-- Published: Monday, 18 March 2019 | Print | Disqus

The broad averages have rallied from their Christmas lows almost as steeply as they got there in the fourth quarter. The first 2,000 points of the Dow’s trampoline bounce took just seven trading days. At the time, we wrote that the trend would continue until even hardcore skeptics were convinced that new all-time highs were likely. That is what bear rallies are supposed to do. Well, another 1100 points and we’ll be there, but that still wouldn’t persuade us that this rally is the real deal and not just a bull trap.

No one can predict such things with certitude, or course. But when we examine just two key stocks, Apple and Facebook, the smell of distribution is unmistakable. Both companies have serious problems, but lately their shares have been acting like everything is coming up roses. Facebook’s core subscribers, the millennials, have been leaving in droves, in part because of the dishonest way the company has handled privacy issues, but also because Facebook conversations have turned increasingly political and rancid. (Click here for Tim Pool’s report, Facebook Is Dying and Taking Buzzfeed With It.) Zuckerberg evidently sees the handwriting on the wall and recently announced a major shift from an advertising-based model to a service-based one that would facilitate small-group conversations. This is just a smokescreen, since Facebook’s bottom line will continue to depend on how aggressively it sells out its users. Two key executives have left the company since the announcement, presumably because they do not see a brighter tomorrow.

$100 Billion Buyback

Apple long ago stopped innovating and is dependent mainly on iPhone sales at higher and higher prices to grow its bottom line. Trouble is, Huawei and other manufacturers are producing smartphones that can do everything iPhone can do for half the price. It’s a little late in the game for the company to dive into the content business, or driverless cars, or whatever, and Steve Jobs isn’t around to sniff out the Next Big Thing, let alone exploit it. As a result, Apple has been doing what any company would do if it were clueless about the future — i.e., buy back its own shares. It has done so to the tune of $100 billion so far, but we shouldn’t be surprised if the company plows even more into this zero-growth support operation.

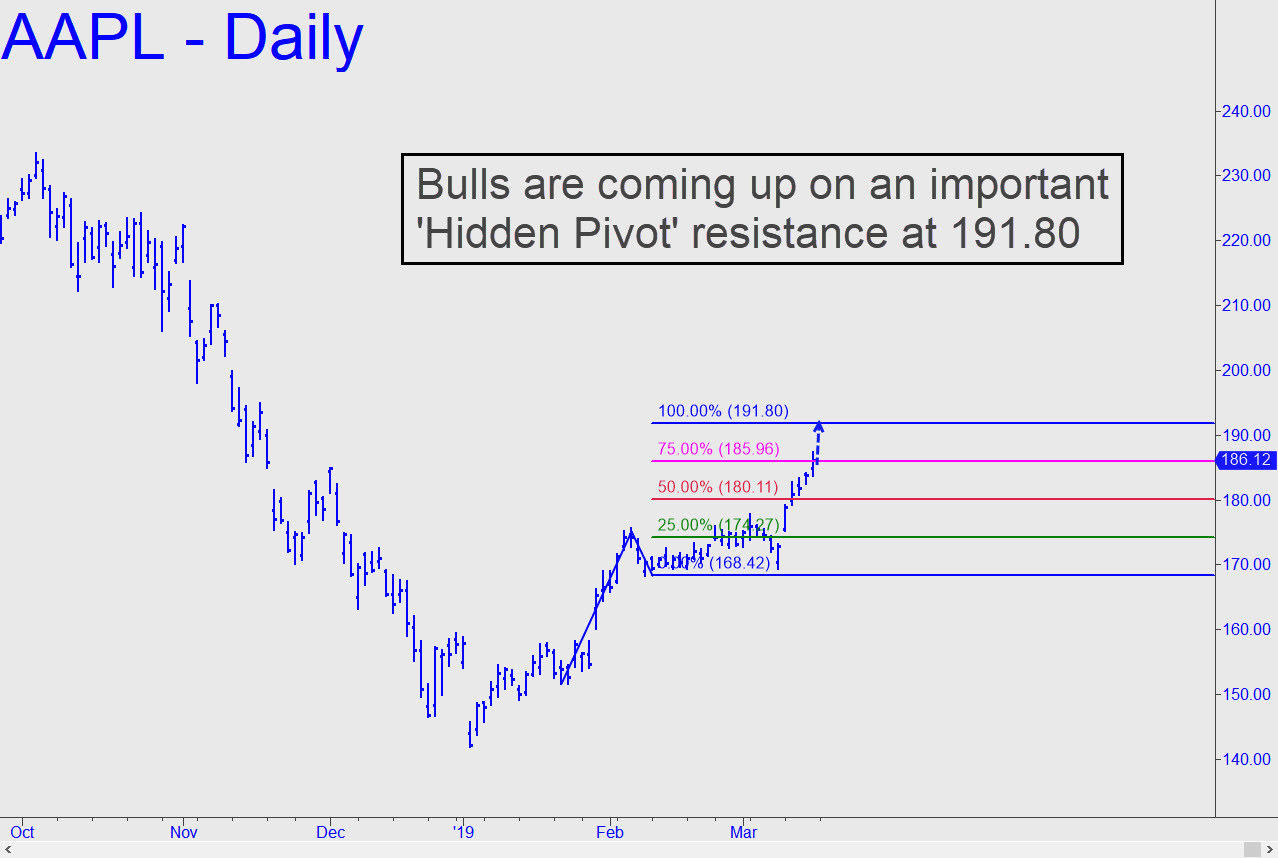

Looking ahead, our advice is to keep up your guard as the broad averages get close to their old highs. You can use the 191.80 target shown in the chart (click on inset) to get a precise handle on AAPL, the stock market’s main driver these days. If its vertical rally stalls out at that Hidden Pivot resistance, it could be warning of an important reversal not only in AAPL but in the stock market as a whole.

If you don’t subscribe,click here for a free two-week trial that will give you access to everything. And please do stop by the Trading Room to say hello.

| Digg This Article

-- Published: Monday, 18 March 2019 | E-Mail | Print | Source: GoldSeek.com