-- Published: Friday, 22 February 2019 | Print | Disqus

On Wednesday the Indoos poked marginally above a key peak at 25,908 recorded in December. This would likely have caused a multitude of technical traders and algos to smack their lips with anticipation, since such breakouts, even when slight, are among the most bullish events that can occur on charts. Of course, it could also be a great way for Mr. Market to set a ruinous trap for bulls, since they are already giddy over the steep run-up in stocks that has occurred since late December.

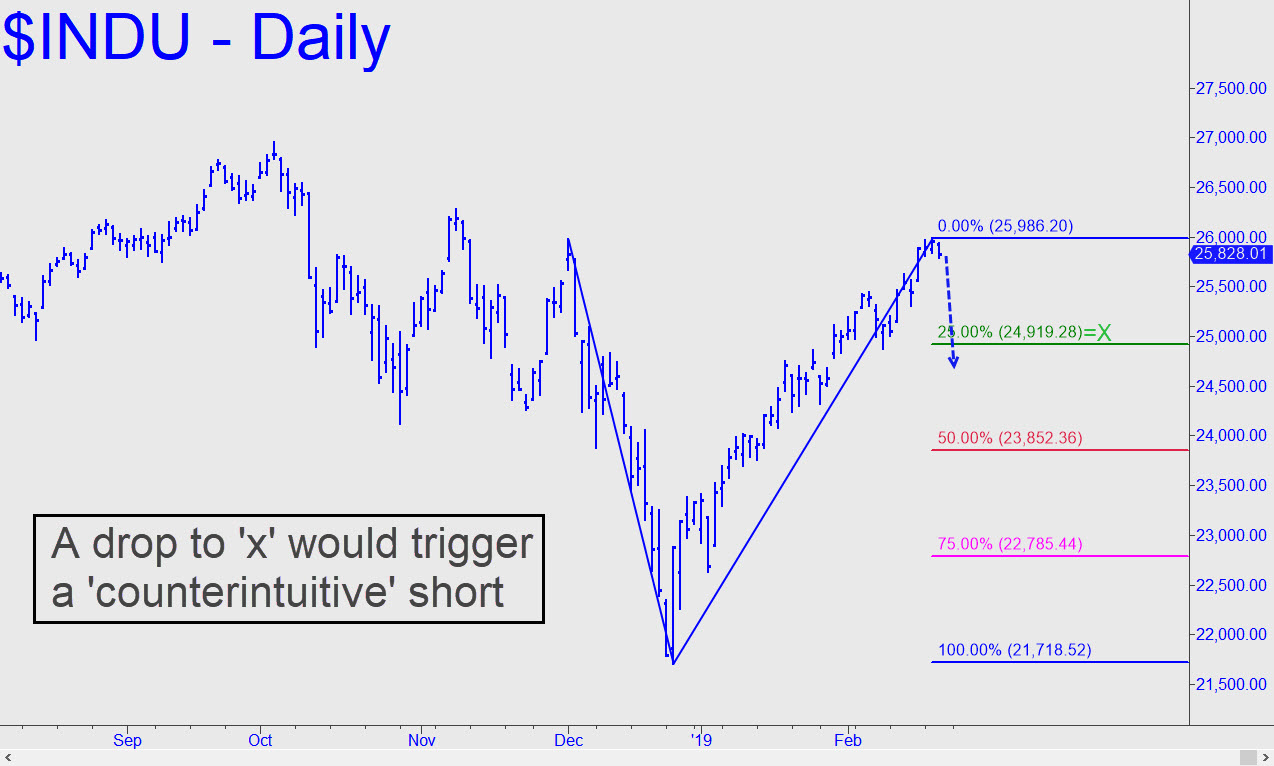

That’s why we are unfurling the yellow flag with tonight’s updates. The chart shows how a 921-point drop to the green line would trigger a theoretical short sale. As a practical matter, we don’t have to wait for something that significant to happen in order to take a bearish position. We like the short at these heights, ahead of the actual signal, because Wednesday’s breakout smells like such a rat.

Fed Murmurings

By treating Thursday’s moderate selloff as the potential start of something big, we risk little. Even if the broad averages were to move somewhat higher, drawn magnetically toward October’s record peaks, that would only heighten our skittishness about bulls’ heedless climb up a wall of worry that looks primed to collapse.

It’s surprising that stocks were able to make any headway at all in the wake of the Fed’s latest murmurings. Dovish they were not, but index futures still upticked for modest gains after the close on Wednesday. They peaked in volumeless trading overnight, however, and DaBoyz began Thursday unable to corral enough bears to keep the faux rally alive. If stocks open higher on Friday, or if they continue upward during the day, it’ll be tempting to fade buyers by acquiring some cheap put options. [This just in: Existing homes sales fell 1.2% in January, the lowest level in three years.]

If you don’t subscribe but want a peak behind the headlines, click here for a free two-week trial to Rick’s Picks. It will give you instant access to all features and services, including a 24/7 chat room where great traders from around the world share ideas that can help you profit.

| Digg This Article

-- Published: Friday, 22 February 2019 | E-Mail | Print | Source: GoldSeek.com