-- Published: Monday, 22 September 2014 | Print | Disqus

When will the bull market end? With money velocity collapsing and ominous divergences developing in both the NYSE Advance/Decline line and the New Highs/New Lows summation, U.S. stocks closed at an all-time high last week. If this were not disconcerting enough, the Hindenburg Omen, which signals an increased probability of a stock market crash, flashed red on Friday. There was also this unequivocal pronouncement from the Elliott Wave Theorist after the Dow Industrials came within a single point last week of fulfilling their long-term rally target at 17280: “Next week, the U.S. stock averages should begin their biggest decline ever.” As for your editor, Rick’s Picks has been drum-rolling a key “Hidden Pivot” target at 2028 in the S&P 500 Index that has been 27 years in coming. On Friday, the index hit a record 2019.

Is a major top at hand? It is often said that bells do not ring to signal the end of a bull market. But if the broad averages were in fact to plummet in the weeks ahead, never forget that bells did indeed ring. Of course, permabulls and Wall Street managers charged with throwing Other People’s Money at stocks will not likely have noticed, so intent have they been on headlines proclaiming the soundness of America’s alleged economic recovery. Over the weekend, one such story that would have goosed their confidence to giddy new heights concerned the recovery of home prices in the exurbs. To the OPM bozos, nothing says “recovery” like renewed growth in subprime mortgage debt.

Flashing Red

For those trying to decide the bullish/bearish case for themselves, let me add the opinions of three heavyweights in the guru world with whom I’ve corresponded over the years: Peter Eliades, Alan Newman and Bob Hoye. Hoye’s latest Pivotal Events insightfully answers the question of how the stock market could be going bonkers while the U.S. economy continues to languish: “At the moment, cash hoarding is being used to explain another failure of interventionist theories that easy money forces GDP growth. Not when the public wants to speculate in financial assets such as now.” Eliades — like Hoye, an analyst whose perspective on the markets stretches back not just decades, but centuries – notes in the latest issue of Stockmarket Cycles that the NYSE Advance-Decline line has failed since June to follow the broad averages higher – has in fact been falling since the beginning of August. This, he says, is “one of the fingerprints that accompanies important market highs that has been missing over the past year and longer.”

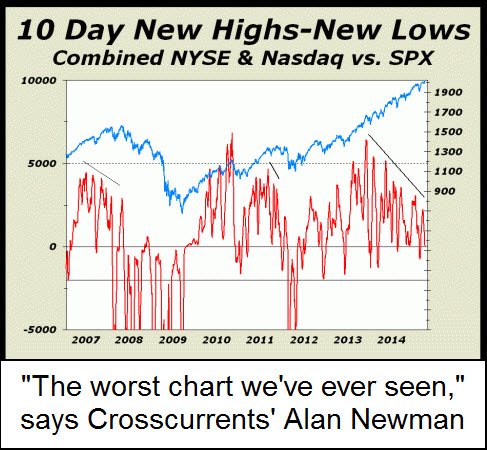

As for Newman, market watchers may recall that for years his Crosscurrents newsletter diligently tracked the dollar volume of all NYSE transactions versus the total dollar value of U.S. GDP. Over decades, the former has grown to several times the size of the latter, supporting Newman’s contention that the main business of America is no longer selling goods and services, but trading stocks. Now he sees a looming train wreck in the chart above, which shows 10-Day New Highs/New Lows for the combined NYSE, Nasdaq and S&P indexes. “This could be the worst chart we’ve ever seen,” notes Newman in a bulletin sent out to subscribers over the weekend. “All the major indexes made new highs on Friday. For the S&P 500 and Dow Industrials, all-time records. For Nasdaq, the same level reached only two weeks before the final tech mania peak. Yet, when you measure new highs minus new lows for the last ten day period, the sum is barely positive. Fewer stocks are participating in this madness. “Frankly, we do not understand how anyone in their right mind could be bullish on the prospects for stocks. As far as we are concerned, this is a dreadful technical condition and we believe stocks are extremely vulnerable at this juncture.”

Odds of calling the exact top of a bull market that has been snaking its way higher for five-and-a-half years will never be great or even good no matter how savvy the forecaster. Even so, investors who ignore the observations above do so at their great peril.

| Digg This Article

-- Published: Monday, 22 September 2014 | E-Mail | Print | Source: GoldSeek.com