|

-- Posted Wednesday, 14 July 2010 | Digg This Article | | Source: GoldSeek.com | | Source: GoldSeek.com

Commercial Production, NYSE: AMEX, Dividends – Update: Gold Resource Corporation (GORO) made a significant announcement on July 1st by reaching commercial production. 1st year production is forecasted to be 70,000 ounces at a $200 cash cost. By year 3, production is projected to ramp up to 200,000 ounces gold equivalent (gold and silver) at a $0 cash cost, as base metals offset costs. The company continues to have an impressive share structure, with just under 50 million shares outstanding. The company has no debt and just announced application to list on NYSE: AMEX, which should open the company further up to new sources of investment capital. With the company now starting to produce strong cash flow and intending to distribute 1/3 of cash flow to investors in a form of dividends, investors continue to revalue the share price.

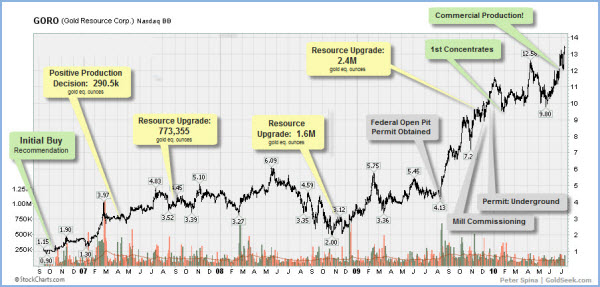

The chart above shows the share price since IPO in Q3 of 2006 along with some annotations of major milestones. Click on chart to enlarge. Give Me a Reason to Sell: Gold Resource Corporation has undoubtedly become a very successful investment for investors as the share price continues to hit new price records, easily attracting new investment capital. What has made this company so incredibly successful is what I see as a combination of talent, vision, experience, hard-work, an incredible mining asset and perhaps one of the most important aspects to investors, management which understands what investors want. And with management owning around 1/5th of the company, they are highly motivated investors-managers. Since meeting with management in 2006, the same principals-goals remain in place. Bring an ultra-low cost asset into production (done), minimizing shareholder dilution during the process (accomplished), and reward investors with a strong share price and through dividend distributions (completed, in progress and pending). That is what takes me to the question; give me a reason to sell! Gold Resource Corp. has successfully not only outperformed the gold price but outperformed the vast majority of public gold mining companies, from the explorers to juniors to seniors. Yet now in commercial production, continuing to expand the size of its resources, I find it difficult to sell at these levels and under current gold-market circumstances. So what is a share of GORO worth to me? When determining what a share of GORO could be worth, I take quite a few circumstances into consideration. Among them are: A mine life with around decade+ production (GORO is near this mark and expanding), resources increasing (significant upside through exploration – system is large and growing! Big upside through ongoing exploration), key shareholders, a quickly strengthening treasury, a growing production profile: 70,000 -> 200,000 gold eq. ounces, production costs reducing from an already low $200 to $0/ounce. With gold trading around $1,200 and silver around $18, and in my opinion heading higher by year’s end and significantly higher over the next 2-3 years, should GORO meet its objectives, we will see a significant cash flow generator. So with the current gold price, GORO should generate around $70 million in year one production cash flow (70k ounces at $200/ounce cost). Even applying a fully-diluted share structure (53M), I come up with $1.32 per share in operating positive cash flow. Producers with similar production profiles are seeing valuations with a 10-12+ operating cash flow expansion (I would contend that GORO should easily receive a premium when considering the ORE GRADES), which would produce $13.20-$15.84 a share valuation, but just based off initial production levels. But the real treat is as the underground mine comes into production, which saw accelerated development with Hochschild’s recent investments. Therefore reaching upwards of 200,000 gold equivalent ounces may come sooner. Using full production figures and the associated fall in production costs to $0+/-, we could see upwards of $1/4-billion in operational cash-flow per year. That translates into roughly $4.53 a share. Using relative valuation metrics, a 10-12+ operational cash-flow multiplier, that projects a valuation of just over $45-54/share. Plug in a $1,500 gold price scenario, then the valuation continues to move to even more impressive levels. When using other industry valuation models, I receive similar share price projections. On the risk side, one factor to consider is to see what if gold prices pulled back? With GORO’s large profit margin, say a $200 an ounce drop in gold to $1,000 an ounce (cash flow would fall to $3.77/share at full production) would not affect the profit margins to the degree a producer which requires $600 an ounce gold price to break even. In that scenario, GORO’s profit margin would decline 16.6% versus a 33.3% for the $600/ounce producer. Sure, there is more leverage for that risk, but that makes GORO a significantly safer investment in my view. Should gold drop to $600 an ounce, how many gold miners would be able to survive?

The Hochschild Factor When Hochschild (a mid-tier gold producer, major silver producer) entered as a strategic investor in late 2008, the development of GORO was about to successfully accelerate. Hochschild has historically focused on epithermal low sulphidation veins. So the investments into GORO seemed quite fitting. Not only has HOC done very well as an investor into GORO, they have provided another strong 3rd party validation of the asset and the company along with accelerating development of the asset. The agreement between GORO and HOC was to give HOC the opportunity to become a significant shareholder. The details of the arrangement includes a standstill through February 2011 in which HOC can increase its position in GORO up to 40% (at 40% they will have 2 of 5 board director seats). The other major component has been HOC was given right of first refusal to any financings until commercial production was successfully reached – which GORO announced entering on July 1st. In fact, with commercial production just about on a steady and successful level, it is unlikely GORO will need to finance going forward. They will have instead become focused on distributing profits back to shareholders.

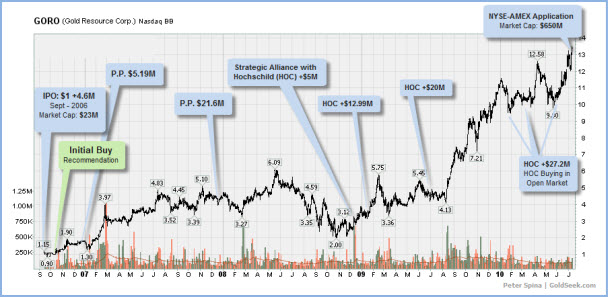

History of initial private placements and subsequent investments with GORO’s strategic investor – Hoschchild Mining (HOC). Also of note, GORO’s market cap has increased by 28 times since going IPO ($23 -> $650M). Click on chart to enlarge. With roughly $65 million in private placements made directly with GORO (with a current market value around $200M – HOC is up over 300%!) and just recently some purchases out of the open market, HOC now is approaching 30% equity interest in GORO. Therefore, now that GORO has been successfully funded to commercial production, the need for future financings appear quite slim, HOC will most likely need to continue to purchase shares out of the open market should it wish to reach the 40% mark. That means over 5 million shares would have to be purchased to reach that 40% level of ownership over the next several months. With GORO’s tight share structure and now as it enters into commercial production, combined with the record gold and near record silver prices, I see there being little chance of HOC being able to pick up that position size around these current prices. More realistically, they will have to see a significantly higher share price to convince shareholders like myself to shed off some shares or they will have to approach the next largest shareholders, management or other large funds. But it is my guess that they are in a similar position like many investors including myself. Under current conditions, GORO shares would have to be significantly higher to interest me. So it is likely that at minimum, HOC should have strong interest in GORO should there be a pullback, giving some stability to a correction and ability to accumulate a larger position. Then there is the other possibility that HOC will continue to increase its equity interest into GORO, continuing its open market purchases along with other investors. That could be a powerful force as well going forward as there seems to be an ever increasing appetite for GORO now as it continues to produce positive results. And if HOC decides to pause any further accumulation, they can be quite pleased of accelerating their own returns on their very successful investment into GORO. Conclusion In late 2006 I wrote that, “Gold Resource Corporation [OTCBB: GORO] is not a name most gold investors have heard of yet. With the IPO of Gold Resource Corp. back in mid-September at $1/share, one of the newest gold companies on the market has yet to receive the recognition it deserves. Time will change this as the company and its properties are noticed.” Nearly four years later, and despite being one of the most successful gold production stories, Gold Resource Corporation still has a limited profile even after reaching commercial production this past July 1 – the upside being there are a lot of potential investors who have yet to be introduced to GORO. Shareholders have little to complain about with GORO shares appreciating over 1,300% since its IPO in the 3rd quarter of 2006.

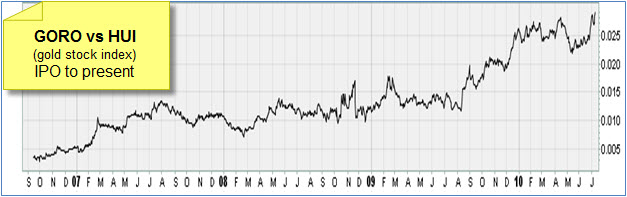

It’s all relative -- GORO versus Gold Stock Index (HUI). Shows GORO’s strong relative performance since IPO, a market leader. Example: Investors in GORO at IPO would have outperformed the HUI since Q3 2006 by a factor of roughly 700%. Beginning with a shareholder-friendly vision to become one of the world’s ultra-low cost gold producers, GORO has achieved this major milestone. This signals the next stage of the company’s evolution with the company now entering into a strong cash flow position; shareholders are likely to see substantial dividends. I view the current situation in GORO as one which could quickly revalue the company, share price over the coming months. I believe we have begun to see the initial start of this process over the past few weeks. That is why I continue to keep GORO as my largest investment holding and carrying on the belief from late 2007 in which I described GORO as “A Great Investment in a Great Bull Market!” Research Resources:  Website: http://www.goldresourcecorp.com/ Website: http://www.goldresourcecorp.com/

o News Releases: http://www.goldresourcecorp.com/news-releases.php o E-mail sign-up: http://www.goldresourcecorp.com/email-list.php  Contact the Company Directly: 303-320-7708 Contact the Company Directly: 303-320-7708

Reviews SEC Filings: http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=1160791 Reviews SEC Filings: http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=1160791

Quote: http://finance.yahoo.com/q?s=goro.ob Quote: http://finance.yahoo.com/q?s=goro.ob

Peter Spina's Free E-Mail List: www.GoldSeek.com/email Peter Spina's Free E-Mail List: www.GoldSeek.com/email

Additional Research & Reports by Peter Spina:

www.goldforecaster.com | www.silverforecaster.com

- Peter Spina, GoldSeek.com and GoldForecaster.com

Click here to download this report - PDF format. Disclosure, Conflict of Interest: I am long Gold Resource Corporation. The company is an advertiser on GoldSeek.com, which I am the President of. I have not been compensated to publish this report. I continue to be positively biased on GORO and have been since going public in 2006. These are my opinions and mine solely. I am not a registered investment advisor. I strongly urge you to do your own investment due diligence. I strongly urge you to research Gold Resource Corporation. Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold Forecaster - Global Watch / Julian D. W. Phillips / Peter Spina, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold Forecaster - Global Watch / Julian D. W. Phillips / Peter Spina make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold Forecaster - Global Watch / Julian D. W. Phillips / Peter Spina only and are subject to change without notice. Gold Forecaster - Global Watch / Julian D. W. Phillips / Peter Spina assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. Additional Disclosure: The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise outside of the trading timeframe listed above. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.

-- Posted Wednesday, 14 July 2010 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

Sign-Up for Free E-mail list: Peter Spina

Peter Spina's experience with the precious metal markets started back in the mid-1990s, which led to the creation of GoldSeek.com back in 1995. Today GoldSeek.com ranks in the top three most popular global gold websites and its sister site, SilverSeek.com ranks as the most visited silver website in the world. Back at the start of the new secular precious metals bull market, Peter established the technically-focused subscription newsletter, Gold Seeker Report, which at the start of 2005 was merged into the more comprehensive Gold Forecaster (goldforecaster.com) service. In addition to the newsletter and websites, Peter frequently appears in the media including MarketWatch, Reuters, and theStreet.com

Previous Articles by Peter Spina, GoldSeek.com

|