-- Published: Thursday, 10 January 2019 | Print | Disqus

Gold Outlook 2019 – World Gold Council

As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance:

· financial market instability

· monetary policy and the US dollar

· structural economic reforms.

Against this backdrop, we believe that gold has an increasingly relevant role to play in investors’ portfolios.

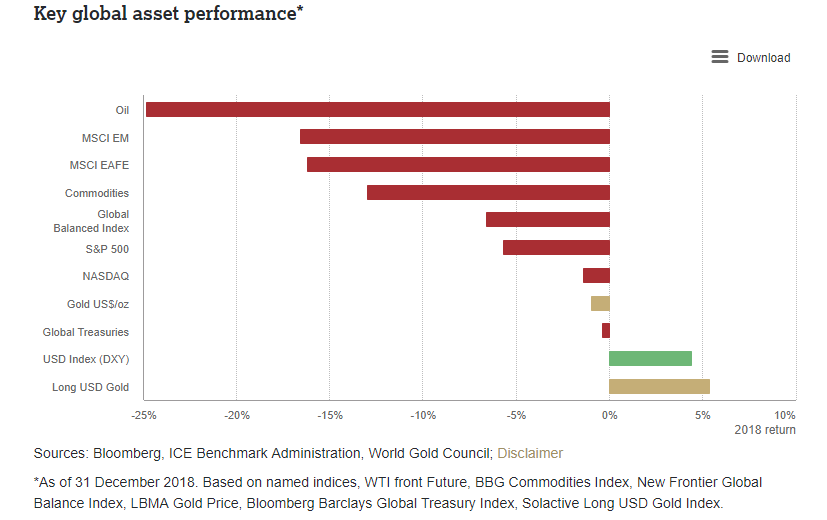

Gold Outperformed Most Assets In 2018

Why gold why now

Gold’s performance in the near term is heavily influenced by perceptions of risk, the direction of the dollar, and the impact of structural economic reforms. As it stands, we believe that these factors likely will continue to make gold attractive.

In the longer term, gold will be supported by the development of the middle class in emerging markets, its role as an asset of last resort, and the ever-expanding use of gold in technological applications.

In addition, central banks continue to buy gold to diversify their foreign reserves and counterbalance fiat currency risk, particularly as emerging market central banks tend to have high allocations of US treasuries. Central bank demand for gold in 2018 alone was the highest since 2015, as a wider set of countries added gold to their foreign reserves for diversification and safety.

More generally, there are four attributes that make gold a valuable strategic asset by providing investors:

· a source of return

· low correlation to major asset classes in both expansionary and recessionary periods

· a mainstream asset that is as liquid as other financial securities

· a history of improved portfolio risk-adjusted returns.

‘Outlook 2019: Global economic trends and their impact on gold’ – Full report from World Gold Council here

News and Commentary

Palladium hits record high on China impetus; lower dollar lifts gold (Reuters.com)

Gold lifted by weaker dollar as market ponders pace of Fed interest-rate hikes (MarketWatch.com)

Bank of England’s Carney sees China’s yuan as possible reserve currency (Reuters.com)

ISIS ‘kills’ five UK soldiers in Syria rocket attack (RT.com)

Stock Rally Takes a Break as Bonds Rise, Oil Drops: Markets Wrap (Bloomberg.com)

Tanzania’s president orders central bank to create gold reserve (TheEastAfrican.co.ke)

May Stares Into Brexit Abyss as Parliament Takes Control (Bloomberg.com)

These Nine Charts Show Just How Deeply Brexit Has Divided Britain (Bloomberg.com)

The EU In 2019 – The Problem Of Survival (ZeroHedge.com)

This Is A Completely Horrific Situation: What “Bond King” Gundlach Expects Will Happen In 2019 (ZeroHedge.com)

Outlook 2019: Economic trends and their impact on gold (Gold.org)

Gold Prices (LBMA PM)

09 Jan: USD 1,281.30, GBP 1,006.41 & EUR 1,118.32 per ounce

08 Jan: USD 1,291.90, GBP 1,006.71 & EUR 1,121.62 per ounce

07 Jan: USD 1,291.50, GBP 1,013.83 & EUR 1,129.03 per ounce

04 Jan: USD 1,290.35, GBP 1,016.80 & EUR 1,131.24 per ounce

03 Jan: USD 1,287.95, GBP 1,024.05 & EUR 1,132.62 per ounce

02 Jan: USD 1,287.20, GBP 1,014.44 & EUR 1,125.27 per ounce

Silver Prices (LBMA)

09 Jan: USD 15.62, GBP 12.27 & EUR 13.64 per ounce

08 Jan: USD 15.64, GBP 12.24 & EUR 13.64 per ounce

07 Jan: USD 15.75, GBP 12.35 & EUR 13.77 per ounce

04 Jan: USD 15.70, GBP 12.40 & EUR 13.76 per ounce

03 Jan: USD 15.53, GBP 12.37 & EUR 13.70 per ounce

02 Jan: USD 15.44, GBP 12.19 & EUR 13.51 per ounce

- www.GoldCore.com

| Digg This Article

-- Published: Thursday, 10 January 2019 | E-Mail | Print | Source: GoldSeek.com