-- Published: Friday, 27 December 2019 | Print | Disqus

- Bob Moriarty

My Best Year-End Tax-Loss Harvesting Advice

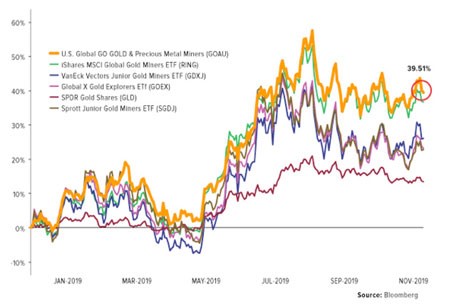

With only a few trading days remaining in 2019, a clear winner has emerged in the contest of gold mining ETFs. The U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) was up 39.5 percent year-to-date as of November 30, beating five of its peers, including those that focus on explorers and junior miners, or that are backed by physical gold (as in the case of GLD).

(Click on images to enlarge)

Since I first recommended GOAU back in July, just five months ago, GOAU has raced ahead of the VanEck Vectors Junior Gold Miners ETF (GDXJ)—by as much as 218 basis points.

GOAU has also crushed GDXJ since its debut at the end of June.

It’s time to get smarter! I see this as an opportunity to offset capital gains taxes by dumping your losers—GDXJ, in this case—and buying GOAU.

Now as you may know, securities law states that if you buy a “substantially identical” asset within 30 days of selling, you lose the benefit of tax-loss harvesting. This is what’s known as a wash sale, and it prevents investors from “having their cake and eating it, too.”

The good news is that GOAU is not “substantially identical” to most other gold equity ETFs, including GDXJ.

You might ask how this is possible.

GOAU is unlike any other gold ETF because it’s a dynamic, quant-based investment vehicle that seeks to track an index focused on undervalued, high momentum mining stocks. It’s not a dumb “one size fits all” product, so you’re not going to find the Barricks or Newmonts.

As a result, GOAU shares very little overlap with other precious metal and mining ETFs. According to Toroso Investments’ comparison tool, the closest ETF to GOAU, in terms of holdings, is the VanEck Vectors Gold Miners ETF (GDX). And yet the two ETFs have an overlap of only around 35 percent.

That’s hardly “substantially identical.” And the similarities between GOAU and GDXJ only shrink from there.

Let’s dig a little deeper. The top three holdings in GOAU, representing more than 30 percent of the fund, are superstar royalty and streaming companies Franco-Nevada, Royal Gold and Silver Wheaton. Fellow royalty companies Sandstorm Gold (at about a 4.8 percent weighting) and Osisko Gold Royalties (2.9 percent) can also be found, for a total royalty weighting of 38 percent.

GDXJ owns only Sandstorm and Osisko, with a combined weighting of 2.3 percent.

Of the top 10 holdings in GDXJ, none appears in GOAU.

What this means is that investors can sell GDXJ for tax purposes and buy GOAU within the 30-day window without fear of a wash sale. Always double-check with your accountant.

Maybe you can “have your cake and eat it, too!”

No other precious metal ETF that I know of has such a sizeable weighting in royalty and streaming companies—the “smart money” of the metals and mining industry. As I see it, this is the key contributor to GOAU’s outperformance.

GOAU is also more focused and concentrated. Whereas GDXJ has as many as 74 constituents, GOAU has only 30 names, or approximately 2.5 times fewer.

Bottom line: If you invest in gold equities and ETFs, or if you’re planning on doing so, you really owe it to yourself to at least check GOAU out. Don’t get stuck in a dumb product like GDXJ.

You can learn more about GOAU by clicking here!

- Bob Moriarty, 321Gold.com

| Digg This Article

-- Published: Friday, 27 December 2019 | E-Mail | Print | Source: GoldSeek.com