-- Published: Thursday, 18 April 2019 | Print | Disqus

By: David Chapman

Coimbra, Portugal

Not much happened this past week. The S&P 500 gained 0.5% while the Dow Jones Industrials (DJI) was essentially flat. Gold was also flat but silver lost 0.9%. Here in Canada the TSX Composite gained 0.5% while the TSX Venture Exchange (CDNX) lost 0.7%. The US$ Index fell 0.4% while the Canadian dollar gained 0.4%. Gold stock indices fell portending a further drop in gold as the Gold Bugs Index (HUI) lost 1.7% while the TSX Gold Index (TGD) dropped 1.9%. WTI oil was up 1.3% continuing its recent rally.

The S&P 500 continued its recent climb and we believe it is only a matter of when that it makes new all-time highs. The TSX Composite continues its upward march as well to new all-time highs. None of this is surprising as the markets not only demonstrate resiliency, but they are also demonstrating considerable complacency.

Bond yields backed up this past week keeping in line with our thoughts that the bond market has probably bottomed (yield) for the time being. Could a bond accident be upon us? We were stunned to learn this week that there is still some $10 trillion of sub-zero bonds out there mostly in the Euro zone and Japan. We continue expect the US$ to rise further despite the setback this past week and if that happens it is going to put more pressure on the huge amount of US$ denominated debt out there in foreign countries. All this continues to point to a bond disaster at some point as yields rise, the US$ rises and huge amounts of sub-zero debt. In a bond panic liquidity dries up and prices basically just fall.

But back to complacency. The VIX volatility indicator broke down this past week. That surprised us as we thought it would hold the line. That suggests to us that the stock market is once again moving into a new level of complacency. The expectation is now that the rally will continue and there is little to stop it. The market tends to ignore the goings on in Washington. And the economy while not steaming ahead is at least continuing to bumble along. They call it the Goldilocks economy – not too hot, not too cold. Anyway, the VIX has fallen to its lowest level since August of 2018 but still well above the low levels of 2017. But now that the uptrend is broken expect the VIX to fall further. That also is in-line with the continuing to rise NYSE advance-decline line that is still rising in record territory. We’ll keep an eye on this.

But a falling VIX in the stock market is not the only one. Elliott Wave International www.elliottwave.com noted the falling FX volatility. We have noted that the US$ Index has largely range traded for the past two years and that does translate into falling volatility. Low volatility precedes a sharp move one way or the other. Our expectation is that the US$ Index is preparing to break out to the upside towards 100.

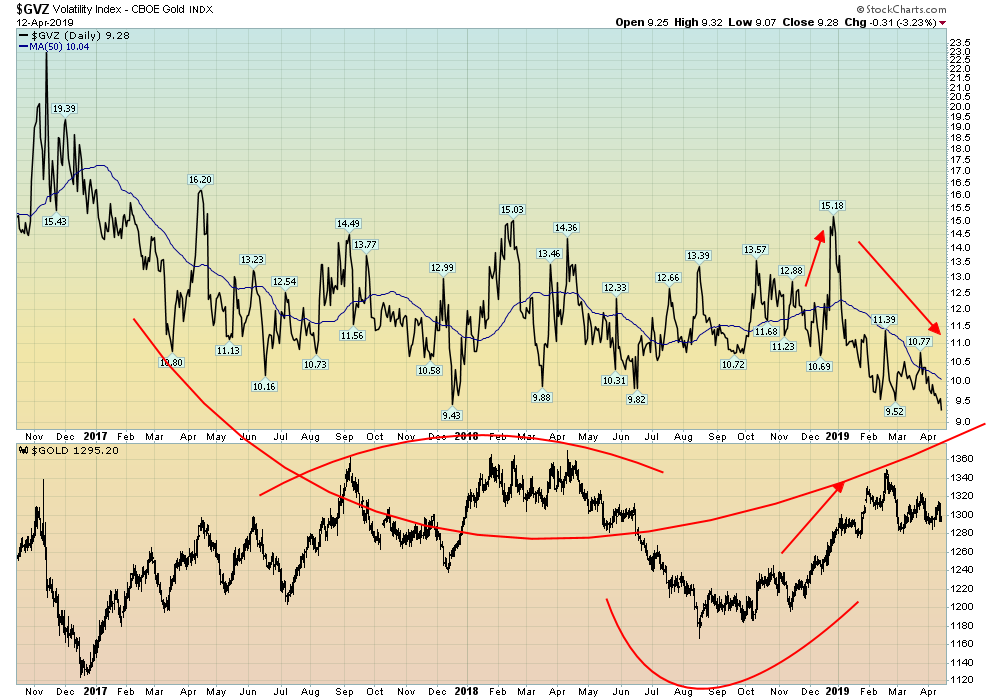

Source: www.stockcharts.com

But low volatility goes beyond just stocks and the US$. Gold’s volatility has also collapsed. We have never seen it so low. None of this is to suggest that gold has finished its move nor that the stock market is not going to continue its upward trend or the US$ is about to burst up any time soon but what it does portend is that a sharp move is coming even if that move is weeks or even months away. Low volatility is a sign of complacency in markets and when markets are complacent, they can soon expect a “kick in the groin”:

Source: www.stockcharts.com

April 15, 2019 (orig. publish date)

Copyright David Chapman, 2019

TECHNICAL SCOOP

Charts and commentary by David Chapman

Chief Strategist, Enriched Investing Inc.

Phone: 416-523-5454 Email: david@davidchapman.com

dchapman@enrichedinvesting.com

Twitter: @Davcha12