-- Published: Monday, 14 January 2019 | Print | Disqus

By: Jordan Roy-Byrne CMT, MFTA

Although the financial media conflates the two, there is a difference between a rally and a bull market.

A rally implies a rebound after or a reprieve from weakness. A bull market is higher highs and higher lows for a period of at least a few years.

Goldís strength in the 2000s was not a rally, as many have deemed it, but a bull market. Goldís rebound in 2016 was a rally.

Nevermind the Gold pundits who insist Gold is in an invisible or stealth bull market or even a correction. A market that pops for seven months then doesnít make a new high for almost two and a half years is not a bull market.

Despite the recent recovery, precious metals are not in a bull market yet. Letís use the gold stocks to exhibit this.

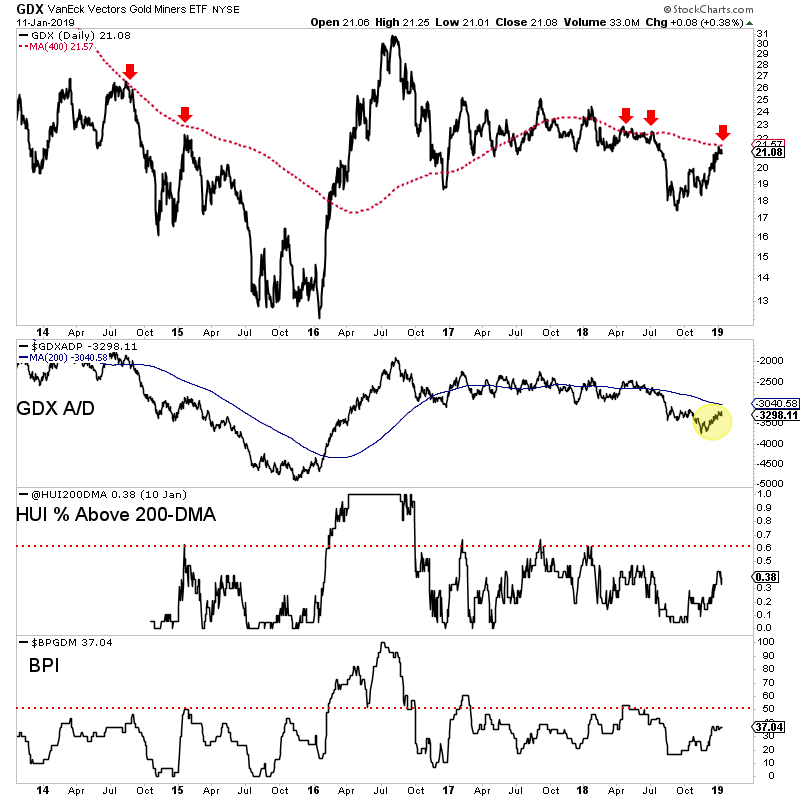

Below we plot GDX with its 400-day moving average and some important breadth indicators.

The 400-day moving average provided resistance for GDX in 2012, 2014, 2015, several times in 2018 and at present. Itís holding GDX for now.

The breadth indicators donít signal a bull market either.

The GDX advance-decline line remains well below its 200-day moving average and is carrying some negative divergences. The percentage of stocks trading above the HUI (a very similar index to GDX) has been below 60% for over two years. The bullish percentage index (another breadth indicator) has remained below 50% for essentially the past five years (aside from most of 2016).

We see the same issue with GDXJ and its 400-day moving average. It served as resistance in 2014, support in early 2017 but again resistance several times in 2018 as well as at present.

The percentage of stocks in our 55-stock junior basket has remained below 50% for nearly two years. Another leading indicator (miners versus Gold) is not showing a bull trend for GDXJ.

These things could obviously change at somepoint.

If GDX and GDXJ explode above their 400-day moving averages then the recent rally would be turning into a bull market.

If we see a clear improvement in momentum, breadth and further strength in real terms (precious metals relative to stocks and currencies) that would also signal a shift from a rally to a bull market.

On the fundamental side, weíve noted that the start of rate cuts (given the current context) will confirm a bull market. In the meantime, weak economic data and the S&P 500 threatening recent lows could bring us much closer.

Many gold pundits, analysts and fanatics alike are getting excited. They think a new bull market has begun or the 2016 surge is resuming.

They may be right in due time but for now, the sector has simply rallied. It has not begun a bull market yet. If the Federal Reserve is done hiking then the odds favor a bull market starting sometime this year.

For now, we want to own stocks based on their own value and merit. In other words, we want to own stocks that can move without the Gold or Silver price. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. Recall that many juniors began huge moves months after epic lows in January 2016, October 2008, May 2005 and November 2000. Donít chase the wrong stocks right now.

- Jordan Roy-Byrne CMT, MFTA,

thedailygold.com