-- Published: Monday, 19 November 2018 | Print | Disqus

Source: Michael Ballanger for Streetwise Reports 11/17/2018

Precious metals expert Michael Ballanger discusses the recent rise in precious metals prices and what he sees ahead for the metals.

-->As many of us have grown to appreciate over the years, forecasts tend to be nothing more than "educated guesses" and no matter what methods one uses, predicting directional and amplitudinal movements in economics or finance or asset prices is analogous to standing in the paddock at Woodbine racetrack with a copy of the racing forum and a cup of black coffee, trying to determine whether Stormy's Revenge or Gluewagon is going to take the fifth in the mud. I spend literally hours upon hours drawing lines on charts and reading other people's forecasts in a desperate attempt to handicap the next $50 move in gold and I must confess that even without the nausea brought about by countless interventions and manipulations, it is an extremely difficult exercise.

Furthermore, irrespective of one's writing style or logistics, true success in the forecasting game is, FIRSTLY, trying to wind up being correct as to direction after which one can only hope to be somewhere on the mark as to amplitude. There are no gold "gurus" or junior mining "junkies" that have been able to generate multi-year positive returns by remaining steadfastly bullish. In fact, my success has been derived from identifying the major selling points along with picking the bottom in early December 2015. Since then, gold has remained in a bull market (despite the fact that it doesn't exactly feel like it).

From a purely technical viewpoint, gold prices are trending higher off the $1,167 low on August 16 and while the gold chart looks "OK," the silver chart is dreadful, and as you well know, no up move in gold is sustainable without the participation of silver and in fact its outperformance. Furthermore, the Gold-Stock-to-Gold ratio has been trending lower since September 2017 and only recently reversed. This outperformance by gold miners must continue in order to confirm the uptrend in gold bullion. Conversely, the most glaring non-confirmation for the PM Complex is the horrific action in the Gold-to-Silver-Ratio (GTSR), which today resides at the same level as it was in 1990, 2001, 2008, just before major rallies got underway. I need a solid, three-day close above the $1,235 level, which represents the downtrend line from April peak. If I get that, gold stands a decent chance of reclaiming a "$13 handle" by New Years. However, I need the other related precious metals markets to confirm.

As I look out to the New Year, I am at once both excited and terrified that macro conditions that I have been expecting since 2007 are about to arrive with a venomous vengeance. The vast majority of stocks within the S&P 500 are now in downtrends with many actually mired in bear market territory but the MSM (like CNBC) continues to trot out the cheerleaders in a valiant effort to instill confidence in what has been a debt-fueled orgy of currency debasement and intervention. One looking at the bullish percentage numbers for the S&P 500 for the year and you are immediately hit with a sense of impending doom. Incredibly, the Squawking Heads on CNBC would have us believe that the market is "cheap" after the train wreck that began last February and which has accelerated into Q4 but a bullish percentage number for the S&P at 46 is a yawn compared to 16 for the Gold Miners that prevailed in the summer and which is STILL only at 20. It is a stark reminder of just how devastating the interventions have been to prices and for morale for the space but just how "cheap" the Gold Miners are relative to the S&P.

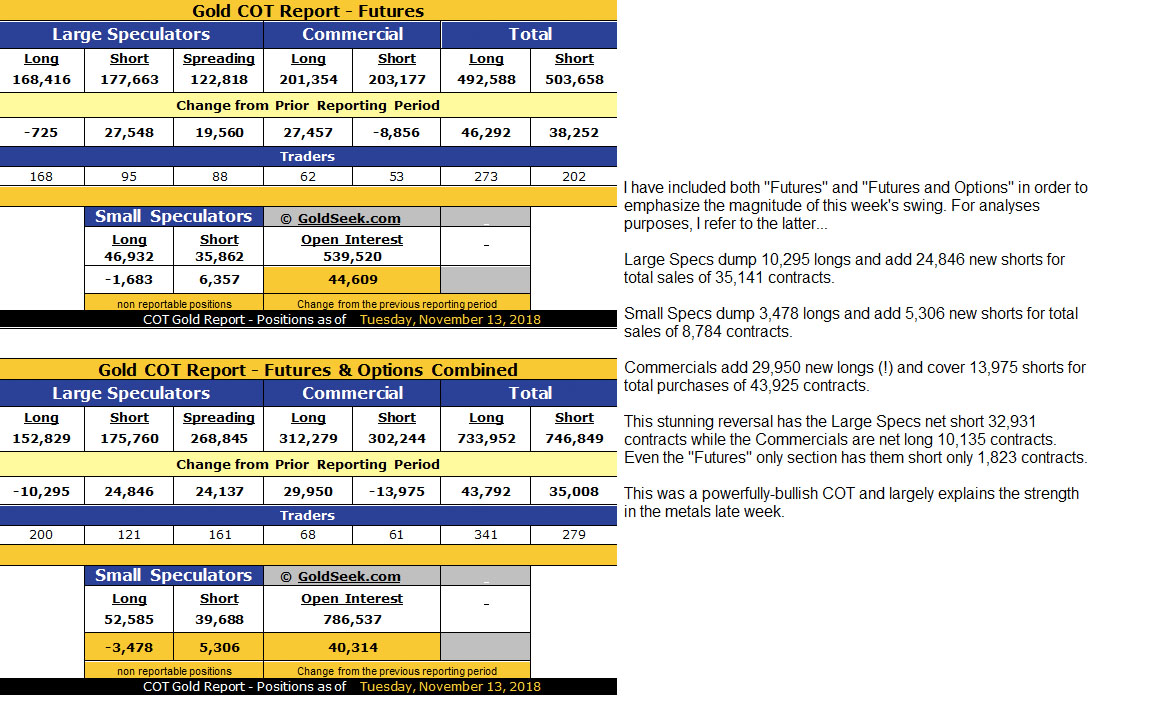

I wanted to wait for the COT before completing my assessment of the trade "set-up" for gold and silver into year end and as you will read in my remarks below, this week's COT was a powerful signal to the markets. On Friday, gold was up 0.58%, silver was up 0.86%, and the HUI was up 1.51%. This was a perfect day as silver and the miners outperformed gold and now we get a constructive COT structure. Odds favor a rally into late January.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

| Digg This Article

-- Published: Monday, 19 November 2018 | E-Mail | Print | Source: GoldSeek.com