-- Published: Wednesday, 22 April 2020 | Print | Disqus

“The stone age didn’t end for lack of stone, and the oil age will end long before the world runs out of oil.”

—Sheik Ahmed Zaki Yamani, Saudi Arabian lawyer & politician, Minister of Oil & Mineral Resources 1962–1986, and a Minister of OPEC for 25 years; b. 1930

You may ask yourself

What is that beautiful house?

You may ask yourself

Where does that highway go to?

And you may ask yourself

Am I right? Am I wrong?

And you may say yourself

"My God! What have I done?"

Same as it ever was

Same as it ever was

Same as it ever was

- Talking Heads,

Once in a Lifetime,

Jerry Harrison, Brian Eno, Chris Franz, Tina Weymouth, David Byrne, 1980

“Ours is essentially a tragic age, so we refuse to take it tragically. The cataclysm has happened, we are among the ruins, we start to build up new little habitats, to have new little hopes. It is rather hard work: there is now no smooth road into the future: but we go round, or scramble over the obstacles. We’ve got to live, no matter how many skies have fallen.”

- D.H. Lawrence, Lady Chatterley’s Lover, 1928

How does one explain the unexplainable? April 20 will go down once again as a day of significance. Oil prices crash below zero. Oil prices hit an unimaginable level low of negative $40.32. Buy when there is blood on the street. How many firms will go bankrupt? Oil firms, hedge funds, more. Thousands more unemployed. A pandemic raging. How many margin calls will not be met? Will even Futures Commission Merchants survive? Is this even real?

Alert! Alert! Malfunction! Malfunction! Hal 9000: “I’m sorry Dave, I’m afraid I can’t do that.” – 2001: A Space Odyssey, 1968. We now have a completely malfunctioning society that is sure to get worse.

The world has been dependent on oil. Oil is the lifeblood of the industrial nations. It has become the major source of energy since the 1950s. It is the major underpinning of modern society, supplying energy to power industry, heat homes, provide fuel for vehicles and airplanes, and provide the basis of numerous products that would not exist without oil. It has driven our technology. It accounts for at least a third of all energy used by humans, and fossil fuels in general account for at least 85%.

WTI Oil

Source: www.tradingeconomics.com

If oil is the lifeblood of the industrial nations it is also the lifeblood for numerous countries. Oil is the key industry for a host of countries. Oil exports make up more than 50% of exports for the following countries: Iraq, Libya, Venezuela, Brunei, Kuwait, Azerbaijan, Sudan, Saudi Arabia, Nigeria, Oman, Kazakhstan, Russia, Iran, Colombia, Norway, UAE, Bahrain, Bolivia, Ecuador. Only Saudi Arabia and Russia are G20 members.

Oil makes up 20% or more of the following countries GDP: Iraq, Libya, Kuwait, Saudi Arabia, Oman and, not included on the other list, Republic of Congo. In the U.S., the oil and gas industry supports some 10 million jobs. In Canada, the oil industry supports directly and indirectly upwards of 800 thousand jobs, generates $14.1 billion in revenue, and accounts for over 10% of GDP. When it comes to combining exports, reserves, production plus consumption Venezuela, Saudi Arabia, Canada, Iran, and Iraq top the list.

The U.S. is the world’s biggest consumer of oil followed by China, Japan, Russia, and India. The U.S. used to be the world’s largest producer, lost the mantle, and then came back. Over the past few years, the world’s biggest producers are the U.S., Saudi Arabia, Russia, China, and Canada. In terms of reserves the leaders are Venezuela, Saudi Arabia, Canada, Iran, and Iraq.

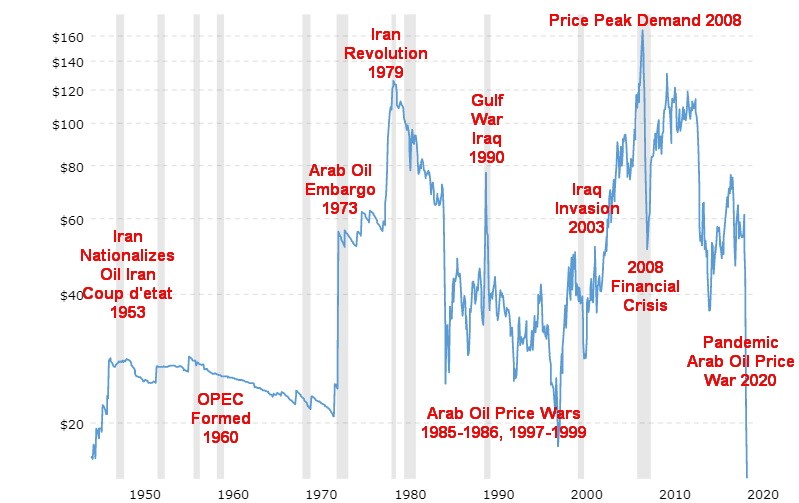

Oil is also the world’s biggest geopolitical commodity. The big price swings seen in the past 50 years have largely occurred because of wars, embargoes, and price wars. The Mid-East produces upwards of one third of the world’s oil. It is also the most unstable region in the world. The world’s largest proven reserves of oil are in Venezuela a country that has been undergoing years of instability. The pandemic struck and killed demand. Russia and Saudi Arabia could not agree on production cuts as Russia walked out. That created a supply glut. By the time they had declared truce oil prices had already fallen 60%.

All the oil produced a glut with a big chunk of it held in Cushing, Oklahoma. Except the tanks were full. Oil tankers lingered in the Atlantic. Some 76% of the world’s available oil was in storages that were already full. When the futures came no one wanted to take possession. Contracts had to be dumped at any price. And possession would occur at Cushing where the tanks were already overflowing. There is no more room in the tankers either. Tankers that normally rent for $20,000/day were now going for over 10X that amount.

So, with the price of oil falling to less than a glass of Kool Aid there are bound to be some dislocations. Rumours are circulating that a giant hedge fund is going under. Banks could be faced with huge losses because of bankruptcies and defaults. Oil companies could just disappear or, if they get lucky, get taken over, assuming they survive. Many will just cap their wells and leave town.

Storing oil has now become a better business than producing it. But if the coronavirus outbreak were to end and people get back to work, will that mean a resumption of demand? Maybe, but not necessarily. The coronavirus has merely exposed problems that were already there. It has exacerbated the problems.

But oil is not just WTI oil. WTI oil is known as West Texas Intermediate. It’s a specific grade. The other two are Brent and Dubai Crude. The global benchmark is Brent. And Brent is just under $20. Brent prices are used by most of the world. Still very low, definitely not negative. It was also no surprise to see WTI oil bounce back the next day. After all, once the rollover of the May contract is complete, then June becomes front month and that was last seen around $12. It fell roughly $8 over night. Could it too go negative come expiry? The U.S. is trying to help out by buying 75 million barrels to top up their strategic reserves.

The collapse in oil prices is throwing the U.S. dollar-pegs into turmoil. Ever since the Arab oil embargo in the 1970’s the U.S. dollar has been known as the Petro-dollar. Major countries that peg their currency to the U.S. dollar include Middle Eastern countries Saudi Arabia, Qatar, UAE, and Oman. Most of the Caribbean countries peg their currency to the U.S. dollar as do some Latin American countries like Ecuador. Countries have different reasons to peg to the U.S. dollar or, in the case of some African countries, they peg to the euro. They do it because it stabilizes their currency, given that a huge portion of their earnings are in U.S. dollars. This applies particularly to the Middle Eastern countries (oil exports) and the Caribbean countries (tourism).

But with their incomes collapsing because of the collapse of oil prices or, in the case of the Caribbean countries, that tourism has collapsed their currencies are starting to become “out of whack” with the U.S. dollar. With declining U.S. dollars earnings, they will have great difficulty in balancing budgets and maintaining, in many cases, extensive social support systems. This in turn could lead to destabilization and the potential for revolts.

There is blood on the street. And according to the old saying, it is the time to buy.

Below is a 70-year chart of oil highlighting the major events that sparked sharp price increases and sharp price declines. The pandemic price-war is merely the latest and won’t be the last. The world remains too dependent on oil and as a result it is held hostage by the large oil producers and geopolitical maneuvering.

Oil Price History (Inflation Adjusted) 1950-Present

Source: www.macrotrends.net

Copyright David Chapman, 2020

GLOSSARY

Trends

Daily – Short-term trend (For swing traders)

Weekly – Intermediate-term trend (For long-term trend followers)

Monthly – Long-term secular trend (For long-term trend followers)

Up – The trend is up.

Down – The trend is down

Neutral – Indicators are mostly neutral. A trend change might be in the offing.

Weak – The trend is still up or down but it is weakening. It is also a sign that the trend might change.

Topping – Indicators are suggesting that while the trend remains up there are considerable signs that suggest that the market is topping.

Bottoming – Indicators are suggesting that while the trend is down there are considerable signs that suggest that the market is bottoming.

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. We do not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be considered a solicitation of an offer or sale of any security. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. We share our ideas and opinions for informational and educational purposes only and expect the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor.

| Digg This Article

-- Published: Wednesday, 22 April 2020 | E-Mail | Print | Source: GoldSeek.com