Avi Gilburt

I have been providing public analysis for the last eight years on many forums in addition to our main website Elliottwavetrader, which just celebrated its 8th anniversary. In fact, my first major public call in the market was when I suggested that the gold would top at $1,915 back in the fall of 2011:

“Again, since we are most probably in the final stages of this parabolic fifth wave “blow-off-top,” I would seriously consider anything approaching the $1,915 level to be a potential target for a top at this time.” --Avi Gilburt, August 22, 2011

And, then, on December 30, 2015, I told our subscribers:

“As we move into 2016, I believe there is a greater than 80% probability that we finally see a long term bottom formed in the metals and miners and the long term bull market resumes. Those that followed our advice in 2011, and moved out of this market for the correction we expected, are now moving back into this market as we approach the long term bottom. In 2011, before gold even topped, we set our ideal target for this correction in the $700-$1,000 region in gold. We are now reaching our ideal target region, and the pattern we have developed over the last 4 years is just about complete. . . For those interested in my advice, I would highly suggest you start moving back into this market with your long term money . . .”

Yet, I am often the focus of attacks by gold-bug pundits simply because I have provided a logical explanation that “manipulation” did not cause the correction we saw from 2011 to 2015. And, I have expressed my views in this article I wrote back in 2017:

Was The Metals Market Manipulated To Drop From 2011 To 2015?

Recently, my subscribers pointed me to an interview which presented the methodology we use to analyze the metals market in a very derogatory manner. So, I thought it would be appropriate to pen a reply.

First, I want to highlight that the pundit who was interviewed was introduced as follows:

“provides some of the very best analysis on banking schemes, the flaws of Keynesian economics, and evidence of manipulation in the gold and silver markets that you will find anywhere.”

Well, did you notice that there was no mention of this pundit’s prescience regarding the direction for the price of gold in his introduction? He clearly was not noted as being "the best analysis for price direction." Yet, should that not be the true determinative factor when it comes to providing successful and profitable analysis in the metals market?

You see, this pundit was ridiculously bullish at the highs in 2011 like most others in the market. Do you think he saw the correction coming? Absolutely not. So, rather than look foolish, the “manipulation” argument became his mantra. In fact, this pundit continued to be wrong for years, as he was bullish all throughout the 2011-2015 bear market, when silver lost over 70% of its value. Now, we understand why his track record regarding prognosticating the metals was not included in his introduction.

Moreover, his perspective begs the question as to why he did not expect the market to drop much lower if he was so certain it was being manipulated? But, I doubt we will ever get an answer to that question.

He then proceeds to denigrate technical analysis because “manipulation makes it worthless.” And, it leaves me thinking “more worthless than his being bullish for the entire decline between 2011-2015?” I didn't think analysis could reach a level more worthless than being bullish during an entire multi-year bear market.

Yet, as far as how well our analysis did during that same period of time, I think there is a reason we have over 5000 members and over 500 money manager clients, especially following us in the metals market. I can assure you that it is not due to manipulation rendering our analysis worthless, as our clients have been quite appreciative of our work:

“I see the best quants, strategists and technicians the street has and you and your group are amongst the absolute best. My trading desk is floored at turning levels you are able to provide.”

“I have followed Avi's analysis for better than a year now. In 20+ years in the market I've never seen anyone even close to his timing and analysis with metals”

But, the issue is not simply that they espouse their manipulation theories as the be-all-end-all when it comes to the metals markets. Rather, it is that they do not recognize how much they really do not understand regarding how the metals move. If they did, then they would have a much better track record when it comes to prognosticating the metals.

Unfortunately, as noted before, they are no better than the average Joe, and, most often, much worse. All they provide is an excuse as to why their followers have lost money so that they don’t have to feel like it is their fault. At the end of the day, it is simply a dishonest perspective that is nothing more than the blame game.

In fact, I often question who does more to harm to the metals market – the manipulators or the gold-bug manipulation theorists!?

But, that is not the extent of the dishonesty presented. You see, even their own internal arguments about how the markets move are never consistent or accurate:

“It doesn't matter what your little wave counts says or some cycle or whatever, knock yourself out. You just get a wad of cash chasing a finite number of assets, prices go up. I mean that's just how it works”

Really? That is how it works?

Well, this was the same person who was claiming the institution of QE3 was going to make the metals soar in 2012 because of all the new “wads of cash” supposedly being placed into the market. Well, that is not exactly what happened, as the metals remained in a bear market for another 3 years. But, I thought it was that simple and that is "just how it works?"

In fact, this particular pundit went on record in 2012 proclaiming that “there is zero chance that gold goes to $1,200.” Maybe he did not believe his own “stuff” about the market being manipulated to lower levels. And, I will give you three guesses as to why gold dropped below the $1,200 level despite it having zero chance of doing so.

But, that does not stop these pundits from continually espousing the same perspective over and over until the market eventually moves in their favor. The biggest issue I have with the gold-bug manipulation theorists is that just because you say the same thing over and over until the market finally moves in your direction does not mean you have any clue about the market. And, that is exactly what these gold-bug pundits offer.

In fact, they are really no different than when my children were 3 years old, and we were stopped at a traffic light. They would look at the traffic light, and say “now,” as they try to time the light changing back to green. And, if it does not change, they again say “now.” And, this goes on for maybe another 10 to 15 times, depending on how long the light takes to change. Yet, when the light finally changes at one of their “now’s,” they proudly assume that they caught that timing ever so perfectly.

This sure sounds like most of the gold-bug pundits we read and listen to, does it not? So, yes, when I read these pundits providing us reason after reason as to why gold will rally, I view it as akin to my 3-year-old child saying “now.” Eventually, the market will turn just like the traffic light will eventually turn and they will react just as proudly as my 3-year-old, assuming they caught that timing ever so perfectly. But, clearly there is no prescience to their abilities to identify the cause of that turn, just like my 3-year-old.

You see, just like my 3-year-old does not comprehend that there is something internal to the traffic light that causes the light to change, the pundits do not comprehend that there is something internal to the financial market that will eventually make it move. This is clearly evidenced by the fact that none of the exogenous events to which they have been pointing for years have been able to cause the turn to the market every time they say “now.” Yet, at least they have an excuse – “manipulation.”

In their eyes, metals are only supposed to move in one direction – UP – and if it does not, then it must be manipulated. They will never highlight that the manipulation cases they so often cite deal with manipulation in BOTH directions.

Yes, my friends. If you are going to be truly honest about all the cases cited by these manipulation theorists, then you are going to have to recognize that all the manipulation was done in both directions in the market. Since that does not fit their narrative, this is not something they will ever point out or address.

Now comes the best part of the interview:

“I see on Twitter everyday people try to say, "Well, wave three of sub wave Z microwave X means that we're going to go down to $1,330 (in gold).” I'm like, "Not if the bond market keeps rallying." I mean these things don't happen in a vacuum. They don't happen independently. You can't look at gold on the chart and go, "Well I've got this wave count and that's it." No, no.

If the employment report shows a contraction in jobs on Friday and the bond market rallies 10 basis points, it doesn't matter what your silly little wave count said was going to happen. In 2020, man, with everything connected by computer and everything done by pre-programmed algo and all of this cash sloshing around the planet, and the central bank intervention and all this kind of stuff, you simply cannot use your little tools from 30 years ago to try to make predictions about where things are headed. It just doesn't ... I'm sorry. Here I am just ranting. I apologize.”

We now have a gold-bug manipulation theorist who is attempting to opine about Elliott Wave analysis. Yet, he has no experience with it and clearly does not even understand it. How foolish does one have to be to even attempt to offer an opinion about something they do not understand? So, do you really think we can take this person seriously?

Moreover, I want to explain that I have a degree in economics and a degree in accounting. I am also a lawyer (graduated Cum Laude) who has been through a master’s of law degree and the Certified Public Accountant examination. I was also a national director and partner at a major firm before I went full-time into the stock market after my wife passed away.

So, not only do I understand Elliott Wave analysis, but I also understand all the issues discussed by the pundit in the interview, and likely in much greater depth when you consider my economics, accounting and legal background. Yet, through experience, I have come to the informed and knowledgeable opinion that Elliott Wave provides you a much clearer perspective of the gold market than anything else I have come across.

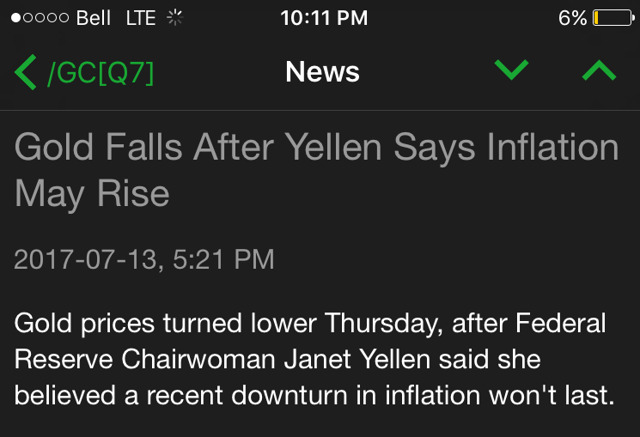

In going on further with the interview, the pundit clearly believes that interest rates and jobs reports are important when it comes to discerning market direction. Well, that is exactly why he has no clue regarding the price direction of the metals. Allow me to show you an example of exactly what would happen to you if you had followed inflation/interest rates regarding gold within just one 48-hour period:

Yes, you read that right. The same inflation expectation caused the price of gold to drop one day and rise the next. And, I have tracked many of these examples. And, you wonder why this pundit is unable to identify the price direction of gold?

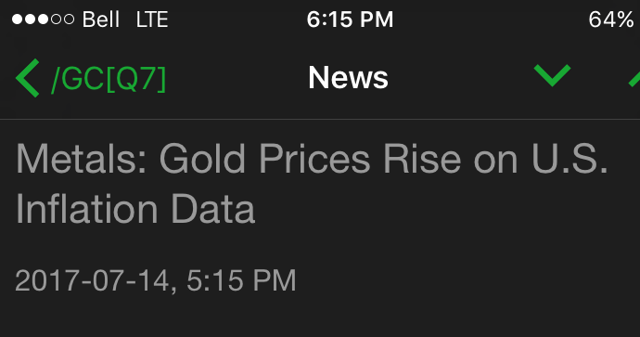

And, believe me, they are not alone. As I said, they are no better than the average Joe who follows CNBC:

Well, I have got this wave count, and yes, yes, yes. Our wave counts do what manipulation theories cannot – we discern market direction and turning points quite accurately.

While we will not be right 100% of the time, we have proven that we are far better than most and certainly better than the gold-bug conspiracy theorists simply because we understand the true nature of the market and do not have to hide behind fear or blame. Moreover, those that follow our work at least know they will be getting an intellectually honest perspective about the metals market.

At the end of the day, as an investor, your goal is to increase your account. To further those goals, you need to decide if you want to read “information” which provides excuses for being on the wrong side of the market or if you want analysis that provides high probability expectations for market direction, which has accurately caught the major turns in the metals market for many years!?