-- Published: Thursday, 11 April 2019 | Print | Disqus

Are these guys good, or what! On Wednesday, with Boeing shares getting clobbered, DaBoyz somehow managed to close the Dow six points higher on the day. That may not sound impressive, but considering that Boeing is by far the most heavily weighted stock in the Industrial Average, the feat was akin to getting a 747 Dreamlifter airborne with two engines out and a half-dozen Abrams battle tanks in its belly. The effort was rewarded with exactly the kind of headline Wall Street needed to distract the herd from the urgent distribution that has been occurring daily: Dow Tacks on a Modest Gain in Quiet Trading. This innocuous report belies the increasing likelihood that the steep recovery begun on December 26 is about to breathe its last.

There are many good reasons for this, including: 1) incipient recessions in China and Europe; 2) a climactic frenzy in IPOs, with Uber leading the pack with a hoped-for $100 billion valuation; 3) falling auto sales…everywhere; 4) a dead-cat bounce in housing; 5) Q1 earnings growth that is expected to fall for the first time in three years; 6) a flat yield curve that is making it extremely difficult for the big banks to shuffle paper profitably; 7) higher energy prices that are starting to impact the transportation sector; and, 8) some key tech stocks that have lost their luster.

Time to Fight the Fed?

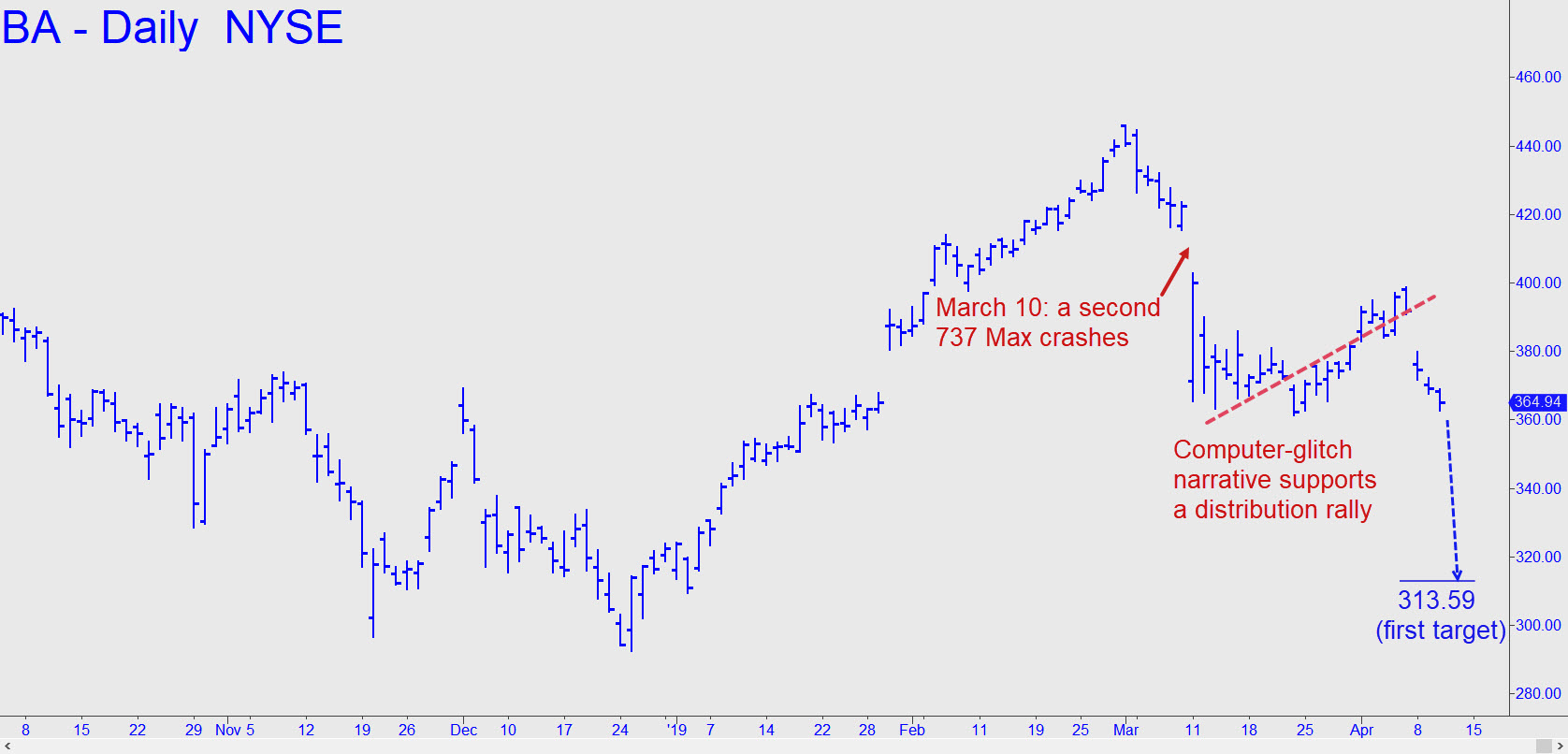

Offsetting all of these negatives, at least in the giddy brains of permabulls, is this: The Fed has no plans to tighten and could conceivably even ease. Place your bets! But before you do, consider that the Dreamlifter is about to take on the added weight of a growing scandal tied to two 737 Max 8 crashes in the last five months that killed 346 people. The stock lost nearly 20% of its value in the weeks that followed the second crash, on March 10. Subsequently, on sketchy news reports that both crashes were caused by a software glitch that presumably could be easily fixed, Boeing shares rallied 10%, recovering nearly half of what they’d lost.

Alas, the glitch turns out to involve far more than just bad computer code. The root of the problem appears to be a decision by Boeing years ago to mount a larger, more fuel-efficient engine on the 737 even though the aircraft wasn’t designed to handle it. Read this first-rate investigative piece from VOX and you will understand just how big this scandal could get. Under the circumstances, shorting Boeing shares against Airbus shares could prove to be the trade of the decade. For there is no way that the story about to envelop Boeing will not have a hugely negative impact on the stock. For starters, consider that Boeing booked not a single commercial order for a 737 in March. The aircraft is the company’s biggest seller, and this hasn’t happened in seven years. Given Boeing’s massive heft in the Dow, a protracted sinking spell in the stock could conceivably kayo the ten-year-old bull market. On days when BA is moving higher, as it sometimes will no matter what the news, view it as subterfuge. You will be witnessing a conspiracy between Wall Street and a benighted press trying their utmost to put a good face on an ugly story.

Click here for a free two-week trial subscription that will give you access to all paid features and services of Rick’s Picks, including daily, actionable trading recommendations and a ringside seat in a 24/7 chat room that draws veteran traders from around the world.

| Digg This Article

-- Published: Thursday, 11 April 2019 | E-Mail | Print | Source: GoldSeek.com