-- Published: Thursday, 18 October 2018 | Print | Disqus

Source: Michael J. Ballanger for Streetwise Reports 10/17/2018

Precious metals expert Michael Ballanger discusses the bullish set-up for gold and why he believes this time is different.

-->For the first time in months, Fido the Wonder Dog has been in my office and at the foot of my bed 24/7 for the past few days giving me great solace that the current advance in precious metals prices is here to stay. Gone are his nervous tics every time my chair squeaks or when I give a little "Whoop-whoop!" at the sight of decent gold quote and most certainly absent are all of the caked mudballs in his fur from having to sleep (hide) under the tool shed.

It was only last February that I found myself waking up to the sight and sound of my faithful pet soundly (and safely) asleep at the foot of the bed. Those were the days of gleeful celebration in the certainty of a $1,400 breakout as gold was being heavily promoted by all of the letter writers and bloggers and Bay St. analysts with the HUI (NYSE Arca Gold BUGS Index) was around 210 and all seemed right with the world. However, that fateful morning when I woke up to see gold down $10 to $1,365 after enduring yet another "failed breakout" and was about to slam my chair into my desk, I suddenly stopped because that was Fido's favorite locale during the day. To my astonishment, he was outside my main floor den window, looking in at me with a stressed look on his face and tail firmly between his legs. As I was about to admonish him for his absence, he suddenly turned on a dime and tore off towards the tool shed as if fleeing from a mountain lion, whereupon I was devoid of dog for what I am sure was the entire month of February, during which, I might add, the HUI crashed from 210 to 168 and gold cratered from $1,365 to $1,301. The direct correlation between the future trends of gold and silver prices and the future living accommodations of my dutiful dog was then and remains today intact. With gold in its current rally mode, it is as if Fido senses a buried and very dead fish in the ground and is reveling in the mere thought of rolling in it. Ergo, gold is going higher—MUCH higher. (Fido takes a bow.)

What the Fed is attempting to do is remove the punch bowl during a time when rising domestic prices are empowering the labor force to demand wage increases but since outsourcing (and the threat thereof) has crushed any and all leverage for North American workers, they are making a mistake. The Federal Reserve Board and all of its global central bank brethren are REACTIVE in their policy moves; they are never PREDICTIVE. They are simply trying to manage the bubbles now floating in the global atmosphere and ensure that they are not going to cause anything close to the panic that gripped the world in 2008. The problem with that is the sheer magnitude of the fiscal impropriety of governments and by that I mean ALL governments whose experimentations and speculations have disrupted the natural order of Darwinian economics and created an ocean of moral hazard the likes of which we shall never again encounter.

If there were no central bankers out there tampering with the natural ebb and flow of goods and services for the enrichment of the elite classes (née bankers), they would never have to arbitrarily set the Fed funds rate or have a meeting to discuss economic policy. I have written about this before but the boom/bust nature of capitalism that is the Battle Hymn of the Socialist State is not caused by big business or billionaire entrepreneurs with black top hats and handlebar mustaches; it is caused by corrupt politicians and even MORE corrupt non-elected, government administrators appointed to positions of power on a platform of protecting the elite classes by way of bureaucratic edicts and rules and regulations raising the barriers to entry and lowering the barriers of abuse.

The problem today lies in one word—DEBT. DEBT is the leviathan lurking beneath the waves of economic stability. It used to be self-cleansing, in that countries that went to war (such as Great Britain) without the resources to finance a campaign usually lost their status as purveyors of the world's reserve currency because in order to maintain their military advantage, they were forced to extend their budgets beyond their means by way of DEBT. It crushed the once-thriving German economy in the 1920s (War Reparations Act) and the British economy in the late 1940s (debts owed to America) and the U.S. economy in the 1970's (Vietnam) before the Americans figured a way to flood the world with U.S. dollars thus ensuring the longevity of its reserve currency status and minimize any need whatsoever for fiscal prudence or monetary accountability.

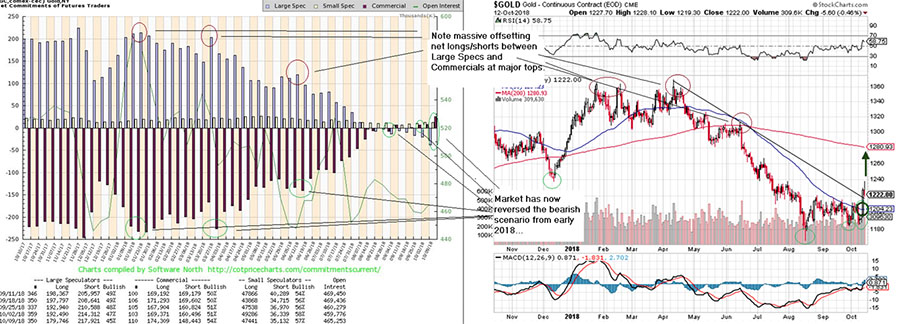

As an investor, there are times when I feel a crushing need to write down on paper, in bullet form, the reasons for buying (or selling) an asset. During these times, if I discover that my reasons have held up after days upon days of self-scrutiny and inward testing, I will usually pull the trigger. I have learned over the years that if you are planning to hold a position longer than it takes for the email confirmation to arrive (in the 1980s I used to say "before the ink dries on your confirmation letter"), your entry should never be the split-second after you have made your mind up; it should be a staged entry where you divide your capital into five equal parts and commit 20% every two to three days. That said, look at the two charts shown below:

See Full Size Image

Notice the two massive offsetting net long/net short positions between Large Speculators and Commercials back in February and continuing through mid-June as gold had THREE probes into the $1,365-1,375 resistance before finally succumbing to the oceans of Commercial paper sales which created the price cap. Fast forward to today, where the situation has gone 180 degrees with the roles from first half of 2018 completely reversed.

Now, could these numbers be fabricated by the bullion banks in order to entrap the managed money crowd? Could the CME and the banks be colluding to cloud the landscape? The answer, of course, is "Yes, quite possibly," but it is unlikely that is the case. I have traded off these data successfully in the past but I stress that the COT data is rarely, if ever, a timing tool. It is more of a sentiment indicator where the two main protagonists, the Large Specs and the Commercials (bullion banks), convey their bullish or bearish bias via the COT. Furthermore, it is not infallible as there have been occasions where the usually correct Commercials have been offside and been forced to unwind losing positions. However, the probability of winning while betting AGAINST these cretins is very low, which is precisely why I backed up the truck in late August and why I am adding aggressively this week.

Now, in recent days, the COT Report is everyone's newfound elixir for solving the gold enigma so you have to beware of any indicator that suddenly becomes widely analyzed, anticipated and advanced. When I called the bottom of the gold market on Dec. 4, 2015, at $1,045, there were only a handful of guys like me that wrote about the COT. Today, there are dozen upon dozens all dissecting the data with meticulous attention to the Bank Participation Rate, the Managed Money breakdown, and of course the EFP fiasco, and everyone draws their own conclusions from the data, which is what interpretation is all about.

My bullish bias for gold and silver is tempered by my fear that global liquidity may be under stresses not unlike 2008 but looking beyond the next 90 days, the new bull market that began in late 2015 for the metal and on January 19, 2016 in the HUI has resumed and is a far safer investment haven than bonds, stocks or real estate, all of which have levitated into bubble territory and are ripe for a crash of epic proportions. The precariousness of the month of October has created a pause in the gold and silver rallies, which I believe one should use to increase exposure to the space.

I urge you all to take a snapshot of that COT report shown above; it may be the last time in history that you see two forces at both ends of the trade with such ferocity of size and conviction. History favors the Commercials just as we witnessed in 2015 so I am heeding history and betting large on the final quarter of 2018 delivering a $1,400 gold price, $20 silver, the HUI at 300, and fair-weather Fido asleep at my feet.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.