-- Published: Monday, 29 April 2019 | Print | Disqus

By: Keith Weiner, Monetary Metals

We have a postscript to our ongoing discussion of inflation. A reader pointed out that Levis 501 jeans are $39.19 on Amazon (in Keith’s size—Amazon advertises prices as low as $16.31, which we assume is for either a very small size that uses less fabric, or an odd size that isn’t selling). Think of the enormity of this. The jeans were $50 in 1983. After 36 years of relentless inflation (or hot air about inflation), the price is down to $39.31. Down 21.4%.

Of course, we just employed a slight sleight of hand. After introducing the concept of useless ingredients, we now showed a lower price on Amazon. Amazon has cut out some ingredients which are useless to many consumers: (1) displaying products on a shelf, (2) in a fancy store, (3) located on prime real estate, and (4) staffed with clerks who clean up after each messy shopper.

Inflation

Nevertheless, the point stands. 36 years of raging inflation (we are told), and the price has not gone up to $1,545 as those who rage against inflation would lead us to think (assuming 10% a year). It has gone down 21%.

We can quibble a bit about the rate. But we can’t debate that 36 years of relentless shrinking of the purchasing power of the dollar should mean much higher nominal prices. And we can’t debate that Levis 501 jeans are now available for a lower nominal price than they were 36 years ago.

This segues into this week’s topic. Keith received an email, saying he is an iconoclast. Merriam-Webster defines iconoclast as “a person who attacks settled beliefs or institutions.” At first glance, this would seem to fit.

Take just the one issue, of the definition of inflation. Milton Friedman expressed the conventional view that “inflation is everywhere and always a monetary phenomenon.” This view is as settled as anything in economics. Indeed, all the major schools of economics agree with it. Our extensive criticism could be characterized as an “attack.”

We want to say one thing, to get it out of the way. Though it is not our primary argument. At the risk of being perceived as defensive, we are not interested in attacking people. And we are not focused on attack anyways. We are seeking the truth, wherever the truth may lead.

Our world has gone mad. We observe the various schools of economics grappling and locked in stasis. The net result is that the central planners—alternately Keynesian or Friedmanite—continue to incentivize us to consume capital. Which they call “growing GDP.”

Notwithstanding the forgoing, we make no apologies. If we offend the adherents to the Quantity Theory of Money, that’s too bad. We intend no disrespect. However, when we examine the Purchasing Power Paradigm and find it fails to describe, much less predict.

“That which can be destroyed by the truth, should be.”

Bamboozling the People

This is widely (and falsely) attributed to Carl Sagan. But regardless of who said it, this must be the attitude of every natural philosopher, every scientist, and every economist (but we repeat ourselves). Carl Sagan did say this:

“One of the saddest lessons of history is this: If we’ve been bamboozled long enough, we tend to reject any evidence of the bamboozle. We’re no longer interested in finding out the truth. The bamboozle has captured us. It’s simply too painful to acknowledge, even to ourselves, that we’ve been taken. Once you give a charlatan power over you, you almost never get it back.”

We have been bamboozled for Sagan’s long enough. Neoclassical economists taught us to focus on aggregate statistics such as money supply. Monetarists taught us that the general price level is proportional to the money supply. Keynesians taught us that the central bank can manipulate the economy into improving, if the bank manipulates the money supply. The monetarists agreed, at least when there is a crisis. And Austrians add that there is a Cantillon Effect, that the newly-created money ripples through the economy, taking time to have its effect on prices.

Economists have lost the distinction between money and credit. As an aside, Keith gave a talk at an Austrian economics conference at King Juan Carlos University in Madrid, last fall. He defended a proposition that was very controversial, even in that august audience: gold is money, and the dollar is not.

All of this bamboozling distracts from the real problem, like a magician flourishing his right hand and red cape, with a bang and a flash, while his left hand casually reaches under the table cloth to pull out the rabbit. And it excuses the Fed—if prices aren’t skyrocketing, then the Fed must not be causing harm.

Grievous Harm

We are not here to attack cherished notions, let alone attack people. We laugh at Don Quixote tilting at windmills as much as anyone else. We are here to shine a spotlight.

The Fed is causing us grievous harm.

It just isn’t the harm of skyrocketing prices. It’s the harm of falling interest rates which incentivizes capital destruction, per Keynes evil plan. They have made destruction pleasant, by making it profitable. Keynes said to euthanize the rentier by driving interest rates to zero. He knew that the flip side of the coin is that asset prices go to infinity.

This is known as a bull market. What capitalist doesn’t love a bull market? And so the capitalists aid and abet Keynes’ descendants in their own euthanizing. We are not attacking this euthanasia because it’s cherished! We are attacking it because it’s killing our civilization!

Is Morpheus in the movie The Matrix an iconoclast? Does he show the truth—that people’s sleeping bodies are being consumed—because Cypher cherishes the illusion? No! Of course not!

OK, so call us iconoclast if you must, but be clear that our motive is to help people understand the destructive trend we’re on. If not for that, we would happily stay away from sacred cows.

Civilization depends on it.

Supply and Demand Fundamentals

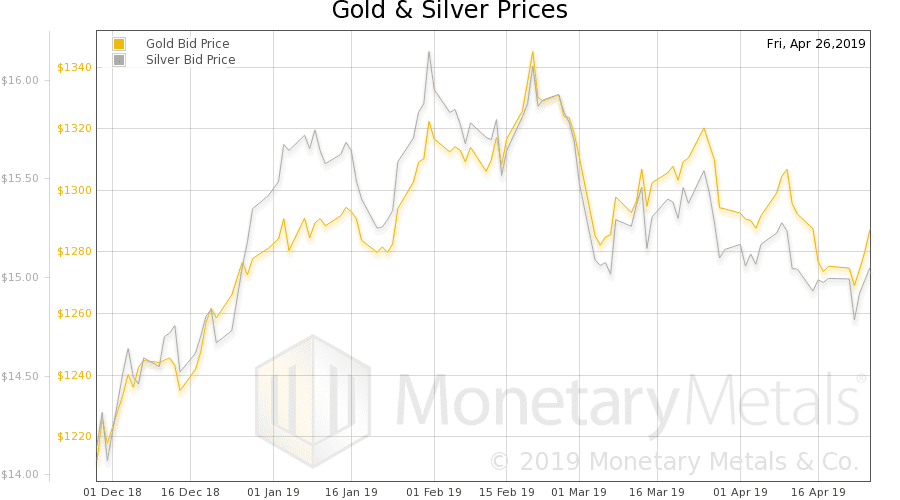

The price of gold was up this week, by $10 and that of silver ¢6. Something is brewing in the fundamentals that we haven’t seen since… last year. We will show a picture of this, below.

There are many problems with assuming a rising stock market means a growing economy. We’ve written many times about the much-greater growth of debt, i.e. borrowing to consume which adds to GDP.

Today, we just want to note that stock prices can rise faster than earnings. We will ignore the so called wealth effect—a feedback loop in which higher stock prices drive greater spending, and hence earnings—and its temporary boost to earnings. Even so, the stock market gains since the start of the year have been due to traders being willing to give stocks a higher multiple (to earnings).

Or, as we look at it, lower yields. Yield is the inverse of price (something Keynes trusted to lure the capitalists on board his plan to overthrow the capitalist order). For four months, we have had a big drop in the earnings yield of the S&P 500. It went from 5.16% to 4.5% so far, a drop of 13%.

The word for someone who thinks that if earnings go up, they must go down is a pessimist. The word for someone who thinks that if the earnings yield goes down, it must go up again is a student of history.

The bear market in earnings yield (i.e. bull market in P/E ratio) began in September, 2011. We note this date, because something else began at that time. The bear market in the price of gold (i.e. the bull market in the price of the dollar).

Of course, correlation does not prove causality. And there is no law of the universe that says the same thing will happen again. We should note that the price of gold had reached an epic high by 2011, after running up massively in a decade-long bull market. In 2019, that is just not the case.

That said, there is something here to ponder.

Demand for money may decline during times of rising optimism. By demand, we don’t mean the rubbish “X” chart of supply and demand, by which most people think to understand money in terms of quantity. We mean the desire to opt out of the financial system. By money, we mean the most marketable commodity, the one financial asset which does not have default risk. By optimism, we mean when the market bids up the price of a dollar of earnings, squeezing the earnings yield lower and lower.

Who would want to own gold—which gold vendors too often promote as a bet on its rising price—and in so doing, miss out on the obvious bull market in stocks? Who has need of monetary insurance when optimism is rising (and most people assume it’s a healthy economy)?

To counterbalance this, we note that the stock bull market is about 8 years staler than it was in 2011. Much destruction of capital has occurred, and the seeds of the next bust are 8 years closer to sprouting.

Anyways, let’s look at the supply and demand picture of silver (and gold too). But, first, here is the chart of the prices of gold and silver.

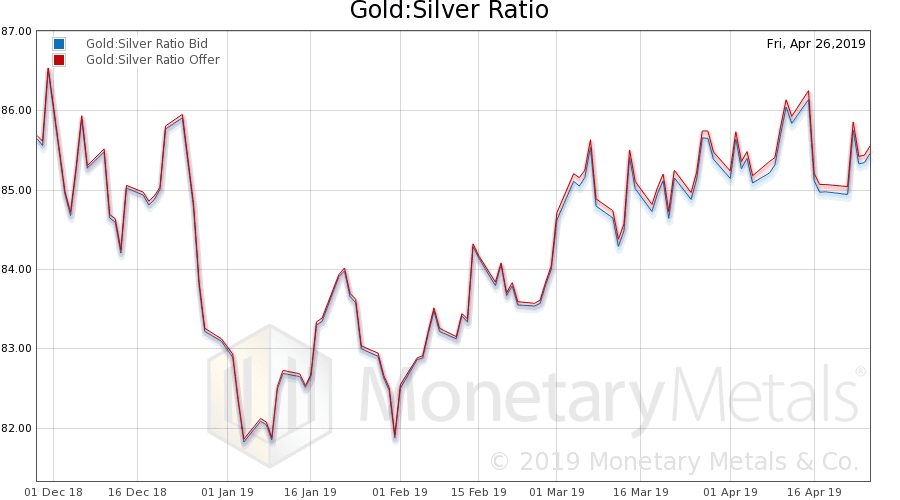

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose.

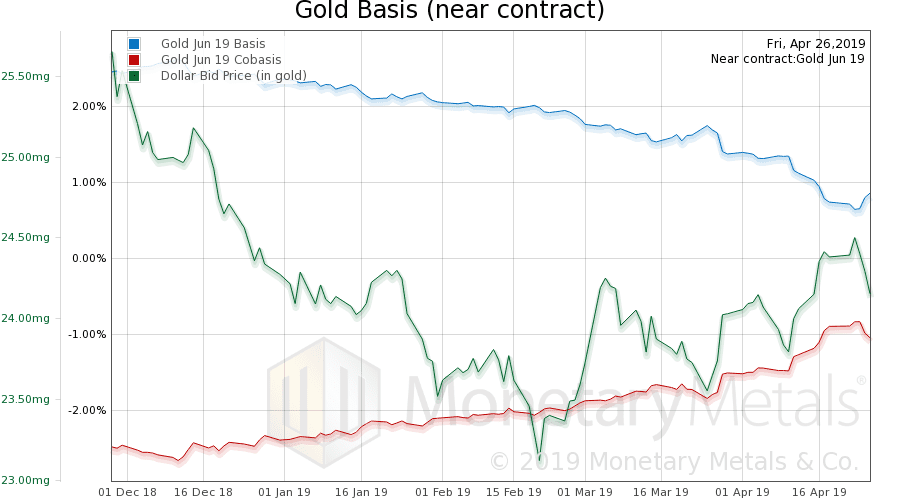

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The scarcity (i.e. cobasis) dropped a bit, not what one would hope for if this is to be a bull market in gold.

The Monetary Metals Gold Fundamental Price is down a whopping $53, to $1,373.

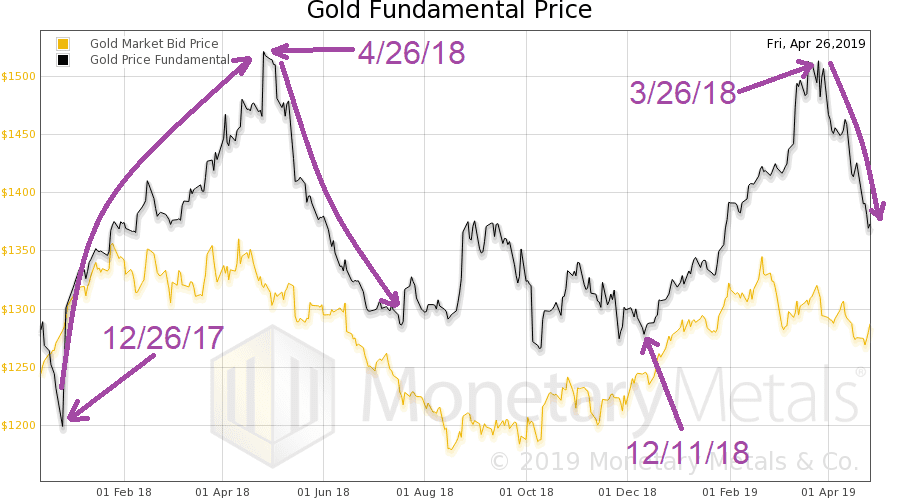

We promised above, to look at a picture of the fundamentals of last year compared to this year.

The similarities, of both the magnitude and timing, are hard to miss. What does it mean? Well, for starters, if you’re paying attention to some myth or whispered rumor of a Big Gold Event to come, don’t pay it much heed. Regardless of last year’s outcome, the trend of the fundamental price this year is not looking like it should if the price is about to go bananas.

Is this just a picture of the old words “sell in May and go away”? Perhaps, but it should be noted that the prior year we had a rise in the fundamentals from December through September. A similar drop up to Dec 2015, and then rise through mid-April 2016 occurred, though there was a second peak in August. The year before that, there was a more modest rise in fundamental from late Dec to January, of about $90.

We think these things can sometimes become self-fulfilling. Traders trade based on their expectations of a price move. If lots of people know what will happen, they trade and it becomes so.

But as they say, “the trend is your friend until the end.” This trend will surely have an end. The gold market is driven by factors other than trading expectations. When some of those factors reassert themselves—and they will with a vengeance—then historical price charts will be irrelevant.

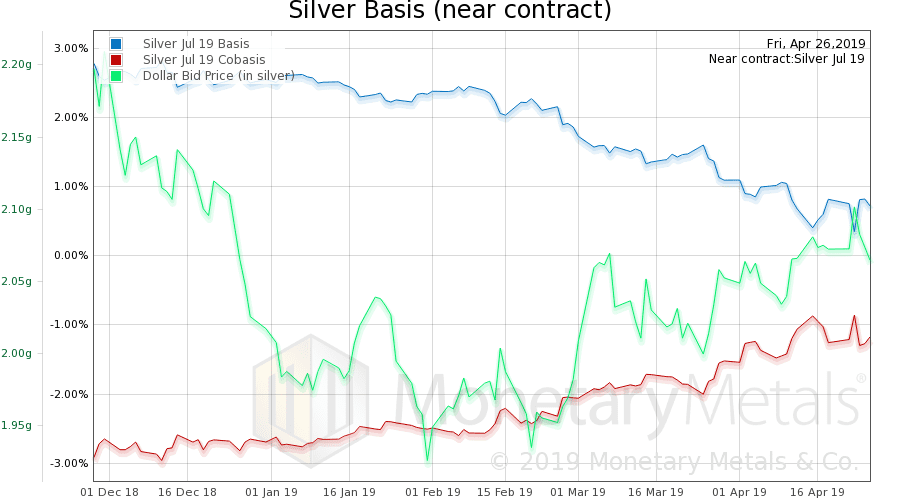

Now let’s look at silver.

The scarcity of silver (i.e. cobasis) rose a hair.

The Monetary Metals Silver Fundamental Price was down another 19 cents to $15.65.

© 2019 Monetary Metals

| Digg This Article

-- Published: Monday, 29 April 2019 | E-Mail | Print | Source: GoldSeek.com