-- Published: Monday, 4 May 2020 | Print | Disqus

By Keith Weiner

The price of gold dropped $29 and the price of silver dropped $0.27. We’ll get back to where we think the prices are likely to go in a bit.

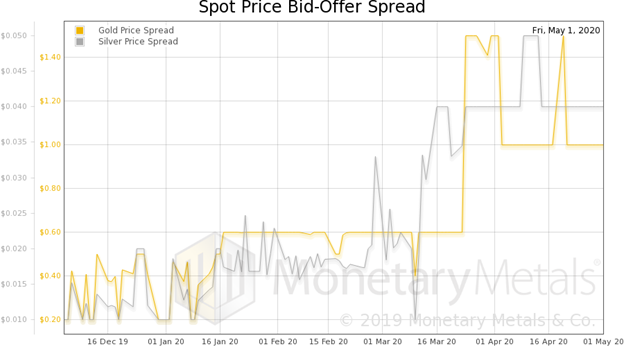

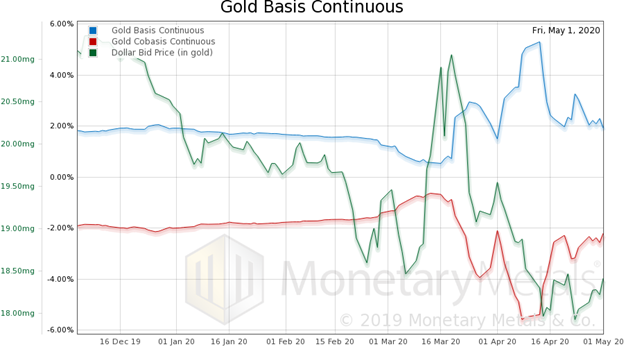

In recent Reports, we’ve looked at the elevated bid-ask spread in gold (though not nearly as elevated as some goldbugs would have you believe) and the elevated gold basis.

As an aside, we continue to see articles that get the high gold basis exactly backwards, the way John Maynard Keynes got commodity markets backwards. A high and rising basis is not a sign that anyone is worried about a shortage of metal, but of abundance.

Blowout in Spreads

Below is a graph of the spot price bid-offer spread in both gold and silver. Notice that, since April 3, the spread in gold is down significantly from its high (with one spike), though not back to its pre-2020 normal. Silver appears to have rolled over, but at $0.04 its bid-ask spread is still quite elevated.

Below is a graph of the gold basis continuous (the June contract shows the same thing).

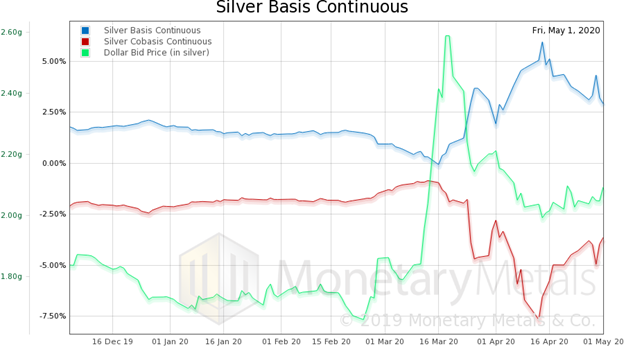

As with the bid-ask spread, the basis has come back down and is almost normal. Here is a graph of the silver basis continuous.

Like gold, the basis had become quite elevated. Like gold, the basis has come down. Unlike gold, the silver basis is still elevated, though not extraordinarily so anymore.

So, what does all this mean?

Dollar Supply and Demand

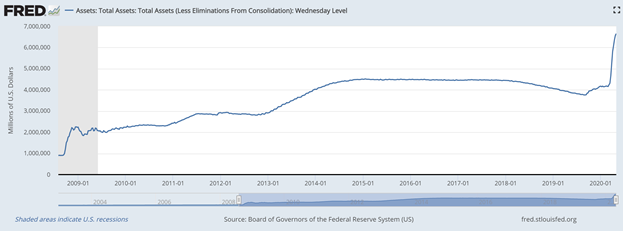

We think it means that the Fed’s massive asset-buying program has had its intended effect (it will have a number of other effects, as well). The Fed has bought about $2.5 trillion worth of bonds, which has grown its balance sheet by 60%. This is the stuff of madness. See the graph of the Fed’s assets below.

The change is greater than the Fed’s then-crazy buying frenzy in the wake of the last crisis, though smaller as a percentage of growth.

The intended effect is to take the pressure off the banks. Reduced contractionary pressures on bank balance sheets frees up the banks for profit-making and risk-free activities such as carrying gold.

The Fed will be able to get away with this for so long as gold bids on the dollar. And the high basis is proof that this bid is very strong for now.

We can think of two primary gold bidders on the dollar. One, likely short-lived, is the leveraged player who buys dollars in order to meet margin calls. Each drop in asset prices, whether in stocks, real estate, or elsewhere, forces some of them to liquidate whatever they can to raise dollar cash—which is often gold. The other, is a much larger group of people worldwide who are forced by economic circumstances to sell gold to buy food.

Those who would claim that the dollar can go poof in an instant—the moment that everyone loses faith in it—would do well to understand the desperate need for dollars of both the farmers and the eaters. Neither party is acting on faith, or for that matter, driven based on belief in the credit of the United States government. They are responding to the incentives with which they are presented: they want to keep their farms and fill their bellies, respectively.

So long as these dynamics continue, there will be a robust gold bid on the dollar.

NB: This is not to say that the price of gold need go down, the dynamics we described could occur with a dramatically rising gold price reaching new record highs over many years.

Gold as an Investment

Of course, there is the other side of the trade. A group of people is buying gold. Ignoring the speculators and momentum-chasers, as these groups have little effect on the long-term price trend, there is a logical reason for people to turn to gold as an investment.

As an aside, gold is not an investment. People may say they are “investing in gold”, but if they are just buying gold to hold or wait for its price to rise, they are not investing at all. They are either speculating on the gold price, or they are opting out of investment. That’s what it means to hold money: to not invest (those who invest in Monetary Metals gold leases or gold bonds are earning gold interest and can be properly said to be gold investing, like dollar investing but with principal and interest repaid in gold).

There are two reasons why people are turning to gold now, more than ever.

Why gold, why now?

One, by our count, the baseline deficit before the virus was $1.7 trillion. Then, the CARES Act pus its follow-on added $2.3 + $0.5 trillion. Finally, tax revenues have dropped substantially—let’s assume by $1 trillion. The U.S. government is now sinking deeper into debt at a rate of at least $5.5 trillion a year (we say “at least” because it seems likely there will be another stimulus/bailout bill).

Do you want to be a creditor to Uncle Sam?

Everyone who holds a dollar balance is a creditor. Investing in gold or gold investing are the ways to opt out.

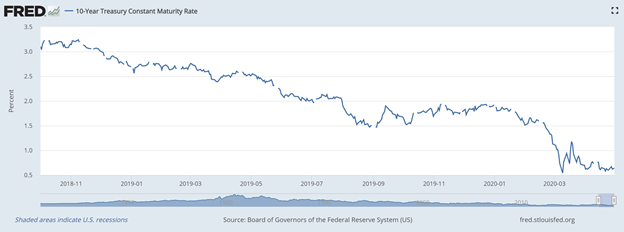

The other reason is that the interest rate has collapsed. In Fall of 2018, the interest rate on the 10-year Treasury bond was 3.2%. As recently as January, that interest rate was 1.9%. But, by March 9, it had fallen to 0.5%, and since then has been bouncing along the floor. See the graph of Treasury yields below.

At 3.2%, many people felt a strong incentive to lend to the U.S. government. In addition to the yield, there were certain capital gains to come. But, now, at 0.5%, there is hardly any yield and little expectation of a capital gain.

At the same time that the risk of lending to the government is rising rapidly, the return has been taken away. No wonder people invest in gold.

As we do not predict any end to either skyrocketing debt or collapsing interest rates, we therefore do not predict any end to demand for gold investing (and hence our own products).

This leads to the question of silver and the gold-silver ratio of 114:1. This number is literally off the historical charts. In other words, silver is very cheap when measured in money (i.e., gold).

There are two schools of thought here.

One, silver is being de-monetized by the market (government has no power to decide what is money, any more than it has the power to decide what is gravity). If silver isn’t money, then we would expect silver mining to cease, and the vast hoard accumulated over thousands of years of human history would be consumed. In the end, there would be no more buffer of silver than of palladium or copper. The price during this period of dishoarding and consumption would necessarily be low.

The other school holds that silver may be temporarily out of favor and/or many of the people who traditionally invest in silver are under greater financial pressure than those who invest in gold. If this view is correct, then at some point, look to arbitragers to trade some of their gold for large amounts of silver.

We adhere to the second view.

Commodity Prices Less than Zero

We wrote about negative crude oil prices recently. Now, we have read that, due to closures at meat packing plants, companies like Tyson are slowing or stopping their buying. Farmers may be forced to destroy their animals.

Think about that. Alive, an animal incurs costs due to feed and labor. With no buyer, it is better to kill the mature animals (more are growing behind them) than to keep them alive. If there were a market to express prices, the price of such animals would be below zero.

The virus lockdown may not have provided the magic to make pigs fly. But it can cause something unprecedented: commodity prices below zero (and debunk the idea that a present good is always worth more than a future good—just look at the mess in the crude oil market, when a futures contract was worth over $20 but spot was -$38!)

© 2020 Monetary Metals

| Digg This Article

-- Published: Monday, 4 May 2020 | E-Mail | Print | Source: GoldSeek.com