-- Published: Friday, 27 December 2019 | Print | Disqus

Daniel R. Amerman, CFA

On August 27th, 2019, in an editorial published in Bloomberg, William Dudley, the former president of the Federal Reserve Bank Of New York, did what had previously been considered unthinkable. The foundation premise of the Federal Reserve is that it is supposed to be completely nonpartisan, insulated from all political considerations. However, Dudley wrote that Donald Trump was a threat to the Federal Reserve and the nation, and urged Fed officials to make decisions that would take into account the need to keep Trump from being reelected.

The freezing up of the repurchase agreement (repo) market had nearly collapsed the U.S. financial system as one part of the financial crisis of 2008, however, the market had enjoyed 11 years of relative calm since then. Three weeks after Dudley's editorial, during the week of September 16th, 2019, the repo market returned to crisis mode and was likely saved only by emergency interventions on the part of the Federal Reserve. A contributing factor was some major mistakes that were made by career officials at the New York Fed - Dudley's former staff.

If the current related crises in the repurchase agreement market and with the funding of the national debt continue and get worse (which is far from certain at this time), crossing over into the wider markets, interest rates and the economy, it could become one of the defining political events of our lifetimes.

If the economy is in recession and the markets have crashed at the time of the November, 2020 election, then control of not only the Presidency but likely the Senate as well would be delivered to the Democratic party. This would give the Democrats simultaneous control of the House, Senate and Presidency during a time of financial emergency, with a claim to a mandate - which could very rapidly lead to some of the biggest political, tax and economic changes of our lifetimes.

Did a few career staff at the New York Fed join the "Resistance" and from the inside attempt a decisive strike to prevent Donald Trump from being reelected, 3 weeks after being publicly called upon by their former boss to do so?

I am not going to attempt a definitive answer in this analysis, as it likely can't be known with certainty by anyone except the insiders who were involved.

Instead, I will explore something that is little understood by the general public, which is the extraordinary financial pressures that have created a situation where a few staff mistakes - whether accidental or intentional - could indeed change the economy, the election, and the values of everyone's retirement accounts and homes.

I will explore the sequence of what has been happening, some interesting coincidences, what is at stake, and what the financial implications could be for individuals. Throughout, I will always take two possibilities into account: accidental mistakes versus deliberate intentions. When the reader has finished this analysis, you will have the information to make your own determination about which of those two you believe to be the more likely.

More details on the current crisis can be found in my analysis linked here. The Fed almost lost control of interest rates in a critical market, and has since then relied on monetary creation - just creating money effectively out of the nothingness (though the actual process is much more complex) - to fund about 90% of U.S. government spending at very low interest rates, and to thereby hold the economy, stock and housing markets together.

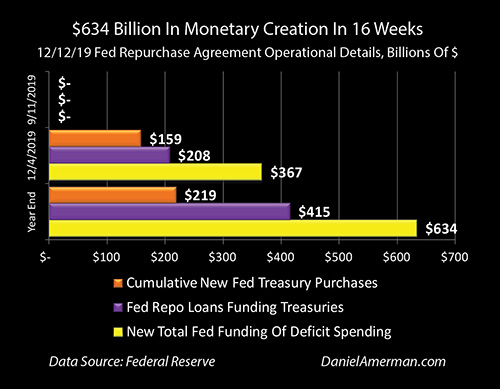

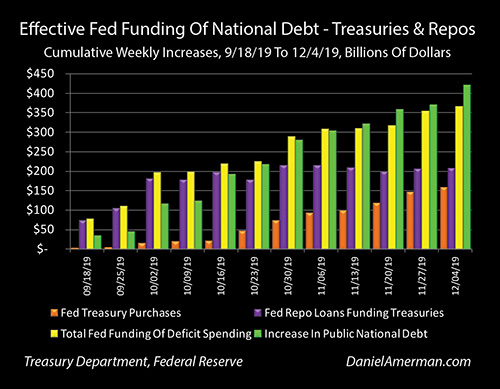

The crisis has been escalating, and the Fed's emergency maneuvers have now reached the somewhat surreal point where up to $634 billion in new money will be created by the end of 2019 to prevent a potential deepening of this crisis that now threatens the financial system, as explored in the analysis linked here. I've been analyzing and writing about related matters for years now, and the speed with which this came up out of nowhere is almost surreal.

For comparison, the total physical money outstanding in the United States as of January of 2008 (before the financial crisis of that year) was only $758 billion, and the total assets of the Federal Reserve were less than $900 billion.

Two Valid Explanations

One of the issues with understanding what has been happening is that the rapid growth in the national debt has created so much pressure on the system, that there are two perfectly valid explanations for what has been happening.

On the one hand, there is the saying "never ascribe to malice what can be explained by incompetence." There is an enormous pressure on a very complex system, and it grows every week, month and year with the growth in the national debt. We are in unchartered territory, people make mistakes - particularly with complex systems under enormous pressure - and there is not one part of what has happened that can't be legitimately explained as an accident or well-intended action. One could even say that such an accident was almost inevitable at some point.

On the other hand, what should be wildly speculative conspiracy theory - isn't. Former New York Fed president William Dudley did quite publicly issue the provocative and unprecedented call for Fed officials to prevent the reelection of Trump that he did, 3 weeks before the mistakes by his former staff helped to create a major crisis out of nowhere. Indeed, as we will explore later in this analysis, if the senior career staff executing monetary policy and understanding that complex system, wanted to bring that system (and the economy) down from the inside without the knowledge and consent of the current Federal Reserve presidents and governors, then three of the most critical places to strike - are three places where critical operational mistakes were made, during the week of September 16th in particular. That is of course not definitive, but it is one part of a series of interesting coincidences.

What both alternatives have in common - is that neither one of them should exist. In a normal, healthy economy and financial system, execution errors by senior staff should be of minor and fleeting consequence. The big decisions are made by the Federal Open Market Committee, and if there is a screw-up at the staff level it could maybe lead to some issues for a week or even a month - but there shouldn't be any lasting impact on the economy, retirement account values, home values or a presidential election. The idea that career staffers could secretly do something that could bring down a robustly healthy economy or determine an election should be ludicrous under normal circumstances.

The underlying problem is that the Fed's complex system for enabling the rapid growth of the national debt while keeping interest rates very low, is under increasingly acute pressure as the debt grows, and this introduces an element of fragility to the financial system (and the economy) that shouldn't be there.

It is this fragility that sets up this deeply abnormal situation where staff level mistakes - whether accidental or intentional - could actually materially change the direction of the markets and economy, and thereby potentially determine the results of a presidential election.

It is this fragility that is the true cost of the $23 trillion national debt for the average American, particularly when it comes to the currently elevated values of their retirement accounts and homes. The rapid growth in the national debt is not some theoretical or purely political issue, and the danger isn't just some potential default or bout of hyperinflation off in the distant future.

Right now, the Federal Reserve is on a weekly basis effectively creating 90% of the money to fund the government's deficit spending in the emergency attempt to contain crisis - and if it fails, the value of the retirement accounts and homes of the nation could be in grave peril within the coming year. And even if the Fed succeeds this time around, the problem will still be there, the pressure will continue to grow, and the system will grow ever more fragile so long as the national debt continues to soar.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

A Series Of Events

1. William Dudley was President of the Federal Reserve Bank of New York from January 27th, 2009 through June 18th, 2018. Dudley was appointed by President Obama, in his first week in office, which would seem to indicate that this was considered a politically vital appointment.

It should be noted that while there are twelve regional Federal Reserve Banks, they are not equal in their powers. Because the New York Fed implements open market operations while regulating Wall Street itself, it has a disproportionate degree of power, and the President of the New York Fed is widely considered the second most powerful person in the Federal Reserve, after only the Chairman.

2. On August 27th, 2019, Dudley wrote an editorial in Bloomberg, link below, saying that for the good of the nation, the Federal Reserve should refuse to enable President Trump, or try to prevent the damage from the trade war from harming the economy. He explicitly called for the Fed to make decisions on a political basis, saying that being apolitical was now untenable.

"I understand and support Fed officials’ desire to remain apolitical. But Trump’s ongoing attacks on Powell and on the institution have made that untenable."

Dudley closed his opinion piece with the extraordinary paragraph below, which seems to say that Trump is a threat to the U.S. & global economy, and therefore the correct monetary policy for Fed officials is for the Federal Reserve to treat the possibility of Trump's reelection as a threat, and to "consider how their decisions will affect the political outcome in 2020."

"There’s even an argument that the election itself falls within the Fed’s purview. After all, Trump’s reelection arguably presents a threat to the U.S. and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives. If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020."

https://www.bloomberg.com/opinion/articles/2019-08-27/the-fed-shouldn-t-enable-donald-trump

Note that Dudley didn't reference the Federal Reserve governors or presidents taking formal action, but simply for "Fed officials" to take this into account when making decisions.

3. Staff at the Federal Reserve made a major mistake, that was unprecedented in the post 2008 era. They were well aware that the Treasury planned to pull out more than $100 billion in cash from the financial system in a day on Monday, September 16th, which would reduce the liquidity in the system. However, they thought that there was $200 to $300 billion in extra liquidity in the system (per Morgan Stanley, via the Wall Street Journal), so they took no precautions.

4. On September 16th-17th, about 3 weeks after Dudley's advice to Fed officials, it turned out that a major mistake had been made, there was not plenty of excess liquidity to handle the payments to the Treasury, and in the repo market there was a shortage of funds available. On September 17th, rates spiked upwards from around 2% up to as high as little below 10% (very briefly), creating an emergency situation.

5. The initial attempt to create liquidity failed as a result of a staff mistake, an execution error, at the New York Fed, and repo loans had to be withdrawn, and then reoffered later that day, adding to the market turmoil.

6. There were a series of oversubscriptions in the following weeks as the Fed failed to provide sufficient liquidity to the market, and the cash they injected into the markets rose from $75 billion up to over $200 billion.

7. In October, the Federal Reserve reversed course, and began purchasing $60 billion per month in short term Treasury obligations with created money, thereby freeing the private market from doing so and helping to keep excess cash in the system.

8. On December 12th, the Fed announced plans to offer up to $415 billion in repo lending to get the banking system through the end of the year. In combination with Treasury obligation purchases, this took the total up to about $634 billion in commitments for funding, all using created money, and all either directly or indirectly funding the growth in the national debt.

9. In a separate and unusual move on December 12th, 2019, the Federal Reserve Bank of New York announced major senior management changes in their Markets and Financial Services groups, simultaneously naming three new Executive Vice Presidents to head key departments that actually implement financial and monetary operations.

The Hack & The Potential Damage

The above may sound a bit on the technical side for many people, and they may not see the implications for their own lives.

We live in a complex world, full of complex technology, complex systems and complex organizations. Because no one can understand everything, we must place trust in things that we don't fully understand - and this very much applies to the Federal Reserve, the economy, the national debt, the value of retirement accounts, the value of homes, and even the very nature and value of money itself.

To understand how a few technical mistakes at the New York Fed could indeed change all of our lives, we need to understand several interrelated issues.

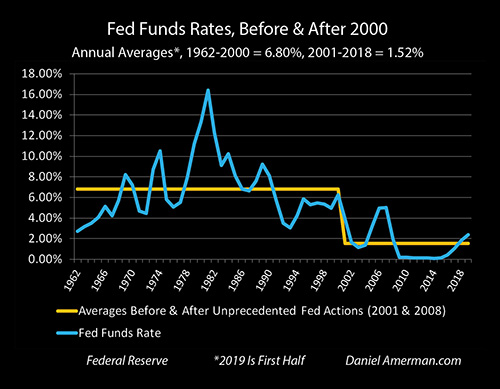

We have had very low interest rates for a number of years now, and this is particularly true of the time since the financial crisis of 2008. For seven years thereafter the Federal Reserve forced zero percent interest rates on the nation - in the attempt to contain the damage, and get the economy going again. Interest rates rose a little bit, but have consistently been far below historic averages, and have rapidly been forced back down by 0.75% since July, in the attempt to prevent a recession.

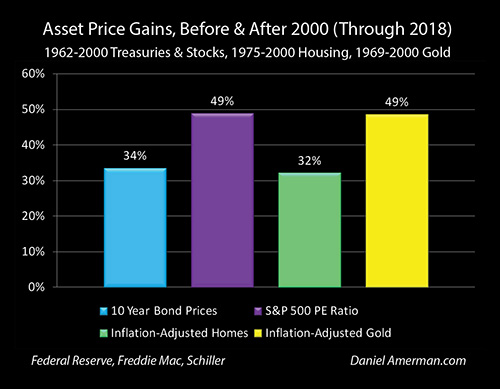

The above graph shows long term asset prices and valuations, and how the averages since 2000 are far higher than in previous decades. Inflation-adjusted home prices (for comparable homes) are up by 32%, the price that investors pay for each dollar of corporate earnings is up by 49%, and the price for a 10 year bond is up by 34%.

The graph just puts numbers on what most people are already quite well aware of - we currently have the highest home and stock prices in history. If we take stock prices, bond prices and real estate prices, then we also get most of the value of most retirement accounts.

What is understood by professionals in the area, but less so by the general public, is that the very low interest rates, and the very high asset prices are two sides of the same coin. The graphs above are from Chapter One (link here) from a free book that I have been writing, and what the book explores in much greater detail than can be covered in this one analysis, is how the Federal Reserve forcing interest rates to record lows has led to the highest retirement account values and home prices that the nation has seen.

The flip side of this relationship is that if interest rates should rise substantially - then home prices and retirement account values should plummet. And if interest rates stay higher - then there is no particular reason to expect a recovery. So a homeowner could be "underwater" for many years, with a house worth less than they paid for it. And a retirement account investor could spend a decade in retirement, without equity prices recovering to where they had been (in inflation-adjusted terms).

What could push up interest rates?

We have a rather enormous problem with the national debt, which has recently passed $23 trillion, and is now larger than the total U.S. economy. That is borrowed money, which has to come from somewhere, and interest payments have to be made on that debt. As I have written about extensively in the past, heavily indebted nations require very low interest rates, and the Federal Reserve creating very low interest rates has been the critical enabler that has allowed the U.S. national debt to grow as fast and as large as it has.

The dangerous part for the economy, retirement accounts and home values is not so much the outstanding national debt, but the deficits, the weekly, monthly and annual borrowing that the Federal government is doing to cover spending that is above tax collections. This is not at all theoretical, but is real cash at the time the government spends it, every bit as real as the money in your retirement account or checking account. Indeed, if you are a federal government employee or if your employer relies on dollars from the federal government to pay you, then your standard of living is to a large part supported by the Federal government pulling the cash out of the financial system to make your paycheck.

There is a fantastic degree of pressure that is building when it comes to the conflict between the very low interest rates that retirement account values, home values and the affordability of the national debt are all dependent upon, and what can be seen in the graph above of the official deficit projections from the Congressional Budget Office. We just had a trillion dollar deficit for the last year, and they are projected to continue for each and every year of the next ten years.

All that cash has to come out of the financial system and ultimately the U.S. economy (unless the debt is being monetized, i.e. being paid with created money, as has recently been the case).

In a market based financial system, steadily higher interest rates should have to be paid, which traditionally then acts a brake on deficit spending and the growth of the national debt. However, those materially higher interest rates would also crash the stock, bond and housing markets, while sending the economy into a potentially deep recession.

What stands between the higher interest rates that a federal government voraciously sucking cash out of the system should trigger, and the very low interest rates that the economy and markets currently depend upon - is the Federal Reserve standing in the middle, with its vast but little understood powers, in a complex process that involves creating trillions of dollars of new money (quantitative easing), to keep interest rates low, asset prices high, the economy holding together, and a rapidly expanding national debt funded at interest rates far lower than what rational investors would accept in a free market.

Most importantly - pressure is created at a rapid rate, with the rapid growth in the national debt. This can be thought of as a sort of ratcheting mechanism. Every week for the next ten years, on average, the federal government plans to pull another $20 billion in real cash out of the financial system, without paying a free market interest rate, which means that investors have to be forced to effectively fund the national debt at lower rates than they what they want. This is an unnatural process, and with each weekly ratchet, the difference between what works for the government and what works for investors grows, and so does the pressure on the complex systems deployed by the Fed that maintains an artificial stability.

This process has been underway for many years, and an extraordinary degree of pressure has already built up, even as the pressure continues to build with each year of trillion dollar deficits.

As the pressure has built, the chances for a mistake being made that would cause the Fed to lose control and the markets to crash has steadily built as will. As the pressure builds, the size of the needed mistake that would crash the markets steadily grows a bit smaller each month and each year, as the margin for error steadily shrinks.

As the pressure builds, if we assume what is supposed to be unthinkable - but is in fact a matter of publicly stated intent and desire - the less it would take for an insider who knows how the mechanism works and is in a place to do something about it, to subtly but deliberately sabotage the very complex mechanism in a way that could likely never be proven, or understood at all by the average voter.

Three Pins That Resist The Pressure & Hold Everything Together

When you come right down to it, what holds everything together right now underneath all the complexity of the ratcheting system is three fairly basic and closely related things: very low interest rates, confidence that the markets are running smoothly, and the market's confidence that the Federal Reserve has the situation completely under control. Should interest rates soar, then a trap door opens up, and the current very elevated values of the nation's stocks, bonds, retirement accounts and homes could all plunge downwards.

Should the markets lose confidence in the Federal Reserve's ability to maintain both financial stability and very low interest rates - then the way markets work is that they price in today what their expectations are for the future. And if confidence is lost on a widespread basis, that trap door can open up almost instantly, in a matter of hours, days or weeks.

A related but distinct problem with confidence is the lack of fear among market participants. If fear gets started - then it becomes self-fulfilling, and the fear of crisis causes an actual crisis. This can particularly be a problem with liquidity - the free cash floating around the system in search of an overnight home, and it has been the most dangerous part of many previous crises.

For months and years, there is lots of extra money floating around as lenders are eager to lend. Then one day something happens, a number of lenders get nervous at the same time, and they each decide to get cautious and stop lending. This was covered in more detail in Chapter 18 (link here), but a number of borrowers who were depending on the availability of the loans and had invested the money they had borrowed - all of a sudden find (as a group) that they are hundreds of billions of dollars short of the money they need to repay their overnight loans which are due later that same day. If they don't get the money they will default, only nobody is willing to lend it to them. Bam! Interest rates spike upwards as they frantically seek cash! Instant crisis!

Then seeing an actual crisis in process, the lenders get even more nervous, lend even less, and the crisis gets still worse. In some ways this could be likened to a form of a bank run - the classic source of banking system collapse. Money is borrowed from depositors and invested, too many people get nervous and demand their money back at the same time, enough money isn't there because it has been invested, the bank fails, and the doors of a previously healthy bank are locked that same day.

A version of this when the repo market locked up in 2008 was one of the key risks that nearly brought down the entire financial system, and the Federal Reserve had to create over $400 billion in a week to save the system, in the first use of quantitative easing in the United States. For the next eleven years, while there were some interesting spots for the professionals in the market, there were no emergencies in the repo market, and the Fed didn't have to intervene.

Then, the week of September 16th, 2019, something happened, the lenders fled, borrowers were in crisis, and the Federal Reserve would create $50 billion, then $75 billion, then $200 billion, and then by December of 2019 announced a willingness to create up to $415 billion in new money to lend it out in the repo market, thereby indirectly funding the growth of the U.S. national debt, and also preventing a potential deep crisis in the financial system.

So if we take the hypothetical case of someone who really, truly understands this complex system and its weaknesses - such as Dudley and his former staffers - and pose the question "how to bring it down with the least effort and in a way that can never be proven?", then a particularly effective answer would be a swift tap, tap directed against two of the vital pins that hold the whole complex mechanism together: the very low interest rates, and the market's confidence that the Federal Reserve has the situation completely under control.

Interestingly enough, the "mistakes" first manifested themselves as an enormous spike upwards in interest rates - from under 2% to almost 10%(ver briefly) - in the systemically important repurchase agreement market, and a series of awkward stumbles in execution that would make a person question whether the Federal Reserve had the situation under control at all. Tap, tap, going straight at two of the most important pins that were holding all the pressure back, or at least the two of the most important pins that could be accessed by senior staffers without the approval of the Federal Reserve Bank presidents and board of governors, and while maintaining plausible deniability.

The most important question however, is the origins of "something happened". This much is clear - a major mistake was made by the Fed. It got the numbers spectacularly wrong on the amount of excess liquidity in the system, and when the Treasury Department took out $100+ billion in cash to fund government spending - a crisis was set off. This crisis created the fear loop, lenders pulled back, borrowers needed help, the situation got worse, and the Fed kept increasing its interventions. Hopefully the Fed will reestablish control, but as of late December - the numbers were still climbing.

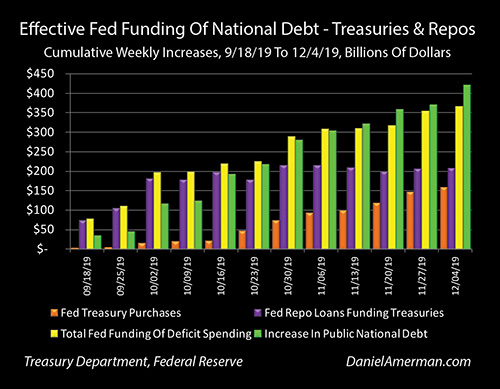

As the Federal Reserve struggles to get the situation under control, it has at least temporarily replaced its former complex and subtle system for making sure the deficits could be funded without raising interest rates, with a form of blunt force, as shown in the graph repeated above.

The Federal Reserve is effectively just creating the money to fund the government deficits, week by week, just taking the very low interest rates for itself, and not attempting to make private investors do that - in order to avoid risking failure. Indeed, what the Fed is doing by throwing so much newly created money at the markets - up to $634 billion in 16 weeks - is trying to make sure that no matter how fast the Treasury is pulling cash out of the system, there will be enough new free cash floating around that interest rates do not spike upwards.

So, does the striking of the two pins and the major mistake on the amount of liquidity in the system mean that this is necessarily deliberate? Absolutely not. As discussed in the beginning of this analysis, this can all be explained on an innocent basis. There is enormous pressure and complexity, this is unchartered territory, people screw up all the time, and the staff at the New York Fed could have been completely blindsided by the blowup of the repo market, and could have then found themselves over their heads, unable to keep up with events as they rapidly developed.

That said, if someone who actually understood how this very complex system works were to be writing a novel about it - or making an action plan -striking those two weak spots while setting a fear-based crisis in motion would be the absolutely perfect way to hit a system that was under great pressure, so that what still might (or might not) become an economic crisis would happen before the 2020 election instead of after. These would also be the exact places to strike if the plot (or the plan) required senior career staff to strike the blows, with plausible deniability and without the knowledge or consent of the current political appointees at the Federal Reserve who are supposed to control such matters.

The theory that underlies the Federal Reserve and our economic system is that because the president of the Federal Reserve Bank of New York is in charge of executing monetary policy, something which can change the economy and elections, that person is supposed to be scrupulously nonpartisan, entirely above the fray, acting only for the good of the entire nation.

For William Dudley to publicly destroy that mantle of nonpartisanship, and publish via Bloomberg a call for Fed officials to make decisions to affect the 2020 election with the goal of preventing the reelection of Trump, and then a mere three weeks later, after eleven years of relative calm in the repo markets with nothing like this happening, have his own former senior career staff make serious mistaken decisions that then triggered a massive repo market crisis - is an astonishing coincidence. Now, that doesn't prove that it isn't a coincidence, but the timing is... remarkable.

The Perfect Political Kill Shot

So why would a prominent but clearly partisan economist such as William Dudley advocate for Fed officials to use their power in a way that could change the election results? The reason is that it could be a perfect political "kill shot", something that could not only guarantee who wins in 2020, but that could change American politics for a generation or more.

Trump is running for reelection primarily on the strength of the economy and the markets. If the average voter in November of 2020 is looking at a raging national recession, widespread unemployment, devastating damage to their retirement accounts, and having lost a big chunk of their net worth with the plunge in home prices - how is that likely to impact the election?

Trump is only the starting point. The issue is that very few people fully understand what is discussed in this analysis. Oh, economists like William Dudley understand it perfectly well and what the consequences would be for the nation, but the average person? Not so much.

So let's say this or another sophisticated form of economic sabotage from the inside were to work. The average person would be facing devastating economic losses and possibly unemployment as well. They wouldn't actually know anything about where any of this came from, but they would know it was real, they would know it was awful and life changing, and wherever they turned, they would be continually told who did it to them.

If I might be allowed to hypothesize that the media would not be strictly neutral, but might actually have a preference as to who is President, then the average person would be told 24/7 via television, newspapers and social media just who is responsible for their pain and the destruction of their dreams. And it wouldn't just be Trump, but the senators and representatives who supported him, as well as his supporters in general.

In such a circumstance, with so much economic pain, and so much agreement as to the source, then something much bigger than just beating Trump becomes not only possible but downright likely. Control of the Presidency, the Senate, and the House, in a time of national economic emergency and with the claim of a mandate from the people for massive change.

A series of radical economic, tax and political changes like the nation has never seen could happen in months. Things that might seem improbable right now, could become quite possible in a time of national emergency, a mandate, and a lack of checks and balances.

What makes it the perfect political kill shot - is that almost nobody would ever know, particularly if control over the narrative is maintained. Most of the people whose lives, employment, financial security and standard of living were severely harmed by the deliberate sabotage would go to their graves blaming the wrong side, and being absolutely convinced that the source of their personal pain was Donald Trump.

Again - does the potential outcome prove that there was a deliberate strategy to make it happen? No, that can't be proven from this information, and it remains true that everything can be explained by the combination of complexity, pressure, and normal human errors.

However, if someone were writing a novel - or action plan - about how to use the little understood and supposedly nonpartisan Federal Reserve to take down a sitting President who is running based on a thriving economy, this would be a potentially quite effective means of doing so. It would be far more reliable than impeachment when it comes to not just to removing Trump, but to taking the Senate as well, with the accompanying vast potential increase in power when the Presidency, Senate and House are all controlled at the same time.

Whether the source is accidental or intentional, the price for the nation would be enormous either way. The consequences of what has been explored herein could be a life defining event, particularly for retirees and for those who are near to retirement, and this would apply regardless of their political affiliation.

The Personal But Universal Price For A Nation

There are very good reasons why the Federal Reserve is supposed to in theory be completely nonpartisan and above politics. Deliberately tilting the economy into a recession in a way that voters would not understand and thereby determining the results of a presidential election is arguably always within the capabilities of the Federal Reserve, although it should be much harder to do than it would be in our current circumstances of fragility, and should require the coordinated efforts of a majority of the voting members of the Federal Open Market Committee (FOMC) and not just a few senior staffers.

The issue with the weaponization of the Federal Reserve to win elections is that while it may have a political appeal to the party seeking power, the costs to the nation as a whole are enormous and they are bipartisan. A recession and potential market crash reaches out and hits everybody, it can hurt many millions of people, some of them quite badly, and it does not discriminate on the basis of political affiliation.

I do believe that there are people in the world who (if they had the power to do so) would without hesitation trigger a recession and crash the markets, if the "bad people" of the other side would be smashed into the ground and "their side" would come into power, with overwhelming control of the powers of the government. If they thought about the cost to the average person at all, they might say that a year of recession and a couple of down years in the markets would be totally worth it and for the good of the nation, so long as the awful people are thrown out, and the correct thinking people take control. (Based on his editorial this seems to be Dudley's rationale, even though he has to be fully aware of the costs.)

However, the risk is far more dangerous than an average recession and bear market, specifically because of the very factors that have created the fragility that makes some minor issues - how the Fed conducts operations on a given day or in a given week - able to potentially influence elections.

One source of extraordinary risk is what was previously explored - our current very low level of interest rates, and the resulting very elevated asset prices for stocks, bonds and homes. A fall from historically elevated asset prices is not a normal downturn or bear market - instead the damage could be far worse, it could be very long lasting, and it could change many millions of lives and standards of living.

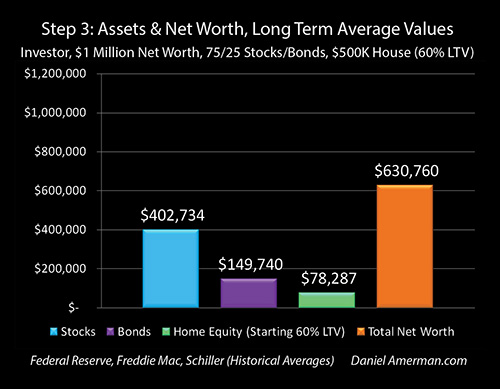

As an illustration in the analysis linked here, I set up a hypothetical investor, with a round number million dollar net worth, $800,000 in retirement accounts with a 75/25 stock/bond allocation, and a $500,000 house with a $300,000 mortgage. (The idea behind the even $1 million was to make it very easy to multiply and adapt for one's own situation.)

If we returned merely to long term averages, then the losses from today's very high asset prices are shown above, in Step 2. This would include about $200,000 in stock losses, $50,000 in bond losses, $120,000 in home losses, and a total loss in net worth of $370,000. (For someone with $500,000 in assets, it might be a $185,000 loss.)

When we start with today's record or near record stock, bond and home prices as shown in Step 1, subtract the losses associated with a mere regression to the mean or return to average as shown in Step 2, then we get what is shown in Step 3 above - what a round number net worth of $1 million today would be worth if we merely had average valuations (in inflation-adjusted terms). It would be down to about $630,000.

Let me suggest that if someone was planning on supporting themselves for potentially decades in retirement based on their retirement accounts and home values today, then a mere return to average could be quite life changing when it comes to their annual standard of living in retirement, as well as their financial security when it comes to handling unexpected expenses or health events.

It should also be noted that what is shown above is in no way a worst case scenario - because about half of long term history is of prices that are below the long term averages. So if a crisis were to hit our current historically high asset prices, then they might go well below what is shown above, and then hopefully recover over time. If the eventual recovery involved a return to long term average interest rates as well as to long term average valuations for stock PE ratios, bond prices and inflation-adjusted home prices, then the result would be Step 3 above.

Again, the fundamental conflicts and dangers are here anyway - the question is if what is underway now does become a full blown crisis that spreads into the stock and housing markets, as well as the economy itself.

It may not. Hopefully it will not. And the most interesting part of all, as explored in Chapter One and throughout the rest of the book that I'm currently still writing, is that there is a very good chance that if the Fed reestablishes full control, it will use still lower interest rates to achieve economic stability. And if that happens, those still lower interest rates in a stable economy could create still higher stock prices than today, possibly materially so, and the same is true for home prices.

The nation does not have elevated stock and home prices in spite of the unnaturally low interest rates that the Federal Reserve imposed to contain the financial crisis of 2008 - but specifically because of those artificially low interest rates. We have never had anything close to average interest rates since 2008 - and asset prices that are well above historic averages are the direct result.

Counterintuitive as it may seem - the containment of the problems with the national debt could lead to still higher stock and home prices. For a while.

However, that would just further increase the fundamental pressure, the clash between an even larger national debt, and even lower interest rates. This would make the system ever more fragile - and the stability of the value of retirement accounts and homes ever more fragile. If that path is the path ahead, then it would make much of the nation potentially very happy for a good while, even happier than they are today - until they weren't.

Providing Information, Not Conclusions

This is a very unusual analysis for me, and I struggled a bit in terms of whether to write it and release it. I'm a financial analyst, not a political analyst. I am well aware that I have plenty of readers from both parties, and I try to keep politics out of things.

Once again, I did not draw any firm conclusions. There are some fascinating and troubling things going on, but the only people who can know for sure are those insiders who participated in these events, or have other insider knowledge.

The first reason for my deciding to release this analysis is that politics and human nature are ultimately the most likely sources of what could break down this complex system that is coming under ever increasing pressure, and likely bring down today's highly elevated asset prices (at least in inflation-adjusted terms). This is true regardless of the specifics of the source of what is in process right now.

There are limitations to that very complex process, at least in its current form - but I doubt that those theoretical limits are ever reached. The bigger issue is that the larger the national debt gets, the greater the pressure, the more fragile the system becomes, and the more vulnerable it becomes to international geopolitics, international financial system risk, domestic political risk, and perhaps the biggest risk of all - human error. Or possibly, though hopefully not - malfeasance or sabotage if someone sees something to be gained in terms of a great deal of wealth, a great deal of political power, or both.

Hopefully, the current crisis will be contained, the economy will not crash, and neither will stock or home prices. But even if this desired outcome does happen, the growth in the debt over the next year will make the system that much more fragile, as will the growth in the national debt in the year after that. The greater the fragility of this highly complex system, the greater the exposure to political forces and human error, and the greater the exposure of the economy and the value of everyone's retirement accounts and homes.

My second reason for deciding to release this information is that this is such a complicated and specialized area that relatively few people understand how the parts fit together in terms of how this could have been done (if it was done), how it could determine the election results, and how it could end up being a determining factor when it comes to the standard of living in retirement that may in practice be experienced by many millions of people. As the result of many years of study and research in closely related areas - it happens that I do.

Something that just kept coming back to me as I was wrestling with whether to prepare and release this analysis, was that possessing this background professional knowledge was actually a quite separate thing from making the determination of what was believable or not when it comes to such things as motivations, coincidences and how politics works in general. It occurred to me that if I decided not to release, then I would effectively be making the decision for others, that none of those millions of people would have the information needed to make their own evaluations, about something that could be one of the most important political and financial events of their lives. That would be quite the presumption on my part! Maybe the better choice, given just how important this might be, was to just try to explain what I know and why it matters, give two fair alternatives, not draw any conclusions, and then let people make their own evaluations.

So, now you know. The rest, if anything at all, is up to you.

Learn more about the free book.

Daniel R. Amerman, CFA

This analysis contains the ideas and opinions of the author. It is a conceptual and educational exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. While the sources of information and the calculations are believed to be accurate, this is not guaranteed to be true. This educational overview is not intended to be used for trading purposes, those making investment decisions should do their own research and come to their own independent conclusions. This analysis does not constitute specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of the information contained in the analysis, either directly or indirectly, are expressly disclaimed by the author.

| Digg This Article

-- Published: Friday, 27 December 2019 | E-Mail | Print | Source: GoldSeek.com