-- Posted Friday, 17 May 2013 | | Disqus

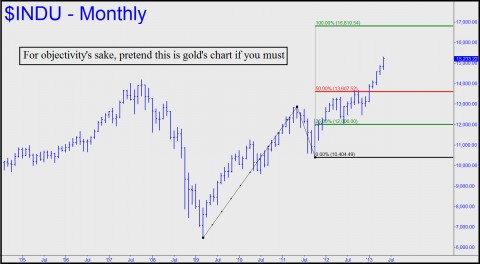

Based on the S&P 500’s brash behavior lately, effortlessly blowing past Hidden Pivot resistance points major and minor, we wrote here recently that the fuse could be lit for a 130-point explosion. That would be equivalent to a Dow move of about 1000 points – a spectacular surge, especially if it were to occur over a period of, not months but weeks. However, a coldly dispassionate look at the Dow’s monthly chart bolsters the case for an even bigger rally – a 1600-point moon shot. That would bring the Dow to exactly 16810, and although the target promises to be a great place to fade buyers, we’re not going to risk the farm on it. Nor do we plan on wasting our breath cursing bulls every inch of the way up. If they’re intent on pushing the blue chip average to nearly 17000, there’s no reason to fight the tape, especially since a pile of money could be made betting the pass line.

We are hardly alone. Some noted gurus have confidently been predicting Dow 20000 for some time. We would lump them together as publicity-seeking windbags who picked the number 20000 out of thin air simply because it sounds good. Wouldn’t you feel more comfortable buying into such a scenario when it has been endorsed by a forecaster who not only has a very precise target in mind, but who gets nauseated at the very thought that it might be achieved?

Too Bullish on Goldman

Some will say we’re throwing in the towel, but consider the facts. Although we’ve hated the stock market since the very first rally off 2009’s bottom at 6470, as traders we have played both the ups and downs of the move, profiting more from bullish positions than from bearish ones. Sometimes we have even been too bullish. A butterfly option spread we’d advised in Goldman, for example, is turning out to have been much too optimistic. But we never shunned the stock just because the firm is run, like the Government itself, by a bunch of sleazeballs, liars and thieves. Who cares, as long as we’re on the right side of the move whenever stocks are in motion? And it’s not as though we won’t be paying very close attention whenever the Dow approaches a potentially short-able rally-stopper (the first of which lies at 15543).

We’ll also admit to having obsessed at times over Hidden Pivot rally targets as though each had the potential to deliver the Mother of All Tops. As a result, we were generally too cautious about joining the buying stampede. And for good reason. Bulls seem to have abandoned common sense, seduced by an economic mirage that could end at any moment. Nor would the mirage become even the least bit more convincing if stocks were to continue to rampage.

So now we say: screw logic, reasoning and interpretation. Pretend instead that the Dow’s chart is Comex Gold’s, then see how it looks. In fact, the Dow’s chart says higher — much higher – and that is reason enough to suppress a gut feeling that it’s too late in the game to dive in. Contrarians who are convinced that our change of heart is the kiss of death for the stock market can fade us if they wish. But they should hold the guffaws for now. Just in case.

-- Posted Friday, 17 May 2013 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com