-- Published: Monday, 18 August 2014 | Print | Disqus

The wave of cash that flowed into U.S. Treasurys late last week should serve to remind us of the myriad ways investors can profit by betting on a rise in T-bonds prices and a corresponding decline in yields (details below). All it took to set these flows in motion on Friday was some unsettling news from Ukraine. What was the news? That’s the point. Whatever it was, it barely registered on a global-crisis scale so weary of horrifying headlines that no story, no matter how ugly, stays above the fold for more than a few days. Even so, the news from Ukraine was sufficient to coax idle cash from around the world into U.S. debt paper. Just imagine what would happen if a real crisis unfolded.

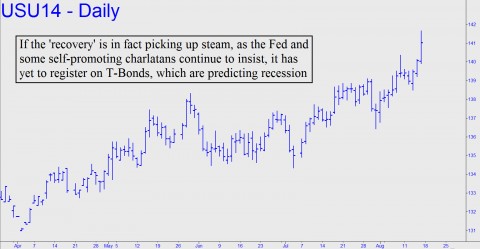

It could come from any one of a dozen geopolitical hot-spots where low-grade troubles have continued to fester without resolution: Iraq, Syria and Gaza, to list the current headliners. War-torn hot-spots aside, Ebola could erupt into a global plague. Or Europe’s supposed economic recovery, an even bigger hoax than the one said to be muddling along in the U.S., could implode, turning their banking system into one big Banco Espírito Santo. What else might favor Treasury Bonds as an investment? How about a U.S. slide into recession-or-worse? It’s not as though the moribund long end of the yield curve hasn’t been predicting this since January, even with the Fed constantly “managing our expectations” with ridiculous talk of an overheated economy and the return of serious inflation.

What Recovery?

What rubbish! It is only auto sales at this point – or rather, auto leases that make expensive cars “affordable” for the masses – that are still registering a pulse. In the still more important real estate sector, re-fi activity remains dead; the surge in home prices has abated despite the return of sub-prime loans and nothing-down deals; and the market for first-time buyers remains lifeless. As for the retail sector, sales remain flat at low-end chains such as Walmart, Kohl’s and Target, but the sluggishness has begun to infect the likes of Macy’s as well. At the very low end, dollar store chains have been consolidating just to stay alive.

Against all this the spinmeisters would have us believe the economy grew at a 4.0% clip in the last quarter, reversing a negative 2.1% adjusted figure for the quarter before it. Which do you believe? Bond yields surged on the bullish number, but we used this fleeting moment of mass stupidity to make hay. Specifically, Rick’s Picks subscribers were instructed to buy bullish calendar spreads in TLT, an equity vehicle that tracks T-Bonds maturing in 20 or more years. TLT was trading for around 115 at the time, and we positioned our spreads to pay off on a rise to just above 118. We expected the rally to take a few weeks, but last week’s bond-buying frenzy got us there in just two days. The bottom line for us was that call spreads whose cost basis had been reduced to 4 cents by some simple, weekly tactical maneuvers were pushing 90 cents as the week ended.

Calendar Spread Zaps Risk

Because we are confident the bond rally will continue, even picking up speed as it slowly dawns on the mindless herd that the manufactured illusion of recovery is fading, we are currently focused on higher strike prices and further-out expirations. The trend is just warming up, but it is bound to explode when the bull market in stocks begun in 2009 draws its last breath. All of that money will have no other place to go. I first described our bullish T-Bond strategy here a couple of weeks ago, but I am repeating it because the investment world still doesn’t seem to get it. And as long investors act stupidly, their common sense warped by Svengalis like Janet Yellin, the investment opportunity of the decade will go begging.

As to those who say the economy is picking up speed, these self-promoting charlatans are thumbing their noses at the most powerful economy-killer of them all: a bear market in stocks. For to blithely assert that the economy will continue to chug along is to ignore the prospect of a market downturn. When it finally comes, as it surely will, it may be for no apparent reason; or, less likely, triggered by a true geopolitical catastrophe; or, potentially worst of all, by a failure of confidence in the banking system as occurred several years ago. Need we remind investors in the meantime that the very illusion of recovery is sustained more by high stock prices than by any other factor — least of all, by corporate earnings that could vanish overnight?

If you believe that bull markets do not go on forever, the T-Bond strategy described above offers a low-risk, high-leverage play against the popular wisdom. Click here if you would like to be apprised of our continuing tactics in real time.

| Digg This Article

-- Published: Monday, 18 August 2014 | E-Mail | Print | Source: GoldSeek.com