-- Published: Friday, 30 August 2019 | Print | Disqus

Avi Gilburt

Personally, I love trading metals and have been doing so for quite some time. In fact, the best trade of my entire career was in silver many years ago.

But, the one thing that we commonly see in the complex is that when the market strikes a top, it most often spikes into and then strongly reverses at that top as a culmination signal. Thus far, I have not seen that in the metals.

So, for this reason, and based upon the analysis I have provided to date, I am still not confident that the metals have topped, and I am now speaking of the alternative scenario presented in yellow. Rather, the market is going to have to prove that to me by a break of the supports I have noted on all my charts and in all my prior analysis. So, I am not going to bore you this weekend with a re-hashing of that analysis.

At this time, the market is now rallying up towards the market pivot I have noted on my 8-minute GDX chart. And, as I have mentioned before, I am using this chart right now as a proxy for larger indications in the overall complex. As you can see, as of the close on Friday, we are hovering just below it, and have almost completed another micro 5 wave structure off what I have counted as a wave (2) of (iii).

But, I want to stress something again, which I attempted to highlight in my live video this past week. The (1)(2) structure I have noted on my 8-minute GDX chart is not the cleanest of structures. It relies upon a truncated pattern, and they are not always terribly reliable. However, if the market is able to push up against this pivot in the coming week, and then pullback correctively, I will be watching for a break out which can signal that larger move higher I would prefer to see to fill in the ideal bullish structures on the daily charts.

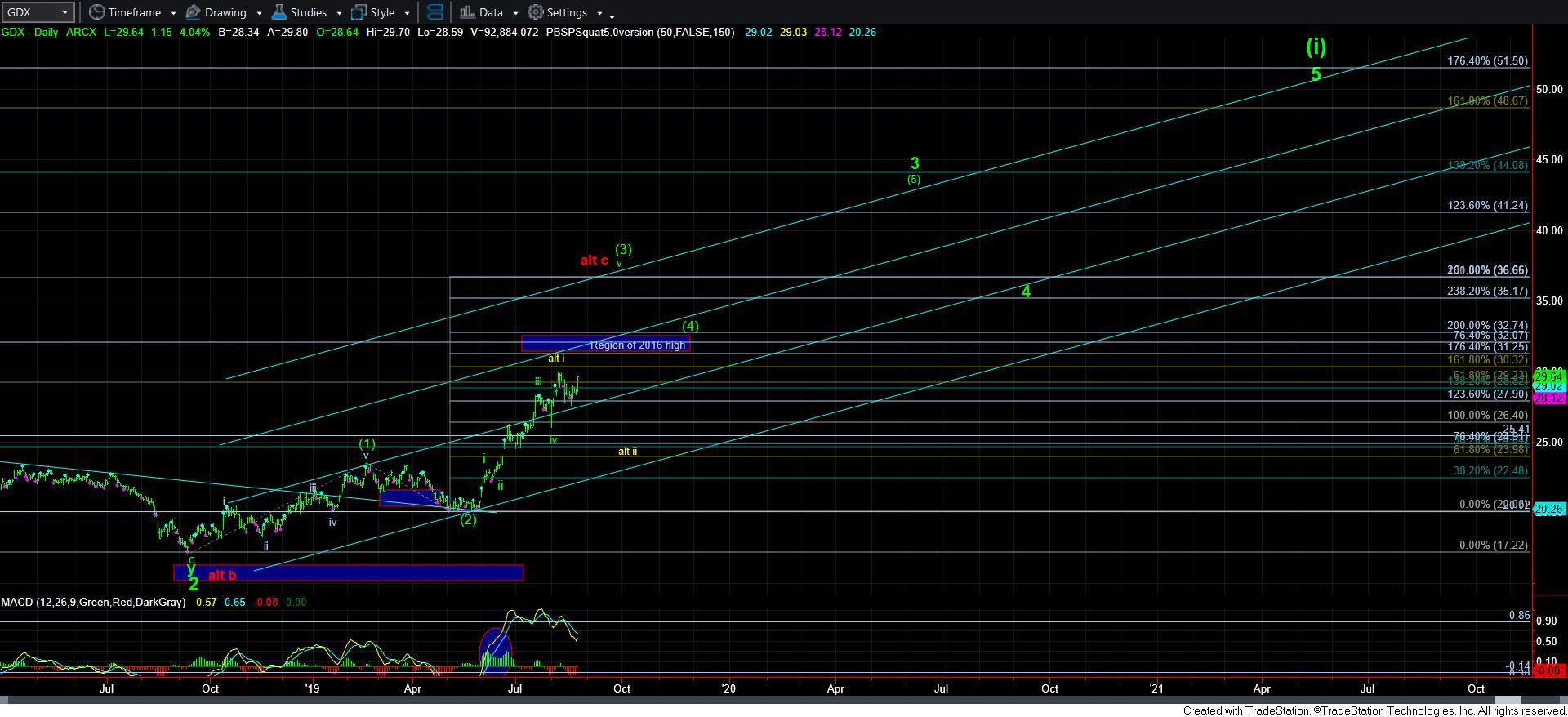

So, I think this next two weeks will likely tell us if the GDX is really on its way to the 35-37 region, or if we have indeed topped in the alternative wave i in yellow. As I have stated many times before as well, I will most often default to the more bullish count in the metals complex if there is a reasonable count to be had, and have explained my reasoning for this in the past. So, when you make an assessment of the manner in which you want to treat this complex, please keep that in mind.

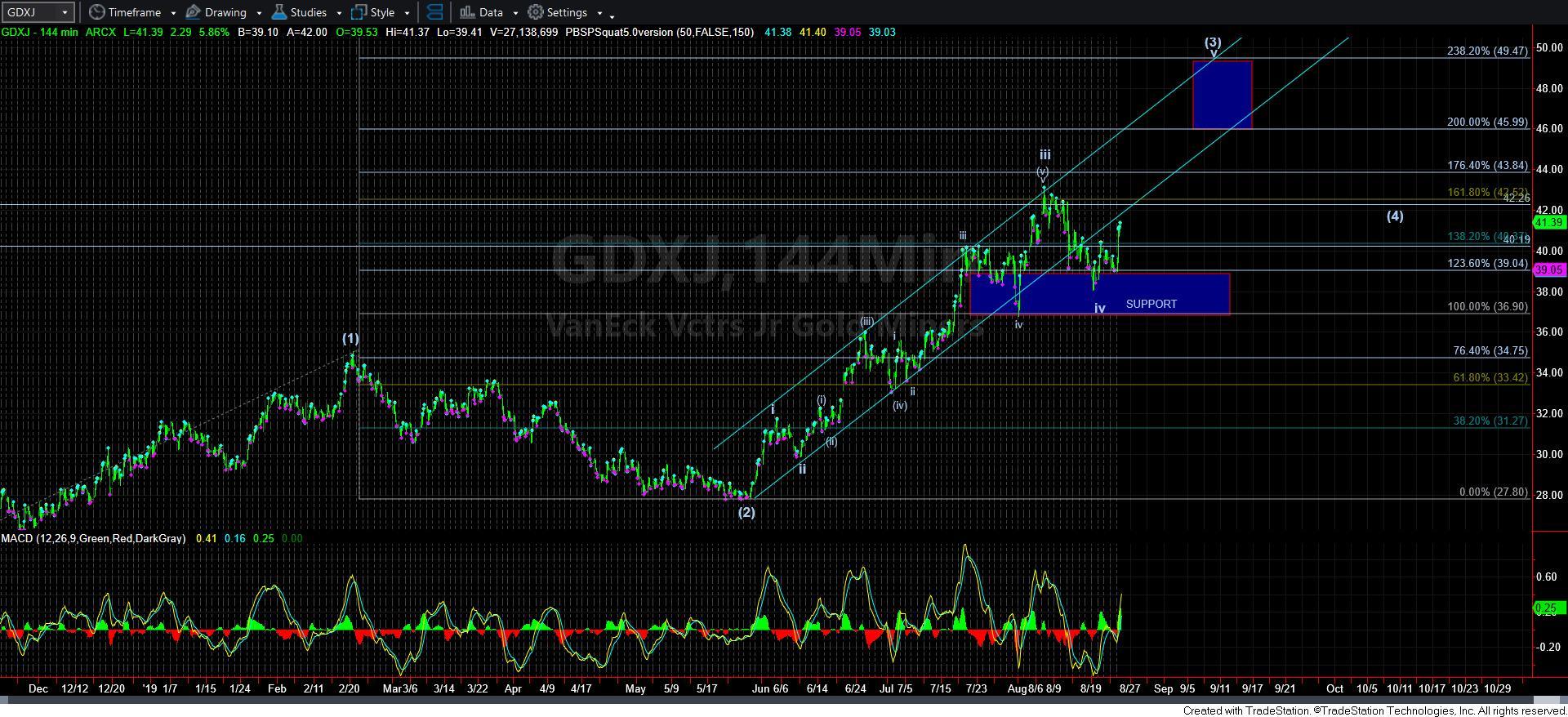

As I have also noted in my last updates, another break out higher would resolve the issues I have had with the GDXJ chart seemingly being one wave degree behind the rest of the complex. So, a strong rally off the support noted on that chart would be wave v of (3), whereas the other charts would also be completing their respective waves v of (3). That being said, the GDXJ really only counts best as a 3-wave move off its last lows thus far, so it does make me a bit more cautious in the near term . . . at least until GDX is able to fulfill its break out potential, which will likely pull the rest of the complex along with it to the upside.

At the end of the day, I have to say that I am cautiously optimistic as long as the supports noted on my charts hold. However, even though I default to the more bullish count potentials, I will not trade them aggressively until the market proves its intention with a break out through the pivot noted on the 8-minute GDX chart. And, unfortunately, I don’t think that happens in a direct fashion, but would be quite pleased if it did. Rather, I think the next pullback off this pivot resistance on GDX can be telling based upon whether it will be impulsive or corrective. So, I am going to be a bit more patient before I trade this complex aggressively to the long side.

While this analysis really discusses the near-term direction of the complex, I have to note that if the alternative wave count does play out, it still keeps us within a larger degree bullish pattern, but may provide us with a multi-week pullback before the resumption of the bull move. So, one way or another, I still expect to see much higher levels in the complex over the longer term.

Click on the charts to enlarge:

GDXdaily

GLD 8min

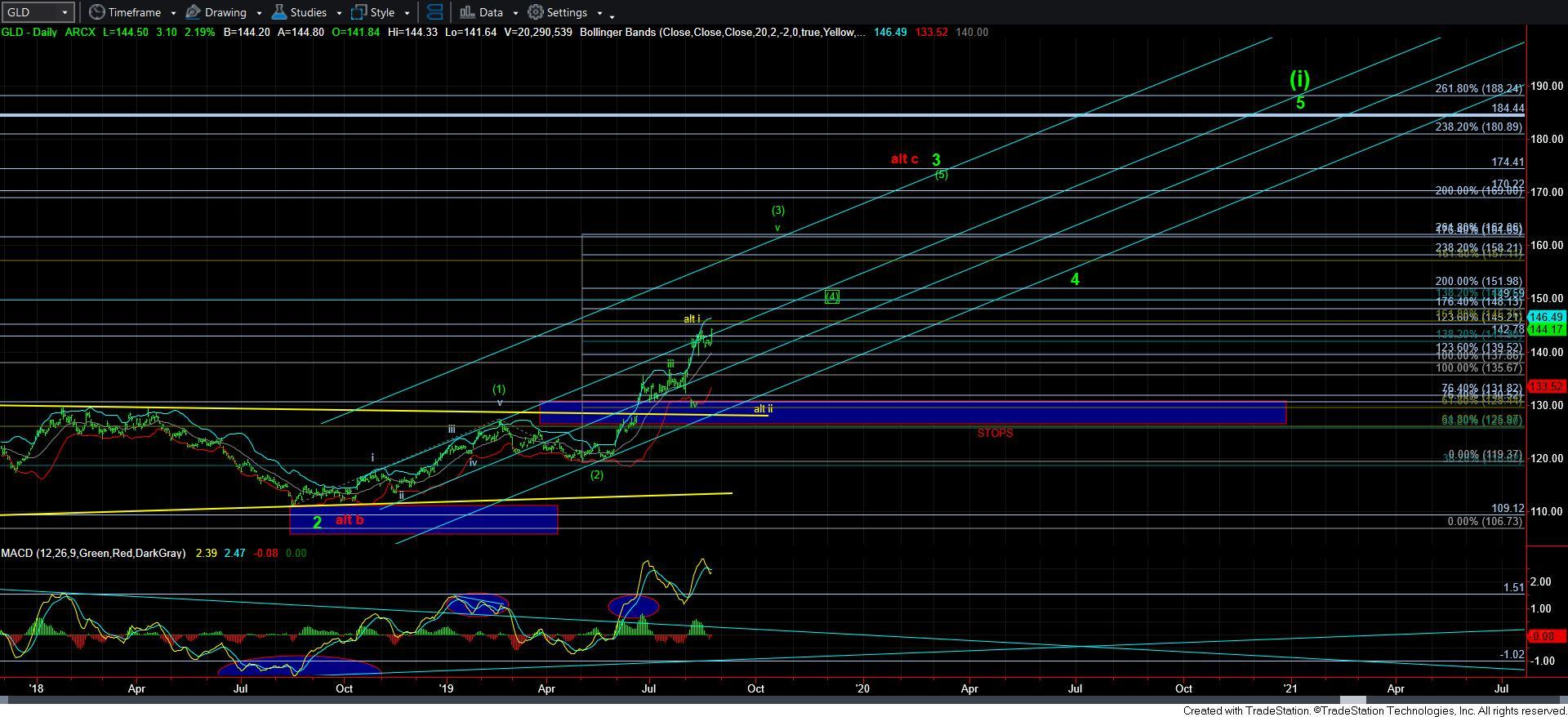

GLD-daily

GDXJ

silver144min