-- Published: Sunday, 29 March 2020 | Print | Disqus

Chris Marchese

Chief Mining Analyst, GoldSeek & SilverSeek

Week Ended March-27, 2020

$AEM $AGI $BTC $CXB.TO $CG.TO $EGO $EDV.TO $EQX $FSM $HL $IAG $HL $LUG.TO $MUX $OGC.TO $PAAS $SSRM

Due to government mandated shutdowns of select businesses and in this case, mining, in response to the COVID-19 outbreak, there has been rather limited news flow except that related to temporarily suspending mining operations. It is important to note those companies which have temporarily placed operations on care and maintenance (C&M) will see cash outflows from those assets as C&M cost money. Strong balance sheets and available liquidity are imperative given the current market uncertainty.

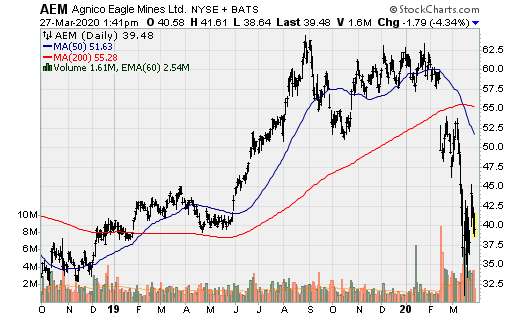

Agnico Eagle Mines: The company will ramp down its operations in the Abitibi region of Quebec including the LaRonde Complex, the Goldex mine and the 50% owned Canadian Malartic Mine (which also impacts Yamana, the 50% JV partner) until at least April 13, 2020. Each operation will be placed on C&M as instructed by the government of Quebec. Furthermore, the company will reduce activities at the Meliadine and Meadowbank in Nunavut. Yamana Gold will also be impacted by reduced operations at its Cerro Moro mine in Argentina.

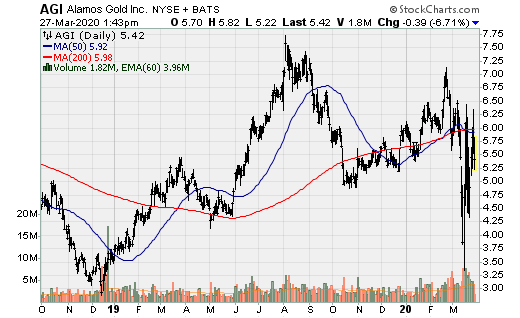

Alamos Gold: Announced a 14-day suspension of operation at its Island Gold operations, though its other Canadian operation, Young-Davidson have not been impacted. It has also implemented preventative measures across all operations including a required 14-day quarantine for any employee returning from out of country travel.

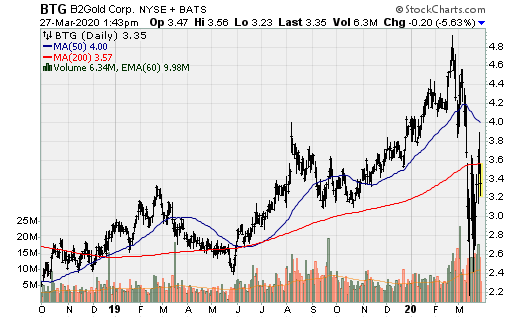

B2Gold: The company continues to operate its flagship asset, Fekola and Otjikoto, with a temporary suspension of mining but continued milling at its Masbate operation in the Philippines. Further, the company has suspended drilling at its Gramolate development project. The company has ample liquidity in the event of a prolonged shutdown of its operations.

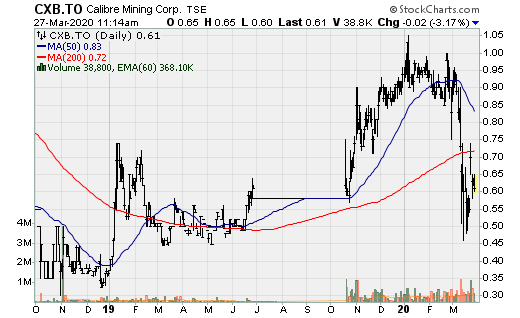

Calibre: The company is in the process of obtaining authorization to temporarily suspend operations at the El Limon and La Libertad operations in Nicaragua. B2Gold has agreed in principle to defer the payment of $10m (part of the acquisition payment of its operating assets) and the $5.5m working capital adjustment for a six-month period to April 15th, 2021. Calibre has a strong balance sheet relative to the size of its company with $33m in cash and equivalents at year end 2019.

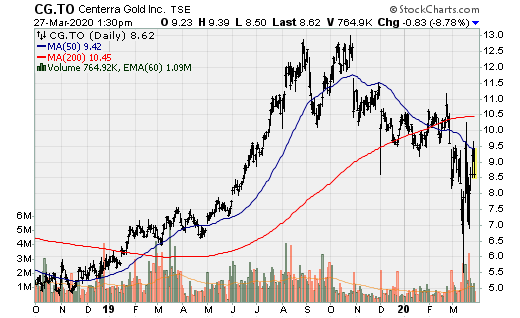

Centerra Gold: There has been both positive and negative news for the company since the start of the year, first recommencing operations at its Kumtor Mine in January and achieving first gold pour at the Oskut project on time and under budget. Kumtor is the company’s flagship operation and over the last 18-months, the company engaged in an aggressive exploration drilling campaign. The company announced an increase in gold M&I resource by 3.3m oz. to 6.3m oz. and an additional 1.2m oz. of inferred resource, now totaling 1.4m oz. On the other hand, another key operation, Mt. Milligan, has been problematic over the last two years with water issues, long-term recovery rates, mine life, etc. It recently released an updated resource estimate, which has essentially cut the mine life in half from 19-years to 9-years as reserves devreased by 2.3m oz. Au to 2.4m oz. and its M&I resource decreased 1.3m oz. to 1.4m oz. in addition to lower recovery rates. Further, forward looking production will be materially impacted, further reducing the value of this asset. Per the previous feasibility study, average annual payable production over the Life of mine was to be upwards of 240k oz. Au with material copper byproduct. In the new technical report, average annual production is estimated to be roughly 160-165k oz. Au. Not only is this big blow to Centerra but to Royal Gold as well. In fact, Royal Gold will likely be more negatively impacted. Royal Gold’s largest and most valuable asset was a 35% gold stream and an 18.75% copper stream on Mt. Milligan, which accounted for approx. 35% of its Net Asset Value and 30% of annual attributable production.

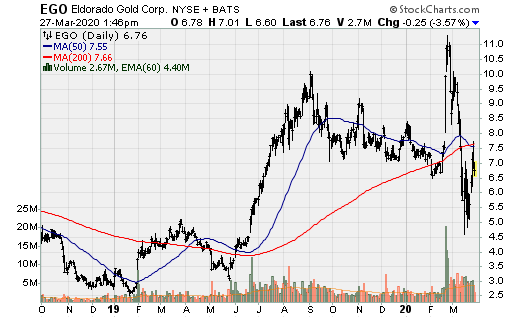

Eldorado Gold: Is ramping down operations at its Lamaque until at least April 13th, 2020.

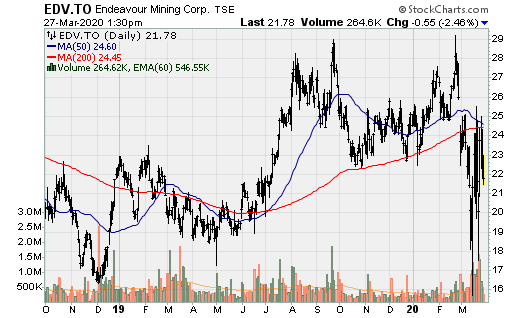

Endeavour Mining: After it was unable to come to agreement with Centamin Egypt on an acquisition price that was mutually acceptable, the company wasted little time adding to its arsenal of assets through the acquisition of Semafo, which will propel it to become a 1m oz. producer. Endeavour already was the leading West African Producer but this move definitely solidifies its position, which should remain the case for the foreseeable future. Through an all-stock transaction, the implied equity value is C$1B (US$720m +/-), a 27.2% premium on the 20-day weighted average price for both companies. Following the close of the acquisition existing Endeavour and Semafo shareholders will own 70% and 30% of the combined company.

This deal serves to significantly increase operating cash flow through the addition of two operating mines (+335k oz. p.a.) and two advanced stage development projects, giving the combined company a deep pipeline of 4 development projects. It also further diversifies Endeavour’s asset base with 6 producing mines and will ensure Endeavour’s currently outstanding convertible note is paid down, reducing future dilution.

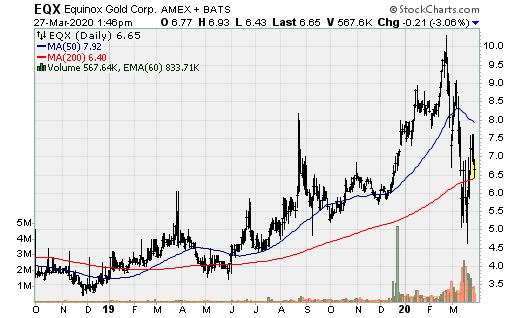

Equinox Gold: Due to local government restrictions, the company has temporarily suspended mining activities for 15 days at the RDM operation in Minas Gerais State, Brazil for an initial period of 15-days. Milling operations will continue to operate and process lower-grade stockpiles until restrictions are lifted. Equinox is properly financed and has huge backing by founder and chairman Ross Beaty so in the event the majority of its operations are impacted for any prolonged period of time, he would certainly inject money into the company. That is very unlikely as Equinox has a total of 4 operating mines in Brazil, a large mine complex in Mexico in Los Filos with underground and open-pit operations, and an operating mine in California.

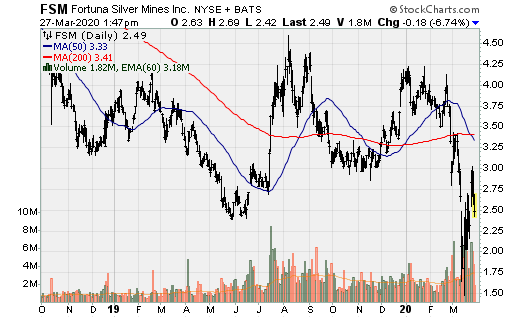

Fortuna: The company is running into various obstacles beginning with increase in the capital costs at its Lindero development project (initial capital requirements have been increased several times), which will be even higher as the company announced the temporary suspension of activities (though the degree to which is not yet known). Currently this shutdown will be effective until at least through the end of March. Peru mandated a 15-day period of national “social isolation” which caused its Caylloma operation to continue to operate but only with essential personnel. While operations will continue by drawing ore from its 30-day coarse stockpile, it is unknown whether this operation can remain cash flow positive given the recent sell-off in silver and more notably, lead and zinc prices. Fortuna also published an updated reserve and resource estimate, which a decrease in reserves at both silver operations. Further, Fortuna will soon begin mining at Trinidad North, which is highlighted by narrower veins (company will need to change mining methods) with far more grade variability. It is looking like the days of producing >7.5m oz. Ag p.a. from San Jose are gone, at least for now.

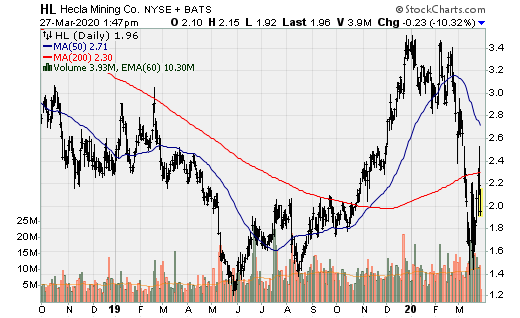

Hecla Mining: Has suspended operations at its Casa Berardi operation in Quebec until April 13th. With depressed silver prices for the time being, without Casa Berardi, the company will likely see some cash outflow should this circumstance prevail for more than 3 or 4 weeks.

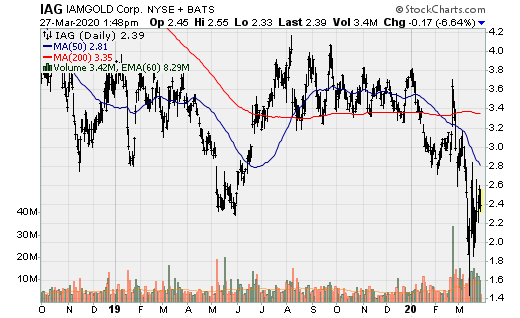

IAMGOLD: Has placed its Westwood gold mine on C&M in accordance with the government of Quebec and Ontario until at least April 13th, 2020. Its African operations continue to operate and IAMGold has proper liquidity to sustain a more prolonged shutdown of all operations with $830m in cash and an undrawn $500m credit facility.

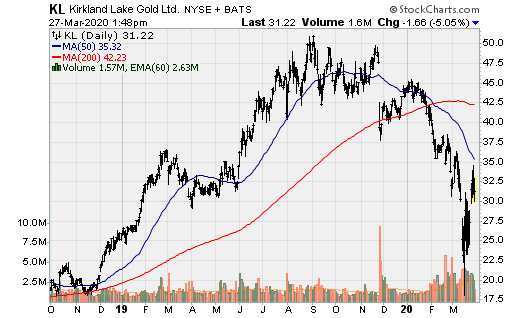

Kirkland Lake Gold: Announced a temporary reduction in operations at its recently acquired Detour Lake Mine until at least April 30th. The company also introduced initiatives to halt exploration activities across all of its assets and the suspension of non-essential work. Further, the company announced it will terminate its automatic share purchase plan. Kirkland Lake arguably has the strongest balance sheet relative to its size in the industry.

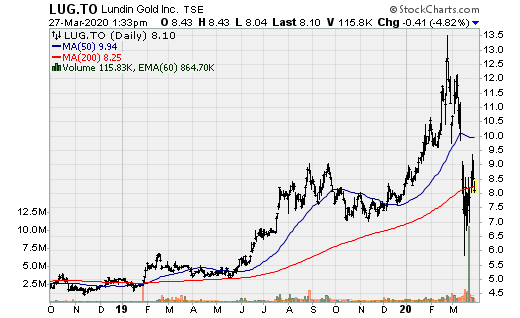

Lundin Gold: Temporarily suspended operations at its flagship asset, Fruta Del Norte in Ecuador. The company has adequate liquidity should the suspension last many more weeks or a couple months. In addition to the positive cash flow generation through the third week in March, the company had a year-end cash balance of $75m.

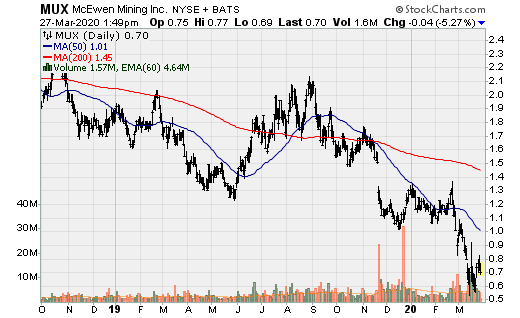

McEwen Mining: The company will scale down operations at its Black Fox and Gold Bar Mines for an initial 14-day periods beginning March 26th, 2020. The company has seen numerous operational issues over recent years, notably keeping costs under control and while its not the strongest company financially, having Rob McEwen as the largest shareholders will all but ensures any potential financial needs will be satisfied.

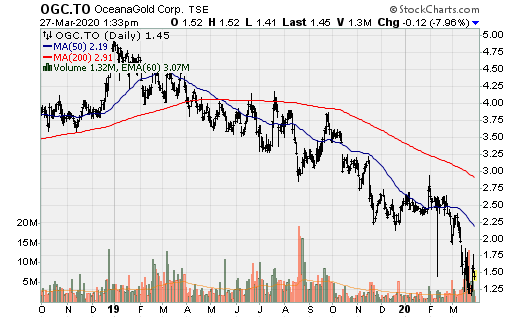

Oceana Gold: Temporarily suspended the on-going development of the Martha underground mine and go into C&M for the next four weeks.

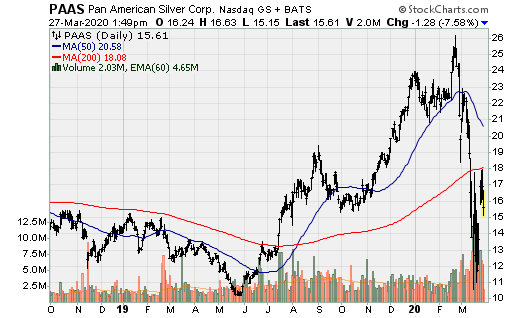

Pan-American: In addition to the 15-day shutdown of its gold and silver operations in Peru, the company announced it was temporarily suspending operations in Argentina and that it is suspending supply deliveries and personnel transport at its San Vicente operations in Bolivia to comply with the mandatory national quarantine that is stated to be in effect until at least March 31, 2020.

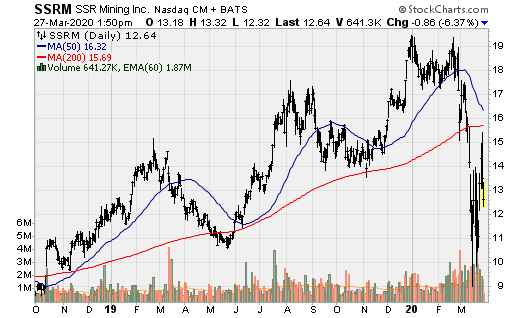

SSR Mining: Announced the temporary suspension of its Puna silver operations in Argentina through at least March 31st. It also announced it is undertaking a voluntary suspension of operations at its Seabee operations until at least April 30th, 2020. SSR has maintained a strong balance sheet and for the time being is still generating robust operating cash flow from its flagship asset, the Marigold mine in Nevada.

Chris Marchese for the Gold Seeker Report

Chief Mining Analyst at GoldSeek & SilverSeek

Chief Mining Analyst with GoldSeek and SilverSeek. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

| Digg This Article

-- Published: Sunday, 29 March 2020 | E-Mail | Print | Source: GoldSeek.com