-- Published: Friday, 10 January 2020 | Print | Disqus

- Rob Kirby

During the run-up to year end, the narrative being fed to the population by the Wall St./Fed crowd was that massive liquidity [cash] injections were required in the banking system to ensure there were no “accidents” over the “turn” of the year end calendar to 2020. We’ve all been treated to some pretty sophisticated technical explanations by Wall Street and Fed mavens about the intricicies and manutia of balance sheets and bazookas.

So what is the true nature of our global financial malaise?

Compound Interest and Debt

What the Fed is confronting is not unique or specific “squaring financial books” for the year end. The issue is much more systemic in nature and it stems from the very fact that irredeemable debt based fiat money systems with compound interest are unstable in their very design. Years ago, when this fact that keynesian monetary theory was fatally flawed and it was pointed out to the dispicable cad John Maynard Keynes [who lends his namesake to our failing monetary system], he shrugged and said, “so what, we’re all dead in the long run anyway”.

Well folks, welcome to the long run.

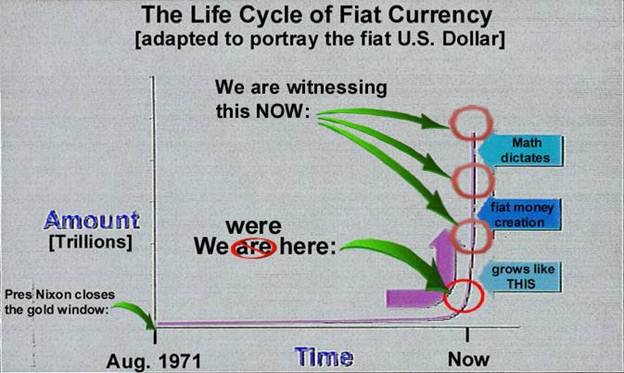

Outcome Guaranteed, Perpetual Money Growth

In an irredeemable debt based fiat monetary system there is no way to “reduce” money supply except bankruptcy or forgiveness [jubilee]. Empirically, these outcomes are avoided at all cost. The reason money supply must perpetually grow is as follows: when each new monetary unit is loaned into existence, the future interest due on the loan is not. For interest to be paid, this necessitates perpetual money growth to satisfy the payment of ever increasing interest due. As in nature, perpetual uncontrolled growth is referred to as cancer – which often kills the host. When money was redeemable in specie, debt money could be extinguished with an exchange for specie.

Cancerous Growth and Timing of Collapse

In monetary parlance, perpetual money growth is referred to as monetary debasement. When monetary debasement grows in an unbridled fashion, mathematics dictates that it metasticizes into hyper-inflation through dilutive destruction of the value of the currency unit. The destruction of the currency unit through hyper-inflation is manifested through parabolic [vertical] growth in money supply. This is the ultimate fate for ALL irredeemable debt based fiat money regimes with compound interest – bar none.

How the System “Buys Time”

In the chart below, the inflection point where money growth goes vertical is a mathematical certainty. So the ultimate outcome is not in question but “when” this inflection occurs can be delayed [not avoided] with lower interest rates. So now we know why the Exchange Stabilization Fund [ESF] engaged in trading hundreds upon hundreds of trillions in interest rate derivatives with the likes of J.P. Morgan, Citi, BofA, MS and Goldman Sachs in the wake of the financial crisis of 2008/9. Engaging in this trade made the banks captive buyers of US government debt; thereby, kicking the can down the road, so-to-speak, buying time for our failing fiat financial system by dramatically lowering rates. Some may have trouble believing that the system would go to these lengths to buys time. For those who feel that way I invite them to consider the following: summing up the thought of former US Treasury secretary Robert Rubin as he reveals the motivation or drivers of crisis management in the interaction between himself, Lawrence Summers, the ESF [exchange stabilization fund], the IMF and presumably the Maestro at the Fed – during the Clinton administration. On pages 290 - 291 of his book, In An Uncertain World, referencing the Brazilian financial crisis of the late 1990’s, Rubin outlines how very expensive “bad decisions” can buy time. Sometimes, he asserts, these bad decisions have a great deal of merit because they can,

“..Probably defer the impact of the collapse for six or eight months, and that will more than justify the effort.”

Ladies and gentlemen, players at the apex of power are demonstrably strong adherents of the addage, “live to play another day”.

Do Deficits Really Matter?

To say America spends money like “drunken sailors” is an understatement. America’s “official” national debt currently stands at 23.2 Trillion with roughly an additional Trillion being added to the debt pile every year. This amount represents $187,000 per taxpayer in the US. US federal tax revenue is currently 3.5 Trillion, so the official national debt amounts to almost 7 times revenue. All told, the data above paints a pretty bleak financial picture, or so one would think.

Despite the realities of the debt picture portrayed above, the thinkology of the most ardent of the Deep State looters would suggest otherwise. Remember folks, it was none other than Donald [let me hold your wallet] Rumsfeld who, on Sept, 10, 2001, curmudgenly proclaimed,

“According to some estimates we cannot track $2.3 Trillion in Transactions.”

Of course, shills in and for the mainstream make claims like this one,

“In 2001, Donald Rumsfeld said 'According to some estimates, we cannot track $2.3 trillion in transactions.' This has been misinterpreted by many people as $2.3 trillion actually going missing. However it's really just about the way the money was accounted for.”

In other words, the messaging coming from the mainstream is that there is nothing to see here, MOVE ALONG.

Coincidentally, or perhaps not, it was shortly after 9/11 – in 2002 that V.P. Richard “Penis” Cheney uttered to then Treasury Secretary, Paul H. O'Neill,

“that deficits don’t matter.”

Love him or hate him, the arrogant hubris that was uttered from the heartless one would seem to indicate that unfettered spending in the W. Bush administration was “no problem” – like they had a secret stash of wizardly cash they could rely on to “screw” anyone who opposed them.

Come to think of it, has America ever had to think twice about whether or not they could afford to invade the next country, have 9 nuclear aircraft carrier battle groups active in the world’s oceans or order the next generation weapons system??

And speaking of screwing the opposition, we should take pause and consider the manner in which “whistleblowers” are treated by the establishment – the ones who cannot account for things properly.

Not accounting for things properly has a very familiar ring to it in Federal American finance. As revealed by Catherine Austin Fitts, who’s securities firm Hamilton Securities had become a contractor to HUD,

“In 1999, under the direction of HUD Secretary Andrew Cuomo, HUD’s Inspector General refused to certify its own financial statements, as required by law, while admitting that $59 billion somehow disappeared. The explanation given was accounting systems failure, and the matter was dropped without investigation.”

Has a familiar ring to it, ehh?? Massive amounts of money “missing” – and no action taken - and the whistleblower Fitts, she has been deliberately poisoned more times than you can count on one hand, been subject to merciless, baseless legal threats by the DOJ [thank you Mr. Climate Change, Albert Gore], run off the road and had friends and associates threatened. Monkeys who don’t know how to “account for things” sure don’t play nice, ehh?

Sometime between now and then another notable development occurred. Since 1934, the President has had the ability to grant to companies a “waiver” excusing them from accurately reporting their true financial condition if it was deemed to be in the interest of National Security. Well, back in the spring of 2006, Business Week reported,

“President George W. Bush has bestowed on his intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006, that was opaque to the untrained eye.”

What this means folks, if institutions like J.P. Morgan, Citi, B of A, Goldman or Morgan Stanley are deemed to be integral to U.S. National Security ‐ can be "legally" excused from reporting their true financial condition – including KEEPING TWO SETS OF BOOKS.

The entry in the Federal Register is described as follows: The memo Bush signed on May 5, which was published seven days later in the Federal Register, had the unrevealing title "Assignment of Function Relating to Granting of Authority for Issuance of Certain Directives: Memorandum for the Director of National Intelligence." In the document, Bush addressed Negroponte, saying:

"I hereby assign to you the function of the President under section 13(b)(3)(A) of the Securities Exchange Act of 1934, as amended."

A trip to the statute books showed that the amended version of the 1934 act states that "with respect to matters concerning the national security of the United States," the President or the head of an Executive Branch agency may exempt companies from certain critical legal obligations.

These obligations include keeping accurate "books, records, and accounts" and maintaining "a system of internal accounting controls sufficient" to ensure the propriety of financial transactions and the preparation of financial statements in compliance with "generally accepted accounting principles."

This was the day that the keys to American finances were effectively handed over to the intelligence community, aka the Deep State. Since then, we have seen the arrogance of the Deep State grow with them acting like they can snub the constitution with impunity. Handing the reigns of America’s finances to the Deep State has only emboldened them [Mueller, Comey, Clapper, Holder, Brennan etc.] to act like God - and why not? Technically, any company or the federal government itself can be excused from accounting. In case anyone has forgotten, the Federal Reserve is no more “federal” than Federal Express – meaning it’s a company that assumedly could be excused from accurate financial reporting also – so how big is their balance sheet really??

Moving On, Because There Was Nothing to See There

There’s an old cliché, that generally speaking, people move on to bigger and better things [well, maybe not better, but at least bigger].

Apart from America being caught LYING about the sanctity of their sovereign gold reserves in yet another example of monetary buggery, we now come to the crème-de-la-crème – the Missing 21 Trillion.

Enter Dr. Mark Skidmore Ph.D. [Morris Chair in State and Local Government Finance and Policy] and his research staff at Michigan St. University – an expert with a specialty in public finance. Skidmore and Fitts teamed up and conducted a thorough examination of publicly available US federal financial books [from HUD and DOD] from the years 1998 – 2015. What they found was that there was US $21 Trillion in unsupported accounting adjustments in the books of these 2 federal government agencies.

Their findings were published at – https://missingmoney.solari.com/ in Sept. 2017 complete with links from their exhaustive report going back to the government’s raw financial data supporting their findings. In Dec. 2017 HUD and DOD took their raw financial data “off line” so the links to the raw data were no longer available – or so they thought.

In the spirit of “there’s nothing to see here” – Fitts and Skidmore archived all the pertinent government data and it is hosted on Fitts’ web site, Solari.com.

An audit of DOD ensued in 2018. Not surprisingly, they failed the audit.

In Oct. 2018, Financial Regulator FASAB [Financial Accounting Standards Advisory Board] introduced a new accounting standard – FASAB 56 which essentially “remade” federal accounting allowing the US Federal government to be excused from keeping accurate books [to literally keep two sets of books] in the name of “national security” [has a familiar ring to it, ehhh?].

So how much US Federal debt is being purchased by the ESF with “dark money” – not acknowledged to exist - and being “memory holed” to keep interest rates from rising and to kick the can down road yet again? Who can really say?

What we can say is this, ladies and gentlemen; US Federal financial books are now “legally” pure financial fiction.

American leadership would be wise to remember, the acts of Adolph Hitler in Germany were also “legal” under the Nazi regime in wartime Germany. The folks who administered justice at Nuremburg begged to differ.

If any of you feel enlightened or empowered by any of the information provided in this article – please subscribe, your help is needed and I appeal to anyone who is in a position to assist. The amount of time that goes into remaining current, researching and collating this information requires time and effort. This is information that the mainstream financial press will NEVER provide you. The alternative press needs your support.

Rob Kirby

| Digg This Article

-- Published: Friday, 10 January 2020 | E-Mail | Print | Source: GoldSeek.com