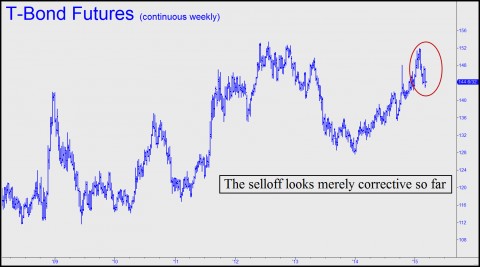

T-bonds have gotten trounced since late January, when long-term yields, which vary inversely with price, touched a millennial low of 2.23%. On Friday they spiked as high as 2.87%, reflecting the growing eagerness of investors to reduce their bond exposure ahead of a presumed credit-tightening later this year. But suppose everyone is wrong and the Feed continues to pussyfoot and prevaricate as it’s been doing since the last rate hike, in 2006? We continue to view that as the most likely scenario, even if the entire investment world seems to regard tightening as all but certain. Going sharply against the consensus, Rick’s Picks has been asserting for nearly two years that the Fed will never raise rates. Obviously, this forecast has to be wrong sooner or later. However, our point is that “later” could prove to be much later than investors appear to expect. Moreover, when interest rates finally do rise, we think the move will be driven by calamitous market forces rather than Fed policy.

In the meantime, the Fed is in the untenable position of needing to strike fear in the hearts of credit-happy investors at a time when the central bank should be loosening, at least in theory. That’s right: loosening! For if the Fed were to tighten, it would turn the dollar’s already steep rally into a vertical spike. That would have catastrophic implications for the economic world. For starters, the quadrillion dollar derivatives bubble would deflate, since the entire Ponzi game is built on borrowed dollars. Players counting on inflation to make it easier to repay those dollars would experience the opposite, and ruinously so.

No Bluffing a Strong Dollar

The dollar’s strength has already begun to take a heavy toll on the earnings of some of America’s biggest multinational firms, including megabanks, because their foreign revenues shrivel when translated into dollars. Under the circumstances, it is suicidal for the Fed to continue pretending the economy is strengthening merely to make their hawkish bluff – and it is a bluff, as far as we’re concerned — sound more plausible. The laughably rosy statistics the government churns out week after week cannot mask the fact that home sales are sinking, even with 3% mortgage money, and that America’s alleged economic recovery – by far the weakest since World War II – is precariously sustained at this point by little more than rising share prices and a boom in auto sales that is being fed by a blowout in subprime loans and giveaway leases.

With a strong dollar tightening the deflationary noose around the global economy, it is by no means certain that the Fed could slow the greenback’s rise with dovish talk or even dovish action, since European rates for large depositors are already negative. How do you compete against that? The answer is that you can’t – unless you monetize so aggressively that you risk hyperinflation rather than deflation. Obviously, that won’t happen, and that is why we remain extremely bullish on Treasury Bonds (as well as long-term munis), notwithstanding the selloff that has occurred since January. The chart above puts the bonds’ weakness in perspective. To us, at least, it looks like no more than a moderate correction in a powerful bull market.

To take the other side of the bet is to implicitly believe, among other things: 1) that the U.S. has succeeded in borrowing its way back to prosperity; 2) that the Fed’s spinmeisters have not exaggerated the strength of the recovery to please their political masters; 3) that the debt paper of Greece, Spain, Portugal et al. presently offers a once-in-a-lifetime buying opportunity; 4) that Europe’s decades-long stagnation is about to reverse; 5) that the wholesale collapse of brick-and-mortar retail in the U.S. has seen its worst; 6) that America’s safe-haven status for global investors is about to end; and 7) that Iran’s growing menace in the geopolitical world will be checked.

If all of these things seem plausible, then, yes, it makes absolute sense to trust in the Fed.

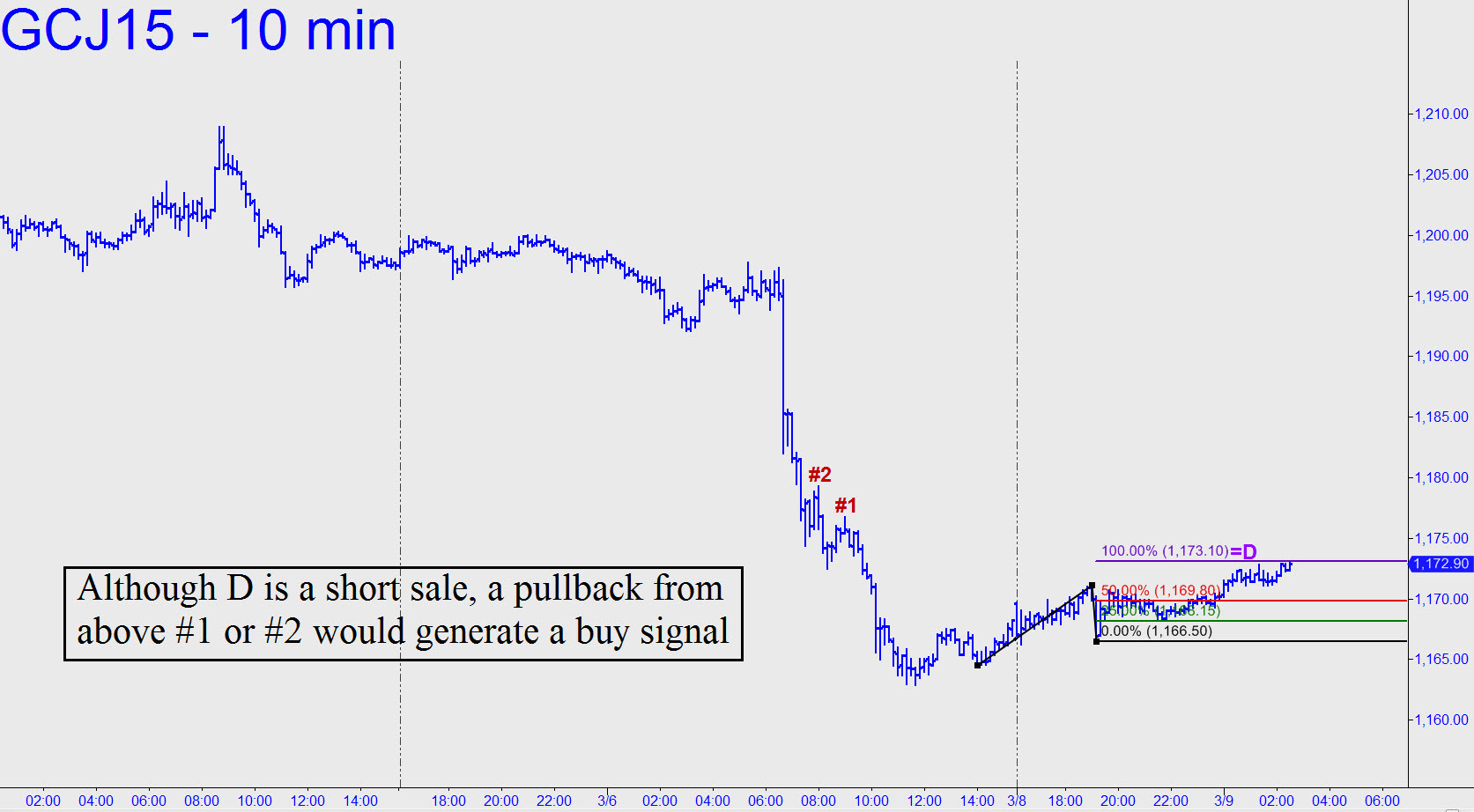

$ GCJ15 – April Gold (Last:1173.00)

March 9, 5:20 a.m.