-- Published: Tuesday, 26 November 2019 | Print | Disqus

Keith Weiner, Monetary Metals

Physics students study mechanical systems in which pulleys are massless and frictionless. Economics students study monetary systems in which rising prices are everywhere and always caused by rising quantity of currency. There is a similarity between this pair of assumptions. Both are facile. They oversimplify reality, and if one is not careful they can lead to spectacularly wrong conclusions.

And there are two key differences. One, in physics, students know that pulleys have mass and friction, and graduate to a more sophisticated understanding. Two, the Quantity Theory of Money (QTM) is not a simplified view of reality. It is oversimplified, to be sure, but it is a false theory.

QTM leads one to think that the groceries you can buy with a dollar are intrinsic to the dollar itself. And this leads to the idea that, the lower the dollar goes, the easier it would be to pay dollar debts. Returning to our physics analogy, pulleys are not massless and frictionless. And the value of the dollar is not 1/P (purchasing power).

Useless Ingredients

We have written a lot about when government forces businesses to pay for things that their customers do not value, and do not usually even know about. We deem these things useless ingredients. Consider an example. Suppose the federal government got more serious about the Americans with Disabilities Act, and they no longer allow noncompliant restaurants and bars to remain grandfathered under the old code. All of these businesses now must spend a lot of money getting compliant, and reducing their revenue-generating floor space for the sake of much larger bathrooms. This does not cause prices to rise, directly. If restaurants could charge more, then they would already be charging more.

However, it will make some restaurants nonviable. So they close. The same number of customers are still seeking to be served, but now there are fewer restaurants. Which also have less capacity.

Then, they can raise their prices.

Next, the government says air conditioning must be replaced immediately, with new carbon-neutral units. Some more restaurants go out of business. The rest now have a $2,500 a month mortgage to finance their spiffy new green appliances. Then the walk-in refrigerator, and eventually the stoves. With each new law mandating more useless ingredients, some restaurants fail and the remaining ones may be able to raise their prices (“may” because people may go out to eat less, if these new laws are affecting other industries too).

The end result could be that the price of a steak dinner is now twice as high as before—while restaurants make less money than before. With less capacity, and several expensive new mortgages to pay, plus less economies of scale in ordering, and likely fewer suppliers competing for their business, they might find that they cannot raise prices to keep up with their costs.

Think Spread, Not Price

This leads us to the economics analog to physics. In physics, you can’t just assume that a force applied to a cable running over a pulley will cause motion. It may not overcome the static friction. In monetary science, you cannot assume that a higher price means a higher profit margin. It may not overcome the higher cost.

Physics has friction. Economics has spread.

Profit is not given by only the price charged. It is price charged minus cost paid. If the government is pushing costs up, and the economy is in the phase of falling interest and prices of the interest rate cycle, then we would expect that profit margins are compressing. Let’s look at that in further detail, the analogy to mass in physics.

We said above (and many times over the years) that a restaurant cannot charge higher prices simply because its costs went up. It can get away with raising prices—i.e. it won’t drive down its volume—only when some of its competitors fail. And, then, the reason why it can raise prices is not that its costs are higher. The reason is that there are fewer competitors, and less supply. Prices must go up to ration a smaller supply to the same population. That is, higher prices reduce the demand to match the reduced supply.

The Difference Between Rising Costs and Rising Price

Observe that there is no particular correlation between the restaurant’s higher cost and the price elasticity of the market. It could be that a very large increase in price only causes a small reduction in demand. This occurs where there is price inelasticity. For example, people don’t change their driving habits if the price of gasoline goes up $0.25.

But in other goods, if the price goes up a bit the demand can fall off a cliff. This is because people can substitute a similar good. In the case of restaurant meals, they can obviously substitute home-cooked. Or heating up a supermarket prepared meal.

Restaurants could find themselves on the losing side of this dynamic. On the one hand, costs rise linearly with each new mandated useless ingredient. On the other, pricing power rises sub-linearly. And the restaurants can get caught in this vice.

As an aside, we frame it this way quite deliberately. In a dynamic system, the net motion may not be so interesting. But the relative motion between two different moving parts may be quite revealing. And not just the velocity of one and the other. But also the rate at which those velocities are changing—i.e. acceleration. And maybe the rate at which acceleration is changing (called jerk in physics). This is a key principle in Keith’s theory of interest and prices (a new paper, that he presented at King Juan Carlos University in Madrid a few weeks back is forthcoming).

The rate that costs go up is determined by the federal, state, county, and city legislatures. And innumerable regulatory agencies at every level. And the tax agencies at every level too. The rate that prices can go up is constrained by consumer incomes, even if supply were to be decimated. Other factors such as available substitutes also constrain prices.

What’s This Got To Do With the Interest Rate?

To bring this back to monetary economics, it should be clear that these factors affecting the price of a hamburger are not intrinsic to the dollar. They are not a monetary phenomenon. So what is a central bank supposed to do in response, if the price of a burger goes up 20%? And the prices of all other consumer goods are going up for similar, nonmonetary reasons?

It is not true that the dollar is worth less than it was. It is buying just as much or more as it did before—it’s just buying lots of things that the consumer does not want and the economist does not know about.

What is supposed to happen to interest rates? The old saw says that savers won’t deposit their dollars unless they are compensated for inflation (ignoring the question of where are they supposed to put their dollars, if not in a bank, and what rate they’d get). But this logic is broken, in a similar way as the logic was broken, above, that rising prices makes restaurants more profitable.

The price a restaurant can charge does not necessarily rise, when its costs rise. The same thing is true with the rate of interest. Why would borrowers be able or willing to pay a higher rate, just because regulators and taxinators have imposed more useless ingredients? Borrowers are not able to pay more.

The same fallacy is at work here, as above: assuming that different phenomena in different markets are linked.

Monetary Central Planning

If prices rise due to increased useless ingredients, then any attempt to raise interest rates will fail. Yes this is the formula that right-thinking monetary planners would blindly follow. They would raise rates to give savers that higher yield that ought to go with the reduced purchasing power of their dollars.

However, they cannot see the dynamic we describe above, because they are in the throes of the Quantity Theory of Money. They are desperate to get control over the quantity of dollars, which they believe is everywhere and always the cause of rising prices.

Supply and Demand

The price of gold subsided a few bucks, and the price of silver blipped a few pennies. Not much action this week, groceries neither pumped into nor drained out of this asset class. Those who look to exchange capital goods for groceries need to find a different asset. Not even S&P 500 equities provided a gain in groceries this week. It certainly wasn’t the much-vaunted store of groceries, bitcoin, which leaked 12 of them this week.

10-year Treasuries picked up some purchasing power, but not a lot.

Maybe President Trump can order the Fed had to fire up their tried and true grocery printing machine. If not, how can the strong economy stay strong? How can they keep GDP growing, if the incentive to convert capital to income, to consume, is withdrawn?

Speaking about eating the seed corn, we came across this post on Facebook. It is quite poignant.

“7 years ago, a glass bottle with millet was accidentally found in the village of Velyki Krushlyntsi in Vinnytsia oblast, Ukraine.

“7 years ago, a glass bottle with millet was accidentally found in the village of Velyki Krushlyntsi in Vinnytsia oblast, Ukraine.

The bottle had been buried under the root of aspen by Semen Poberezhnyak in 1932, when the Soviet commissars nationalized Ukrainian villages all that was edible.

In spring, he had wanted to sow this millet to save his family from starvation. Alas, he could not find the tree he had dug the bottle under, from among the other trees. To the end of his days he was sorry he did not put a mark on the tree. He could not forgive himself that his daughter Justine and her three children – two girls and a boy – died of starvation then.

His great-grandson found the bottle in November 2012.”

The Ukrainians suffered the consequences of the Soviets eating their seed corn. We fear that people in the West will once again learn the consequence of eating our seed corn. But right now they cheer a rising GDP, heedless that the Fed’s trick is to fuel it with seed corn.

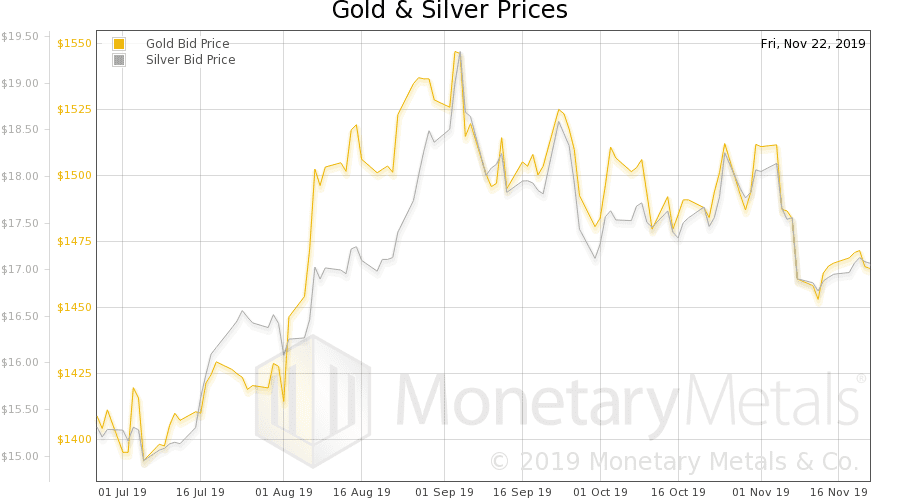

Let’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

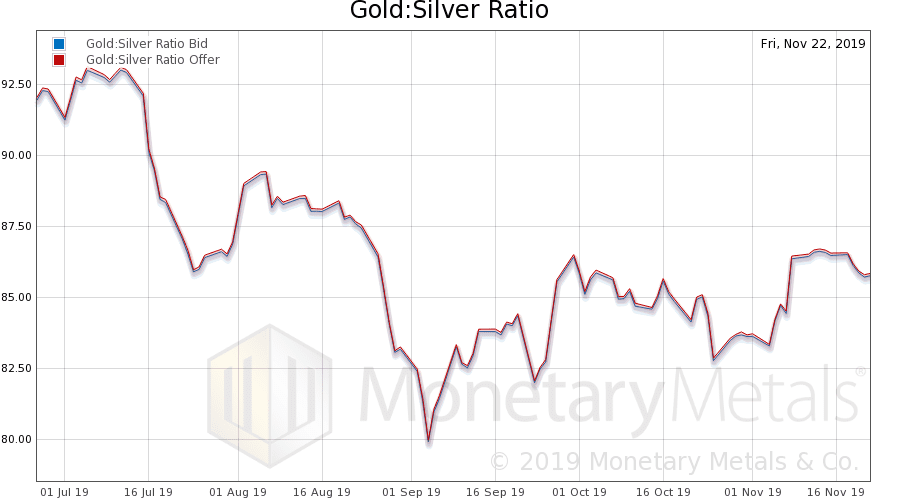

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio fell this week.

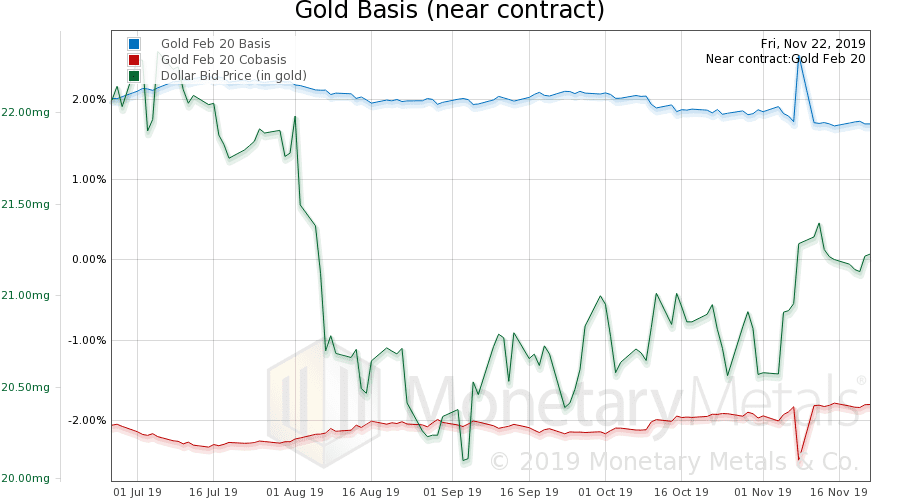

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. It rose this week.

There’s a slight drop in scarcity (i.e. cobasis) along with rise in the price of the dollar (i.e. drop in the price of gold, measured in dollars). Note that this close to December contract expiry, we have shifted to the February 2020 contract (and March contract for silver).

The Monetary Metals Gold Fundamental Price, was down another $8 this week, to $1, 457

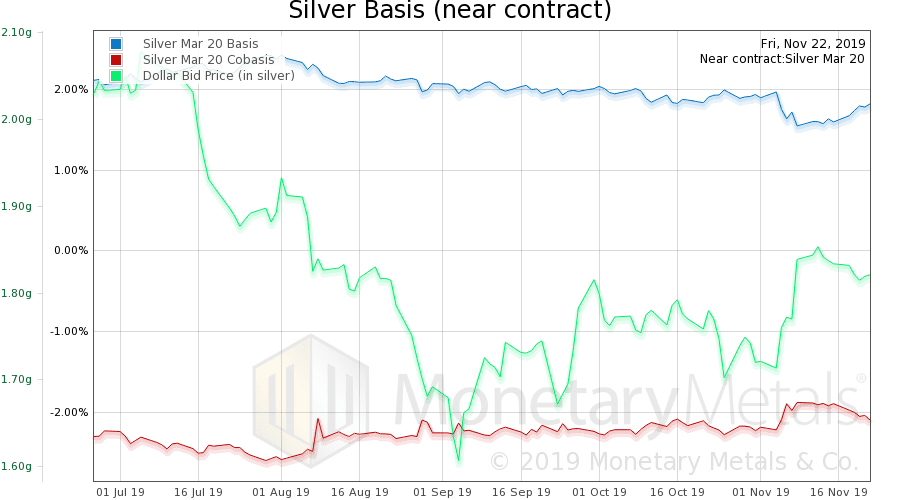

Now let’s look at silver.

In silver, scarcity is falling, and abundance is rising.

The Monetary Metals Silver Fundamental Price fell by another 19 cents, to $16.13.

© 2019 Monetary Metals

| Digg This Article

-- Published: Tuesday, 26 November 2019 | E-Mail | Print | Source: GoldSeek.com