-- Published: Thursday, 11 June 2020 | Print | Disqus

Chris Marchese

Chris Marchese

Chief Mining Analyst, GoldSeek & SilverSeek

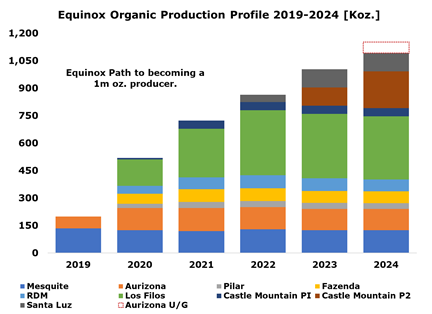

Equinox has been and currently is one of the premier mid-tier gold producers because of I) its people, management and BOD, most notably Chairman Ross Beaty, II) its assets: a nice portfolio of assets with material organic growth potential and significant exploration upside, III) its near and medium-term growth profile [which will see output increase from 200k oz. Au in 2019 to >1m oz. in 2023/2024], and iv) its diverse geopolitical exposure: Mexico, the U.S., and Brazil. Its reserve base is more or less spread equally across each country. While its valuation isn’t nearly as attractive as it was just 6 months ago, pullbacks in the stock price could make for some excellent entry points.

Ross Beaty, a serially successful entrepreneur, launched this gold vehicle at an ideal time, just a few years ago in 2017. He was going to build it via accretive acquisitions, improving the quality of the portfolio over time, much like that of then peers Leagold and Endeavour Mining. Equinox as it is known today was initially formed via a 3-way merger [Newcastle Gold, Trek Mining & Anfield Gold], providing the company with two near-term producing assets [Aurizona and Castle Mountain Phase I], began trading in late 2017, making it one of the newer gold producers. Shortly after the 3-way merger was completed, Equinox announced full scale construction activities at its Aurizona project in Brazil.

It has always had strong ownership, with management and insiders still holding approx. 10.6% of the company. At the time, through the aforementioned merger, Equinox announced the spin-out of its copper assets, creating Solaris Copper. It distributed 60% of Solaris Copper shares to then Equinox shareholders, with the remainder held by Equinox Gold. Solaris Copper is not publicly traded at this time but has an excellent portfolio of earlier stage exploration projects. Down the line, especially when copper is back in favor, this could unlock value for Equinox.

Equinox has had essentially constant positive news-flow from the day it started trading. In mid-2018, it released a very robust PFS for its Castle Mountain project. It is on pace to become a low-cost, long-lived asset of scale beginning in 2023, when Phase II reaches production. About 3 months later, on September 5th, 2018, Equinox bought the Mesquite Mine from a financially distressed New Gold on very attractive terms [$158m]. It has the added benefit of becoming the company’s first producing mine, with output of 125-135k oz. Au annually. In the 1H 2019, Aurizona poured first gold, becoming its second cash flowing assets, making the company a large junior producer/small mid-tier [250k +/- oz. p.a.]. Commercial production was then achieved in early July 2019.

Equinox then began trading on the NYSE, commenced Phase I construction at Castle Mountain, and made a transformational at-the market acquisition of peer Leagold, expanding its presence to a third country, Mexico. This acquisition added what is its largest asset as well as two moderately sized producing assets, one quality development asset, and one small, high-cost producing mine in Brazil. It also gave Equinox the asset base to become a 1m oz. producer within a 5yr period, which was its objective since the company was formed. Typically, when one company acquires another it either trades down or flat before the deal closes. Equinox appreciated in price as the market recognized the value creation of the combination.

Equinox refinanced its existing debt facilities, improved its balance sheet through private investments, cash inflow from the exercise of warrants and rapidly growing cash flow in the face of substantially higher gold prices. The company has been impacted very little by the CV19 pandemic as it had to temporarily shutdown two smaller mines in Brazil for a brief time and suspended mining operations at Los Filos for 8 weeks but the mine continued to produce from the leach pads albeit at lower rates. The company is fully funded to bring all of its growth projects online with a cash position at May 31st, 2020 in excess of $480m.

Equinox’s share price has run up nicely and was lucky in that it fared very well during the CV19 pandemic. Not only is Equinox run by a very capable management team and has strong ownership but it has the added benefit of embarking on a prolonged and substantial growth spurt from 2020-2024/2025. It’s not just growth but high-quality growth in that its five advanced growth projects and expansions will lower company-wide all-in sustaining costs. But Equinox may not be done here as it has made it known it would look to engage in additional M&A, should the right company or asset present itself. Ross Beaty has publicly said he’d be willing to invest up to $500m in support of the company’s growth objective. This was said prior to the Leagold deal, in which Ross Beaty invested an additional $40m. It is excellent to know the company has the backing (financial and otherwise) of its chairman and the experience h. It has also been made clear it would either have to be a company or single asset that is producing or with near-term production.

The above chart presents a clear path toward Equinox’s initial goal of becoming a 1m oz. gold producer and described in a bit more detail:

- 2020: A partial year (almost 10 months) of production from the Leagold assets and roughly a quarter of production from Castle Mountain Phase I. Attributable production from Los Filos is projected to 145k oz. Au due to the timing of the close of the Leagold acquisition as well as operating a reduced capacity for two months due to CV19.

- 2021: Benefits from a full year of Leagold’s assets and no CV19 shutdown. It also includes a partial year of expanded higher output from Los Filos as the expansion project [+70k oz. from 2019] progresses and its first full year of Castle Mountain Phase I [+45k oz.].

- 2022: Growth driven by the Los Filos expansion [+150k oz. vs. 2019] and first production in the 2H from the Santa Luz development project [+40k oz.]. Production at Santa Luz could be achieved earlier given the short buildout period.

- 2023: Growth driven by a full year of production from Santa Lux [+100k oz. vs. 2021 and +60k oz. vs. 2022] and partial year production from Castle Mountain Phase II [+100k oz.]

- 2024: Growth driven by first full year of production from Castle Mountain Phase II [+200k oz. vs. 2022 and +85k oz. vs 2023]. There is optionality in the Aurizona underground mine, though the timeline to production is unclear. If in operation in 2024 it would add +60-65k oz. to production, though this could be increased upon further successful drilling.

Cornerstone Assets: All of Equinox Gold’s cornerstone assets have significant exploration upside, which will lead to mine life extensions and potentially increased output.

Castle Mountain (US - California, 2-Phase Development Project): Equinox’s portfolio has excellent diversification in three mining friendly countries. It has two projects in California, one of which is Castle Mountain [which pushed the border of state line between California and Nevada], a cornerstone asset for the company. It commenced construction of Phase I last year and as of the end of May 2020, is 75% complete, with first production expected in late Q3. Phase I will add little to the company’s production profile, with 40-50k oz. Au over the first 3yrs with AISC of $950-$1,000/oz and just 5-10k oz. Au in 2020.

Phase I isn’t the primary aspect of Castle Mountain as the company is on track to complete a feasibility study this year and make a production decision for Phase II construction. Construction is anticipated to commence in 2021 and be completed in 2023. Phase II will increase production by an additional 203k oz. Au over an initial 12-yr mine life with AISC of $765/oz. In other words, once fully ramped up in 2024, Castle Mountain will add just over 200k oz. of annual low-cost production with plenty of opportunities to extend the mine life and/or increase annual output. The capital costs are very reasonable with $58m of initial capital investment for Phase I, followed by an additional $175m + mining fleet for Phase II. Phase II will also have AISC that is roughly $200/oz. less relative to that in Phase I.

There is plenty of exploration upside, if only the company converts a reasonable amount of M&I and Inferred resources. Excluding exploration targets, there is an additional 770k oz. of M& I resources and a staggering 2.2m oz. Inferred.

Reserves and Resources: 2P Reserves: 3.563m oz. @ 0.56 g/t Au, M&I Resources (Exclusive of Reserves): 770k oz. Au @ 0.56 g/t Au, Inferred Resources: 2.21m oz. @ 0.40 g/t Au

Los Filos (Mexico, producing – Undergoing a significant expansion): The anchor asset in the Leagold acquisition was the producing Los Filos operation of scale [180-200k oz. of annual production]. But when Leagold acquired Los Filos from Goldcorp a couple years ago, there was significant upside in place with the Bermejal underground mine and the Guadalupe open-pit, to complement the Los Filos underground mine and Los Filos and Bermejal open-pit mines. The company, now Equinox has undertaken and fast tracked the $215m expansion, which will increase output to 330-360k oz. Au annually at AISC between $800-$850/oz. This expansion includes development of the two aforementioned mines and a new Carbon-in-leach (CIL) plant to process high-grade ore.

Based on its current reserve base of 4.5m oz, the project has a current mine life of 10yrs. I fully expect the mine life to be extended, especially at its underground mines [Los Filos and Bermejal], successful exploration drilling and/or the acquisition of additional properties in the prolific Guerrero Green Belt (GGB). One asset that comes to mind is Alio Gold’s nearby [soon to be Argonaut’s] Ana Paula project, which could serve as a standalone mine or be a source of additional feed. There are also several other exciting prospects in the area. Equinox will begin seeing higher gold production in 2021, though it won’t approach 350k oz. Au until 2022.

Like Castle Mountain, excluding exploration drilling, the company can greatly increase reserves through the conversion of just some of M&I and Inferred resources.

Reserves and Resources: 2P Reserves: 4.39m oz. @ 1.31 g/t Au, M&I Resources (exclusive of reserves): 5.38m oz. @ 0.93 g/t Au, and Inferred Resources: 2.63m oz. @ 0.83 g/t Au.

Aurizona (Brazil, producing w/underground potential): Prior to the Leagold acquisition, which added Los Filos, Aurizona was the asset that was and still is understood in terms of exploration upside and having district scale potential). There is clearly robust exploration upside as the previous operator, Luna Gold, had grown the resource (all categories) pushing 5m oz. Au. [2.36m oz. in reserves, 1.3m oz. in M&I, and 1m oz. Inferred]. This was with very little of the property explored. Equinox hasn’t yet engaged in aggressive exploration as its doesn’t have to for another couple of years and it has more pressing issues with the Los Filos expansion, building Castle Mountain, and Santa Luz]. The company’s near-term focus is on advancing the Aurizona underground and additional drilling. The previous operator didn’t initially understand the orebody, thinking it had more saprolite, which is soft, compared to the harder ore Equinox is now processing via heap leach and carbon-in-pulp (CIP) plant.

The current operation is small with a short initial mine life (6yrs from the start of 2020), producing an average of 125-130k oz. Au per annum at low LOM AISC of $850-900/oz. Production is projected to be lower in 2020 at 115-125k oz. Au with significantly higher AISC of $1,100-$1,150/oz. Costs will fall from 2021 onward. Equinox mostly replaced the depleted reserves from 2019 with 958k oz. in reserves. Equinox also released a PEA for an underground component which would be mined concurrently with the open-pit, and increases gold production by 740.5k oz. Au over a 10yr period [average annual payable output of 65-68k +/- oz. Au with AISC of $925/oz.]. Aside from the open-pit and underground component, Aurizona has additional M&I and Inferred resources of 1.2m oz. There isn’t an immediate need to engage in aggressive exploration at Aurizona and infill drilling will add mine life as resources are converted to reserves.

Equinox could easily extend the mine life at Aurizona through exploration at the numerous targets along strike on the Piaba and Piaba North Trend and underground at Tatajuba. With successful exploration efforts, production could be increased from the open-pit and underground, though that will take additional time. The land package is sizeable [1,100 sq. km’s].

Reserves and Resources: 2P Reserves: 958k oz. @ 1.51 g/t Au, M&I Resources (exclusive of reserves): 835k oz. @ 1.62 g/t Au, Inferred Resources: 1.10m oz. @ 1.98 g/t Au.

Tier II Assets:

Mesquite (Producing, California: US): In October 2018, Equinox acquired its first producing assets in Mesquite from New Gold as New Gold was financially over-extended, having too much debt on its books as well as on-going cost issues at its Rainy River mine (which aren’t as noticeable with higher gold prices). This was a nice accretive acquisition for $158m, and completed 6-7 months prior to the gold price breaking out of multi-year resistance at the $1,350/oz. level.

Mesquite is a straightforward open-pit heap leach operation and has been in production since 1985. Average annual production has been 120-140k oz. Au at AISC between $925-$1,000/oz. There is significant exploration upside and Mesquite is one of those operations that has never had and likely never will have a large reserve base, rather it keeps a 3-4yrs mine life, which has been continuously extended by a year or two with most updated resource estimates. For valuation purposes we will use a 6yr mine life, though it is likely to be in operation beyond that timeframe.

Reserves and Resources: 2P Reserves: 584k oz. @ 0.62 g/t Au, M&I Resources (exclusive of reserves): 450k oz. @ 0.57 g/t Au, and Inferred Resources: 349 oz. @ 0.46 g/t Au

Santa Luz (Development, Brazil): This past producing mine (operated by Yamana Gold) was shut down due to low recovery rates as the company didn’t understand the ore-body (attempting to process Ore via carbon in leach vs. Resin in leach). As such, this is a low-cap ex, moderately size mine which will fuel Equinox’s near-term growth [2022]. There is already substantial infrastructure in place, greatly reducing initial capital costs. There is also longer-term upside potential via an underground mine. Ore will be processed via Resin-in-leach (RIL). While not an especially large operation, it will add 11yrs of 100k oz. of annual production at reasonably low-cost (AISC of $856/oz.) for an initial capital investment of just $82m. The bulk of the capital costs will be a result of the installation of the RIL circuit. Recovery rates are far more improved at 84%.

Reserves and Resources: 2P Reserves: 1.26k oz. @ 1.39 g/t Au, M&I Resources (exclusive of reserves): 716k oz. @ 1.96 g/t Au, and Inferred Resources: 501 oz. @ 2.02 g/t Au

Smaller Operations:

Fazenda (Producing, Brazil): Another long-lived gold operation, having been in production for more than 40-yrs. Unlike Mesquite, this underground operation is being mined by retreat longitudinal open stoping with a 1.3mtpa CIL milling facility. This has also been an operation that doesn’t carry a long reserve life, rather a continuous 3-5yr mine life. This is of similar size, annual production wise to RDM, with average annual production of 60-75k oz. Au. AISC tends to range between $950-$1,025/oz. Going forward, should Equinox engage in additional M&A, it will likely choose to divest an asset or two, the most likely of course being the higher cost Pilar mine, but Fazenda isn’t out of the question either.

Reserves and Resources: 2P Reserves: 319k oz. @ 1.84 g/t Au, M&I Resources (exclusive of reserves): 239k oz. @ 2.30 g/t Au, Inferred Resources: 476 oz. @ 2.45 g/t Au

RDM (Producing, Brazil): This smaller asset should be a larger producer for the company but due to on-going water issues, it continually falls short of its potential. Nonetheless, it is a solid asset for the company. Production tends to range from 65-80k oz. Au p.a. with AISC of $925-$1,025/oz. in 2020.

Reserves and Resources: 2P Reserves: 789 oz. @ 0.99 g/t Au, M&I Resources (exclusive of reserves): 470k oz. @ 2.30 g/t Au, and Inferred Resources: 401 oz. @ 1.50 g/t Au

Pilar (Producing, Brazil): This small high-cost asset has significant exploration upside as it has 925k oz. Au of M&I resources exclusive of reserves and over 2m oz. Inferred, both significantly higher grade relative to that of reserves. Pilar’s average production has been 30-40k oz. p.a. with AISC of $1,200-$1,300/oz. Equinox is likely to divest this asset whether or not it engages in additional M&A. It may be waiting until gold moves higher near or past $2,000/oz. as that would Pilar much more profitable as margins would expand and it would therefore be able to divest it at a higher price.

Reserves and Resources: 2P Reserves: 266k oz. @ 1.18 g/t Au, M&I Resources (exclusive of reserves): 925k oz. @ 2.33 g/t Au, and Inferred Resources: 2,108 oz. @ 3.21 g/t Au.

Valuation Assumptions: Gold price deck of $1,625/oz. as well as a 1.25x NAV multiple. As the gold bull market progresses, the multiple should expand but at this time, its peer group is trading with an approximate 1.25x NAV multiple. The discount rate, across the board is 6.50%. A nearly fully diluted share count will be used for those securities that are in the money, including a 280m of equity settled notes held by Mubadala and Pacific Road as well as unlisted warrants and in the money options. Sandstorm Gold also holds a $9.9m note but this settled at the 20-day volume weighted average price (VWAP). While the cash position is currently $480m as of the end of May 2020, Pro-forma cash is used to account for the in the money warrants and options being exercised.

Aurizona will have an assumed 8yr mine life for the open-pit and a 10yr (per the most recent technical study) on the underground. Very little exploration upside it included. It is also assumed that RDM, Pilar, and Fazenda all have 5yr LOM and a 6yr LOM for Mesquite.

| Net Asset Value: $1,625/oz. Au @ 6.50% |

| Asset | NAV | NAVPS | 1.25x NAV |

| Aurizona | $640,156,309 | $2.17 | $2.83 |

| Castle Mountain | $754,021,794 | $2.56 | $3.33 |

| Los Filos | $1,103,651,458 | $3.75 | $4.87 |

| Santa Luz | $351,071,563 | $1.19 | $1.55 |

| RDM | $172,382,511 | $0.59 | $0.76 |

| Fazenda | $136,098,965 | $0.46 | $0.60 |

| Pilar | $39,399,338 | $0.13 | $0.17 |

| Other Expenses | ($124,786,654) | ($0.42) | ($0.42) |

| Debt | ($512,000,000) | ($1.74) | ($1.74) |

| Pro-Forma Cash | 543,153,750 | 1.84 | 1.84 |

| P/D shares Out | 294,569,230 |

| Total | $3,103,149,034 | $10.53 | $13.79 |

| NAV Sensitivity: Changes in Gold Price Vertical & Discount Rate Horizontal |

| $10.53 | 5.50% | 6.50% | 7.50% | 8.50% |

| $1,300 | $5.85 | $5.46 | $5.10 | $4.77 |

| $1,450 | $8.32 | $7.80 | $7.32 | $6.88 |

| $1,600 | $10.79 | $10.14 | $9.55 | $9.00 |

| $1,750 | $13.26 | $12.49 | $11.78 | $11.12 |

| $1,900 | $15.73 | $14.83 | $14.00 | $13.24 |

| $2,050 | $18.20 | $17.18 | $16.23 | $15.36 |

| $2,200 | $20.67 | $19.52 | $18.46 | $17.48 |

If you’re looking for material and high-quality growth in an intermediate gold producer, Equinox might be right up your ally. As previously mentioned, the company has everything necessary to create and unlock significant value for shareholders through the course of the gold bull market.

Chris Marchese for the Gold Seeker Report

Chief Mining Analyst at GoldSeek & SilverSeek

Chief Mining Analyst with GoldSeek and SilverSeek. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto. Fortuna Silver Mines is not a sponsor of this, or any other related, websites. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.

| Digg This Article

-- Published: Thursday, 11 June 2020 | E-Mail | Print | Source: GoldSeek.com