Avi Gilburt

So, as the bulls pat themselves on the back for holding all the way down last year for a 20% draw down so that they can “enjoy” the rally we got in 2019, I hope they don’t hurt their arms and shoulders from all their back-patting. But, they may be in for a dose of realism when they realize that the market has now been completely flat for the last twelve months.

Allow me to show you a simple fact that should make bulls feel like they have exerted a lot of energy and worry, only to be completely flat over the last year. (And, yes, I am going to use a date from the middle of this past week for a reason). On August 14th of 2018, the SPX closed at 2839.96. And, now, one year later, on August 14th, 2019, the SPX closed at 2840.60.

Think about that before you continue to pat yourself on the back. You have lost a tremendous amount of opportunity over the last year by holding during the 2018 20% decline.

Now, how many foresaw this potential over the last year? Well, we did. And, we even earned over 20% during that time with the money we took out from the market last fall, whereas “holders” have been flat.

And, it may even get worse before things get better. As I warned those willing to listen over the last few weeks, it was time to prepare for a wild market represented by whipsaw. Thus far, the market has certainly followed through on our expectations.

As I have said so many times before, I know of no other market analysis methodology which can provide you the context for the market as well as Elliott Wave analysis. As one of our members noted at the end of this past week:

“In crazy whipsaw market, EW can identify almost every twist and turn, and even curveballs. Last October to December was a great example, so was the present.”

Yet, my larger degree expectations have not changed. Over the coming weeks, I still foresee the market breaking down towards levels below 2700SPX. However, we will likely see further whipsaw over the coming week before that decline may begin in earnest.

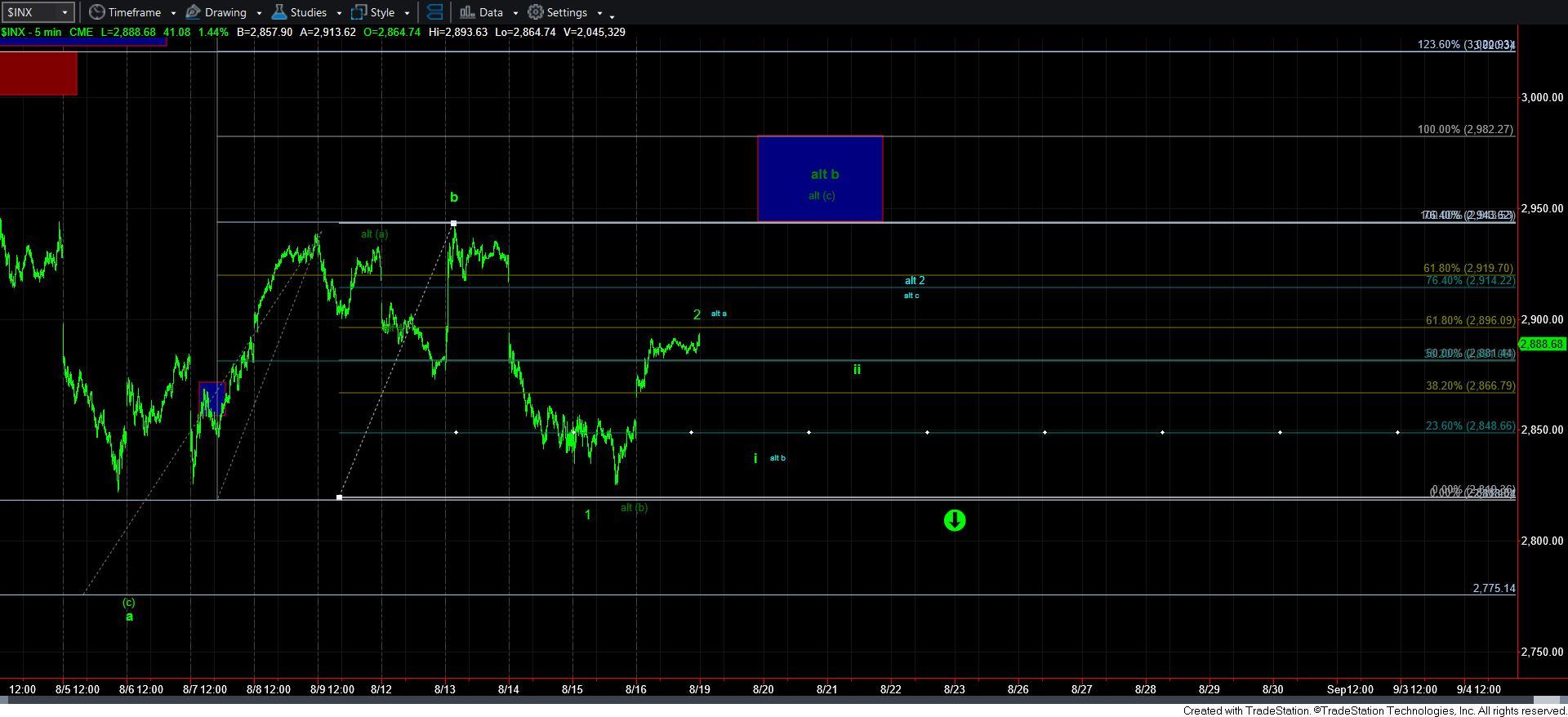

While the details of the continued whipsaw potential can be seen in the potentials I am following on the attached smaller degree charts, I will simply note that as long as the market remains below the 2950-80SPX resistance region, I am going to maintain my expectations for the market to break down below the 2700SPX region in the coming weeks.

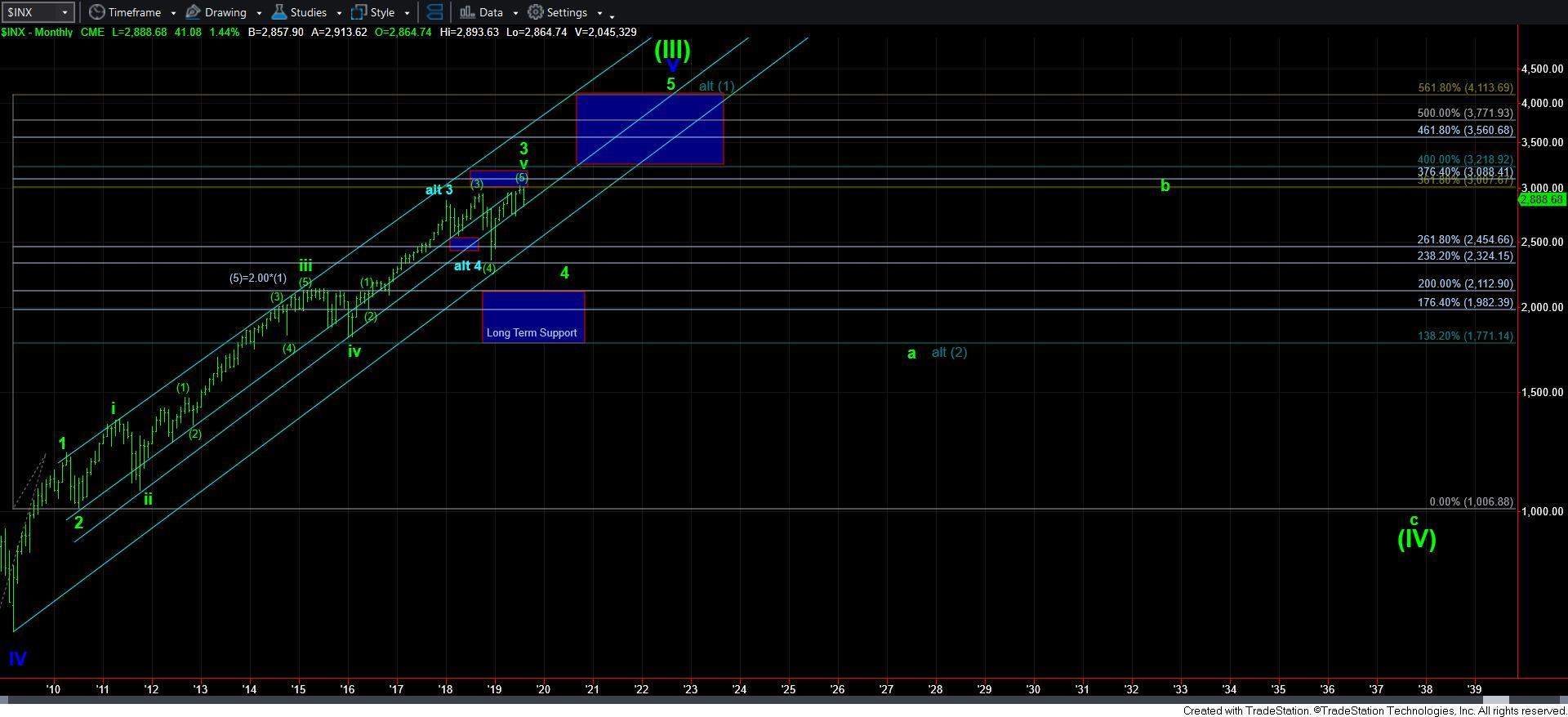

Should we see this downside follow through in the coming weeks, the action we then see in the last quarter of 2019 will tell us whether we will begin the rally to 3800-4100SPX sooner rather than later, or if the market will ultimately point us back down towards the 2200SPX region over the coming year before we begin that rally to 3800-4100.

3minES

5minSPX

60minSPX

1SPXdaily

SPX LONGTERM