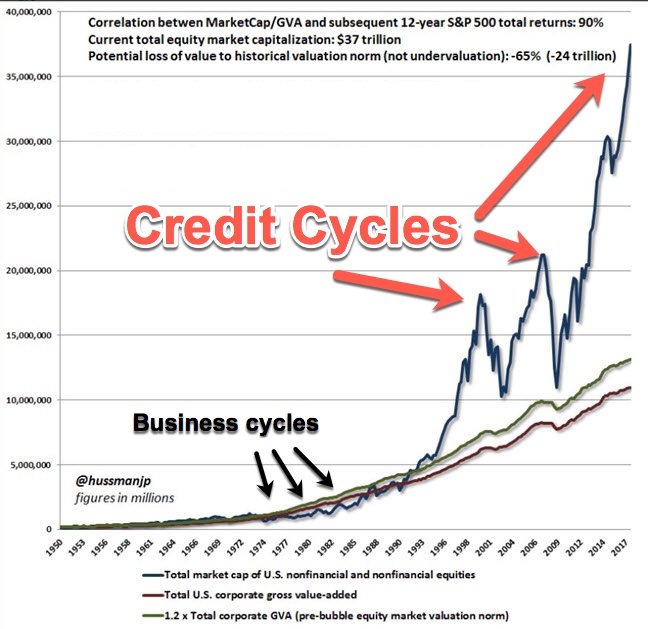

In my assessment, the biggest crime of the Fed was the decision under Greenspan to try to eliminate the business cycle by replacing it with a credit cycle. Here’s what that looks like in chart form:

If you can't clearly spot the absurd Fed-blown asset bubbles in the above chart, you may as well stop reading here. With that kind of blindness, nothing can help you plan for what's coming next.

Now, why would central banks prefer credit cycles? Easy! They're a lot more fun. When they're expanding, everybody loves you. You get invited to Davos and people love celebrating you at parties.

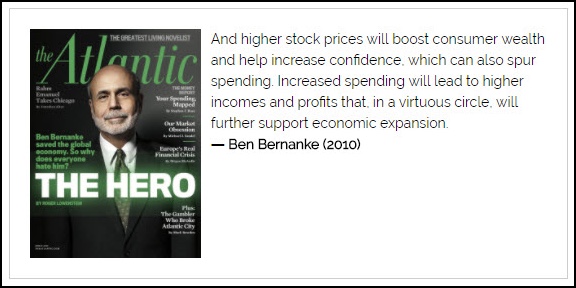

Just as good, when the bubbles burst, as they always must, you get to ride to the rescue and play the role of savior. And when the dust settles, you get feted as a “hero” by the mainstream media (even though you were no better than an arsonist putting out his own fire).

Case in point:

Yes, I blame the central banks for the breakdown about to come. They are the villain to blame for their horse-whipping of stocks, bonds and real estate into dangerously over-valued asset price bubbles. Nobody else.

Former Fed chairs Greenspan, Yellen and Bernanke have to shoulder nearly all of the culpability. It remains to be seen what Powell does, but so far he seems less interested in bailing out stock market declines than his predecessors. If indeed so, he’s an enormous improvement.

Already, under Powell, for the first time in a decade, we are emerging out from underneath the miserable thumb of financial repression, the key cornerstone of which is having to accept negative real yields on saved money. Today the rate of interest on a 3-Mo T-bill is higher than the (stated) rate of inflation. It’s also higher than the dividend yield on US equities. So savers finally have an option that doesn't unjustly punish them.

If we can thank Powell for that, then he’s already done more good than all three of his predecessors combined. And if he allows this last ill-conceived credit cycle to finally die of its own accord, he'll actually deserve that "hero" accolade. Especially because doing so will not only be the right thing to do, it will be deeply unpopular with the Powers That Be, and require an inordinate amount of courage to effect.

Heck, Trump was already gunning for Powell on Wednesday after just the first -3% decline:

“The Fed is making a mistake, they’re so tight. I think the Fed has gone crazy.”

~ Donald Trump, 10/10/18

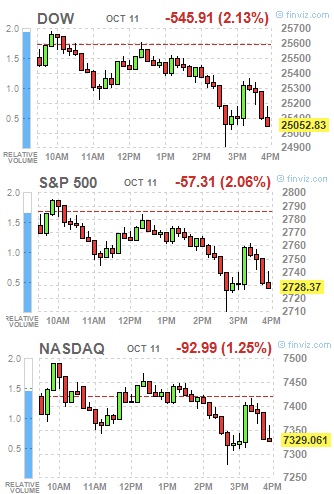

But if Trump was concerned on Wednesday, he must have been spitting nails on Thursday as the market carnage continued:

Is this really it?

Has the worm really turned? Is it not possible that the authorities will once again rescue these “markets” driving them ever higher in their quest for printed-up prosperity?

Again, anything is possible, but our view is that until and unless the central banks decide to reverse their QE wind-down operations the faux gains that resulted from the money flood will evaporate as well.

Our view is that things progress from “the outside in” reflecting the fact that it is always the cash strapped zombie company that fails before the AAA rated company, and it is the weaker emerging market economy that suffers before the core OECD economy.

This table of various year to date stock market returns perfectly illustrates that the “outside in” dynamic has been in place for a while.

It’s not a perfect detection mechanism certainly (Germany is down 4x more than Portugal?) but the pattern is more than directionally adequate. The money flood has reversed and we’re seeing that in the losses that have been mainly concentrated at the periphery -- but are fast rippling into the strongest "core" markets

Time For Safety

Admittedly, we’ve been mostly out of the markets for a long while, preferring cash, gold, some core real estate holdings; while slowly building a small short position.

Our main strategy for surviving bubbles is to not get caught up in them in the first place. We've long advocated the wisdom of amassing cash, to have 'dry powder' capital to deploy at much better valuations after the bubble's bursting. In our opinion, everyone should be working on ‘buy list’ for that day.

Sadly, the expansion of the Everything Bubble has gone on for far too long as the central banks have all but destroyed true price discovery and well-informed capital allocation. Heck, most Millennial adults weren't old enough to experience the 2000 and 2008 episodes -- to them, today's Frankenmarkets are 'normal'. Most seem to have exactly zero clue of the role of the central banks have played in fostering the lion’s share of the stock and bond market gains that have occurred during their short adult lives.

The investment chat sites I lurk through to gauge the mood are awash with folks telling each other to “buy the dip” and “stand firm.” Many are parroting the Wall Street/CNBC mantra that "This time is different!", so it’s best to just keep putting money in, staying long and fully invested.

We disagree. And we think those blindly marching to Wall Street's tune will be the first and worst victims when the next major correction hits.

Which is why we encourage everyone reading this to crash-test their portfolio with their professional financial advisor. If indeed we're entering another 2008-style correction, how will your current holdings fare? How risk-managed are your positions? Are your potential losses hedged to the downside? And once the dust settles, what's your plan for re-entering the market?

These are critical questions to be asking right now. And the time to address them may indeed be very scarce (the Dow has dropped another 100 points as I've been writing this).

If you don't have a financial advisor, or are having difficulty finding one willing to address the risks discussed here, consider scheduling a portfolio crash-test consultation (it's completely free) with the advisor Peak Prosperity endorses.

Just please, whatever you do, make sure you've taken prudent steps to prepare for a major market downturn. Don't leave your hard-earned wealth exposed, unless that's an intentional decision on your part.

Conclusion

The recent market sell-off was not at all unexpected by us. We began observing the first tremors at the periphery many weeks ago.

Last week, on October 5th, we sent out a market warning to our premium subscribers under the banner The Markets Are Suddenly Looking Very Sick.

Whether the central banks blink here and ride to the rescue is the big question.

While we'll have to wait and see to learn the answer, in all of our interviews with experts (e.g. Axel Merk) who know the Fed and its staffers personally, the consensus is that Powell is a different animal from his predecessors. He'll tolerate quite a lot of stock weakness before he's moved to act. Is his line in the sand -20%? -30%?

Whatever it is, it’s likely a lot more than the -6% we’ve seen so far.

Further, the ECB is in a bind because it, too, are publicly committed to tapering its balance sheet expansions to zero by the end of 2018. And as the EU is also locked in a budget battle with Italy, and it would be very politically difficult for the ECB to both play dove and hawk at the same time by bailing out the markets with more QE while also not buying any more Italian government debt or helping Italian banks.

The Bank of Japan is pretty much done, too. It has recently even (gasp!) shrunk its balance sheet a few times in recent months.

China is busy fighting its own battles with slowing growth and history's largest ever-real estate bubble. It's also in very delicate trade negotiations with the US, complicated enormously recently with the revelation that the Chinese PLA had a role in inserting hardware hacks (chips) onto high tech products supplied to the US. So the PBoC is probably not going to be in the business of doing anything dramatic in terms of balance sheet expansion right now.

Add it all up, and the “outside in” contagion we’ve been observing over the past few months seems to have finally reached the core.

In Part 2: Preparing For The 'Big One' we examine what a true market "crash" would look like. We’ll be looking at bonds, stocks, gold, the gold miners, currencies as well as discussing potential candidates to consider for your post-crash 'buy list'.

Ready or not, developments are escalating. Be as ready as you can for what's coming.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access